Insurance as an industry works on data and risk evaluation. Functions like underwriting, claims processing, and customer service– all depend on how accurately insurers can assess and manage risk.

Wherein traditional methods struggle to keep up with the growing complexity and volume of data, resulting in slow processes, impersonal policy recommendations, and a less-than-ideal customer experience. Artificial Intelligence (AI) is improving it all. AI is crucial in helping insurers move from a reactive to a proactive model. Its ability to process and analyze vast amounts of data in real time enables insurance providers to deliver more accurate, personalized, and timely services.

Insurers utilizing AI for personalized services have observed a 15–30% increase in customer satisfaction, owing to more accurate risk profiling and tailored policy offerings. In this blog, we’ll explore how AI agents are personalizing and shaping the future of insurance and what this means for insurers and policyholders.

Let’s begin!

What are AI Agents in Insurance?

AI Agents in Insurance are intelligent systems often powered by machine learning, natural language processing (NLP), and automation that perform tasks traditionally handled by human insurance agents. These AI agents can operate independently or assist human agents in tasks across the entire insurance lifecycle. AI agents are constantly learning, evolving, and becoming capable over time.

AI can recognize trends in large datasets and anticipate possible hazards before they materialize. Their customer service, claims processing, risk assessment, and fraud detection functions make them essential tools to improve insurance industry efficiency, accuracy, and consumer satisfaction. AI in the insurance industry with AI chatbots can now provide basic answers around the clock, walk you through policy specifics, and even handle basic transactions.

How AI Agents in Insurance Work?

AI Agents work by automating and enhancing key processes, leading to more accurate risk assessments, pricing, and improved experiences. Here’s how AI Agents in Insurance work:

1. Data Collection

AI Insurance agents can gather information using data from various sources, this includes customer applications, medical records, public records, and history. AI Agents for Insurance algorithms analyze this data to identify patterns, correlations, and risk factors that humans might miss this includes predictive modeling, clustering, and natural language processing.

2. Risk Assessment

Insurance Agents with Artificial Intelligence can work on the analysis of a vast amount of data and can work on creating more accurate risk profiles for customers. This enables insurers to offer personalized premiums, identify high-risk individuals, and reduce underwriting bias.

3. Automated Claims Processing

AI for insurance agents can automate tasks like initial claim assessment, document verification, and payment processing. This has its benefits like reduced waste times, improved customer satisfaction, minimized automation, fewer errors, and consistent application of policies

4. Fraud Detection

It is easy for AI for life insurance agents to detect fraudulent claims by analyzing patterns in data, such as inconsistencies in claim narratives or unusual claims. AI Agents in Insurance help insurers reduce losses and protect their bottom line. These suspicious patterns can be frequent claims for the same individual or group and discrepancies between claim descriptions and supporting.

5. Personalized Recommendations

AI tools for insurance agents help with customer data analysis to recommend insurance products that best suit their individual needs and circumstances. This assists insurers to improve customer satisfaction and loyalty. Understanding customer needs based on analysis can help AI for customizing insurance policies, and personalizing communication resulting in improved customer loyalty.

Benefits of Using AI Agents for Insurance

Adopting AI in the insurance industry brings a variety of benefits not alone for insurers but also for policyholders:

1. Improved Accuracy and Efficiency

AI is great for automating repetitive tasks that take a toll on such agents. Usually, it is seen in intro clerical jobs that entail digit entry, documentation, and responding to basic consumer inquiries, artificial intelligence insurance also allows human agents to spend more time-solving complex issues and providing customers with specific attention. capable of processing massive amounts of data to identify patterns and trends to enhance traditional insurance processes.

2. Customized consumer Experience

An example of a business process that can be provided by AI agents in finance is insurance policies tailored to meet the customer’s needs and how much s/he is willing to take. This has the double benefits of happier customers and better risk selection for the insurance company. The insurance company can provide 24/7 help, answering common questions and helping clients with their insurance.

3. Cost Reduction and Fraud Detection

It can be noted that AI for life insurance agents algorithms can be trained in an even better way to detect false claims. Such AI systems can shave millions of dollars off insurance companies’ costs as they help to evaluate previous information on fraudulent claims and suspicious trends.

4. Innovation and Product Development

This might help insurance agent AI to analyze enormous amounts of data and provide insightful observations about trends and demands of the markets. This allows insurers to develop new products and services that are innovative and geared toward some segments. For instance, AI can be applied, for example, usage-based insurance where one will be charged depending on how safe.

