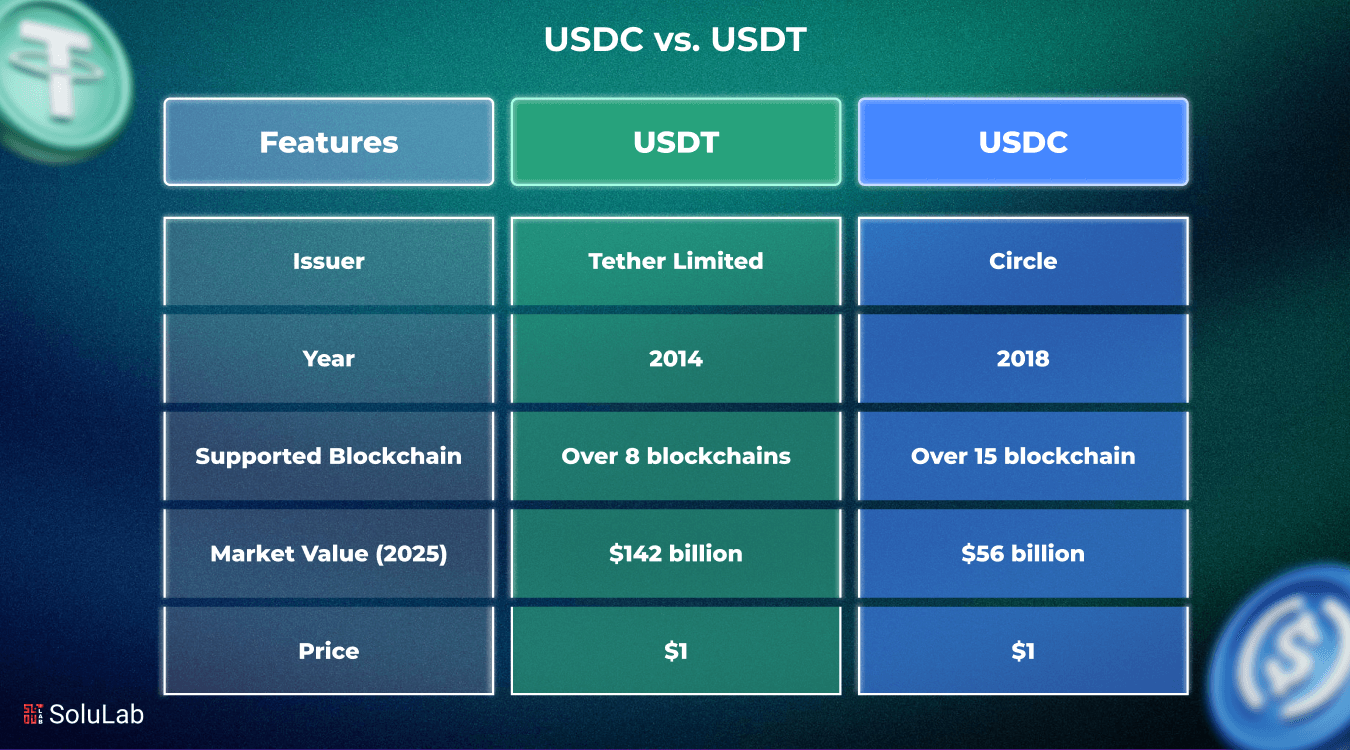

Stablecoins are a unique class of cryptocurrencies designed to offer price stability by pegging their value to a fiat currency, most commonly, the U.S. dollar. Among the most prominent names in this space are USDT (Tether) and USDC (USD Coin).

Both aim to maintain a consistent 1:1 value with the dollar, yet they differ in how they’re backed, governed, and used across blockchain networks. While USDT dominates on Ethereum, USDC has spread across multiple chains, including Algorand.

This blog will help investors compare USDT and USDC in 2026, looking at how each one works, how secure they are, where they’re most useful, and which might be a better fit for different crypto strategies.

What is USDC?

