A security token offering of STO is a unique token issued on either a permission or a permissionless blockchain. The token represents a stake in an external enterprise or asset. A number of entities such as the government as well as businesses can issue security tokens that tend to serve the same purpose as bonds, stocks, and other equities. In recent times, STO Blockchain has been readily associated with the real estate industry. Let us now understand STO Blockchain in the real estate industry in detail and how it brings about an improvement in the market.

Concept of Real Estate Tokenization

Tokenization of real estate is the method of representing a fractional ownership interest in an asset with a security token based on blockchain. Here the asset can be a security asset or utility asset. Tokenization of real estate involves the creation of tokens on the Blockchain network and assigning them to assets in the real estate market that is already existing or are presently under construction. Tokenization plays a significant role in helping the asset or fund owners efficiently raise capital by issuing tokens via blockchain platforms.

In addition to being used for the purpose of raising capital towards development investments, these tokens can also denote an interest in the real estate market, thereby allowing a broader range of developers as well as investors to participate in the real estate market. These security tokens can be bought by other investors, where tokens represent a specific amount of shares for some assets in the real estate field. Now, the investors become the partial owners of that particular asset, which provides the investors unique access to private real estate investments, with complete transparency as well as liquidity.

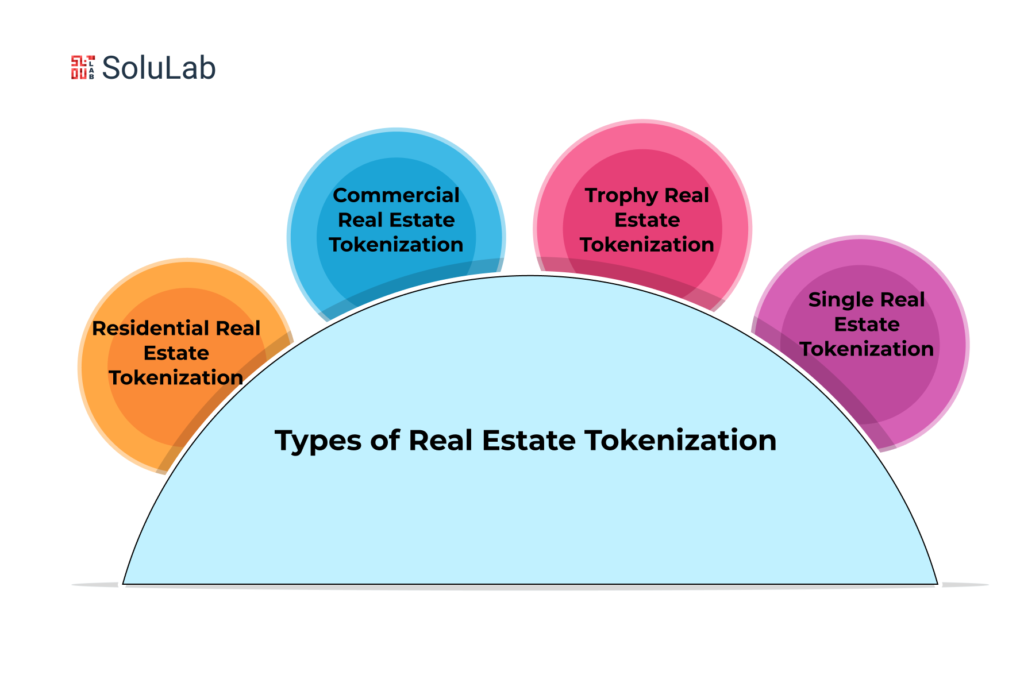

Different Types of Real Estate Tokenization

Real estate tokenization on a blockchain is usually classified into four types based on the type of assets.

-

Residential Real Estate Tokenization

Residential real estate tokenization involves converting individual residential properties, such as houses, apartments, or condominiums, into digital tokens on the blockchain. This process allows property owners to fractionalize the asset, dividing it into smaller tokenized shares. Investors can then purchase these tokens, giving them fractional ownership of the property. This democratizes the real estate market, making it more accessible for smaller investors to participate in the lucrative residential property sector, which was traditionally limited to larger investors or homeowners.

-

Commercial Real Estate Tokenization

Commercial real estate tokenization is the process of digitizing commercial properties, such as office buildings, retail spaces, and industrial complexes, into blockchain-based tokens. By dividing the property’s value into tokens, investors can buy and trade fractional shares of the property, creating a more liquid and flexible investment environment. This form of tokenization opens up new opportunities for investors to diversify their portfolios and gain exposure to the potentially profitable commercial real estate sector, which was previously limited to institutional investors and wealthy individuals.

