Many creators, startups, and businesses struggle to extract real value from their IP assets, whether it’s a patent, a design, or a copyrighted work. These assets often remain locked away, offering little to no return.

Traditional IP monetization methods are slow, complex, and limited to a few gatekeepers. This not only reduces your earning potential but also keeps innovation from reaching its full market potential. Moreover, tokenized real-world assets (including IP) could hit $30.1 trillion by 2034

By converting IP assets into digital tokens using blockchain technology, creators can now get liquidity, trade IP rights globally, and even raise funds by offering fractional ownership. In this blog, we’ll break down how tokenization works, its benefits, and real-world examples. Let’s get started!

What are IP Assets?

IP assets, or Intellectual Property assets, refer to creations of the mind that have commercial value and are protected by law. These can include inventions, brand names, logos, designs, software, trade secrets, written content, music, and even business processes. Companies and individuals can own these intangible assets, just as they can physical property. Protecting IP through :

- Patents

- Trademarks

- Copyrights

- Trade secrets

Helps prevent unauthorized use. It allows the rightful owner to monetize their innovations, gain a competitive advantage, or license them to others.

What is Tokenization for IP Assets?

A process of turning intellectual property rights, like patents, copyrights, trademarks, or trade secrets, into digital tokens on a blockchain is known as IP tokenization. These tokens provide the safe and transparent purchase, sale, licensing, and investment of intellectual property by representing ownership, usage rights, or revenue shares.

How Do Tokenization Of IP Assets Work?

By turning intellectual property (IP) into a digital asset, tokenization enables co-ownership, licensing, and trading. However, how does this operate? Let’s explore it properly (without getting bogged down in technical terms).

1. Identifying and Digitizing the Intellectual Property

To begin with, what precisely are you tokenizing? It can be a trade secret, a copyright, a trademark, or a patent. Before converting the asset into a blockchain-friendly format, the IP owner must confirm and record it. Consider this as converting your conventional intellectual property rights into a digital certificate that can be safely sold and preserved.

2. Selecting the Proper Token Standard and Blockchain

Blockchains are not all made equal. While some are more adept at financial transactions, others focus on smart contracts and NFTs (non-fungible tokens). Platforms like Ethereum, Polygon, or Hyperledger are well-liked options for IP tokenization.

Because ERC-721 and ERC-1155 (Ethereum standards) are widely used for NFTs, they are excellent for distinctive intellectual property. ERC-1400 and other security tokens function effectively in situations involving fractional ownership or investment.

Read Also: ERC-3643 vs ERC-1400 vs ERC-20: Best Token Standard?

3. Developing Smart Contracts to Establish Rights and Ownership

A smart contract is a self-executing contract that outlines the ownership of intellectual property, who gets royalties from its use or sale, and the rights of token holders (such as complete ownership versus licensing rights). When an artist tokenizes a song, for instance, smart contracts can transfer royalties to token holders automatically each time the piece is licensed or streamed, doing away with the need for middlemen.

4. Issuing and Providing Stakeholders or Investors with Tokens

After IP is tokenized, tokens can be used for crowdfunding (IP-backed investment), sold to investors (fractional ownership), or licensed for digital rights management (think of it like purchasing stock in a business, but for intellectual property).

5. Using Smart Contracts to Manage Transactions, Royalties, and Licensing

Among the most interesting features of IP tokenization? Royalties are paid automatically! Without having to wait months for a check, smart contracts ensure that the legitimate owners of intellectual property (IP) assets get compensated immediately each time they are used (for example, when a song is streamed, an artwork is resold, or a patent is licensed).

Benefits of Tokenization of IP Assets

Before you tokenize an IP asset, you must look at these advantages of tokenization of intellectual property unfold for you:

