In the ever-evolving landscape of the digital economy, Non-Fungible Tokens (NFTs) have emerged as a groundbreaking concept, revolutionizing the way we perceive and trade digital assets. At the forefront of this revolution is OpenSea, an NFT marketplace that has gained significant attention for its role in facilitating the buying, selling, and trading of NFTs. In this article, we will delve into the intricacies of OpenSea’s business model, its revenue sources, and its position in the NFT marketplace ecosystem.

Understanding OpenSea: The Decentralized NFT Marketplace

In the digital age, traditional concepts of ownership and value have undergone a paradigm shift, thanks to the emergence of Non-Fungible Tokens (NFTs). At the forefront of this transformative movement is OpenSea, a decentralized NFT marketplace that has been a driving force behind the rapid growth of the NFT ecosystem. In this article, we will delve deep into understanding OpenSea: its purpose, features, significance, and the role it plays in the world of NFTs.

The Essence of OpenSea:

OpenSea, founded in 2017 by Alex Atallah and Devin Finzer, represents a revolutionary concept that has changed how we perceive and interact with digital assets. At its core, OpenSea is a platform that enables users to buy, sell, and trade NFTs. NFTs are unique digital tokens that establish ownership and authenticity of various digital and physical items, such as digital art, collectibles, music, virtual real estate, and more. Unlike cryptocurrencies like Bitcoin or Ethereum, NFTs are indivisible and cannot be exchanged on a one-to-one basis.

Read Our Blog: How to Build an NFT Marketplace on Ethereum Blockchain?

Empowering Creators and Collectors:

One of OpenSea’s primary functions is to provide creators with a platform to mint their own NFTs. Minting involves tokenizing a digital asset, essentially converting it into a unique, tradable token on the blockchain. This process embeds ownership and provenance information into the token, ensuring its authenticity. Creators can then list their NFTs for sale on OpenSea, reaching a global audience of potential buyers and collectors.

For collectors, OpenSea offers a vast marketplace to discover and acquire a diverse range of NFTs. Whether you’re passionate about digital art, a fan of a specific artist, or interested in a particular category, OpenSea’s interface makes it easy to explore and engage with the NFT ecosystem.

Decentralization and Transparency:

Central to OpenSea’s ethos is its decentralized nature. The platform operates on the Ethereum blockchain, leveraging its smart contract functionality to ensure transparency and security. Each NFT transaction, listing, and ownership change is recorded on the blockchain, providing an immutable and publicly accessible ledger. This decentralization eliminates the need for intermediaries, creating a direct connection between buyers and sellers.

NFT Marketplace Dynamics:

OpenSea operates as a hub for NFT transactions, both primary and secondary. Primary transactions involve the initial sale of NFTs from creators to buyers, with creators setting their own pricing and terms. Secondary transactions occur when buyers resell their acquired NFTs to other interested parties. OpenSea’s marketplace provides a seamless environment for these exchanges, fostering liquidity within the NFT ecosystem.

Read Also: Binance Business Model and Revenue Sources Explained

Interoperability and Integration:

OpenSea’s significance extends beyond its own platform. It has become a hub for managing NFTs acquired from various sources. NFTs minted or purchased on other platforms that adhere to Ethereum’s standards can be managed and viewed within a user’s OpenSea wallet. This interoperability enhances convenience for users, who can access their entire NFT collection in one place

How Does OpenSea Work?

OpenSea operates as a decentralized NFT marketplace that functions on the Ethereum blockchain. Its platform facilitates the creation, discovery, buying, and selling of non-fungible tokens (NFTs), which are unique digital assets that represent ownership of specific items or content. Let’s take a closer look at how OpenSea works:

1. Ethereum Blockchain Integration:

OpenSea is built on the Ethereum blockchain, which is a decentralized and programmable blockchain known for its smart contract functionality. NFTs on OpenSea are ERC-721 tokens, a specific token standard on Ethereum that enables the creation of unique and indivisible digital assets.

2. NFT Creation:

Creators, artists, and users can mint their own NFTs on OpenSea. Minting an NFT involves turning a digital file, such as an image, video, music, or other forms of content, into a unique token on the blockchain. This process establishes ownership and authenticity of the digital asset.

3. Listing NFTs:

Once minted, NFTs can be listed for sale on the OpenSea marketplace. Sellers set the price, choose whether the NFT is an auction or fixed-price listing, and add a description and relevant metadata to provide context about the NFT. These listings are visible to potential buyers on the OpenSea platform.

Read Our Blog Post: Why Should You Start Your Own NFT Marketplace Business?

4. Discovering NFTs:

Buyers and collectors can browse the OpenSea marketplace to discover a wide range of NFTs across various categories such as art, collectibles, virtual real estate, domain names, and more. The platform offers search and filtering options to help users find NFTs based on their preferences.