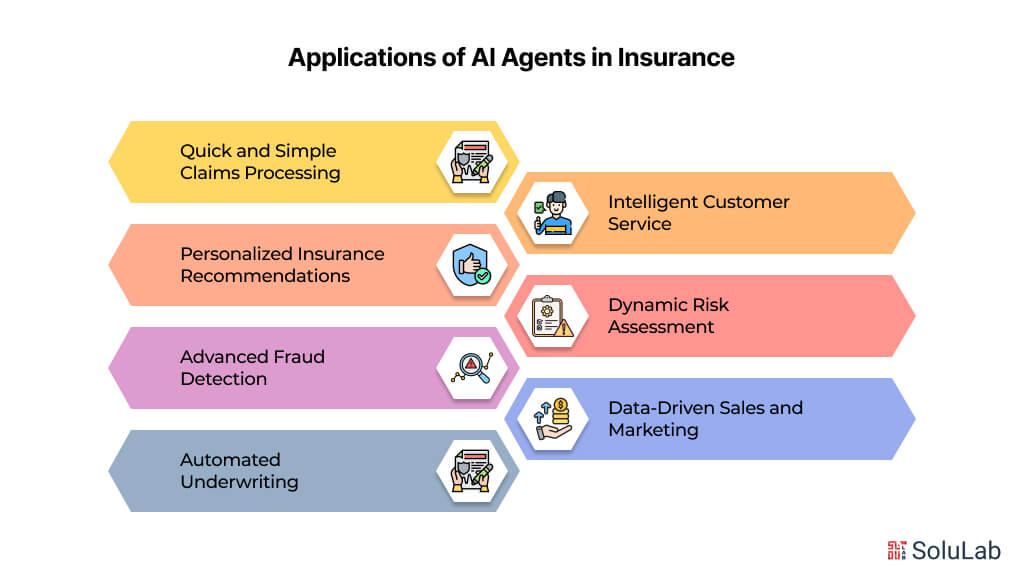

Applications of AI Agents in Insurance

AI Agents for Insurance are shaking things up by automating tasks, and building intelligent services. Here are use cases of AI and insurance:

1. Quick and Simple Claims Processing

Technology plays a crucial role and with the applications in the insurance industry, it is possible to offer clients a chance to file claims in an instant, collation of other important details including the verification of the claims and even the beginning of the repair estimates.

2. Personalized Insurance Recommendations

AI Agents in Insurance are used to analyze customer data, including demographics, driving history, health records, and lifestyle choices to assess risk more accurately. This allows insurers to offer personalized premiums based on individual risk profiles, leading to fairer pricing and improved customer perception. This enables customers to receive valuable options for specific needs.

3. Intelligent Customer Service

It could be termed that with the use of AI-powered chatbots, clients can get quick assistance in answering some basic insurance queries, locating particulars related to policies, and undertaking basic solved procedures and self-serving facilities at any time and from any location that the client may opt for.

4. Advanced Fraud Detection

Cautiously, the same database analysis can be presented as an attempt to find specific trends or inconsistencies that may point to the fact that the case is filled with false statements. The use cases of AI agents insurers by pointing out the activities on which they should or could concentrate more.

5. Dynamic Risk Assessment

The features, traffic, and climate of several automobiles can be considered by the real-time data to result in lively risk analysis with the help of artificial intelligence insurance. It allows insurers to set rather reasonable tariffs and will most probably stimulate safe behavior.

6. Automated Underwriting

Using insurance agent AI in underwriting can ease the underwriters’ burden and make the underwriting process quicker, assisting in delivering answers sooner so that these personnel can concentrate on more complicated issues.

7. Data-Driven Sales and Marketing

AI Agents for Insurance may use customer details to determine the place where the insurance products may be advertised and sold alongside the appropriate marketing texts that will reach the correct persons at appropriate times.

Changes AI Agents are Bringing in Insurance

There are sophisticated solutions known as Artificial Intelligence (AI) that are changing not only the bureaucratic insurance companies’ processes and methods of interacting with customers. These are some of the main adjustments that AI agents are bringing about:

1. Transitioning from Reactive to Proactive

Insurance has been mostly claim-based which means that it goes into action when events happen and claims are filed. Due to the interventions offered by AI Insurance agents, one can take a more proactive approach. AI can monitor all the signs in a system that may be associated with potential threats before these threats become detectable. Think of getting specific recommendations on your health depending on the wearable data that you have or a reminder to alert you of the need to service your car depending on the trends in your driving.

2. Customized Insurance

Chances Insurance that fits all people well is starting to fade away. To create a unique risk score for each consumer, the AI for life insurance agents can analyze specific pieces of information like driving history, passenger’s health, and even data from the smart house. This evolves into individual insurance solutions that meet specific needs, or ensure that you are not being overcharged for the insurance.

