In today’s cryptocurrency market, tokens play a pivotal role in shaping the future of digital finance. As we navigate through the complexities of the crypto exchange ecosystem, understanding the significance of tokens becomes paramount. These digital assets, representing a myriad of functionalities and values, have become the linchpin of modern financial innovation.

Tokens in crypto exchange are not mere digital currencies; they are versatile instruments that fuel the engine of decentralized finance (DeFi), decentralized applications (DApps), and transformative blockchain projects. In this blog, we embark on a journey to unravel the multifaceted role that tokens play in the crypto exchange landscape. From their creation and diverse types to their intricate economics and real-world applications, we will explore the intricate tapestry of tokenomics.

So, let’s get started!

Introduction to Tokens and Their Significance

In the vast and intricate landscape of cryptocurrency, tokens stand as digital representations of value, utility, or ownership within a specific ecosystem. Unlike traditional cryptocurrencies such as Bitcoin or Ethereum, tokens operate on existing blockchain networks, leveraging the technology’s capabilities to offer a wide array of functionalities. These digital assets are created through smart contracts, self-executing contracts with the terms of the agreement directly written into code.

The significance of tokens extends far beyond their technological underpinnings. They serve as the lifeblood of decentralized systems, fueling transactions, powering decentralized applications (DApps), and enabling innovative financial models. Tokens come in various types, each designed to fulfill a unique role within their respective ecosystems. Utility tokens grant access to a platform or service, security tokens represent ownership in an asset or company, and governance tokens empower holders to participate in decision-making processes within decentralized organizations. As we delve deeper into the world of tokens, it becomes evident that their significance lies not only in their technological functionality but in their transformative impact on the broader financial landscape. Through tokenization, we witness the democratization of financial systems, offering inclusivity and efficiency that traditional models often struggle to match.

Understanding Tokens

Tokens, in the context of cryptocurrency, are digital assets that represent ownership, access rights, or stakes in a specific blockchain-based ecosystem. Unlike traditional currencies, tokens leverage blockchain technology, offering immutable records of ownership and transactions. They embody programmable functionalities through smart contracts, allowing for a wide range of applications beyond simple transactions. The key characteristics of tokens include decentralization, security, and transparency, making them integral components of the crypto exchange ecosystem.

Types of Tokens

There are various types of tokens in today’s modern world. Let’s have a look at them:

- Utility Tokens: Utility tokens are a cornerstone of the cryptocurrency space, designed to provide users with access to specific functionalities or services within a decentralized network. Users acquire these tokens to unlock features or participate in decentralized applications (DApps). Utility tokens play a pivotal role in fostering engagement within a blockchain ecosystem, creating an economic incentive for users to interact with and contribute to the network. For instance, within the crypto exchange landscape, utility tokens like Binance Coin (BNB) grant users discounted trading fees and other privileges when used on the Binance platform.

- Security Tokens: Security tokens represent ownership in real-world assets such as real estate, company stocks, or commodities. Unlike utility tokens, security tokens are subject to regulatory frameworks governing securities, as they essentially digitize traditional financial instruments. Compliance with legal standards ensures that security tokens adhere to investor protection measures. The issuance of security tokens often involves thorough legal processes to ensure alignment with securities laws. In the context of crypto exchanges, security tokens bring traditional assets onto blockchain platforms, expanding the scope of tradeable assets while maintaining regulatory compliance.

- Governance Tokens: Governance tokens empower holders with voting rights and decision-making authority within decentralized autonomous organizations (DAOs) or blockchain networks. These tokens enable users to participate in the governance of the protocol, allowing them to propose and vote on changes to the system’s rules and parameters. Within crypto exchanges, governance tokens influence the development and evolution of the platform, with users having a direct say in decisions such as fee structures, listing new tokens, and implementing changes to the exchange’s protocol. Maker (MKR) for the MakerDAO platform is a notable example of a governance token.

How Tokens are Created and Distributed?