-

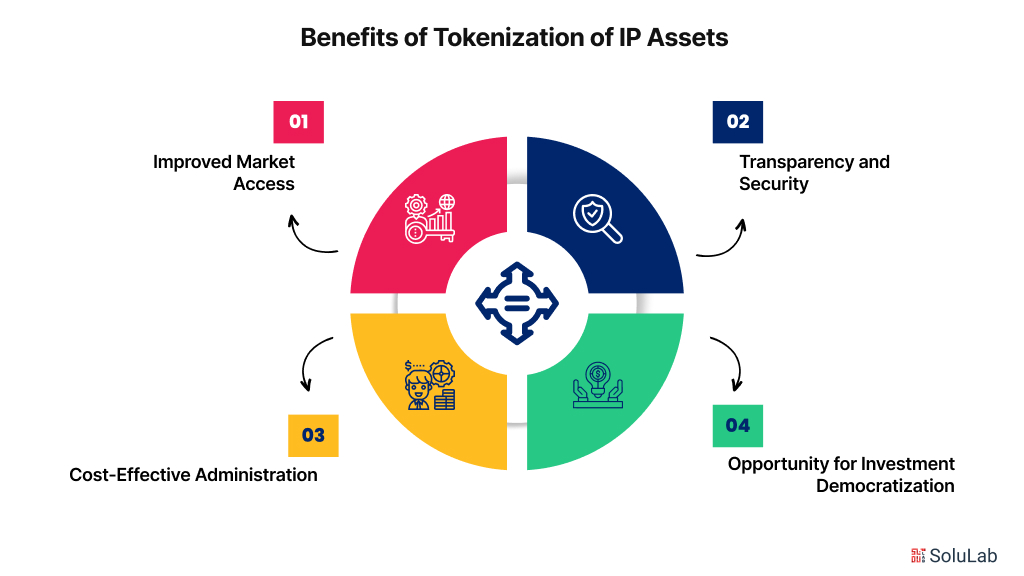

Improved Market Access

IP asset tokenization into digital currencies that are simple to trade on blockchain-based platforms, and tokenizing intellectual property greatly improves liquidity. Conventional IP asset transactions, which are frequently lengthy and time-consuming, are simplified into quick and effective exchanges. These platforms make it easier for IP assets to be purchased, traded, or licensed.

-

Transparency and Security

Tokenized IP transactions are secure because of blockchain technology. An unchangeable and opaque decentralized ledger records every transaction, offering a strong defense against fraud and unwanted changes, This reduces risks connected with IP assets tokenization by guaranteeing the safe, transparent, and verified ownership and exchange of IP tokens.

-

Cost-Effective Administration

Tokenization streamlines and automates the licensing and royalty procedures, which are typically complicated and time-consuming. The distribution of royalties and execution of license agreements can both be automated with smart contracts. Administrative overheads are significantly decreased when IP management procedures are automated and digitalized through tokenization.

-

Opportunity for Investment Democratization

Tokenized IP on blockchain democratizes investment options by dividing valuable IP assets into lower and more manageable tokens. Before only major firms or rich investors could invest in intellectual property, now a wider spectrum of investors including people and smaller companies, can do so thanks to this fractional ownership model. By reducing the barrier to participation, tokenization makes the IP market more accessible.

What is the Role of Smart Contracts in Tokenized IP?

For many concerns regarding the management and utilization of such valuable assets, there have to be creative solutions in the Tokenized IP rights, which come from smart contracts. Here is a breakdown of their importance:

1. IP Management Automation

Smart contracts dramatically reduce the need for intermediaries through such functions as license agreements and royalties. It accelerates business and ensures that all parties settle the burden accurately and within the due time especially in businesses that have involved royalty payment structures like music and movies.

2. Higher portions in Fractions and Liquidity

Smart contracts make fractional ownership possible as they turn ideas into tokens. This makes it possible for several investors to hold of shares valuable Intellectual Property and enhances the availability of investment. For instance, it will be possible to generate several tokens from one patent; thus, small companies or private investors can participate in the market.

3. Security and Transparency

Smart contracts are based on the blockchain mechanism, due to this, transactions with valuable assets like tokenization of digital assets are safe and transparent. Since no data can be altered on a blockchain, all the transactions are accurately recorded hence less chances of ownership theft and more security to the intellectual property. Combating these issues like IP theft as well as unlawful use, needs this transparency.

4. Community Relations and Management

Also, smart contracts help build decentralized governance models where users and artists would have a say in managing their ideas. This is a community-generated approach that fosters collaboration and innovation, as stakeholders have the means to collectively shape their intangible assets.

Smart contracts are central in the reformation of the policies governing tokenized intellectual property rights through automation, increased open-market trade, security, and globalization. What is more, as this technology is still developing, is it capable of dramatically changing the notion of IP property and its monetization.

Sectors that are Ready for IP Tokenization

IP rights on the blockchain are ideally positioned to make use of IP tokenization across a wide range of sectors which include:

Biotechnology and Medicine

With their potential for large financial gains and creative product offerings, the pharma and biotechnology industries have high-value intellectual property. Toenzied patents can help medical companies fresh sources of funding and make it easier for research groups to share intellectual property. IP-NFTs can also be used to decentralize research, which supports an inclusive, community-driven approach to research while lowering the requirements of patenting or starting a new business.

Entertainment

The idea of digital property rights and commercialization in the creative industry has already changed as a result of artists and content procedures tokenizing their work in response to the explosion of NFT Marketplace Platforms. Entertainment is a related but less-known area that is affected by IP asset tokenization. Tokenizing IP from public domain works and cultural archives can protect and preserve important information while creating new opportunities.

