A buzzword including digital artwork, animal pictures, trading cards, music, and online gaming, NFT or non-fungible tokens became a major digital topic throughout 2021. By late 2022, the daily market size of NFTs on Ethereum was much lower than in 2021. NFTs first grabbed headlines in March 2021 when the crypto art piece First 5000 Days from Beeple became most expensive NFT in the world at 69 million U.S. dollars. The digital tokens were not new, however. The sales development of CryptoKitties – a project that involves randomly generated pictures of cats – can be retraced back to 2017. How, then, do NFTs work, and are they disrupting particular industries in 2022?

Beyond their superficial appearance as JPEGs, NFTs hold immense potential to upgrade various industries, including event ticketing, digital art, and “phygital” goods. The hidden value of NFTs lies in their utility, which goes beyond what can be captured by a screenshot.

One lesser-known aspect of NFTs is their ability to generate passive rewards. Many NFT collections allow users to “stake” their NFTs, similar to crypto staking, in order to earn rewards. There are also dedicated NFT staking platforms that enable both NFT holders and non-holders to capitalize on these digital assets.

In this article, we will delve into the world of NFT staking, exploring various opportunities and examining how NFT holders and non-holders alike can leverage these platforms to earn passive income through NFT staking rewards.

What is NFT Staking?

NFT staking involves locking up an owned digital asset for a specified duration, resulting in rewards often distributed in the form of cryptocurrency. Some collections enable indefinite staking, while others impose strict time limits.

To streamline this process, dedicated staking platforms exist that are not limited to specific collections. These platforms incentivize NFT collectors by offering tokens in exchange for staking NFTs from various projects and blockchains. More details on these platforms will be provided later.