The creation and distribution of tokens are pivotal stages that significantly impact their adoption, value, and role within the crypto exchange ecosystem. Token creation often involves the definition of specifications and the deployment of smart contracts on a blockchain. In the context of crypto exchange tokens, developers specify the token’s purpose, supply, and features, leveraging blockchain technology for transparency and security.

The distribution phase encompasses various methods, each tailored to achieve specific objectives. Public sales, where tokens are offered to the broader market, and private placements, involving strategic investors, are common distribution methods. Crypto exchange tokens may also be distributed through airdrops, where tokens are given to existing users for free, fostering community engagement. Moreover, participating in liquidity pools on decentralized exchanges (DEXs) has become a popular method for distributing and acquiring tokens. These innovative distribution mechanisms contribute to the liquidity and accessibility of tokens within the crypto exchange ecosystem, shaping their overall market dynamics.

Overview of the Crypto Exchange Landscape

The crypto exchange landscape is a bustling and dynamic ecosystem where participants buy, sell, and trade various digital assets, including crypto tokens. These platforms serve as the bridge between traditional finance and the burgeoning world of cryptocurrencies, providing a marketplace for users to exchange their digital holdings. The landscape encompasses a diverse array of exchanges, ranging from centralized platforms like Binance, Coinbase, and Kraken to decentralized exchanges (DEXs) such as Uniswap and SushiSwap.

In this multifaceted environment, users can trade a myriad of crypto tokens, each representing a unique project, utility, or investment opportunity. The exchange landscape plays a crucial role in determining the accessibility, liquidity, and overall health of the broader cryptocurrency market. It serves as a reflection of the evolving nature of digital finance, adapting to technological advancements, regulatory changes, and the ever-growing demands of a global user base.

Role of Exchanges in Facilitating Token Trading

Crypto exchanges act as the primary facilitators of token trading, providing a platform for users to buy and sell digital assets securely and efficiently. These platforms play a pivotal role in establishing market prices, ensuring fair and transparent transactions, and fostering liquidity within the crypto token ecosystem. Centralized exchanges (CEXs) act as intermediaries, matching buyers with sellers and executing trades in a centralized order book. On the other hand, decentralized exchanges (DEXs) operate without a central authority, allowing users to trade directly from their wallets, promoting increased privacy and control over their funds.

Exchanges contribute significantly to the overall vibrancy of the crypto token market by listing a diverse range of tokens. The ability to access a multitude of projects and assets on a single platform enhances market efficiency, enabling users to explore and invest in a variety of opportunities. The listing process involves careful vetting of projects, ensuring a level of legitimacy, and reducing the risk of fraudulent activities. As gatekeepers of the crypto market, exchanges play a crucial role in shaping investor sentiment and establishing trust within the community.

Importance of Liquidity in the Token Market

Liquidity is the lifeblood of any financial market, and the crypto token market is no exception. In the context of crypto exchanges, liquidity refers to the ease with which a token can be bought or sold in the market without significantly impacting its price. High liquidity is a hallmark of a healthy and efficient market, offering benefits such as reduced price slippage, increased trading volumes, and enhanced price discovery.

Crypto exchanges actively contribute to liquidity by connecting buyers and sellers, creating an environment where assets can be traded seamlessly. The bid-ask spread a key indicator of liquidity, is minimized on platforms with robust trading activity. Exchanges employ various strategies to enhance liquidity, including market-making programs, incentive mechanisms for liquidity providers, and the introduction of trading pairs to encourage diverse asset trading.

In the crypto token exchange ecosystem, liquidity is vital for the success of trading operations, the execution of large transactions, and the market’s overall stability. Platforms that effectively manage liquidity contribute to a more vibrant and resilient marketplace, attracting more participants and fostering sustained growth within the crypto token ecosystem.

