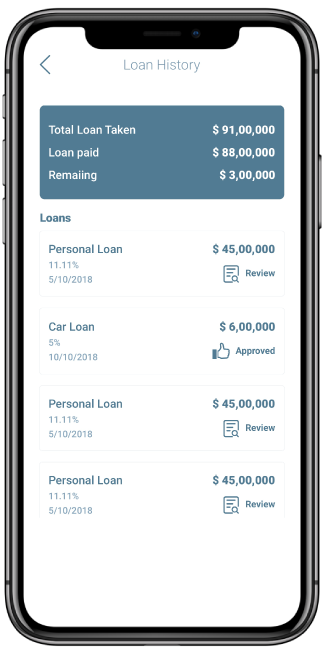

Rupiyah allow users to manage their loan payments by scheduling payments, connect loan seekers, borrowers with loan lenders, etc. Rupiyah helps in establishing a direct connection between loan seekers, borrowers and lenders.

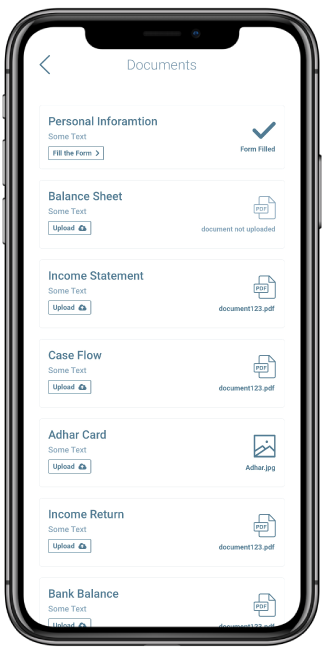

All necessary proofs and documents required for loan approval can be uploaded within the Rupiyah app for verification. This speeds up the process of loan approval and eliminates the need for multiple middlemen intervention.

Business Overview

The Challenge

Our Approach

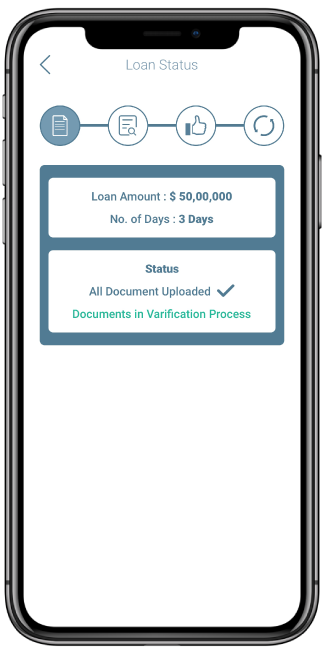

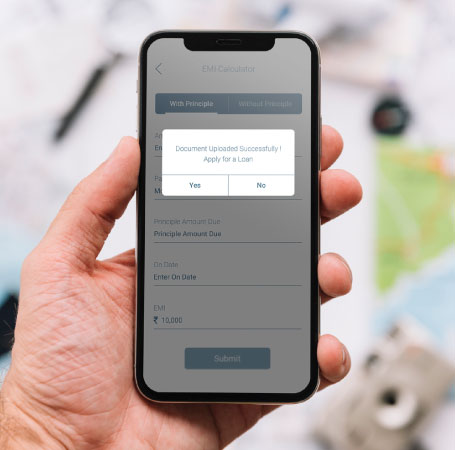

We streamlined the

process of documenting loan applications digitally

by automating the approach of loan processing. First

of all, we built two-step authentication for

enhancing the security of all user profiles and

data. And, also used advanced Artificial

Intelligence (AI) programming and tools to track

loan status instantly and validate KYC documents.

This in turn decreases the time taken to process

documents in full-time equivalents (FTEs) per week,

i.e. process multiple loan applications at

once.

USP of our project:

About App

Results – a journey from ideas to success

Technologies we used

AngularJS

NodeJS

MySQL

MongoDB

Client Testimonial

“They very well managed our expectations; always under promising and over delivering.”