How To Stake NFT: Step-by-Step Process

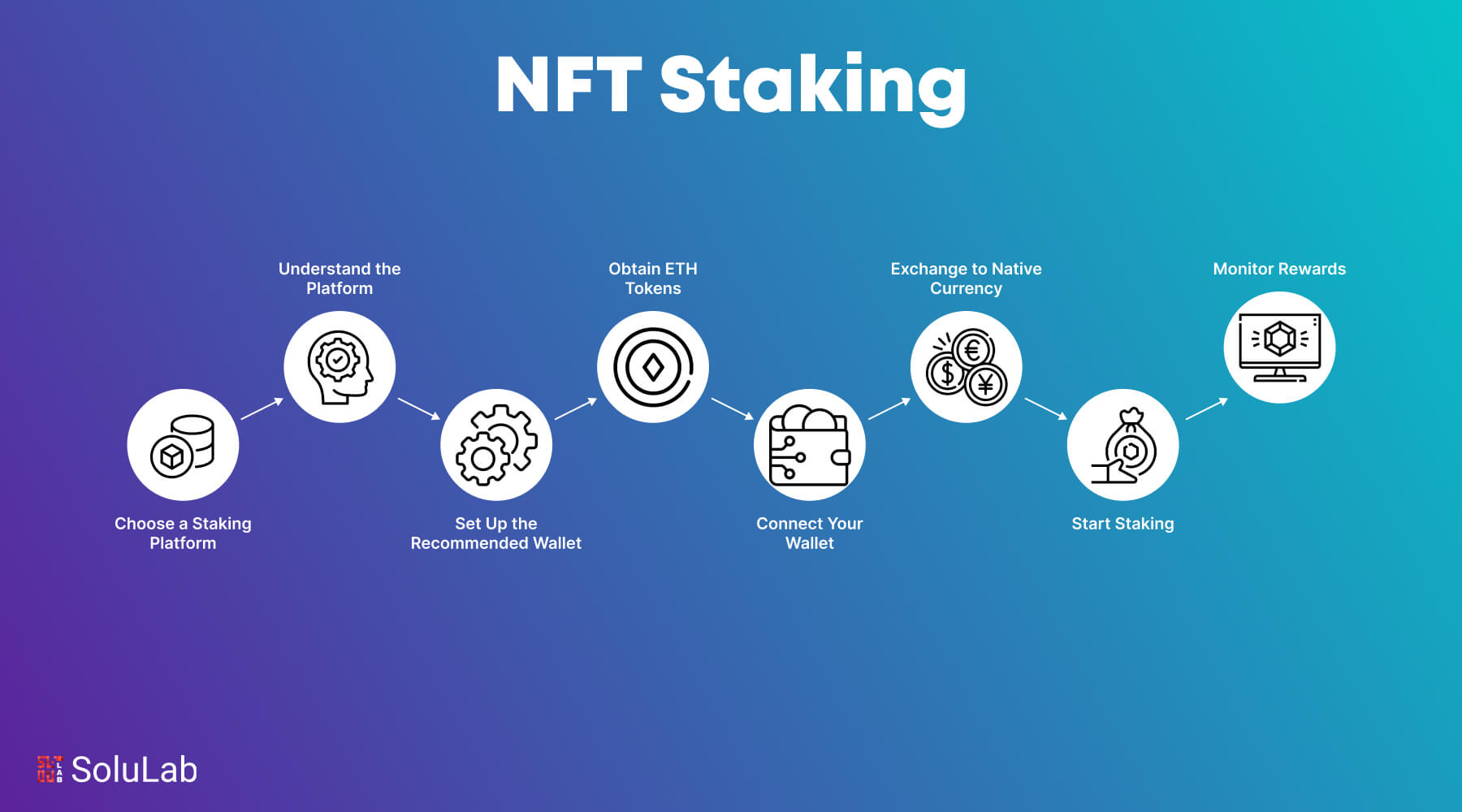

Staking NFTs is a simple, eight-step process.

1. Choose a Staking Platform:

- Begin by selecting a user-friendly staking platform that aligns with your preferences.

2. Understand the Platform:

- Spend adequate time understanding the chosen platform’s rules, rewards, and processes.

3. Set Up the Recommended Wallet:

- Install the digital wallet suggested by the platform. MetaMask is widely supported in the Ethereum ecosystem for NFT staking.

4. Obtain ETH Tokens:

- Acquire ETH tokens by purchasing them or transferring them from another wallet (if applicable).

5. Connect Your Wallet:

- Link your wallet to the staking platform.

6. Exchange to Native Currency:

- If the platform has its own native currency, exchange your ETH for it following the platform’s instructions.

7. Start Staking:

- Initiate the staking process by locking your NFTs in a smart contract on the platform.

8. Monitor Rewards:

- Keep track of your staking NFTs and the rewards you earn, which are usually in the form of additional tokens.

How are NFT Staking Rewards Calculated?

Each NFT staking collection features unique rewards rates, encouraging holders to lock up their assets for extended periods. Similar to viewing annual percentage yield (APY) on traditional cryptocurrency staking platforms, NFT staking sites offer projections of returns. However, some sites display expected token rewards (e.g., 10 tokens per day) rather than an exact APY.

It’s essential to note that actual returns may deviate from projected token rewards, so conducting thorough research on any staking platform is crucial. The reward value varies across NFTs, but most projects compensate users with utility tokens for staking NFTs.

These tokens may offer additional benefits like voting rights or governance participation in decentralized autonomous organizations (DAOs). Notably, some NFT collections even allow users to stake these earned tokens, further enhancing the potential rewards.

How could you Benefit from NFT Staking?

NFT staking allows holders to maintain ownership of their digital collectibles while generating passive income. According to Synodus, the benefits include earning rewards and fostering scarcity since staked NFTs are removed from the open market, making them unavailable for sale. Staking also contributes to the blockchain’s usability and security, similar to crypto staking.

To participate, holders need a crypto wallet and must connect it to an NFT staking platform. These platforms run on specific blockchain networks, and staking is endorsed and validated by smart contracts on the blockchain.

Staking typically involves locking NFTs on the platform for a predetermined period in exchange for rewards. This can result in deflationary supply pressure, increasing the price of similar NFTs in circulation. Both collectors and the broader NFT market benefit from this.

Rewards are often distributed in the form of platform native tokens, tradable for currency or other cryptocurrencies. Each platform uses its method of calculating interest rates, aiming to attract NFT assets holders to stake their assets for as long as possible. While some services may offer high interest rates, investors must carefully weigh the associated risks.

Thorough research (DYOR) is crucial before staking NFTs to ensure full understanding of the risks. Factors determining the rewards include the platform’s annual interest rate, staking duration, and the number of NFTs staked. Additionally, some NFTs may have unique staking features determined by the project team at launch.

Related: Multifunctional Fractionalized NFTs

Is NFT Staking right for me?

While NFT staking presents enticing opportunities, it is imperative to exercise caution and evaluate critical factors before embarking on this endeavor. Certain conditions must be met to ensure a rewarding NFT staking experience.

1) Annual NFT staking yield/APY

As a potential NFT Staking Platforms, an essential question to ask is: what returns can I expect from staking? While some NFT collections may offer enticing returns, be wary of rates that seem too good to be true. These rates often fluctuate significantly and may not persist for long.

