In Web3, it’s not competition that kills projects, it’s vulnerabilities. The $625M Ronin hack, $600M Poly Network exploit, and $320M Wormhole breach proved how one unchecked bug can wipe out hundreds of millions instantly

In 2026, the stakes are even bigger. With blockchain hitting $14.2 trillion TVL, projects are losing over $3.2 billion every year to exploits. That’s why a smart contract audit is insurance. It protects your users, your funds, and your reputation. Founders who skip audits don’t save money, they take on a massive silent risk that can destroy everything overnight.

So, on average, a smart contract audit cost, around $3,000–$5,000 for simple tokens, $15,000–$30,000 for DeFi protocols, and $50,000+ for complex multi-chain systems. The price may look high, but it’s nothing compared to a security breach. This guide breaks down what you’ll pay, why it matters, and how to get maximum value without cutting corners, so you launch with confidence, not fear.

Key Takeaways

- Smart contract audit costs vary based on the size and complexity of your code.

- One small bug can destroy your whole product. A proper smart contract security audit protects your users, your funds, and your reputation.

- Projects with audits report 3.2 times faster institutional adoption and 2.8 times higher seed round valuations compared to unaudited peers

- Manual audits take 2–6 weeks, while automated scans are cheaper but miss almost 40% of the issues.

How Smart Contract Audit Services Protect Your Funds and Prevent Multi-Million Dollar Hacks?

Launching without a smart contract audit is the biggest hidden risk in Web3. You might attract $10M in deposits, feel confident in your code, and still miss a tiny bug that a hacker finds in hours. One exploit can drain your entire pool, kill user trust, destroy your reputation, and wipe out your project. That’s a $10M loss that a $40K audit would have prevented, a clear 250x ROI in security.

Audits are now mandatory if you want growth. Major exchanges like Coinbase, Kraken, and Binance require a smart contract audit before listing. Without one, you’re stuck on low-volume DEXs with little trust or liquidity. Users also deposit more into audited protocols, most projects see 3–5x higher adoption and TVL simply because people feel safer.

Investors follow the same rule. VCs, funds, insurance companies, and banking partners will not support or invest in unaudited protocols. An audit signals seriousness, stability, and long-term potential. Without it, you’ll lose deals before the conversation even starts.

And the impact is proven. Uniswap’s early OpenZeppelin audit built credibility, attracted liquidity, and helped them scale into a DEX handling trillions in annual volume. One audit shaped their entire success.

Here is the true cost of skipping Audit:

| Project | Audit Cost | Hack Loss | Value Preserved / ROI |

| Poly Network | $0 | $600,000,000 | Everything |

| Compound | $20,000 | $100,000 | 5,000× ROI |

| Harvest Finance | $12,000 | $34,000,000 | 2,833× ROI |

| Yearn Finance | $25,000 | $11,000,000+ | 440× ROI |

If you want trust, listings, funding, and long-term growth, a smart contract audit is not a cost, it’s the smartest investment your protocol can make.

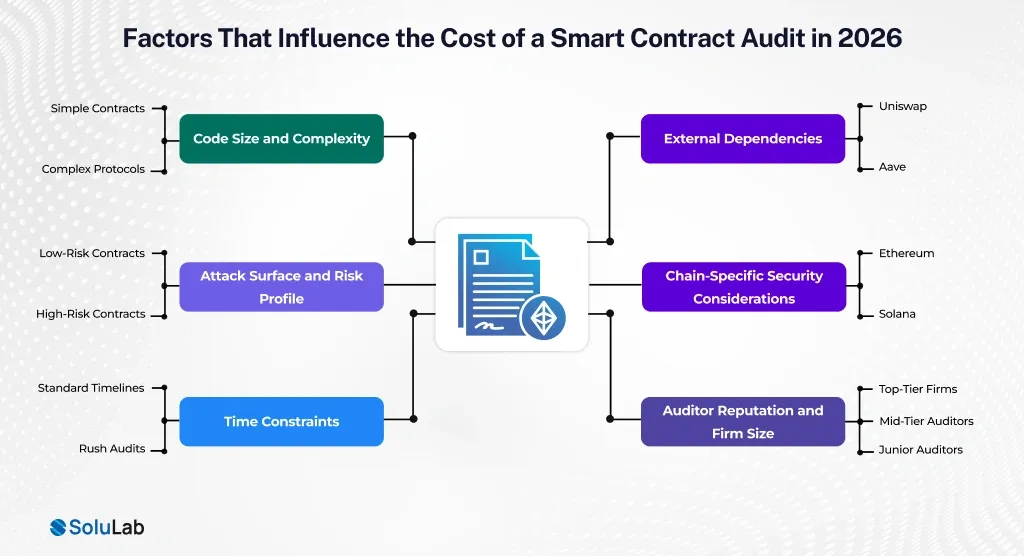

Key Factors Influencing Smart Contract Audit Costs in 2026

Smart contract audit costs vary widely from twenty thousand dollars to two hundred thousand dollars depending on several key factors. Understanding these factors helps you plan your project budget and ensures your code is secure and reliable.