Circle launched USDC in 2018, and it is fully backed by extremely liquid cash or cash-equivalent assets. The value of USDC can always be exchanged into US dollars at a 1:1 ratio. Due to Circle’s frequent third-party audits of its reserves, it is also renowned for its transparency.

As of March 28, 2026, USDC is now valued at $60,134,104,803 and rated #7 on CoinGecko. USDC is a price-stable digital asset that has multiple applications.

- Protect against volatility: By carefully purchasing a stablecoin like USDC, investors who are exposed to other cryptocurrencies can lessen the volatility of their portfolios. Having USDC on hand can help stabilize the value of a portfolio during times of high market volatility.

- Pricing in fiat currency: A stablecoin such as USDC can be used to price digital assets listed on cryptocurrency exchanges in fiat currency.

- Stable price-pegging: USDC’s price stability makes it possible for the stablecoin to support investments or reflect equity ownership. Liabilities or debt can also be represented as USDC.

Features of USDC

- Regulatory Compliance: USDC is a safe and legal option because it complies with stringent US and EU regulations.

- Support for Multiple Blockchains: accessible on Ethereum, Solana, and other platforms.

- Wide Adoption: Utilized on decentralized finance (DeFi) systems and exchanges.

- Transparency: Frequent audits of reserves by outside parties.

Benefits of USDC

Here are the key benefits of USDC:

1. Regulatory Transparency: Issued by Circle, a regulated U.S. fintech firm, USDC follows strict compliance standards. It undergoes monthly audits and reporting, making it one of the most transparent stablecoins, especially appealing to risk-conscious and institutional investors.

2. Fully Backed Reserves: Every USDC token is backed 1:1 by cash and short-term U.S. Treasuries held in segregated accounts. Circle publishes regular attestations, offering users peace of mind about liquidity and redemption at any time.

3. Trusted by Institutions: USDC is the stablecoin of choice for many financial institutions, banks, and DeFi platforms. Its credibility and transparency make it ideal for enterprise-grade applications like tokenized securities, cross-border, and B2B payments.

4. Lower Volatility Risk: Due to regulatory oversight and a strong reserve system, USDC has a stable track record with minimal deviation from its $1 peg. This makes it less likely to face sudden trust crises compared to competitors.

What is USDT?

The most popular stablecoin is Tether (USDT), which was first released in 2014. Its value is backed by a reserve of fiat money and other assets, and it is linked 1:1 to the US dollar. Despite its flaws, especially regarding transparency, USDT is still the biggest stablecoin in terms of market value.

As of March 28, 2026, USDT has a market capitalization of $144,201,607,371 and is ranked #3 on CoinGecko.

Features of USDT

- Regulatory Compliance: USDT adheres to international regulations, including KYC and AML standards, ensuring trust with regulators and users alike.

- Support for Multiple Blockchains: Operates on multiple blockchains like Ethereum (ERC-20), Tron (TRC-20), Solana, and more.

- Wide Adoption: It is one of the most traded worldwide and is utilized on DeFi systems and exchanges.

- Transparency: Audits of reserves are performed regularly by third parties.

Benefits of USDT

Here are the key benefits of USDT (Tether):

1. High Liquidity: USDT holds the largest market share among stablecoins, which means it’s easy to buy or sell without affecting its price. This makes it a preferred choice for traders needing quick access to stable assets.

2. Wide Exchange Support: USDT is available on almost every major crypto exchange, including Binance, Coinbase, WazirX, and KuCoin. Its broad adoption ensures users can trade it easily, no matter which platform they prefer.

3. Fast Transfers: USDT supports multiple blockchain networks like Tron (TRC-20), Ethereum (ERC-20), and Solana. Transfers, especially on Tron, are completed within seconds with minimal fees, perfect for quick trades and international payments.