Certain projects offer increased Annual Percentage Yield (APY) rewards for staking multiple NFTs or NFTs with higher rarity scores. If you plan to hold more than one NFT from the same collection, evaluate if staking multiple NFTs is advantageous for better interest rates.

2) NFT collection price

Seasoned NFT traders have a keen sense of when to hold and when to sell their assets. For those looking to quickly flip an NFT, selling may be a more lucrative option than staking, particularly if the collection has experienced recent price fluctuations. Staking can potentially restrict the sale of an NFT due to lengthy lock-up periods.

While staking can serve as a protective measure against short-term price movements, in certain cases, higher returns can be obtained by selling when the floor price increases. However, determining the optimal timing for such transactions is highly challenging, and even skilled traders may struggle to make the right call.

3) Cryptocurrency price movement

In addition to considering the base price of the NFT collection, it’s crucial to remember that the value of the cryptocurrencies associated with NFTs can fluctuate significantly. For instance, if you acquire an NFT for 1 ETH when the price of Ethereum is $3,000 and later sell it for 1.1 ETH when Ethereum’s value has decreased to $2,500, you will inadvertently incur a loss of $250.

4) Percentage of total NFTs staked

Regarding NFT Staking Platforms, it can be insightful to examine the project’s website and observe the percentage of NFTs that are currently staked. A higher staking percentage suggests that NFT owners are inclined to hold their assets long-term.

While not a definitive indicator, a notable proportion of staked NFTs, particularly when accompanied by an extended lockup period, may reduce the likelihood of a mass sell-off and subsequent price drop.

5) Lock-up period

The duration of lock-up periods for best NFT staking collections and staking platforms varies. If you prioritize quick access to your NFT, it’s advisable to select an NFT staking option with a shorter lock-up period. A lock-up period ranging from hours to days is preferable compared to one that lasts for weeks, ensuring greater flexibility and liquidity.

Consider the Advantages and Disadvantages of NFT Staking

Here come several variables as you decide whether your NFT staking is the best course of action or not.

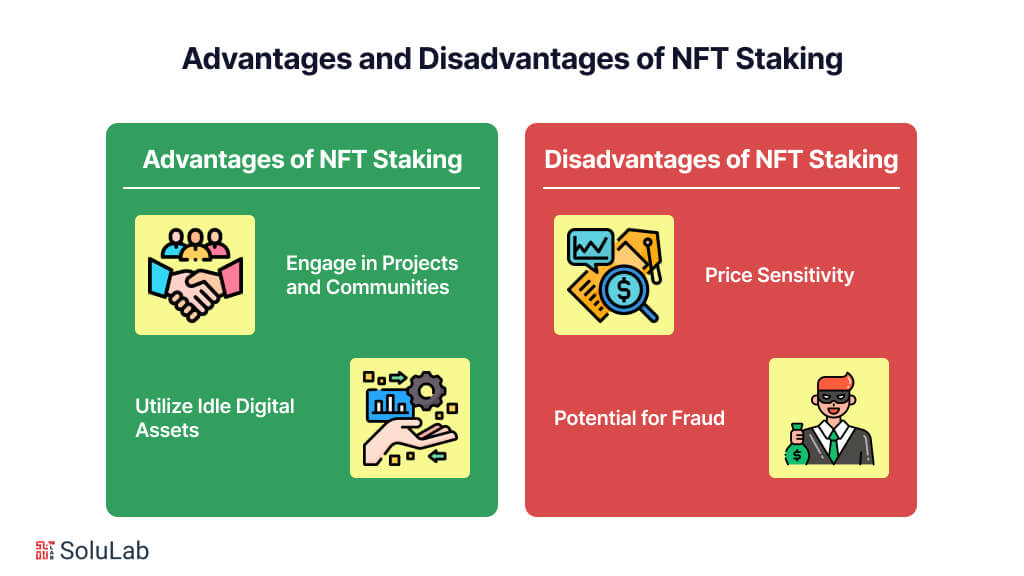

Advantages of NFT Staking

1. Engage in Projects and Communities: Most projects offer rewards for users who commit their non-fungible tokens (NFTs) with utility tokens. However, the specific payouts and benefits vary across projects. Additionally, these tokens provide advantages like voting and governance rights, enabling holders to influence the project’s future direction.

