Launching a cryptocurrency exchange in the UK in 2026 is different from what it was a few years ago. The opportunity is still massive, but the rules, user expectations, and technology standards have evolved.

Today, it’s not enough to just start a crypto exchange platform. You need a clear business plan, strong security, and a deep understanding of UK regulations. With the FCA rules oversight and users demanding more transparent platforms, preparation matters more.

This guide walks you through every stage of launching cryptocurrency exchange software in the UK, from market research and legal setup to technology, security, and post-launch operations, so you can build a compliant, scalable exchange with long-term credibility.

Key Takeaways

- Launching a crypto exchange in the UK in 2026 requires balancing technology, compliance, and user trust. FCA readiness is just as important as the software itself.

- Early market research and business planning help you choose the right exchange model, features, and revenue streams for UK users.

- Strong AML, KYC, and custody frameworks are non-negotiable and must be built into the platform from day one.

- Using white-label or modular solutions can reduce time-to-market and costs while still meeting regulatory expectations.

- Long-term success depends on continuous monitoring, audits, and updates to stay aligned with evolving UK crypto regulations.

Why Launch Your Cryptocurrency Exchange Software in the UK?

The UK offers a strategic, trusted, and innovation-ready environment for digital assets, making it one of the top destinations for cryptocurrency exchange development with strong market demand and clear legal frameworks. This growth is reflected in market projections, as Statista estimates the UK crypto market will reach $2.8 billion in revenue by 2026.

1. Strong Legal Property Protections: UK law now recognises crypto as enforceable property, protecting assets from theft and insolvency. This convinces users and institutional partners to trust and use your crypto exchange software platform.

2. Predictable Compliance Framework: The Financial Conduct Authority (FCA) regulates exchanges with clear AML/KYC standards. A compliant crypto exchange software platform helps you meet UK requirements and build credibility with users.

3. Enhanced Customer Trust: Operating in a regulated jurisdiction like the UK boosts user confidence and attracts traders who prefer secure, compliant environments critical for long-term growth.

4. Banking & Payments Integration Ease: A regulated status in the UK makes it easier to partner with banks and payment processors, helping your exchange accept GBP deposits and withdrawals smoothly.

5. Quick Market Entry with White Label: Using white-label crypto exchange software speeds up your launch, getting your brand live fast without building infrastructure from scratch, perfect for capturing early UK market share.

Key Security Measures for UK Crypto Exchanges

Security is non-negotiable for UK crypto exchanges. From strict regulations to advanced tech safeguards, these measures protect user funds, data, and platform trust.

- Data protection and GDPR Compliance: UK exchanges must follow GDPR rules, ensuring user data is collected, stored, and processed securely, building trust and credibility for any FCA-registered crypto exchange in the UK.

- Cold Wallets, Encryption, and DDoS Protection: Most funds stay in offline cold wallets, while strong encryption and DDoS protection prevent hacking attempts—critical for secure crypto exchange development in UK projects.

- Regular Audits and Penetration Testing: Frequent security audits and penetration tests help identify vulnerabilities early, keeping platforms resilient, compliant, and competitive among users searching for the best UK crypto exchange.

UK Crypto Regulations You Must Know for Crypto Exchange Development

The UK government has confirmed that formal regulation of cryptoassets (including exchanges) will start being brought under existing financial services law by October 2027. This means crypto firms will fall under traditional FCA-type regulation rather than a standalone regime.

The FCA is actively consulting on proposed crypto rules covering trading platforms, asset listings, and protections against market abuse; final rules are expected by the end of 2026.

1. FCA Regulations for Crypto Exchanges

The Financial Conduct Authority (FCA) is the main regulator for crypto firms in the UK and requires registration for firms handling cryptoasset services in a business capacity. FCA also seeks feedback on proposals for a comprehensive crypto regime to protect consumers, support innovation, and standardize operations for exchanges and other platforms.

2. AML, KYC, and Compliance Requirements

The FCA enforces anti-money-laundering (AML) and counter-terrorist financing (CTF) rules under existing regulations: crypto asset businesses must register with the FCA before beginning operations and comply with AML/CTF standards like customer due diligence and suspicious activity reporting.

3. Licensing Timeline and Costs in the UK

Typical FCA authorization/registration timeline for top crypto exchange development firms ranges from about 6–12 months, depending on documentation and review complexity. Costs associated with setting up and obtaining a crypto license, including legal advisory, application preparation, and AML policy creation.

How to Launch Your Crypto Exchange Software in the United Kingdom?