Tokenomics: A Deep Dive

Tokenomics serves as the bedrock of the crypto exchange ecosystem, providing insights into the economic intricacies that govern the creation, distribution, and value propositions of crypto tokens. As we unravel the layers of tokenomics, it becomes evident that these digital assets are not merely speculative instruments; they embody economic models that shape their utility and influence their role within the broader financial landscape.

Beyond the theoretical constructs, the real-world impact of tokenomics is felt within the crypto exchange marketplace. Let’s explore how these economic principles manifest in tangible ways, impacting traders, investors, and the overall health of the ecosystem.

Economic Models Behind Token Creation

Tokenomics delves into the economic principles that underpin the creation, distribution, and utilization of crypto tokens within the crypto exchange ecosystem. Understanding the economic models behind token creation is crucial for deciphering the incentives and mechanisms that drive the value and sustainability of these digital assets.

Token Creation and Initial Distribution:

- Many tokens are created through Initial Coin Offerings (ICOs), where project developers issue a new token to fundraise for their project. Other methods include Token Generation Events (TGEs) and Security Token Offerings (STOs).

- Economic models often involve a predetermined supply of tokens, with scarcity built into the protocol to create perceived value. This scarcity can drive demand and influence token prices.

Utility and Incentive Structures:

- Tokens often serve a specific purpose within a blockchain ecosystem, providing utility such as access to a platform, voting rights, or participation in a decentralized application (DApp).

- Incentive structures, such as token rewards for network validators (Proof-of-Stake), contribute to the economic models by aligning the interests of participants with the success and security of the network.

Token Supply and Demand Dynamics

Token supply and demand dynamics are fundamental factors that shape the value and market behavior of crypto tokens within the crypto exchange ecosystem.

Fixed Supply and Scarcity:

- Many tokens are created with a fixed supply, creating a sense of scarcity that can drive demand. Bitcoin, for example, has a capped supply of 21 million, contributing to its digital gold narrative.

- Scarcity often leads to increased demand, especially if the token has utility or is perceived as a store of value.

Market Forces and Liquidity:

- Token prices are influenced by market forces, including buyer and seller activity, overall market sentiment, and macroeconomic trends.

- Liquidity, or the ease with which tokens can be bought or sold, plays a crucial role in determining price stability and preventing extreme price fluctuations.

Token Burn Mechanisms:

- Some tokens incorporate burn mechanisms, where a portion of tokens is deliberately destroyed, reducing the overall supply.

- This can create scarcity and potentially drive up the value of remaining tokens.

Token Utility and Its Impact on Value

Token utility, or the practical applications and functions a token serves within a blockchain ecosystem, has a direct impact on its perceived value and market demand.

Use Cases and Practical Applications:

- Tokens with clear and practical use cases tend to have higher value. For instance, utility tokens that provide access to specific services or platforms within the crypto exchange ecosystem carry intrinsic value for users.

- Governance tokens, allowing holders to participate in decision-making, add another layer of utility, fostering community engagement.

Network Effects and Adoption:

- The value of tokens often grows with increased adoption. As more users and projects join a blockchain network, the utility and demand for its native token tend to rise.

- Crypto exchange tokens that facilitate diverse trading pairs and offer incentives for users can experience network effects, contributing to sustained growth and liquidity within the platform.

Incentive Structures and Staking:

- Tokenomics often includes incentive structures such as staking, where users lock up their tokens to support network security and receive rewards.

- This can influence token demand and supply dynamics.

In brief, the intricate interplay of economic models, supply and demand dynamics, and token utility within the crypto exchange ecosystem creates a complex but fascinating landscape where the value and success of tokens are determined by a myriad of factors.