3. Frictionless Claims Processing

Endless questionnaires and hours-long talks on the phone are no longer a thing of the future. Other Appropriate Insurance Agents with Artificial Intelligence is revolutionizing that procedure. Of course, the use of a smartphone camera may let one instantly file a claim with the app, and the underlying AI would gather information, verify a claim, and even launch the repair estimate. Contained herein are the key changes that make it easier to manage and work or operate the company, free from bureaucratic intervention, paperwork, delay in payments or settlements, and tough situations.

4. AI-powered Customer Support

It can be annoying to wait on hold for a customer support agent. Chatbots with AI are altering that. These virtual assistants can manage simple transactions, walk you through the terms of your policy, and respond to your basic insurance questions around the clock. In addition to offering prompt assistance, this frees up human agents for more intricate client engagements.

5. Improved Fraud Detection

Insurance companies face a major obstacle as a result of fraudulent claims. In this battle, AI has the potential to be quite effective. AI for life insurance agents algorithms can detect suspicious patterns and warning signs with remarkable accuracy by examining past data on fraudulent claims. This saves insurers millions of dollars by enabling them to flag questionable claims for additional examination.

What Does the Future of AI Agents Look Like in Insurance?

It is expected that AI agents in the insurance sector will develop and broaden their skills and uses in the future. The following are some possible future trends:

1. Explainable AI: The need for explainable AI models will grow as AI agents grow in crucial decision-making procedures such as claims processing and underwriting.

2. Custom Insurance Solutions: AI agents will use machine learning and advanced analytics to provide highly customized insurance services and products based on the requirements, preferences, and risk profiles of each consumer.

3. Telematics and Internet of Things (IoT): AI agents will easily interface with telematics systems and IoT devices to collect real-time information about insured assets, including equipment, homes, and cars.

4. Natural Language Processing (NLP): As AI agents develop their natural language processing skills, they will be able to engage with clients in more conversational and organic ways.

5. Collaborative intelligence: AI agents will work with human specialists like analysts, claims adjusters, and underwriters. By combining the advantages of AI and human experience, this collaborative intelligence will provide more precise and informed decisions.

6. Ethical AI: There will be an increasing focus on creating ethical AI frameworks and adherence to legal requirements for dealing with concerns about algorithmic bias, data privacy, and accountability.

These upcoming developments show how AI agents can alter the insurance sector by improving risk assessment, client satisfaction, operational effectiveness, and decision-making procedures in general.

Take Away

AI agents are set to redefine personalized risk evaluation in insurance by making assessments smarter, faster, and more accurate. With access to real-time data, behavioral patterns, and advanced analytics, insurers can now tailor policies to individual needs rather than relying on broad risk categories.

This shift not only improves customer experience but also enhances underwriting precision and fraud detection. While human oversight remains crucial, AI agents will continue to handle complex tasks with greater autonomy. SoluLab, a leading AI agent development company in USA, is a dedicated team of expert professionals backed by years of experience and technical prowess. Even though we got a chance to develop a project on health insurance powered by AI , resultingly processing time was reduced by 70% and held financial benefits also.

SoluLab is a dedicated team of AI and finance experts ready to help you with all your queries. Get in touch with us today!

FAQs

1. What roles do AI agents play in improving the client satisfaction of insurance services?

AI-enabled chatbots attempt to supplement consumer support 24/7 to respond to most of the queries and help users with policy-related information. In addition, insurance as a service can be advised and claims processed by AI through AI apps hence enhancing the general flow of insurance.

2. In what ways can Artificial Intelligence help insurance risk management?

AI brings the advantage of real-time risk evaluation since it can consider big volumes of data, current traffic, and weather conditions, for instance. This makes it efficient for insurance firms to afford fair tariffs and possibly promote effective conduct such as safe driving.

3. Will AI replace insurance agents?

No. They will work like more of smart companions, AI agents perform repetitive work and provide the first contact. This means freeing up the human agent’s time for tackling complex problems, personal one-on-one correspondence, and enhancing their relations with clients on average.

4. What may be the possibilities of applying AI in insurance risk management?

Hence, AI offers a more multifaceted risk analysis, one that is capable of deploying not only in raw data but also in the actual real-time inflow of data such as traffic and weather conditions. This in turn allows insurance organizations to offer more fair tariffs and in the future – safe behaviors such as proper driving.

5. How can SoluLab help insurance companies with AI Agents?

At SoluLab we design efficient insurance solutions, These solutions will help you identify potential fields that require the integration of the best AI for insurance agents with your company’s operations, create new products, and gradually apply to liberalize the insurance market for your enterprise.