1. Code Size and Complexity

The size and complexity of your code directly affect the audit cost. A simple 500 line token contract takes less time to review and costs less. A 50,000 line DeFi protocol with governance, complex math, and multiple integrations requires far more time and effort. More code means more review, which increases the cost.

2. External Dependencies

Contracts that interact with other protocols such as Uniswap, Aave, or Curve require additional checks. Each external connection adds security risk and auditors must ensure your contract handles every scenario from these protocols. For example, a lending protocol borrowing from both Compound and Aave requires auditing both interactions, which increases the time and cost.

3. Attack Surface and Risk Profile

The financial risk of your contract is a major factor. Low-risk contracts, like read-only NFT metadata contracts, are less expensive to audit. High-risk contracts, such as DeFi platforms handling large sums, require premium rates. Auditors charge more because the consequences of bugs are much higher, similar to an insurance hazard premium.

4 Chain-Specific Security Considerations

Each blockchain has unique vulnerabilities. Ethereum contracts require checks for EVM-specific attack vectors. Solana and Aptos require auditors with specialized knowledge of their architectures. Specialized expertise increases the audit cost.

5. Time Constraints

Projects with tight deadlines usually incur higher fees. Rush audits require auditors to prioritize your project over others, which increases costs by thirty to fifty percent compared to standard timelines.

6. Auditor Reputation and Firm Size

Top-tier firms such as OpenZeppelin, Certik, and Trail of Bits charge between 80,000 -200,000 for enterprise audits due to their strong track record and credibility. Mid-tier auditors typically charge 25,000 to 70,000, while junior auditors charge 3,000 to 15,000 but carry higher risk of missing vulnerabilities.

How Much Does a Smart Contract Audit Cost?

Smart contract audit prices change a lot based on what you are building, how complex it is, and which blockchain you use. Here’s a clear and simple breakdown to help you understand real 2026 audit costs:

| Audit Type | What’s Included | Estimated Cost (2026) |

| Simple Token Audit (ERC-20, basic tokens) | Code review, vulnerability checks, standard compliance | $3,000 – $5,000 |

| Basic Staking Token Audit | Mint/burn logic, reward checks, basic economic flow review | $8,000 |

| Mid-Level DeFi Audit (DEX, lending, yield farming) | Full code review, economic risk tests, gas optimization, and architecture review | $15,000 – $35,000 |

| DEX Audit (Uniswap-style) | Swap math verification, LP mechanics, fee logic, flash-loan protection | $20,000 – $40,000 |

| Lending/Stablecoin Audit | Interest logic, collateral checks, liquidation math review | $40,000 – $60,000 |

| Complex Multi-Chain Audit | Multi-chain testing, security modeling, and oracle checks | $70,000 – $100,000+ |

| Bridge/Interoperability Audit | Cross-chain message validation, signature verification, and security modeling | $80,000 – $150,000+ |

| Formal Verification Add-On | Mathematical proof that code works exactly as intended | +$10,000 – $50,000 |

How Long Does a Smart Contract Audit Take in 2026?

The duration of a smart contract audit depends on the complexity of your project. A simple token audit usually takes 5–7 days, a standard DeFi audit can take 2–4 weeks, complex protocol audits may require 4–8 weeks, and enterprise-level audits with formal verification can extend to 6–12 weeks.

Auditing is not a quick glance at the code, it’s a detailed, technical process designed to ensure your smart contracts are secure and reliable. Auditors don’t just skim your code, they:

- Read and understand your code to see exactly what it does

- Trace all execution paths to check every possible scenario

- Test edge cases to find potential failures

- Model tokenomics and economics to ensure calculations are correct

- Verify security assumptions to confirm your contracts are safe

- Write detailed reports and answer your questions clearly

You can speed up a smart contract audit, but each method comes with its own trade-offs.