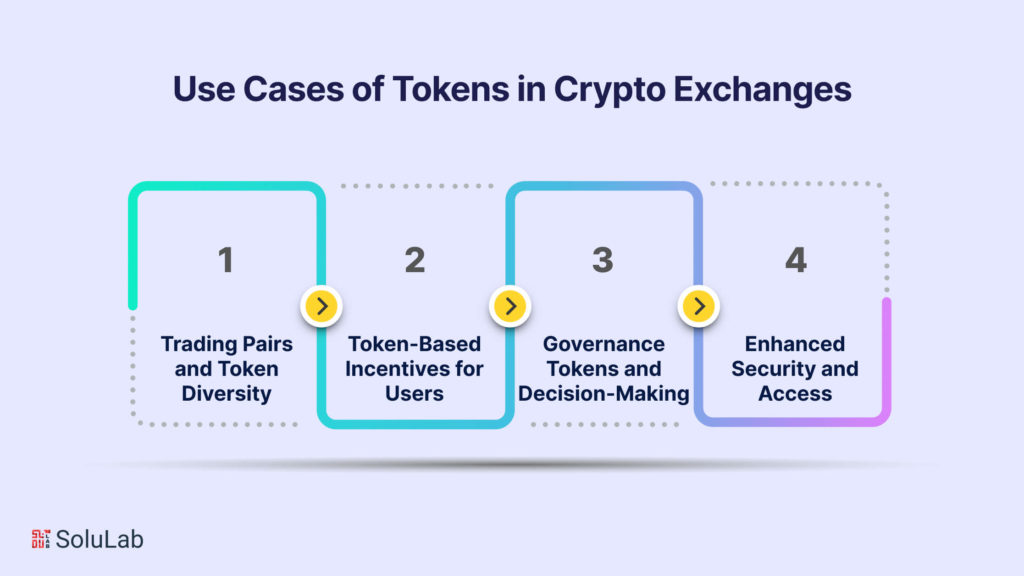

Use Cases of Tokens in Crypto Exchanges

The use cases of tokens in crypto exchanges extend far beyond mere digital representations of value. These digital assets are dynamic instruments that serve a multitude of functions, enhancing the user experience, fostering engagement, and contributing to the overall efficiency of the marketplace.

Trading Pairs and Token Diversity

- Diverse Trading Opportunities: Tokens act as the foundation for the creation of trading pairs, enabling users to trade one digital asset for another. The extensive range of tokens listed on exchanges provides traders with diverse investment opportunities, ranging from well-established cryptocurrencies to innovative projects.

- Market Dynamics and Price Discovery: The existence of various tokens facilitates robust market dynamics, allowing users to actively participate in price discovery. As different tokens interact within the exchange, their values fluctuate based on supply and demand, providing valuable insights for traders.

Token-Based Incentives for Users

- Reduced Trading Fees: Many exchanges incentivize users to hold and trade specific tokens by offering reduced trading fees. This not only promotes token adoption but also rewards users for actively participating in the exchange ecosystem.

- Rewards Programs: Crypto exchanges often introduce token-based rewards programs, distributing tokens to users based on their trading volumes or engagement levels. These rewards can be redeemed for additional trading privileges, creating a gamified and incentive-driven environment.

Governance Tokens and Decision-Making

- Participation in Exchange Governance: Governance tokens empower users to actively participate in the decision-making processes of the exchange. Holders can vote on proposals related to platform upgrades, fee structures, and the addition of new trading pairs, providing a democratic and community-driven approach to governance.

- Community Engagement: By involving users in decision-making through governance tokens, exchanges foster a sense of community engagement. This direct involvement not only empowers users but also ensures that the exchange evolves in a direction aligned with the collective interests of its user base.

Enhanced Security and Access

- Access to Premium Services: Some exchanges offer premium services that can be accessed exclusively through the ownership of certain tokens. These services may include advanced trading features, priority customer support, or participation in exclusive events.

- Security Features: Tokens may be used to enhance security features, such as two-factor authentication or whitelisting of withdrawal addresses. By tying security features to token ownership, exchanges incentivize users to prioritize the protection of their accounts.