-

Trophy Real Estate Tokenization

Trophy real estate tokenization targets exclusive and high-value properties, often considered luxury assets or iconic landmarks. By tokenizing trophy real estate, developers and owners can attract a global pool of investors interested in acquiring fractional ownership. Investors, in turn, gain access to the prestige and potential returns associated with these premium properties. Tokenizing trophy real estate democratizes access to these elite assets, providing a level playing field for investors to participate in the high-end real estate market and potentially benefit from its long-term appreciation.

-

Single Real Estate Tokenization

Single real estate tokenization focuses on tokenizing individual properties, irrespective of whether they are residential or commercial. It allows property owners to digitize their real estate assets and offer tokenized shares to investors. By doing so, they can raise capital more efficiently and enhance liquidity in the real estate market. For investors, single real estate tokenization offers the opportunity to invest directly in a specific property, providing greater transparency and control over their investment decisions. This type of tokenization caters to both property owners seeking innovative fundraising options and investors looking for a more personalized real estate investment approach.

Process of Tokenizing Real Estate

The procedure for real estate STO blockchain can be done in the three steps described below.

1. The first step to follow for the purpose of tokenizing a house, property, or any commercial place is to find an appropriately regulated blockchain platform that possesses the rights to store ownership of their tokens via the proper authorities.

2. In the next step, it is to be made sure that the platform also offers the owner the function of transferring those rights to anyone and transferring the entire ownership to someone else in an authorized way.

3. Tokenization of real estate is a way of exchange similar to any other type of security, where the owner needs to exchange the token for a certain value so that each of the assets can get their proper value represented in the tokens.

4. The entire process of tokenizing real estate is not quite complicated but there might be a few obstacles in the path. Hence, it is recommended to get in touch with an expert before proceeding with the same.

Working Process of Real Estate Tokenization

The process of tokenization helps divide the value of assets in the real estate market into shares or tokens. These tokens denote a predefined share of the underlying asset and they are referred to as security tokens. They can be easily traded at any time and are kept on a digital wallet. The tokenized assets are very securely issued, traded, and settled via a distributed ledger. The technology of distributed ledger existed for about a decade but its true potential in leveraging property management has been brought to light very recently. Distributed ledger technology uses smart contracts for the purpose of validating the ownership of an asset.

The technology’s consensus mechanism offers top-notch cyber security measures for both the issuers as well as investors. Legal complexity is one of the major challenges of launching an STO Blockchain in real estate. In this regard, it is recommended that the issuers seek professional help from an expert in this field since all the legalities need to be met and complied with. Seeking professional help would not only be making the entire process smooth and hassle-free but also avoid costly legal mistakes.

Benefits of STO Blockchain in Real Estate

STO Blockchain in real estate comes with a wide range of benefits that are discussed below.

-

Offers the Highest Level of Security

STO Blockchain in real estate not only makes the transactions secure but also makes them completely transparent. It has been observed that new technologies are questioned for security but tokenization makes sure to use the highest level of security based on the two following things.

Tokens – They help in promoting security since the investment is digitally assigned to an investor and remains with the investor till the time it is refunded or sold to another person.

Blockchain – Implementation of blockchain technology makes security even tighter.

The data so transmitted is both accessible as well as inaccessible to the ones outside the network which is possible with the help of cryptographic algorithms. The key lies in the fact that the data is decentralized. There is no copying or reversal of the code, and nodes are capable of identifying any attempts to change this code and prevent it from executing. Moreover, data is recorded in a number of places simultaneously, and the door for distributed accounting technologies opens up.

Now, the open systems will help create an entirely transparent register for real estate. The entire data associated with resources is available to everyone. Additionally, the investment is much safer since smart contracts reduce the requirement for the exchange of various documents between each of the parties involved. Most importantly, the paperwork associated with the entire process of completion of a contract is readily simplified because of tokenization. A smart contract is electronically signed which makes it irreversible, hence its content cannot be changed.

-

Immense Flexibility

Tokenization in real estate offers immense flexibility to investors. Anyone can invest a certain amount and possess partial ownership of an asset in the real estate market along with obtaining benefit from the potential profits. Moreover, these tokens can be very easily and conveniently bought as well as sold on secondary markets. The owner of the asset can also sell a part of their assets by issuing tokens. These tokens can be very easily exchanged similar to stocks, with their value oscillating depending on the changing price of the asset. Tokenization certainly offers an advantage over crowdfunding since it allows investors to have instantaneous digital ownership as well as the freedom to sell at any point in time.

-

Easy and Speedy Investment

Limiting any kind of unnecessary expenditures by staying within the legal framework is undoubtedly the most effective optimization option for any kind of activity. Blockchain technology plays a crucial role in enabling the same by the removal of barriers such as bank fees, notary fees, etc. Paying via cryptocurrency helps get over these barriers appropriately. This, in turn, results in enhancing the returns of the investors and at the same time compressing the process of raising capital where the entity manages the investment, thereby streamlining the entire process.