2. Utilize Idle Digital Assets: Staking presents an opportunity to make the most of your unused digital assets. If you’ve held an irreplaceable token for a while but don’t have immediate plans to sell it, staking allows you to put it to work. By locking your NFT on a staking platform, you can earn rewards while maintaining ownership and without giving it up.

Disadvantages of NFT Staking

1. Price Sensitivity: The value of your NFT can fluctuate significantly due to market conditions and trends in the digital art world while it is locked in for staking. Depending on the terms of your staking period, you might not be able to withdraw the extended lock-up best NFT staking. However, if long-term holding is your ultimate goal, short-term market fluctuations should not concern you as much.

2. Potential for Fraud: While receiving rewards for staking your NFT may seem attractive, be aware of the associated risks. The NFT industry is still in its early stages, and differentiating between genuine and fraudulent platforms can be challenging. Unethical staking platforms may attempt to steal users’ funds and tokens. To avoid falling victim to fraud, it is crucial to conduct thorough research before committing your NFT. Investigate the staking platform and the team behind it, and exercise caution if anything seems suspicious.

How to Make More Money with NFT Staking

Engage in NFT staking within your cryptocurrency wallet as a means of generating passive income. NFT staking presents a distinctive and fascinating application of blockchain technology, enabling you to create passive revenue streams. To embark on this income-generating endeavor, an initial investment is necessary. While monetary investment is the primary method of earning passive income through NFTs, time investment can also be leveraged. For long-term NFT holders, known as HODLers, instead of storing their NFTs in digital wallets, they have the option to lock up their NFT collections for passive income generation.

A substantial proportion of NFTs belongs to the gaming super universe within the Web 3.0 ecosystem. Individuals can lock up their NFTs in various blockchain games, including Axie Infinity, The Sandbox, MOBOX, and Zookeeper, among others. These games offer staking options that enable players to earn money.

Previously, the metaverse in gaming platform, NFTs were limited to acquiring a single object crucial to that particular game. Consequently, digital assets for crypto super games had limited utility. However, with the emergence of NFT staking, the utility of these assets has expanded. The popularity of a game can also contribute to the monetization of NFTs.

Nevertheless, it is essential to conduct thorough research on the NFT, its market, utility, and staking incentives before venturing into NFT staking. This knowledge empowers you to make informed decisions and maximize your potential for passive income generation through NFT staking.

NFT Staking Platforms

For those who own NFTs eligible for staking, the official collection website provides comprehensive instructions on where and how to do so. Additionally, there are versatile platforms available that enable users to stake NFTs from various projects, regardless of their specific collection. Here are a few examples of currently accessible staking platforms:

1. LooksRare

LooksRare, launched in January 2022, is an NFT assets marketplace that also serves as a staking platform. It enticed NFT traders to use its platform by airdropping 120 million of its native $LOOKS tokens. To be eligible for the airdrop, users had to make a specific amount of trades (over 3 ETH) on OpenSea.

Rewarding traders remains essential to LooksRare’s functionality. Users can earn more $LOOKS by buying and selling NFTs on the marketplace. Earned $LOOKS tokens can be staked directly on the platform to earn even more $LOOKS and wrapped Ethereum (WETH).

While the incentive to earn $LOOKS primarily targets NFT traders, the token is also accessible on decentralized exchanges like Uniswap.

Shortly after its launch, the annual percentage yield (APY) for staking $LOOKS soared to as high as 9000% but eventually stabilized just below 200%. Currently, the APY fluctuates around 9.24%, influenced by trading volume and market conditions.

2. WhenStaking

WhenStaking, a staking platform for NFTs, operates on Onessus, a WAX-based decentralized application development studio. Onessus has created NFT play-to-earn games such as HodlGod and NiftyVille.

NFT assets from these games can be staked on WhenStaking to earn returns in the form of VOID, the native token for Onessus. Fans of these games can conveniently integrate with WAX Cloud Wallet, as both Onesimus and WhenStaking are integrated with it.

Rewards on WhenStaking vary depending on NFT rarity, collection value, and the platform’s unique level system. Over time, users can earn more rewards as NFTs level up and increase APY the longer they are staked. Stakers can still utilize their NFTs as assets in their chosen game through a leased version of the staked token.

Related: Best NFT Marketplace Platforms

NFT Collections Available for Staking

1. The Sandbox

The Sandbox, a prominent metaverse platform built on the Ethereum blockchain, offers cryptocurrency staking opportunities for holders of its native SAND token. Staking rewards vary based on the number of LAND NFTs a user possesses.