5. Buying NFTs:

When a buyer finds an NFT they are interested in, they can make a purchase by placing a bid or buying it at the listed price, depending on the seller’s preferences. Bids are placed during auction-style listings, and the highest bidder wins the NFT when the auction ends. For fixed-price listings, buyers can immediately purchase the NFT at the specified price.

6. Ownership and Transfer:

Once a purchase is made, ownership of the NFT is transferred from the seller to the buyer. This ownership transfer is recorded on the Ethereum blockchain, providing an immutable record of the transaction. Buyers can view their NFTs in their OpenSea wallet and manage them from there.

Read Our Blog: Rarible Business Model and Revenue Sources

7. Interoperability:

OpenSea is not limited to its own ecosystem. NFTs bought or acquired from other platforms that are compatible with the Ethereum blockchain can also be managed and viewed within the OpenSea interface. This interoperability allows users to have a comprehensive view of their NFT holdings.

8. Community and Engagement:

OpenSea fosters a community of creators, collectors, and enthusiasts. Users can follow their favorite artists, creators, or NFT projects to stay updated on new releases and developments. The platform often hosts special events, collaborations, and drops that engage the community and promote the NFT ecosystem.

9. Secondary Market:

After purchasing an NFT, buyers have the option to resell their NFTs on the OpenSea marketplace. This creates a secondary market where NFTs can change hands multiple times, each time recorded on the blockchain. The ability to trade NFTs in the secondary market adds to the liquidity and dynamic nature of the platform.

Check Our Blog Post: Top NFT Development Companies To Look At In 2023

10. Decentralization and Security:

OpenSea operates in a decentralized manner, meaning that ownership, transactions, and listings are recorded on the Ethereum blockchain, reducing the risk of fraud and ensuring transparency. The platform does not hold users’ private keys, enhancing security and control over their assets.

In essence, OpenSea serves as a bridge between creators, collectors, and buyers in the NFT ecosystem, leveraging the power of blockchain technology to create a transparent, secure, and accessible marketplace for unique digital assets.

OpenSea Business Model:

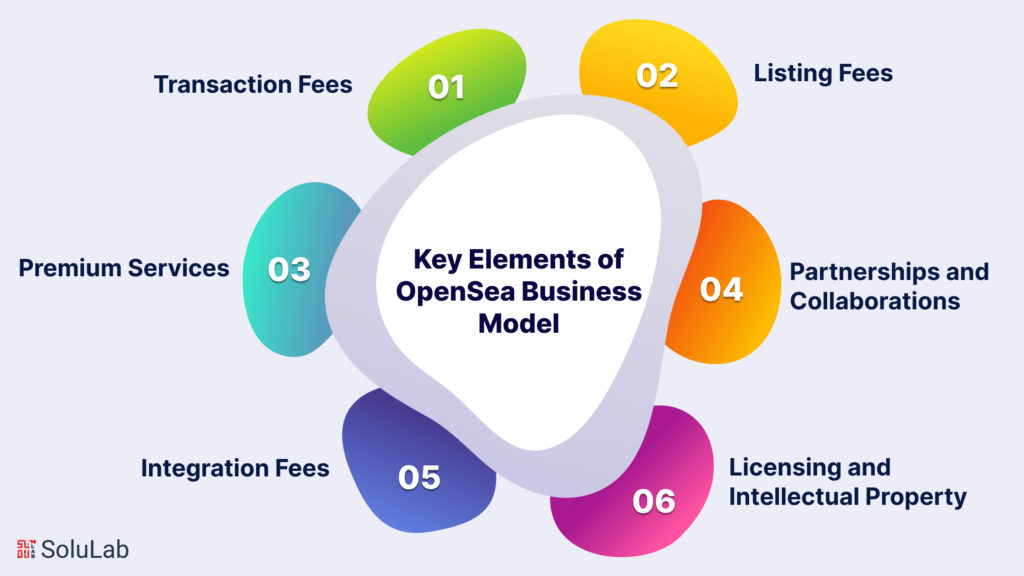

OpenSea’s business model is rooted in several key elements:

Transaction Fees: One of the primary revenue streams for OpenSea is the collection of transaction fees. Whenever a successful NFT transaction occurs on the platform, OpenSea charges a percentage of the sale value as a fee. These fees can vary based on factors such as the type of asset being traded and the total transaction amount.

Listing Fees: In addition to transaction fees, OpenSea may also charge listing fees to creators who wish to list their NFTs on the platform. These fees contribute to the operational costs of maintaining the marketplace.

Premium Services: OpenSea has the potential to introduce premium services for both buyers and sellers. These services could include enhanced visibility for listings, analytics tools, and customization options, all of which could be offered at a premium price.

Read Also: Navigating the NFT Marketplace Landscape: Exploring the Best Platforms in 2023

Partnerships and Collaborations: OpenSea can explore partnerships with brands, artists, and other NFT projects. Collaborative efforts can lead to exclusive drops, special events, and limited editions, generating additional revenue through shared profits or collaboration fees.

Integration Fees: OpenSea can offer integration services to other platforms, allowing them to incorporate OpenSea’s marketplace functionality into their own ecosystems. This could involve licensing fees or revenue-sharing arrangements.

