Stablecoins now have a market supply of over $300 billion and process huge transaction volumes — reaching $9 trillion in stablecoin payments by the end of 2025. As usage grows, managing reserves, liquidity, compliance, and risk manually is no longer practical.

This is where AI agents are becoming critical. Unlike static rule-based systems, AI agents continuously monitor on-chain activity, detect anomalies, and adapt to changing market conditions in real time.

AI agents help bridge this gap by bringing automation, intelligence, and decision-making into stablecoin development. In this blog, you’ll learn why AI agents matter in stablecoin development, their benefits, and more.

Key Takeaways

- Stablecoins have AI agents that manage them on autopilot.

- The AI agents minimize human mistakes because they make faster and data-driven decisions.

- The next generation of stablecoins is not a stagnant one.

- Artificial intelligence agent projects are in a better position to scale and be sustainable in the long run.

Why AI Agents Matter in Stablecoin Development?

The role of AI agents in the stablecoin development is important, as they allow them to automatize the decision-making process, preventing risks in real time, and ensuring the stability of prices in rapidly moving crypto markets with high volatility.

1. Stability management in real-time: AI agents constantly track market data and transactions in order to identify risks as soon as possible and take immediate measures to stabilize the peg of the stablecoin.

2. Automated reserve management: They are monitoring reserves 24/7, keeping backing assets adequate and balanced, eliminating the risk of human error, and enhancing transparency in the work of stablecoins

3. Smarter supply control: AI agents use dynamism to regulate minting and burning according to demand trends and curb over-issuance, liquidity crunch, and price volatilities.

4. Fraud and anomaly detection: The analysis of the behavior of transactions helps AI agents reveal suspicious transactions, manipulation attempts, or unusual spikes that may compromise the security of stablecoins within a short period.

5. Regulatory and compliance support: AI agents assist in monitoring AML and compliance requirements, changing regulatory requirements, and lessening the operational load on issuers of stablecoins.

6. Scalability and efficiency: With the increase in transaction volumes, the AI agent will make the system of stablecoins scale without any significant effect due to the dependence on human supervision or large staff teams.

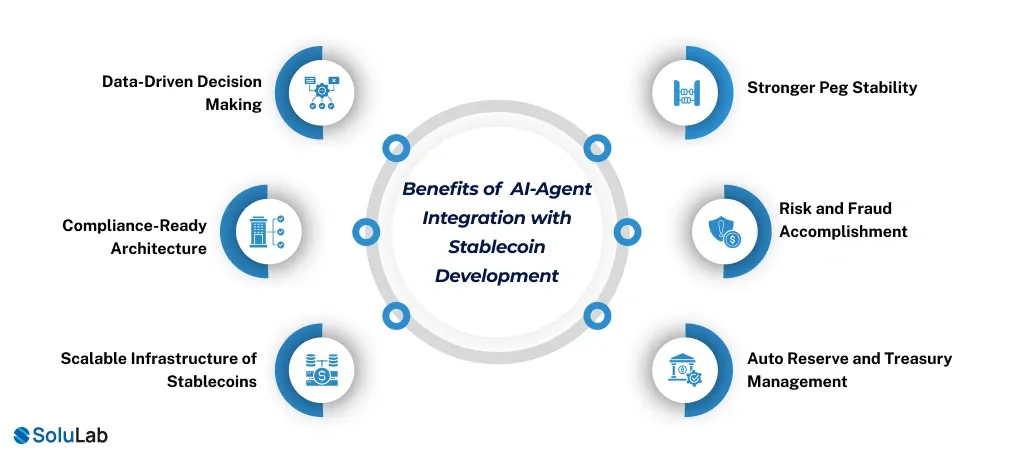

Benefits of AI-Agent Integration with Stablecoin Development

Development of AI-integrated Stablecoins involves the integration of intelligent agents with blockchain to automate financial transactions in order to enhance peg stability as well as assist enterprises in making safe, scalable, and regulation-ready stablecoin platforms.

1. Stronger Peg Stability: AI agents are used to track liquidity, demand, and market indicators in real time and automatically modify supply mechanisms to keep prices stable during turbulent crypto market conditions.

2. Risk and Fraud Accomplishment: The agents based on AI constantly analyze the transaction behavior and identify fraud, manipulation, or abnormal activity at an early stage, lowering the systemic risk and safeguarding stablecoins ecosystems.

3. Auto Reserve and Treasury Management: Monitoring the reserves, the collateral ratio, and the movement of assets in real-time, AI agents guarantee transparency, accuracy, and effective operations of treasuries without extensive manual control.

4. Scalable Infrastructure of Stablecoins: AI automation also allows stablecoin platforms to maintain the growing volume of transactions and multi-chain operations without affecting performance or operational efficiency.

5. Compliance-Ready Architecture: AML, transaction monitoring, and regulatory reporting AI agents can be used to adapt to regional compliance requirements and facilitate the stablecoin projects to comply with global regulations.

6. Data-Driven Decision Making: In contrast to a conventional rule-based framework, AI agents are informed by historical and real-time information, which enables platforms that use stablecoins to regulate minting, burning, and liquidity policies.