Popular Smart Contract Audit Services & Their Pricing in 2026

This simple comparison helps you understand real smart contract audit costs and what you get for your money.

| Auditor Firm | Simple Token Audit | DeFi Protocol Audit | Enterprise/Complex | Reputation | Turnaround Time |

| OpenZeppelin | $25,000 | $60,000 | $150,000+ | ⭐⭐⭐⭐⭐ | 4–6 weeks |

| Certik | $15,000 | $45,000 | $120,000+ | ⭐⭐⭐⭐⭐ | 3–5 weeks |

| Trail of Bits | $20,000 | $50,000 | $140,000+ | ⭐⭐⭐⭐⭐ | 4–6 weeks |

| PeckShield | $10,000 | $35,000 | $90,000+ | ⭐⭐⭐⭐ | 3–5 weeks |

| SlowMist | $12,000 | $40,000 | $100,000+ | ⭐⭐⭐⭐ | 4–6 weeks |

| ConsenSys Diligence | $18,000 | $55,000 | $130,000+ | ⭐⭐⭐⭐⭐ | 4–6 weeks |

| Quantstamp | $14,000 | $42,000 | $110,000+ | ⭐⭐⭐⭐ | 3–5 weeks |

| Runtime Verification | $22,000 | $58,000 | $145,000+ | ⭐⭐⭐⭐⭐ | 5–7 weeks |

| Halborn | $16,000 | $48,000 | $125,000+ | ⭐⭐⭐⭐ | 3–5 weeks |

| Oak Security | $13,000 | $38,000 | $95,000+ | ⭐⭐⭐⭐ | 4–6 weeks |

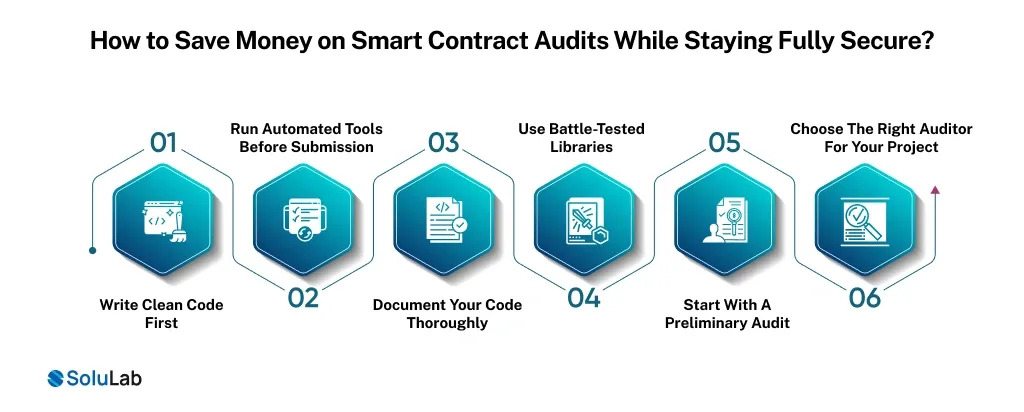

How to Save Smart Contract Audit Costs While Staying Fully Secure?

Most projects overspend on smart contract audits, not because the auditors charge too much, but because the code is messy or incomplete before it even reaches them. Studies show auditors spend up to 40% of their time fixing avoidable mistakes, rather than focusing on critical security issues. By preparing properly, you can cut audit costs significantly while improving contract security.

1. Write Clean Code First

Clean, structured code is the foundation of a faster, cheaper audit. Use ERC standards, follow proven design patterns, and leverage trusted libraries like OpenZeppelin. Avoid hard-coded values, inconsistent naming, or redundant logic. Clean code allows auditors to focus on security vulnerabilities instead of decoding your intentions.

Please conduct internal peer reviews before submission. Having another developer review your code often catches obvious mistakes and saves hundreds of auditor hours.

2. Run Automated Tools Before Submission

Automated tools like Slither, MythX, and Echidna detect vulnerabilities in seconds that would cost auditors hundreds of dollars to find manually. Run multiple tools to cover different types of vulnerabilities like static analysis, fuzz testing, and runtime checks. Fix flagged issues thoroughly before submission.

So, integrate these tools into your CI/CD pipeline to catch bugs early in development, not just before audit. This approach improves code quality continuously, reducing audit friction.

3. Document Your Code Thoroughly

Auditors spend less time guessing your logic when your code is well-documented. Add clear comments for complex functions, explain the reasoning behind critical decisions, and note any assumptions or limitations.

So, create a short developer’s guide or README summarizing contract architecture, dependencies, and external integrations. This not only helps auditors but also your internal team for maintenance.

