The tax industry faces complexity and constant regulatory changes. Generative AI in tax reshapes workflows through automation and predictive analytics. Professionals handle compliance, tax preparation, and accounting with enhanced efficiency.

In 2023, 73% of tax professionals reported no adoption plans. In 2024, accelerated adoption of generative AI in tax research emerged.

Firms integrate tax software with AI features for real-time data insights. Businesses utilize AI for regulatory monitoring and risk detection. Industry transition establishes generative AI as a standard.

Let’s get to know more about how generative AI in tax gives solutions for complex changes.

What is Generative AI In the Tax Industry?

The tax industry is undergoing a quiet but powerful transformation, and at the heart of this revolution is generative AI in tax. From simplifying complex research tasks to automating compliance workflows, artificial intelligence is helping professionals deliver faster, more accurate, and cost-effective tax solutions.

With AI-powered insights, tax professionals can provide clients with data-backed advice that’s both thorough and tailored. This helps accountants, tax consultants, and CFOs provide better, faster, and more strategic advice to their clients.

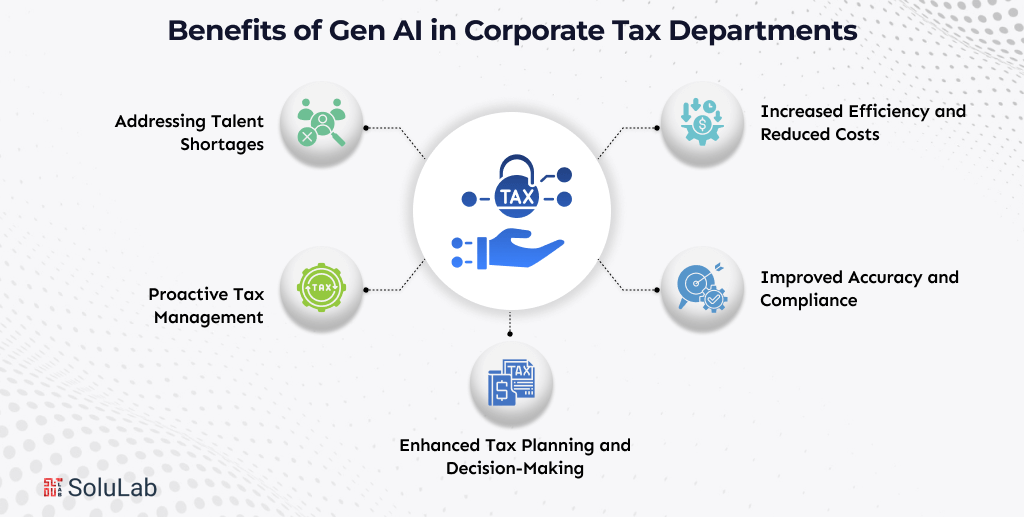

Why Corporate Tax Departments Are Exploring Generative AI?

Generative AI is beginning to restructure the way tax departments operate, offering practical benefits that go beyond efficiency gains:

1. Increased Efficiency and Reduced Costs

AI can handle repetitive tasks such as data entry, document classification, and routine calculations. By automating these processes, professionals save valuable time, reduce manual errors, and focus on higher-value strategic work.

2. Improved Accuracy and Compliance

With the ability to process and analyze large datasets, AI helps identify potential risks and ensures compliance with complex regulations. This reduces the likelihood of penalties, fines, or missed filing obligations.

3. Enhanced Tax Planning and Decision-Making

AI systems draw on historical data and current trends to provide actionable insights. These insights support tax planning, helping companies optimize deductions, minimize liabilities, and improve overall profitability.

4. Proactive Tax Management

Instead of reacting to issues as they arise, AI can highlight potential savings opportunities and recommend strategies in advance. This proactive approach strengthens financial planning and keeps organizations ahead of regulatory challenges.

5. Addressing Talent Shortages

The tax profession faces a shortage of skilled professionals. While tools like Ripping or Remote are addressing recruitment challenges by enabling borderless hiring,AI helps bridge this gap by managing routine tasks and giving junior professionals tools that accelerate learning and decision support.

While still in the early stages of adoption, generative AI is already proving its value. Many tax departments are experimenting with pilot programs, exploring how the technology can improve workflows, reduce risk, and unlock new opportunities.