At the time when investments are made with tokens, it readily reduces costs. At the same time, tokens provide greater freedom as the investor can buy a share in real estate and profit from it at any time. The entire process is automated and does not require any kind of unnecessary formalities, thereby making it speedy. The right to an asset in the real estate market can be acquired through the purchase of a token that does not require any kind of changes to the records of real estate.

-

Geographical Barriers are Eliminated

STO Blockchain in real estate helps in the elimination of geographical barriers. Thus, investors regardless of their location can purchase an asset in any part of the world. The investors can benefit from participating in the same and enjoy profits from various housing estates, resorts, commercial properties, or any other irrespective of the time as well as their location.

-

The entry Barrier is Lower

Investing in real estate is always associated with huge sums of money. The high entry amount in real estate investment is precisely the reason why a considerable volume of investors stays away from it. But with the help of tokenization, there is no need to purchase an entire property. Any of the properties can be divided into several thousands of tokens. So, all that an investor requires to do is to purchase only a single token. As a result of asset tokenization, investors can very easily participate in a smaller shareholding structure which is similar to distributed investing. Therefore, tokenization eliminates millions of dollars of investment and can be done with only a few dollars of investment in purchasing a part of any asset in the real estate market. This, in turn, results in a lower entry barrier for investors with lower capital.

-

Diversification is Higher

Tokenization of assets in real estate plays a significant role in diversifying investment strategies as well as assets. With a lower entry amount, investors can buy a number of assets in the real estate market in parts instead of buying only one. It results in the diversification of their investment wallet as well as their sources of revenue.

-

Elimination of Middlemen

STO Blockchain in real estate helps liquidate the secondary real estate market. Hence, the need to deal with formal barriers like bank charges, notarial deeds, and similar others is eliminated. Moreover, blockchain helps eliminate middlemen like agents, lawyers, etc., and reduces deposit fees. Most importantly, it works 24*7 and investors need not worry about time while planning to invest. Also, there is no limit on the number of tokens purchased or traded by an investor.

-

Costs are Lowered for Investors

Tokenizing assets involves much lower costs as compared to the other methods of financing. Moreover, the investors or developers also require a way for raising capital for various projects. Stock markets and bonds have become costly, time-consuming, and complicated. Tokenization, on the other hand, provides a faster as well as cheaper method for holding assets. If any of the real estate developers happen to choose between listing assets on the stock exchange or issuing bonds, tokenization is undoubtedly a cheaper as well as simpler option.

Use Cases of Real Estate Tokenization

Let us now analyze a few of the use cases of STO Blockchain in real estate.

- Raising Capital for Different Real Estate Projects – STO Blockchain in real estate offers a revolutionary method to raise capital for various real estate projects. Whether it’s for property purchase, construction, expansion, or development, tokenization allows property developers and owners to fractionalize the property’s value into digital tokens. These tokens can then be sold to a broader pool of investors, including retail investors, institutional players, and international buyers. By leveraging blockchain technology, the fundraising process becomes more accessible, efficient, and transparent, attracting a larger number of potential investors and accelerating project development.

- Selling Existing Properties – Tokenizing existing properties enables property owners to sell fractional ownership stakes to multiple investors, reducing the minimum investment threshold. This increased accessibility to real estate investment attracts a more diverse range of potential buyers, ultimately leading to a quicker sale of properties. Through tokenization, property owners can offer fractional ownership, enabling investors to diversify their portfolios by acquiring stakes in multiple properties and potentially creating a more liquid market for real estate assets. As a result, sellers can benefit from enhanced liquidity leading to increased profitability and faster real estate transactions.

- Buying Distressed Real Estate – STO Blockchain provides an innovative solution for acquiring distressed real estate assets. Tokenizing distressed properties allows interested investors to contribute capital, collectively transforming the property’s value through renovations, upgrades, or redevelopments. As the property’s value increases, the token holders can sell their stakes at a higher price, generating profits for both the investors and the original property owners. This not only attracts capital for rehabilitation but also fosters community-driven investments leading to revitalized neighborhoods and higher returns for investors.

Read Also: 9 Blockchain Real Estate Companies to Watch in 2023

- Creation of a Real Estate Marketplace – An STO-powered real estate asset marketplace presents a compelling use case for tokenization. This marketplace can host various real estate properties available for tokenization, allowing multiple property owners to list and sell their assets to a global audience. Through the marketplace, investors can explore and participate in crowd real estate investing by purchasing fractional ownership in multiple properties and diversifying their investment portfolio. Such a decentralized marketplace eliminates geographical barriers, making it easier for international investors to access and invest in real estate projects around the world.