Overall, the use cases of tokens in crypto exchanges extend well beyond their primary function as a medium of exchange. From incentivizing user engagement to shaping the governance structure of the platform, tokens are versatile tools that contribute to the vibrancy and functionality of the crypto exchange ecosystem. As the crypto landscape continues to evolve, the innovative uses of tokens in crypto are likely to play a pivotal role in shaping the future of digital finance.

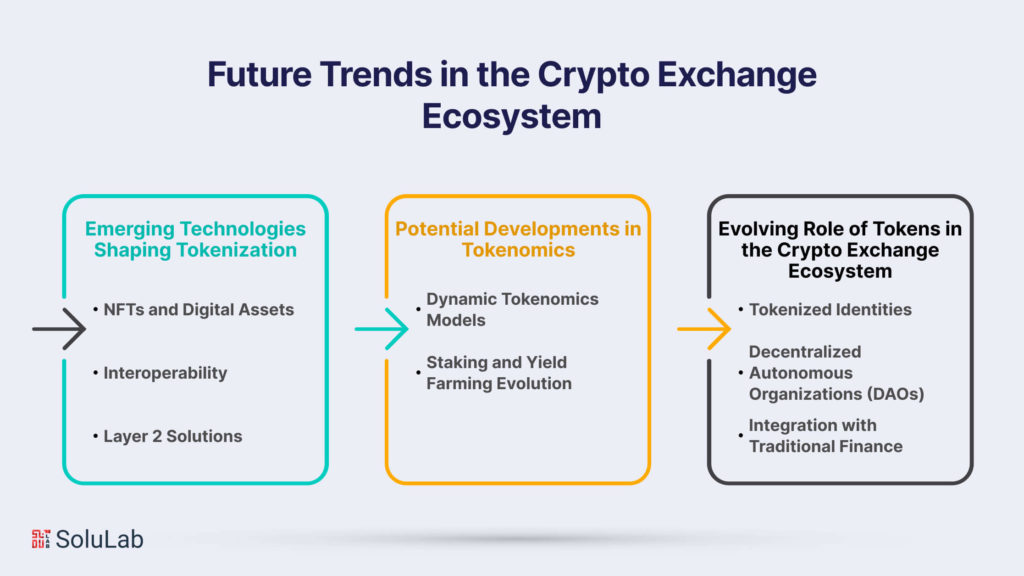

Future Trends in the Crypto Exchange Ecosystem

The future of tokens within the crypto exchange ecosystem promises to be both exciting and transformative. As technology continues to advance and the crypto space matures, several trends are likely to shape the trajectory of tokenization. Let’s explore the key future trends in the dynamic world of tokens.

Emerging Technologies Shaping Tokenization

The integration of emerging technologies is set to redefine how tokens operate within the crypto exchange ecosystem.

- NFTs and Digital Assets: Non-fungible tokens (NFTs) have already made waves in the art and entertainment industries. The future sees an expansion of NFT use cases, from tokenizing real-world assets like real estate to enabling the ownership of digital goods in virtual worlds.

- Interoperability: The interoperability of blockchain networks is becoming a focal point. Projects are actively working towards creating bridges between different blockchains, allowing tokens to move seamlessly across various platforms. This trend promotes inclusivity and collaboration within the crypto space.

- Layer 2 Solutions: As blockchain scalability remains a challenge, layer 2 solutions, such as sidechains and rollups, are gaining prominence. These solutions aim to alleviate congestion on the main blockchain networks, making transactions faster and more cost-effective.

Potential Developments in Tokenomics

The economic models governing tokens are poised for refinement and innovation.

- Dynamic Tokenomics Models: Traditional tokenomics models may evolve to become more dynamic, incorporating mechanisms that adapt to market conditions. Smart contracts could automatically adjust token supply or utility based on predefined criteria, ensuring a more responsive and sustainable ecosystem.

- Staking and Yield Farming Evolution: Staking and yield farming have become integral components of token economies. Future trends may involve more sophisticated staking mechanisms, with enhanced rewards for long-term holders and innovative yield farming strategies that foster liquidity and participation.