USDT vs. USDC: You Need To Know This

Before you choose between USDT and USDC, it’s important to understand how they differ in terms of trust, usage, and real-world applications, because not all stablecoins are created equal.

| Attributes | USDT | USDC | Winner |

| Transparency | Limited auditing | Full monthly audits | USDT |

| Launch Year | 2014 | 2018 | USDC |

| Regulation | Less regulated | Highly regulated | USDC |

| Price | $1 | $1 | – |

| Market Cap | Higher | Lower | USDT |

| Blockchain Protocol | Omni Layer, Etherum, Solana, Tron, Algorand, and more | Ethereum, Solana, Algorand, Tron, Avalanche, Stellar, and more | – |

| Adoption | Broadest usage | Growing in DeFi | USDT |

| Stability | Occasional depeg | Occasional depeg | Tie |

| Fees/ Speed | Low on Tron | Preferred on ETH | Tie (depends on blockchain) |

Which is Better: USDC vs. USDT?

When comparing USDC and USDT, the “better” choice depends on your priorities as an investor.

USDC (USD Coin), issued by Circle, is known for its transparency and regulatory compliance. It undergoes regular audits and provides detailed reports on reserves, making it a popular choice among institutional investors and those who value trust and legal clarity. USDC is also supported across multiple blockchains like Ethereum, Solana, and Algorand, offering flexibility and efficiency.

However, in terms of usage and liquidity, USDT (Tether) leads the stablecoin market. It is freely accessible on almost all cryptocurrency exchanges and is the most traded stablecoin. This makes it ideal for quick trades, arbitrage, and high-volume transactions. USDT has faced criticism over its reserve transparency and was fined by U.S. regulators in the past.

If your priority is regulatory safety and transparency, USDC is a better fit. But if you need fast, global trading with high liquidity, USDT may serve you better.

Should I invest in USDC or USDT?

Choosing between USDC and USDT depends on your investment goals, risk tolerance, and how you plan to integrate the stablecoin working in your business operations.

If you’re looking for transparency and regulatory assurance, USDC is the safer bet. Issued by Circle, a U.S.-based company, USDC undergoes regular audits and complies with strict regulations. This makes it a preferred choice for businesses, institutions, and investors who prioritize security and compliance. It’s also ideal if you plan to use it within regulated platforms or for long-term stable holdings.

On the other hand, USDT (Tether) offers greater liquidity and global adoption. It is widely accepted across international exchanges and is frequently used for quick trading, DeFi protocols, and cross-border transfers due to its presence on fast and cheap blockchain networks like Tron. However, it has faced regulatory scrutiny and questions over its reserve transparency in the past.

Conclusion

Both USDC and USDT in 2026 remain important players in the stablecoin space, each with something to provide to meet different investor demands. USDC is distinguished by its regulatory clarity and credibility, making it the best choice for risk-averse investors.

USDT, with its liquidity and usage, remains the preferred option for swift, international trading. Your choice is based on your preferences, whether compliance, usability, or speed is more important.

With the evolving crypto space, it is essential to be informed and, at times, to revisit your stablecoin options. A savvy strategy could be hedging between both to benefit from the most secure and flexible setup in your portfolio.

SoluLab, a Stablecoin development company, can help you pick the right one as per your preferences. Contact us today.

FAQs

1. Is investing in USDC or USDT safe?

Both USDC and USDT are regarded as secure stablecoins for investment purposes. They vary in terms of regulations, use cases, and transparency.

2. Are USDT and USDC considered crypto assets?

Crypto assets do not include USDT and USDC. They are categorized as stablecoins instead. By tying their value to a fiat currency, such as the US dollar, stablecoins seek to promote stability.

3. Can I transfer USDT to USDC?

If the cryptocurrency exchange has a USDT/USDC trading pair, USDT can be exchanged for USDC in the same way that cryptocurrency tokens can be exchanged for one another.

4. Is it possible to convert USDT to USDC and vice versa?

Yes, most major exchanges support swapping between USDC and USDT with minimal fees.

5. Can I use both USDC and USDT on the same blockchain?

Yes, both tokens are available on multiple blockchains, including Ethereum, though network availability can differ.