White-label crypto wallet development often becomes complex when regulations are unclear, and security standards vary by region. These issues slow launches and increase compliance costs. And this leads to loss of trust with users and investors.

However, with clear virtual asset guidelines, strong data protection standards, and a fintech ecosystem built for cross-border growth, it’s quickly becoming the preferred jurisdiction for crypto wallet development.

In this blog, we’ll break down why Hong Kong offers the right balance of regulatory clarity, technical readiness, and long-term scalability for 2026 and beyond.

Key Takeaways

- Hong Kong has a clear and developing regulatory system that provides businesses with certainty and optimism when introducing white-label crypto wallets in 2026.

- Hong Kong is a significant financial center, which enhances investor, user, and banking partners’ trust, which is essential in the adoption of crypto wallets.

- Hong Kong is an effective regional and global growth gateway through which companies can expand easily in Asia.

- Government programs and regulatory sandboxes promote innovation and ensure security and compliance levels.

Understanding the Hong Kong Web3 Crypto Wallet Development Market

Hong Kong is establishing itself as a reputable Web3 destination, and exchanges, fintech startups, and blockchain developers are flocking in. This expansion is driving the need for secure and user-friendly, yet compliant, crypto wallets.

Businesses prefer flexible solutions, such as white label blockchain wallet Hong Kong offerings, which enable faster market entry without requiring the development of everything from scratch. At the same time, enterprises with unique use cases are investing in the best crypto wallets for development options to support DeFi, NFTs, and tokenized assets. With rising institutional interest, strict AML norms, and a tech-savvy user base, Hong Kong’s Web3 wallet market presents strong long-term opportunities for compliant wallet providers and innovators.

Hong Kong’s Crypto-Friendly Regulatory Framework

Hong Kong’s crypto regulatory framework aims to balance innovation with investor protection, creating clear rules for licensing, compliance, AML/KYC, and broader Web3 support to attract global digital asset businesses.

1. Hong Kong’s Crypto-Friendly Regulatory Framework

Hong Kong has moved from an experimental sandbox to a full regulatory regime that encourages virtual asset business growth while aligning with global AML and investor-protection standards. The government’s “same activity, same risk, same regulation” approach provides clarity for firms entering the market.

2. Virtual Asset Service Provider (VASP) Licensing Explained

- All virtual asset trading platforms (VATPs) that cater to investors in Hong Kong are required to apply for an authorization from the Securities and Futures Commission (SFC) as of June 1, 2023.

- Not less than two licensed representatives, the required minimum capital for a regional corporation or registration, and an authorized accountable officer are among the prerequisites.

- to ensure that authorized companies function openly, licenses encompass trading sites, custodial services, and related virtual asset operations.

3. AML, KYC, and Compliance Requirements in Hong Kong

- AML/CTF compliance: VASPs are subjected to stringent anti-money-laundering and counter-terrorist-financing regulations in the AMLO, such as customer due diligence, monitoring, and reporting of transactions, and suspicious activity issues.

- Travel Rule: VASPs should disclose recipient and sender data when transferring above thresholds, enhancing traceability.

- Stablecoin KYC: Stablecoin issuers need to implement strong customer identification, and this has been a source of debate in the industry on the importance of privacy versus regulation.

4. Government Stance on Web3 and Digital Assets

- Policy support: Hong Kong’s 2022 virtual asset policy statement signaled a long-term commitment to Web3 development, emphasizing global standards and investor protection.

- Stablecoin regulation: A new stablecoin bill places fiat-referenced issuers under licensing and oversight by the Hong Kong Monetary Authority (HKMA), reinforcing the government’s proactive role.

- Broader Web3 ecosystem: Authorities also support infrastructure development, tokenization of real-world assets, and safe market access for digital asset products.

Reasons for Investing In a White-Label Crypto Wallet In Hong Kong Now

Clear regulations, robust financial systems, and increasing Web3 support are rapidly transforming Hong Kong into one of the leading locations for starting a crypto business, with white-label crypto wallet investment being particularly appealing.

- Well-defined licensing system and expedited approvals: Hong Kong has a clear licensing system and a well-defined regulatory framework that has made licensing more predictable and faster. This assists crypto businesses to venture more quickly without compromise to the changing rules of digital assets.

- Developed banking and financial infrastructure: Hong Kong has the best banks and fintech infrastructure that facilitates easier integration of fiat services, controls liquidity, and instills confidence in users and institutional partners.

- Asian and global crypto access: Hong Kong serves as an entry point to Asia, but remains also connected to global markets, providing top crypto wallet development companies with access to booming markets and international investors.

- Web3 ecosystem and support: Hong Kong will be an excellent location to expand white-label crypto wallet solutions with government-funded Web3 initiatives and grants.

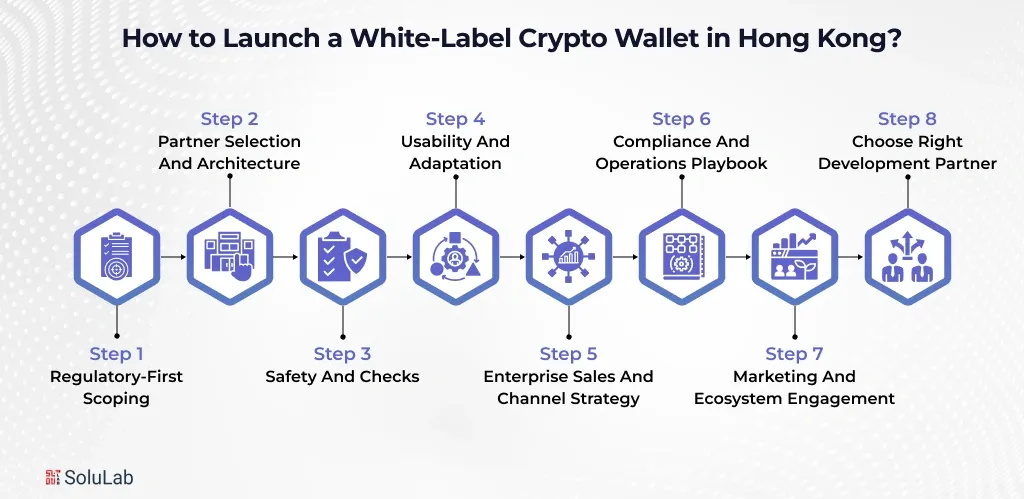

How to Launch a White-Label Crypto Wallet in Hong Kong in 2026?