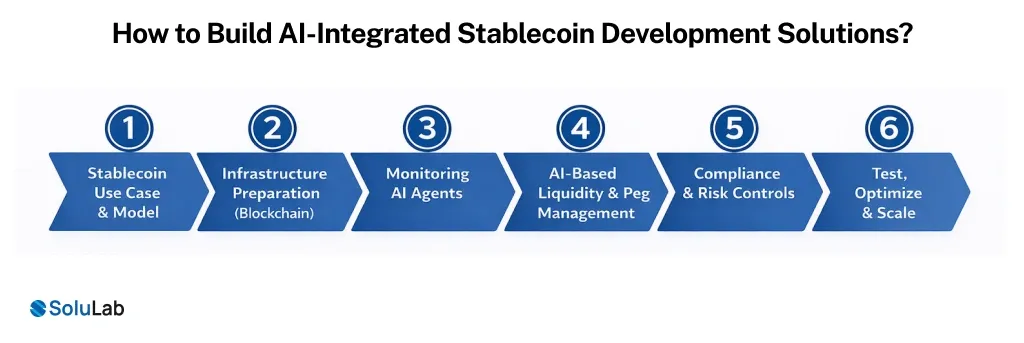

How to Build AI-Integrated Stablecoin Development Solutions?

To develop AI-based stablecoin solutions, there is a need to have smart AI blockchain integration and good AI agent development services to automate and enhance stability to ensure compliance and scale safely within the real-world financial systems.

Step 1: Stablecoin Use Case and Model

Begin with the choice of the kind of Stablecoin: fiat-backed, crypto-backed, or algorithmic. Establish clear objectives such as price stability, the level of automation required, compliance requirements, and volume of transactions to guide in AI and blockchain design decisions.

Step 2: Infrastructure Preparation (Blockchain)

Select the appropriate blockchain, depending on the scalability, fee, and security. Install smart contracts to mint, burn, and govern so that they are easily accessible to AI agents via APIs or oracles.

Step 3: Monitoring AI Agents

Create AI agents that will constantly check reserves, transactions, and market signals. These agents identify risks before time, mark anomalies, and assist in real-time decision-making without necessarily involving a lot of human input.

Step 4: Empower AI-Based Liquidity and Peg Management

Analyze demand, supply, and volatility using AI models. To keep the peg and avoid the de-pegging events, AI agents may automatically increase or decrease minting or burning systems.

Step 5: Unite Compliance and Risk Controls

Integrate AI agents to facilitate AML, KYC, and fraud detection. They are systems that are responsive to changing regulations, track suspicious activities, and minimize compliance overhead without compromising transparency and trust.

Step 6: Test, Optimize, and Scale

Simulate and run stress tests to verify AI resolutions in varied market conditions. Continuous model improvement by use of real data, and then scale the solution across the network or regions, but safely.

Cost and Timeline Breakdown for AI-Powered Stablecoin Development

AI-powered stablecoin development costs $140K–$370K and takes 4–6 months, varying by complexity, team expertise, and compliance needs like MiCA regulations.

| Phase | Timeline | Cost Range (USD) | Key Factors |

| Planning & Stability Model | 2–4 weeks | $20K–$50K | Model selection (fiat/algorithmic), regulatory research |

| AI/ML Integration | 6–8 weeks | $50K–$150K | Predictive models, risk engines, and data training |

| Smart Contracts & Blockchain | 4–6 weeks | $40K–$100K | Solidity coding, DeFi integrations, oracle setup |

| Testing, Audits & Compliance | 4 weeks | $30K–$70K | Security audits ($8K–$25K), KYC/AML, stress tests |

| Total | 4–6 months | $140K–$370K | Excludes ongoing liquidity/ops; lower on L2 chains |

Why AI + Stablecoins Is the Ultimate Investor Play in 2026?

In 2026, AI agents in blockchain are reshaping finance. From smarter automation to trust-backed assets, AI for stablecoin development makes ai agents blockchain a strong, future-ready investor opportunity.

1. Regulation + Infrastructure Trends (EU MiCA, DePIN, RWA)

Clear frameworks like EU MiCA are reducing uncertainty, while DePIN and real-world asset (RWA) tokenization add utility. AI agents help stablecoins stay compliant, scalable, and adaptive across decentralized and regulated ecosystems.

2. ROI Potential Backed by Early Signals

Early AI-DeFi and AI-stablecoin projects have reported returns of up to 300%, according to Dune Analytics. Investors are rewarding platforms where AI agents improve efficiency, risk control, and decision-making, not just hype-driven narratives.

3. Risks Investors Must Weigh Carefully

The space isn’t risk-free. Hyped, insufficient transparency, and black-box decision-making by AI can become detrimental to trust. Critical investors are targeting those teams whose primary focus is explainable AI, good governance, and practical use cases.

Conclusion

With the spread of stablecoins around the world, manual controls and fixed rules are no longer adequate. The AI agents are used to monitor real-time reserves, manage liquidity, identify early risk, and ensure compliance without causing innovation to slow down.

They are also better in transparency and decision-making, which enhances a user and investor trust. In the future, the successful stablecoins will be ones that are constructed as intelligent financial systems, with AI agents collaborating with blockchain infrastructure to provide stability, efficiency, and resilience over time.

SoluLab, an AI agent development company, helps you design, build, and deploy intelligent stablecoin systems powered by autonomous AI agents.

FAQs

AI agents are also autonomous systems within stablecoin environments to monitor data, make decisions, and automate such actions as risk management, compliance checks, and liquidity control.

Yes, AI agents pick up early warning signs and make automated supply, liquidity, or risk controls changes in order to minimize the risk of de-pegging events.

AI agents automate AML, KYC, and transaction monitoring, helping stablecoin platforms meet regulatory requirements while reducing manual effort and operational delays.

AI agents will contribute to the safety aspect when applied in a responsible way, making them better at monitoring, fraud detection, and governance, but they still need a high level of supervision and transparency.

They analyze transaction patterns in real time, flag suspicious activity, and help prevent fraud, manipulation, and unauthorized access within stablecoin ecosystems.