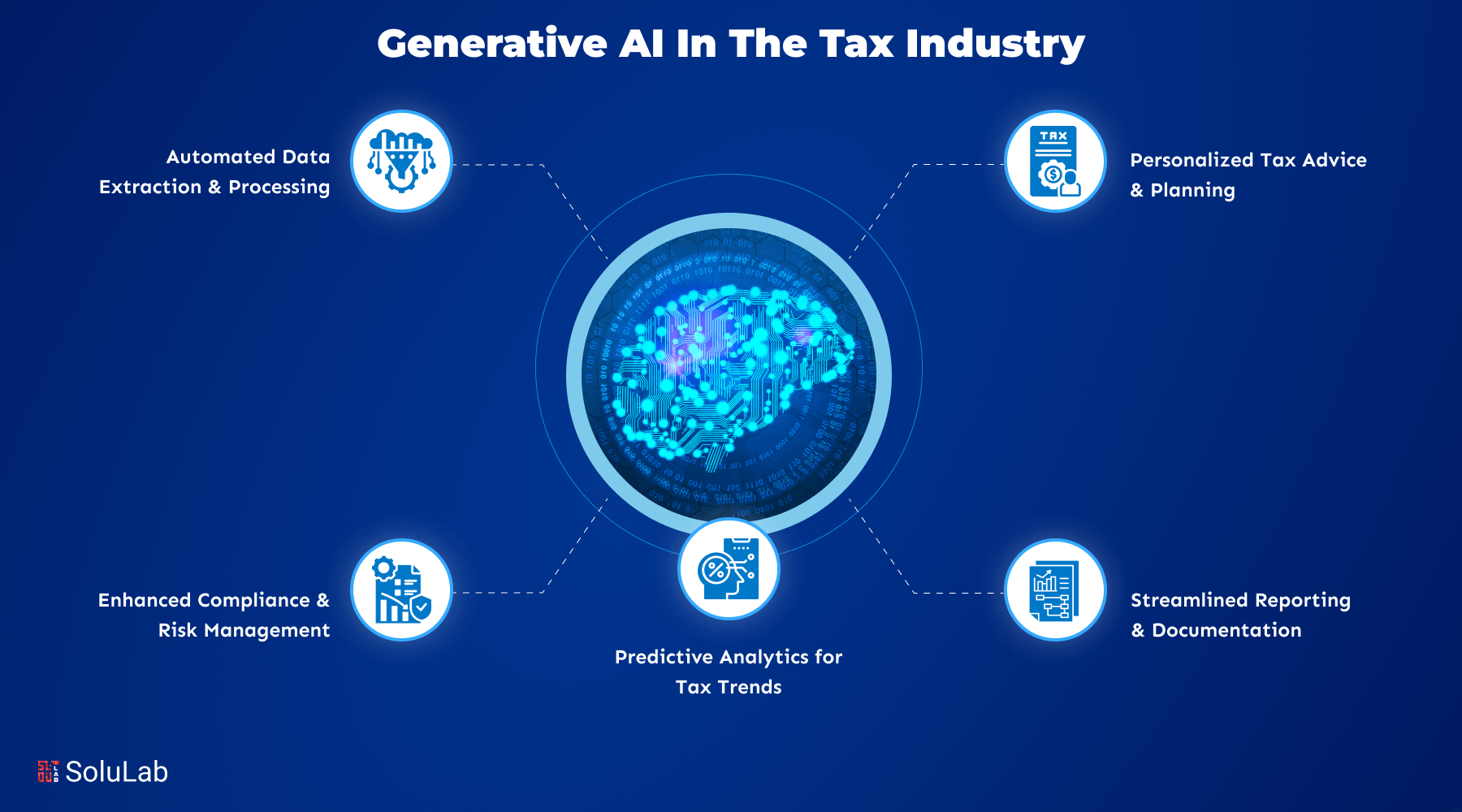

Generative AI Use Cases in the Tax Industry

Intelligent software can now predict tax liabilities, advise on deductions, and generate reports, all while reducing human error. This not only saves time but also enhances service delivery for businesses and individuals alike. From fraud detection to financial planning, the use cases of Generative AI in tax are expanding across various industries.

1. Generative AI in Tax Research

Gone are the days when tax research required endless hours of searching through documents and legal codes. Today, the rise of generative AI in tax research allows experts to find relevant regulations, case laws, and precedents quickly.

Use cases in tax research

- Faster tax research with automated queries

- Access to updated tax codes and case references

- Enhanced decision-making powered by AI algorithms

2. Generative AI in Tax Accounting

Handling vast amounts of financial data is a challenge for tax accountants. Generative AI in tax accounting helps by automating calculations, reconciling accounts, and flagging inconsistencies. This ensures a higher degree of accuracy while freeing accountants to focus on strategic decision-making rather than routine tasks.

Use cases in tax accounting

- Automated data extraction and classification

- Real-time reconciliation and error detection

- Predictive analytics for tax planning

3. Generative AI in Tax Compliance

Tax compliance is one of the most regulated and complex areas in finance. Generative AI in tax compliance helps organizations stay audit-ready by monitoring filing deadlines, detecting potential errors, and ensuring adherence to constantly evolving tax laws. This reduces risk and strengthens trust between firms and their clients.