To grow fast and fulfill enterprise, compliance, and market demands, developing a white-label crypto wallet in Hong Kong in 2026 will need regulatory assurance, secure architecture, intelligent collaborations, and local implementation.

Step 1: Regulatory-first scoping

Begin by establishing the scope of your wallet in accordance with Hong Kong’s regulatory framework. Identify licensing requirements, custody regulations, data protection standards, and transaction restrictions early on, so that product decisions are consistent with compliance rather than requiring costly rework later.

Step 2: Partner Selection and Architecture

Find infrastructure and software providers who know about the modular wallet design. Focus on scalability, API-first design, and blockchain compatibility so your wallet can support future assets, integrations, and enterprise use cases without major redevelopment.

Step 3: Safety and checks

Introduce multi-signature wallets, safety encryption, and secure key management. Conduct regular and scheduled third-party audits and penetration testing to earn the confidence of controllers, companies, and institutions.

Step 4: Usability and adaptation

Create a digital wallet for Hong Kong’s diversified user base. Provide easy registration, multilingual support, and payment procedures as per specific regions. A clear, straightforward design reduces user errors. And increasing adoption among retail and enterprise users.

Step 5: Enterprise sales and channel strategy

Define who your primary buyers are. They could be fintechs, exchanges, or enterprises. Build a clear sales narrative around compliance readiness, scalability, and reliability. Partner-led sales and B2B channels often work better than pure direct acquisition.

Step 6: Compliance and operations playbook

Next, create a documented compliance and operations playbook. Cover KYC, AML, monitoring, incident response, and reporting as well. This helps teams execute consistently and reassures partners and regulators that your wallet can operate at scale.

Step 7: Marketing and ecosystem engagement

Engage actively with Hong Kong’s crypto and fintech ecosystem. Participate in events and industry forums too. Educational marketing works well here, especially content that explains security, compliance, and real-world use cases.

Step 8: Choose the right development partner

Work with a development partner experienced in Hong Kong regulations and enterprise-grade crypto products. The right partner reduces time to market, avoids compliance mistakes, and helps you focus on growth instead of doing guesswork.

Technical Advantages of Building Crypto Wallets in Hong Kong

The technical advantage of developing an AI-powered smart crypto wallet in Hong Kong is the pro-fintech environment, which is characterised by high security standards, developed infrastructure, and systems of the future to enable blockchain products of global scale.

- High levels of cybersecurity and data protection: Hong Kong adheres to high cybersecurity-related levels, enterprise-level encryption, and data protection policies, which are the perfect choice for a crypto wallet development enterprise in Hong Kong aiming to achieve global compliance and user confidence.

- Support for multi-chain and institutional-grade wallets: It supports a lot of chains, like Ethereum and Bitcoin. It also supports chains Layer-2s. This means a development company in Hong Kong can build wallets that are very good and can handle a lot of different assets. The region supports chain wallets, which means these wallets can work with many different chains, like Ethereum and Bitcoin.

- Infrastructure readiness for scaling: With cloud adoption, low-latency data centers, and fintech-ready APIs, Hong Kong offers infrastructure built to handle high transaction volumes and rapid user growth by 2026.

Conclusion

Hong Kong has the appropriate balance of regulation, technology, and access to world markets. Clearly, the virtual asset framework reduces uncertainty, and cybersecurity standards help establish long-term trust among users.

For businesses planning to launch secure, compliant, and future-ready crypto wallets, Hong Kong isn’t just a safe option; it’s a strategic move for sustainable growth in the evolving digital asset economy.

We helped build Mobyii, a secure, feature-rich digital wallet app enabling cashless payments. Using strong encryption, tokenization, and biometric security, the app delivered transactions, utility bill payments, rewards, and an intuitive user experience, successfully turning a fintech idea into a scalable, trusted wallet solution.

SoluLab, a crypto wallet development company, can help you build compliant, scalable, white-label solutions. Book a free discovery call today!

FAQs

Yes, based on the qualities of your wallet. The handling of assets, token trading, and custodial wallets might require a license and strict observance of regional AML and KYC laws.

The time it takes to launch a white-label crypto wallet depends on what you need. If you want a white-label crypto wallet, it will take 7-10 days. However, if you want a typical and customized white-label crypto wallet for your gaming platform with a lot of features or for any particular business use case, it will take time of 4 to 6 weeks.

The white-label crypto wallet should be able to send and receive cryptocurrency, like Bitcoin. It should be able to store different kinds of cryptocurrency. It should also have security to protect people’s money and information. A crypto wallet should also work well on devices, like phones and computers, so people can use it wherever they are.

Security is essential. To secure user assets and meet regulatory requirements, strong encryption, multi-signature wallets, frequent audits, and penetration testing are important.

Yes. Most solutions allow customization, features, supported blockchains, compliance tools, and user flows without building everything from scratch.