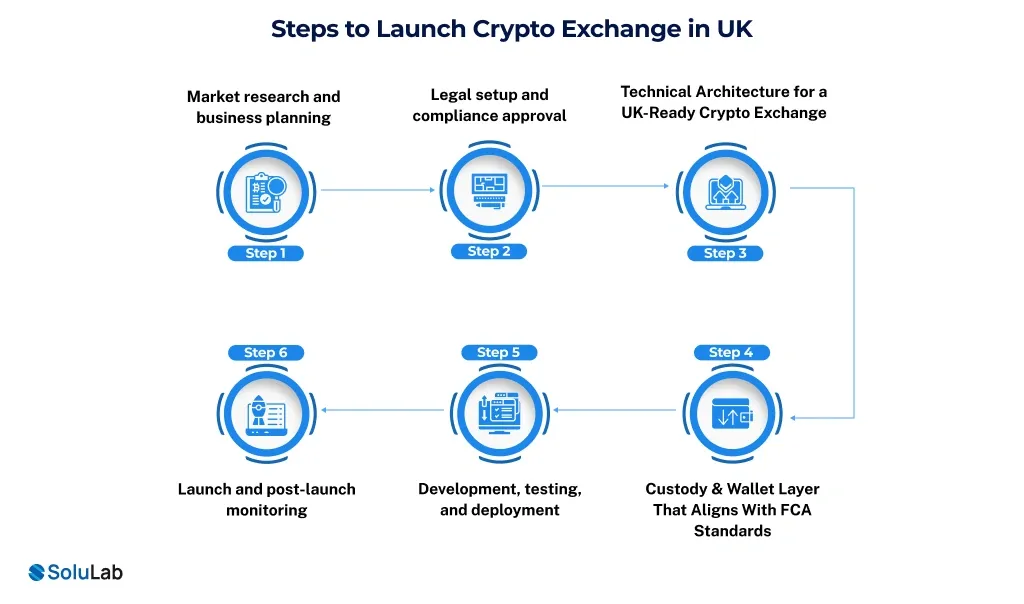

Launching a crypto exchange in the UK isn’t just about tech; it’s about strategy, compliance, and trust. From market research to post-launch monitoring, every step must align with UK regulations and user expectations.

Step 1. Market research and business planning

Start by analysing the UK crypto market, target users, competitors, and revenue models. A clear business plan helps validate demand, define features, pricing strategy, risk management, and prepares you for FCA-facing compliance discussions early.

Step 2. Legal setup and compliance approval

Register your business in the UK and apply for FCA registration under AML regulations. This includes KYC policies, risk assessments, internal controls, and appointing compliance officers before operating or marketing your exchange.

Step 3. Technical Architecture for a UK-Ready Crypto Exchange

Design a scalable, secure architecture that supports high transaction volumes, audit logs, reporting, and data protection. UK-ready systems must prioritise uptime, transparency, and easy integration with compliance and monitoring tools.

Step 4. Custody & Wallet Layer That Aligns With FCA Standards

Implement secure custody solutions using cold wallets, multi-signature access, and strong encryption. FCA expectations focus on safeguarding customer funds, clear ownership records, withdrawal controls, and strong incident response processes.

Step 5. Development, testing, and deployment

Build the platform in phases with rigorous testing for security, performance, and compliance. Conduct penetration testing, stress testing, and user acceptance testing before deployment to avoid operational and regulatory issues at launch.

Step 6. Launch and post-launch monitoring

After launch, continuously monitor transactions, security events, and compliance metrics. Regular audits, system updates, customer support readiness, and FCA reporting ensure long-term trust, stability, and regulatory alignment in the UK market.

Cost to Launch a Crypto Exchange in the UK

The cost to launch a crypto exchange in the UK typically ranges between $20k to $250k, depending on your approach, features, and compliance depth. If you choose white-label cryptocurrency exchange software, costs stay on the lower end because the core technology is pre-built, saving time and development effort. Custom-built platforms increase costs due to advanced security, scalability, and integrations.

Major expenses include FCA registration and compliance ($15,000–$50,000), legal and AML/KYC setup ($10,000–$30,000), technology development, hosting, and security audits. Operational costs like staffing, marketing, and ongoing compliance also add up. Overall, launching Crypto Exchange Software in the United Kingdom is less about a cheap setup and more about building a compliant, trustworthy platform that can scale safely.

Conclusion

Launching a cryptocurrency exchange in the UK is a strategic move, but it requires more than just solid technology. Success depends on deep market research, FCA-aligned compliance, secure architecture, and continuous monitoring after launch.

The UK market rewards platforms that prioritise transparency, user safety, and regulatory compliance from day one. By planning early, choosing the right technology model, and investing in strong legal and security frameworks, you reduce risk and build long-term trust.

SoluLab, a top cryptocurrency exchange development company, can help you at every stage from compliance-ready architecture to secure, scalable exchange development. Contact us today to discuss further!

FAQs

Yes. FCA registration under the AML regime is mandatory for crypto exchanges offering services to UK customers.

Typically, FCA registration takes 6 to 12 months, depending on documentation quality, compliance readiness, and how quickly you respond to FCA queries.

Yes. White-label platforms speed up crypto exchange development UK by reducing build time, cost, and technical risk while still allowing customization.

Yes. The UK plans tighter crypto regulation, so choosing adaptable cryptocurrency exchange software solutions helps your platform stay compliant as laws evolve.

Yes, if built correctly. Scalable Cryptocurrency exchange software development allows you to add features, assets, and users without compromising security or compliance.

Look for a trusted cryptocurrency exchange software solution provider with UK compliance experience, proven security standards, and post-launch technical support.