Licensing and Intellectual Property: OpenSea might delve into licensing digital assets from creators, enabling the platform to earn through sublicensing and the commercial use of these assets.

OpenSea’s Revenue Sources

As of 2023, OpenSea’s revenue model has been fueled primarily by transaction fees and listing fees. The exact percentages and fee structures can vary over time and may depend on the evolution of the NFT market. These fees are instrumental in sustaining the platform’s operations, supporting technological advancements, and fostering the growth of the NFT ecosystem.

Service Fees

With each transaction conducted on the platform, OpenSea imposes a service fee of 2.5%. This implies that a transaction amounting to $1000 results in OpenSea earning revenue of $25.

During its initial stages, OpenSea introduced the bundles feature as a solution to address situations where Ethereum gas fees exceeded the value of an NFT. However, at present, OpenSea assumes responsibility for covering all Ethereum gas fees.

Read Our Blog: How To Launch Your Own NFT Marketplace Website in Less Than 2 Days?

Registration Fees

To initiate a user’s account, OpenSea applies an initial fee ranging from $70 to $300. Additionally, for obtaining access to a user’s NFTs, OpenSea imposes a fee of approximately $10 to $30.

OpenSea’s Revenue in 2023

As of 2023, OpenSea’s revenue has seen substantial growth, mirroring the explosive rise of NFTs in mainstream culture. With the increasing adoption of NFTs across industries and the growing interest from collectors, OpenSea’s transaction volume has likely expanded, consequently boosting its revenue.

OpenSea’s Competitive Landscape

While OpenSea has established itself as a prominent player in the NFT marketplace, it faces competition from various other platforms with similar offerings. Competitors include Rarible, Foundation, SuperRare, and Mintable, among others. Each of these platforms employs its own unique business models and revenue strategies, contributing to a diverse and competitive NFT marketplace landscape.

Final Remarks

OpenSea’s future growth prospects are closely tied to the evolution of the NFT market. As NFTs continue to infiltrate sectors such as art, gaming, music, and real estate, OpenSea’s user base and transaction volume are poised to expand. The platform’s revenue streams may diversify further as it introduces innovative services and leverages partnerships to tap into emerging trends.

As the NFT ecosystem continues to evolve, OpenSea’s adaptability and capacity to innovate will play a pivotal role in shaping its revenue trajectory and solidifying its position as a key player in the NFT marketplace.

With the increasing popularity of NFTs, businesses and entrepreneurs may find themselves intrigued by the prospect of establishing their own NFT marketplaces. SoluLab stands out as a reputable company specializing in the development of NFT marketplaces, offering customized solutions tailored to the unique requirements of businesses aiming to venture into the NFT domain.

Whether the need is to enlist the services of NFT developers or to acquire a white-label NFT marketplace, SoluLab possesses the expertise and technical prowess to transform conceptual NFT marketplace ideas into tangible realities.

Leveraging its profound grasp of blockchain technology and its array of NFT marketplace development services, SoluLab brings a range of comprehensive offerings to the table. In summary, OpenSea’s success as a digital asset trading platform highlights the growing demand for NFT marketplaces. If you are considering entering the NFT space, SoluLab is a trusted partner that offers comprehensive services, including NFT marketplace development, hiring NFT developers, and white-label NFT marketplace. Embracing the potential of NFTs and partnering with SoluLab can open up exciting opportunities for businesses in the digital asset industry.

FAQs

1. What is the OpenSea NFT marketplace?

OpenSea is the largest user-friendly exchange platform for buying and selling NFTs. The founders; Devin Finzer and Alex Atallah established OpenSea after the great success of NFT CrypoKitties. It is a great marketplace to browse through, buy, and sell NFTs, including music, collectibles, art, and video game things. It offers an opportunity for users to trade with one another in a quick, complete, and trustless manner. Users get full access to and control over their cryptocurrency wallets due to the noncustodial aspect of the platform.

2. What is the business model of OpenSea?

The OpenSea business model is flexible because it enables users to buy, sell, and trade non-fungible tokens online. OpenSea turns a profit via service chary. Each successful sale of a digital asset via a platform leads to the collection of these charges. Collectors can safely transfer their money for rare digital products.

3. What are the pros and cons of selling NFTs on OpenSea?

There are certain pros and cons related to selling NFTs on Open Sea. Let’s start with the pros. OpenSea offers significant NFT assets. This has more than 150 different cryptocurrencies, which makes it easy for investors to trade in NFTs. It also accepts over 14 different cryptocurrency wallets for transactions.

4. What are the features of Opensea clone scripts?

The OpenSea Clone Script was built by top-tier computer experts and is completely customizable as per the user’s needs. And experts are 24/7 available to add and remove features based on the user’s requests. OpenSea clone scripts also provide the feature to buy, sell, and trade all the cryptocurrencies and enable the users to trade cryptocurrencies in many domains.