4. Use Battle-Tested Libraries

Don’t reinvent the wheel. Rely on proven libraries like OpenZeppelin for tokens, Uniswap for swap functions, Aave for lending logic. Auditors already know these libraries well and can verify your integration rather than auditing the library itself.

When integrating multiple libraries, write modular functions and clearly separate core logic from library calls. This reduces complexity and makes auditing easier.

5. Start With a Preliminary Audit

A 1-week preliminary audit ($10K–$15K) can catch the most obvious issues before a full-scale audit. Fixing issues early prevents costly revisions during the final audit and ensures your team has time to polish code quality.

Treat this like a practice run. Use the preliminary audit to improve documentation, test coverage, and error handling, so the final audit is smoother and faster.

6. Choose the Right Auditor for Your Project

Not all auditors are equal. Match your auditor to your project complexity and risk:

- Simple token launch: junior or mid-level auditors are sufficient.

- DeFi protocols, bridges, or multi-chain projects: experienced teams like OpenZeppelin or Trail of Bits are necessary.

Don’t forget to ask potential auditors for past project case studies and average audit durations. Choosing the right team reduces cost, avoids delays, and ensures security standards are met. Right-sizing your auditor can save 30–50% of costs.

Checklist Before You Book a Smart Contract Audit

Before spending money on a smart contract audit, make sure your code is fully ready. This helps save time, money, and avoids delays. Use this checklist to ensure your project is audit-ready:

1. Code Quality

- All code follows proven smart contract patterns.

- Uses OpenZeppelin or other battle-tested libraries.

- Code is well-commented and documented.

- No obvious inefficiencies or gas waste.

- Every function has a clear purpose.

2. Testing

- Unit tests cover all functions, around 80% coverage.

- Integration tests check multi-contract interactions.

- Edge cases tested like (zero amounts, max integers, etc.

- All tests pass consistently.

3. Security Preparation

- Ran Slither and fixed all critical/high issues.

- Ran MythX and resolved findings.

- Checked for known vulnerability patterns.

- Verified no hardcoded secrets or addresses.

- Access controls are clearly defined.

4. Documentation

- Architecture document explains system design.

- Threat model identifies known risks.

- README clearly explains what the contract does.

- All assumptions are fully stated.

5. Team Readiness

- Team member assigned to coordinate with auditors.

- Budget approved for audit costs.

- Timeline set for fixing issues after audit.

- Plan for public vs. private audit reports.

- Post-audit retesting budget planned around $5K-$10K

6. Regulatory & Compliance

- Consulted legal team on compliance.

- Decided on bug bounty program.

- Insurance provider, if needed, informed about audit timeline.

- Exchange listing requirements verified.

Following this checklist can save 30–50% in audit costs and ensures your project is audit-ready.

Conclusion

In 2026, smart contract audit costs range from $8K to $250K+, depending on project complexity. But think of it this way: you’re not just paying for an audit, but you’re paying for peace of mind, user trust, and protection against costly mistakes. Proper audits can prevent $100M+ disasters, help unlock exchange listings, and show your users that your project takes security seriously. Cutting corners now could cost millions later.

At SoluLab, we provide professional smart contract development and audit services to help your project stay secure and succeed. Investing in the right audit partner ensures your code is solid, your users are confident, and your project is ready for growth. The choice is clear: spend smart now with experts, or risk paying much more later.

FAQs

If you want the lowest cost, automated tools like Slither run around $300–$1,000. Manual audits from smaller firms start at $3,000–$8,000. But remember, cheaper usually means less thorough. Serious projects handling funds should budget at least $15K for a proper audit.

Technically, yes, but it’s risky. Developers often miss hidden vulnerabilities in their own code. Professional smart contract auditors catch issues 60% of the time that the original devs miss. DIY auditing on contracts that handle money is basically financial suicide.

After major code changes, always get a new audit or at minimum, a targeted re-audit of the changed functions. Small tweaks might skip a re-audit, but that’s risky. Plan for one full audit per major version release.

Automated audits scan code quickly for known vulnerabilities. They catch about 60% of issues and are cheaper. Manual audits are done by human experts who analyze edge cases, logic flaws, and subtle bugs that machines miss. The best approach combines both.

Yes. Public audits build trust with users and investors. Redact sensitive details like deployment dates or private key handling. Many audit firms offer both public and private versions of reports.

A thorough report typically has an Executive summary, Vulnerability findings, Code quality observations, Gas optimization tips, Risk assessment and Remediation recommendations