- Facilitation of Fractional Ownership of High-Value Assets – Tokenization enables fractional ownership of high-value real estate assets, such as luxury yachts, private islands, or commercial jets. Investors can purchase digital tokens representing a share of these assets, gaining access to experiences and benefits that were previously exclusive to wealthy individuals. Fractional ownership democratizes luxury asset investment, making it accessible to a broader audience and providing a new way for individuals to diversify their investment portfolio with unique and prestigious assets.

- Allowance of Cross-Border Real Estate Investment – STO Blockchain facilitates cross-border real estate investments, overcoming geographical barriers and regulatory hurdles. International investors can easily participate in real estate projects in different countries, broadening their investment horizons and diversifying their portfolios with global assets. Tokenization streamlines the investment process, ensuring transparent ownership and simplified cross-border transactions, making it easier for investors to seize attractive real estate opportunities around the world.

- Management of Real Estate Asset – Blockchain-based tokenization streamlines real estate asset management by automating tasks like property valuations, rent collection, and financial reporting. Smart contracts can enforce predefined rules for revenue distribution, ensuring efficient and transparent operations. Tokenized assets also allow for easy tracking of ownership, making real estate asset management more secure and less prone to fraud or disputes. This enhanced transparency can attract institutional investors seeking improved compliance and oversight in their real estate investments.

Future of STO Blockchain in Real Estate

STO Blockchain has already been acclaimed as the future of investing. The growth of global real estate investment market grew from 7.4 trillion dollars in the year 2016 to 8.5 trillion dollars in the year 2017, and then it reached 8.9 trillion dollars in the year 2018. The consistent growth of the market provides a huge scope of STO in real estate. Real estate tokenization has been the emerging trend and market experts expect it to further increase with an overall market capitalization of more than 10 trillion dollars by the end of this year.

Conclusion

The rise of STO blockchain in real estate has revolutionized the industry, unlocking unparalleled opportunities for investors and developers alike. SoluLab’s prowess in blockchain development and commitment to innovation has positioned them as a leading player in this dynamic field. As the real estate landscape continues to evolve, SoluLab remains dedicated to empowering clients with cutting-edge solutions that drive growth, transparency, and efficiency. Whether you are a real estate developer seeking efficient fundraising avenues or an investor looking to diversify your portfolio, SoluLab is your trusted partner in navigating the transformative world of STO blockchain in real estate. Embrace the future of real estate investment with SoluLab and unlock the full potential of blockchain technology in this dynamic industry.

FAQs

1. What is STO blockchain, and how does it impact the real estate industry?

STO blockchain refers to the process of tokenizing real-world assets, such as real estate properties, on a blockchain network. It revolutionizes the real estate industry by enabling fractional ownership, increased investment accessibility, transparency, and efficient fundraising. SoluLab, as a leading technology provider, leverages the STO blockchain to empower real estate developers and investors with innovative solutions for seamless and secure transactions.

2. How can STO blockchain benefit real estate developers?

STO blockchain offers real estate developers an alternative and efficient method of raising capital for their projects. By tokenizing real estate development projects, developers can attract a broader pool of investors, reducing reliance on traditional lenders and accelerating project timelines. SoluLab’s expertise in blockchain technology ensures a streamlined fundraising process, enhancing transparency and reducing administrative complexities.

3. Is STO blockchain secure for real estate investors?

Yes, the STO blockchain ensures a high level of security for real estate investors. Blockchain technology’s inherent properties, such as immutability and transparency, protect real estate transactions from fraudulent activities. Smart contracts govern the terms of token ownership and revenue distribution, eliminating intermediaries and enhancing security. SoluLab’s commitment to the highest security standards guarantees the integrity of real estate assets and the trust of investors.

4. How does the STO blockchain enable cross-border real estate investment?

STO blockchain facilitates cross-border real estate investment by leveraging blockchain’s borderless nature. International investors can seamlessly participate in real estate projects from different countries, diversifying their investment portfolios globally. SoluLab’s expertise in blockchain development ensures compliance with international regulations, making cross-border transactions seamless, secure, and efficient.

5. Can small investors participate in high-value real estate projects through STO blockchain?

Absolutely! STO blockchain allows fractional ownership, enabling small investors to invest in high-value real estate assets. By purchasing digital tokens representing fractional shares of properties, small investors gain access to prestigious and luxury real estate projects that were once reserved for wealthy individuals and institutions. SoluLab’s user-friendly interfaces and innovative solutions make real estate investment accessible and inclusive for all.

6. How can SoluLab assist in implementing STO blockchain solutions for real estate?

SoluLab is a leading technology provider with extensive experience in blockchain development and real estate solutions. We offer comprehensive services, including tokenization, smart contract development, security auditing, and compliance, to ensure a seamless STO blockchain implementation. Our team of experts guides real estate developers and investors throughout the process, making STO blockchain adoption a smooth and successful journey.