For instance, users with up to 5 LAND NFTs can stake a maximum of 10,000 SAND tokens on the Polygon (MATIC) blockchain. Throughout 2023, the value of one SAND token has fluctuated between approximately $0.28 and $0.90, enabling users to stake cryptocurrency worth between $2800 and $9000 during this period.

The Sandbox is accessible on OpenSea, and various in-game items are available for purchase on the platform’s official NFT marketplace. SAND tokens can be purchased using a payment card through MoonPay.

2. Axie Infinity

Axie Infinity, a massively popular blockchain-based game, boasts over 2.8 million daily users at its peak in 2021. In this game, users collect avatar NFTs called Axies to battle against others and earn rewards in the form of Axie Infinity Shards (AXS) tokens. AXS, the native token, allows holders to make in-game purchases in the Axie Infinity Marketplace, such as additional Axies, accessories, Lands, and Land items. Axie Infinity features multiple staking options:

- Cryptocurrency Staking: Users can stake AXS tokens to earn rewards in the form of more Axie Infinity Shards.

- NFT Staking: Land NFT holders can stake their plots to earn additional Axie Infinity Shards. The rarity of the Land NFT determines the amount of AXS tokens earned per day.

3. CyberKongz

CyberKongz, a pioneering NFT staking project, stands out as a collection that rewards its holders with $BANANA, its native cryptocurrency. Owners of the initial 1,000 Genesis CyberKongz enjoy a daily reward of 10 tokens for each first-generation NFT they possess, an enticing incentive that will continue until the year 2031.

4. Mutant Cats

Mutant Cats, a collection of 9,999 feline avatars, is built on the Ethereum blockchain. Holders can stake their Mutant Cats to earn $FISH, the native utility token of the project. Each staked cat generates 10 $FISH per day, which represents fractionalized ownership of the project’s vault assets.

Mutant Cats are available for purchase on OpenSea. The current staking rate offers 10 $FISH per day for each staked cat.

5. Doge Capital

Doge Capital, an NFT collection on the Solana blockchain, features 5,000 pixelated avatars of the Dogecoin dog mascot. Holders of these NFTs can stake them to earn $DAWG tokens, which can also be acquired on decentralized exchanges (DEXs) like Raydium and Dexlab. Inspired by Dogecoin, Doge Capital’s native cryptocurrency, $DAWG, is also a meme coin with utility. According to the official Doge Capital website, $DAWG powers the project’s ecosystem and serves as the native utility token. Doge Capital NFTs are available on Magic Eden, and the current staking rate offers 5 $DAWG tokens per day.

Conclusion

In conclusion, understanding What is NFT Staking and how to make money from NFTs is essential for anyone looking to maximize their NFT assets. By exploring the best NFT staking platforms and utilizing NFT staking smart contracts, you can effectively stake NFTs and generate passive income. Learning how to stake a NFT and identifying the best NFTs to stake are key steps in this process. Companies like SoluLab provide comprehensive NFT solutions, including NFT Token Development and expert guidance on staking NFTs. As a leading NFT development company, SoluLab can help you navigate the complexities of NFT staking and ensure you achieve the best results. Hire NFT developers from SoluLab to leverage the full potential of your NFT investments.

Frequently Asked Questions (FAQs)

1. What is NFT Staking?

NFT Staking is the process of locking up your NFT assets on a blockchain to earn rewards or passive income, typically through a staking platform or smart contract.

2. How do I Stake an NFT?

To stake an NFT, you need to choose a suitable NFT staking platform, connect your wallet, select the NFTs you want to stake, and follow the platform’s instructions to lock up your NFTs.

3. What are the best NFT staking platforms?

The best NFT staking platforms offer secure, user-friendly interfaces and attractive reward structures. Research and reviews can help identify the top platforms for your needs.

4. What is an NFT Staking Smart Contract?

An NFT Staking Smart Contracts is a self-executing contract with the terms of the staking agreement directly written into code. It manages the staking process and distributes rewards automatically.

5. Which are the best NFTs to Stake?

The best NFTs to Stake are those with high value and strong market demand. These NFTs typically offer better rewards and more stable returns when staked.

6. How can I make money from NFTs through Staking?

You can make money from NFTs by staking them on a reputable platform and earning rewards in the form of additional NFTs, tokens, or other cryptocurrencies.

7. Why should I hire NFT developers from an NFT Token Development Company?

Hiring NFT developers from a reputable NFT Token Development Company like SoluLab ensures you receive expert guidance and high-quality NFT solutions, enhancing the security and profitability of your NFT staking activities.