Technology

Similar to biotechnology, other technical domains can greatly profit from the data marketplace and funding opportunities that tokenization makes possible. Software including its source codes and computations can be tokenized by businesses to guarantee that it can be efficiently handled and safeguarded in an online marketplace. Small-scale developers can generate money and compete with larger firms by using tokenizing IP to obtain resources for product design, enhancement, and marketing AI.

Can Tokenized IP Make a Liquid Asset?

By providing these assets in smaller, tradeable portions, tokenization enables IP owners to make their assets available to a wider group of investors. Blockchain IP asset management lowers the danger of IP conflicts by ensuring ownership records are transparent, secure, and unchangeable. An IP asset’s value and the quantity of the tokens to be produced must be decided by the asset’s owner before tokenizing the asset. Working with a blockchain development business or a tokenization platform can do this.

The tokens may be offered for sale on a blockchain-based marketplace. The token’s ability to be bought and sold by investors gives the IP liquidity. By generating digital tokens that signify ownership of the IP assets, the tokenization of their assets offers a solution to the liquidity issue. These tokens can be purchased and traded, enabling partial ownership of the assets.

Real World Examples of IP Tokenization Projects

Here are a few actual initiatives that use tokenization for intellectual property. The majority of them mix the usage of intellectual property with non-fungible tokens.

1. CryptoKitties: NFT-Tokenizing Digital Collectibles

Players breed digital “furrever” cats in CryptoKitties, a blockchain game. Players own these unique pets 100% after collecting.

CryptoKitties’ digital cats are non-fungible tokens and digital artists’ IP. The game supports a digital collectibles and intellectual property market. For context, a buyer reportedly bought Dragon, a CryptoKitty, for 600 ETH ($170,000).

2. Red Bull Racing

Tokenizing F1 Racing NFTs, Red Bull Racing partnered with Bondly to develop non-fungible tokens showcasing past racing moments. The legendary events tokenized as NFTs constitute intellectual property.

The project lets the racing team engage fans and monetize their IP. These NFTs feature exclusive photographs, films, and virtual experiences, giving fans new opportunities to interact with the team and monetizing its IP.

3. Ethernity—Digital Art Tokenization

Other digital art IP tokenization examples include Ethernity. The technology lets artists tokenize their digital art into NFTs for blockchain ownership and exchange. Ethernity helps digital artists monetize their IP.

Ethernity uses its EVM-compatible Layer 2 on Optimism to turn real-world assets and global franchises into blockchain-native experiences, bordering on tokenization RWA.

4. Royal Platform: Tokenizing Music IP

Royal.io is developing music-crypto tokenization projects. By tokenizing music rights, its unique value proposition for musicians and listeners. Additionally, fans and investors can buy partial song and album ownership.

5. Molecule: Tokenizing Scientific Data IP Rights

Molecule tokenizes intellectual property to encourage translational science and relieve human suffering. The platform engages the public in bringing the best scientific research to market.

Molecule lets researchers construct Intellectual Property Tokens (IPTs) with fractional governance rights over research IP. Investors can buy these IPTs to become stakeholders in research decision-making and future orientations. Novel chemicals, screening systems, and therapeutic procedures may be patented.

How is SoluLab Helpful for the Tokenization of Assets?

The tokenization of intellectual property is revolutionizing how creators and businesses manage, protect, and monetize their IP assets. By converting IP into digital tokens on a blockchain, ownership becomes more transparent, divisible, and tradable.

This not only opens doors for fractional ownership and global investment but also simplifies licensing and royalty distribution. For Indian innovators, startups, and content creators, tokenization offers a powerful opportunity to the true value of their creations.

SoluLab, a top asset tokenization development company in USA, can help you tokenize assets securely. Contact us today to discuss further.

FAQs

1. What is asset tokenization on the blockchain?

Blockchain is being used to tokenize assets which are transforming the existing market dynamics and providing several interrelated advantages. This procedure makes it possible to trade on high-valued assets via digital exchange and increases transparency.

2. Why is tokenization necessary?

Tokenization adds a layer of security by substituting tokens for crucial payment information, decreasing its value to hackers.

3. How does tokenization increase liquidity?

Tokenization increases liquidity by converting assets into digital tokens, allowing them to be easily traded, shared, or sold on global blockchain development platforms.

4. What is the difference between tokenization and NFT?

Tokenization represents divisible, often fungible assets, while NFTs (non-fungible tokens) represent unique, indivisible assets like art or collectibles with distinct metadata and ownership.

5. How is SoluLab using blockchain technology for easing operations?

Blockchain technology is being used by SoluLab to optimize processes in some industries. They improve security and streamline procedures by putting BaaS into practice, which builds stakeholders’ trust.