Evolving Role of Tokens in the Crypto Exchange Ecosystem

The role of tokens is likely to expand beyond their current functions, contributing to the broader development of decentralized systems.

- Tokenized Identities: The concept of tokenized identities could gain traction, enabling individuals to have verifiable and portable digital identities. This could have implications for identity verification, access to services, and privacy in various sectors.

- Decentralized Autonomous Organizations (DAOs): Governance tokens are already empowering users in decentralized decision-making. The future may see the rise of more sophisticated DAOs, where governance extends beyond protocol changes to include strategic business decisions, creating truly decentralized organizations.

- Integration with Traditional Finance: As the regulatory landscape becomes clearer, tokens may find increased integration with traditional financial systems. Security tokens, in particular, could bridge the gap between traditional and crypto finance, offering a regulated avenue for asset tokenization.

Overall, the future trends in the realm of tokens are marked by innovation, adaptability, and an increasingly interconnected ecosystem. The evolving landscape holds immense potential for reshaping how we perceive and interact with digital assets, laying the groundwork for a more inclusive and efficient financial future. As these trends unfold, participants in the crypto space will play a crucial role in steering the course of this exciting journey.

Conclusion

In traversing the intricate tapestry of tokens within the crypto exchange ecosystem, we find ourselves at the cusp of a transformative era. The role of tokens, from utility and security to governance, has proven to be more dynamic and influential than ever. As we look to the future, the trends we’ve explored — the integration of emerging technologies, advancements in tokenomics, and the evolving role of tokens — collectively paint a picture of an ever-adapting and innovative crypto landscape.

The potential for tokenization extends far beyond the digital realm, encompassing real-world assets, identities, and organizational structures. As we embrace the rise of NFTs, interoperability solutions, and dynamic tokenomics models, the very fabric of finance is undergoing a metamorphosis. Decentralized systems, empowered by governance tokens and DAOs, are reshaping traditional notions of authority and decision-making, opening new frontiers for user participation and ownership.

In this dynamic landscape, companies like SoluLab play a pivotal role in facilitating and accelerating the adoption of tokens and crypto technologies. SoluLab’s expertise in blockchain development solutions, smart contract creation, and decentralized applications positions them at the forefront of innovation. With a commitment to delivering tailored solutions, SoluLab empowers businesses to harness the full potential of tokens, ensuring seamless integration into the evolving crypto exchange ecosystem. Whether it’s developing custom tokens, implementing secure smart contracts, or navigating the regulatory landscape, SoluLab stands as a trusted partner in the journey toward a tokenized future. As we navigate these exciting times, collaboration with forward-thinking entities like SoluLab becomes instrumental in realizing the full transformative potential of tokens and blockchain technology.

FAQs

1. What exactly is the role of utility tokens in the crypto exchange ecosystem?

Utility tokens facilitate access to features or services within a blockchain platform, serving as a medium of exchange for transactions, DApp usage, and governance participation.

2. How do security tokens differ from utility tokens, and what role do they play in fundraising?

Security tokens represent ownership and comply with regulations, enabling the tokenization of assets like real estate. They play a key role in fundraising by providing liquidity to traditionally illiquid assets.

3. How are governance tokens transforming decentralized decision-making in blockchain projects?

Governance tokens empower users to vote on project decisions, ensuring a democratized approach to protocol upgrades, features, and strategic choices.

4. What factors influence the value of tokens, and how does tokenomics come into play?

Token value is influenced by scarcity, demand, and market sentiment. Tokenomics, the economic model, considers supply dynamics, utility, and incentives for holders.

5. How does SoluLab contribute to the world of tokens and crypto exchanges?

SoluLab specializes in blockchain development, offering solutions for custom tokens, secure smart contracts and regulatory navigation. It facilitates businesses’ seamless integration into the evolving crypto exchange ecosystem.