Use case in tax compliance

- Continuous tracking of changing tax laws

- Automated filing reminders and compliance checks

- Real-time risk assessment and mitigation

4. Generative AI in Tax Software

The latest generative AI tax software solutions are transforming how firms approach tax challenges. By offering predictive insights, automated workflows, and intuitive dashboards, these tools allow professionals to stay ahead of regulatory changes while focusing on client relationships and business growth.

Use case in tax software

- Automated report drafting and client-ready summaries

- Quick summarization of new tax laws and regulatory updates

- Scenario-based tax planning and outcome predictions

The Best AI Tax Software Tools to Look for in 2025

With an influx of AI solutions, selecting the best generative AI tax software can be overwhelming. The ideal software integrates seamlessly with existing systems, offers robust analytics, and provides automated recommendations. This improves efficiency without compromising compliance.

Some of the best generative AI tax software are:

| Software | Best For | Key AI Feature |

| Thomson Reuters | Large Firms | AI Co-pilot for research & compliance |

| Intuit ProConnect | Tax Preparers | Real-time error detection & optimization |

| H&R Block Tax Pro | Seasonal Preparers | AI-assisted interview process |

Real-World Examples of Generative AI in Tax

Let’s check some real-world case studies where Gen AI is advancing the tax industry.

-

TaxGPT: Smarter Tax Drafting and Notices

TaxGPT is helping tax professionals create accurate tax memos and respond to IRS notices more efficiently. Automating routine tasks saves time and reduces human error, a perfect example of how AI tax preparation is transforming workflows.

-

Black Ore: CPA-Focused AI Tax Software

Black Ore provides AI-driven solutions for CPAs, enabling them to handle complex tax forms like 1040s and K-1s quickly and accurately. It’s among the best AI tax software platforms used by tax professionals to boost productivity.

-

Deloitte’s Genie: Optimizing Tax Strategy

Deloitte’s Genie empowers tax professionals by analyzing regulatory changes and minimizing risks. This leading-edge AI in tax compliance tool ensures that firms stay ahead in today’s fast-paced tax environment.

-

Municipal Tax Collection: AI in Action

The Municipal Corporation of Gurgaon successfully leveraged AI to increase property tax collection, surpassing targets and streamlining taxpayer queries, an inspiring adoption of gen AI in tax.

Ethical Ways of Gen AI Adoption in Tax

The rise of Generative AI in corporate tax brings benefits but also important ethical and cultural questions. Businesses must act carefully to build trust and avoid risks.

-

Bias in Algorithms

GenAI learns from large datasets. If those datasets include bias, the AI may repeat and amplify unfair outcomes. Companies must review data sources carefully.

-

Data Privacy and Security

Tax data is highly sensitive. Generative AI systems process huge amounts of confidential information. Strong governance and strict security measures are essential. Failure to protect data may cause legal, financial, and reputational damage.

-

Responsible Generative AI Development

Businesses need clear ethical guidelines. These should cover privacy, transparency, accountability, fairness, and human oversight. Responsible deployment reduces risks and builds confidence with stakeholders.

-

Cultural Impact on Organizations

AI in tax may disrupt traditional work processes. Teams must adapt to new tools and ways of working. A supportive culture encourages innovation and collaboration between humans and AI.

Conclusion

The rise of generative AI in tax research, along with advancements in AI in tax accounting, compliance, and preparation, is reshaping how individuals and businesses approach taxation. Adopting generative AI tax software not only helps you stay compliant but also boosts efficiency.

If you are also looking for a partner to help you in generative AI integration, then SoluLab is here. At SoluLab, we help businesses integrate Generative AI into tax processes to improve efficiency and accuracy. Strengthen your tax strategy and stay future-ready with SoluLab’s trusted, practical, and secure GenAI integration services.

If you are also interested in exploring generative AI integration for your business, contact us now!

FAQs

1. Can generative AI improve accuracy in tax filings?

Yes. By analyzing complex tax codes, past filings, and financial data, generative AI minimizes human errors and increases accuracy in tax preparation.

2. How can generative AI help tax professionals?

It reduces manual workload by automating repetitive tasks like document preparation, data entry, and report generation. This allows tax professionals to focus more on strategy and client advisory.

3. Is generative AI accurate enough for handling taxes?

Generative AI tools are highly accurate when trained on quality financial and legal data. However, human oversight is still essential to handle complex tax cases and interpretations.

4. Does generative AI replace tax consultants or CPAs?

No. Generative AI acts as an assistant, not a replacement. It handles repetitive tasks, while consultants and CPAs focus on strategic decisions and personalized client support.

5. Is my financial data safe with generative AI tools?

Most AI-powered tax platforms follow strict data encryption and compliance protocols (like GDPR or SOC 2). Choosing a secure provider is key to keeping sensitive financial data safe.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]