The decentralization of the Internet is necessary due to the increasing power of centralized entities over users’ data and the Internet itself. Even though web3 has been available for over ten years, people are only now beginning to understand how important a decentralized web environment is. Promised as the next and improved version of the internet, Web3 is expected to address problems with the highly centralized web of today. Giants in the payment processing industry like Visa and Mastercard have been aggressively investigating web3 potential over the last couple of decades. Both businesses declared their collaborations with bitcoin exchanges and wallets. Compared to all Visa payments of $47.6 trillion, $2.5 billion were paid with crypto-connected Visa cards in the fourth quarter of 2021.

Web3, even in its early stages of development, guarantees safer, easier, and more intelligent payments due to its decentralized architecture. Peer-to-peer, international, and capable of supporting several coins and blockchains are Web3 payments. In this blog, we will talk about how web3 payments work inside the decentralized web3 ecosystem.

So, let’s get started!

What Exactly is Decentralized Finance?

Let’s first acquaint ourselves with the concept of decentralized finance (DeFi), which underpins web3 in payments, before delving deeper into them. The primary goal of DeFi is to transform conventional banking and lending. Through cryptocurrency tokens that borrow money and obtain insurance on their own without the help of a third party, DeFi enables its users to earn interest.

Because the blockchain is decentralized, it can function effectively without the need for a middleman. A developer, bank, person, or other organization might act as an intermediary. Enabling trustless financial transactions inside the ecosystem is the primary advantage of DeFi development. With software known as decentralized apps (dApps), users have access to DeFi. Unlike traditional centralized finance, customers need not apply to this scenario to create an account with a bank.

DeFi is accessible through the following methods:

- Every 60 seconds, users may lend their cryptocurrency to receive prizes and interest.

- Obtaining a loan is now simple. Users don’t have to submit any papers to acquire a loan. They have access to “flash loans,” which are quick loans that aren’t typically provided by banks.

- Certain cryptocurrency assets allow for peer-to-peer trade. Direct stock purchases and sales are feasible without the need for a brokerage.

- To earn interest, users may also put cryptocurrency into savings accounts. The interest obtained from cryptocurrency will surpass what individuals usually receive from banks.

- Additionally, we can consider future contracts or stock options for certain crypto assets while placing long or short wagers against them.

How Does Decentralized Financing Work?

DeFi uses cryptocurrencies and smart contracts to provide financial services. This removes the requirement for middlemen such as guarantors. Among these services is lending, which allows users to borrow money instantly, trade without a broker, save cryptocurrency, borrow their cryptocurrency, and earn interest in a matter of minutes. Additionally, users can choose to purchase derivatives such as futures contracts or stock options.

dApps are used by users to enable peer-to-peer commercial transactions. Ethereum is where most of these dApps are available. Coins like Ether, Solana, Polkadot, and Stablecoins are among the most popular dApps and DeFi services. In addition, they comprise tokens, decentralized DeFi mining, yield farming, liquidity mining, staking, and trading, and they also include digital wallets like Coinbase and MetaMask.

Since DeFi is open-source, users may potentially examine and modify its protocols and applications. By building their dApps, users may mix and match DeFi protocols to generate novel combinations of possibilities.

Web2 and Web3 Payment Differences

Peer-to-peer transactions are possible globally with Web2. It also entails a go-between that serves as a reliable bridge between two strangers or persons who don’t know one another. The guidelines for transactions are also set by the middlemen. Decentralized web3 payments, as opposed to web2 payments, are not subject to transaction blocking by any party. Anonymity is provided by blockchain technology. Around the world, Web3-based payment is likewise powered by powerful computers. Therefore, single points of failure are eliminated since even if one node fails, another one takes its place.

The recently introduced peer-to-peer web3 payment architecture greatly simplifies and accelerates the process of delivering apps to production. Blockchain bureaucracy exists. It will therefore enable money transfers between individuals without requiring them to register for financial services. Because Web3 data is encrypted, customers may pay money online without having to create an account for financial services or provide businesses access to their personal and financial data.

Because web3 does not have bureaucracy, payments are processed significantly more quickly. Web3 payments on the blockchain clear in minutes or seconds, but web2 payments might take days to settle. A web3 payment system also makes international transfers easier by removing the need for expensive remittance fees and complicated currency conversion.

Web3 Payment Features

- The payment mechanism in use today is more intricate than ever. There are lengthy settlement timeframes and substantial processing expenses. An alternative to the flawed currency payment system, Web3 provides high security, censorship resistance, quick translation rates, and sufficient incentives.

- dApps may be developed using the Web3 in payments mechanism, which provides a decentralized and permissionless system. They are therefore unaffected by financial censorship. Anyone with an internet connection may access these goods and services from anywhere in the world.

- Furthermore, the Web3 payment system lacks confidence. Without the assistance of a third party, participants may speak with each other both publicly and privately. Instead of an intermediary, self-executing smart contracts that only execute when specific criteria are satisfied are used.

- Another key tenet of Web3 infrastructure design is interoperability, which facilitates connectivity and mobility across many web3 platforms and applications. It is also a crucial first step in quickening the adoption of Web 3.

How Can I Use Web3 to Make Payments?

Payments for Web3 can be made in several different ways:

Web3 SDK and wallets for dApp-based payment processing

Web3 wallets are digital wallets that let you engage with dApps on different blockchains and keep digital assets, such as fungible and non-fungible (NFTs) tokens.

Web3 wallets may be found for many blockchains:

- Browsers Wallets

- Mobile Wallets (Android and iOS dApps)

- Browser Extensions

To keep their digital assets, users can open accounts in web3 wallets. Two keys are associated with a web3 wallet account: public and private. An account’s public key is its address, which anybody may use to send or exchange tokens and other assets to that account. It poses no security risk when shared with others. Simultaneously, the Private key functions similarly to a password, necessary for all transactions within the corresponding wallet. It’s a code that needs to be kept private to prevent security lapses. To import newly established accounts into a web3 wallet, using the same private key.

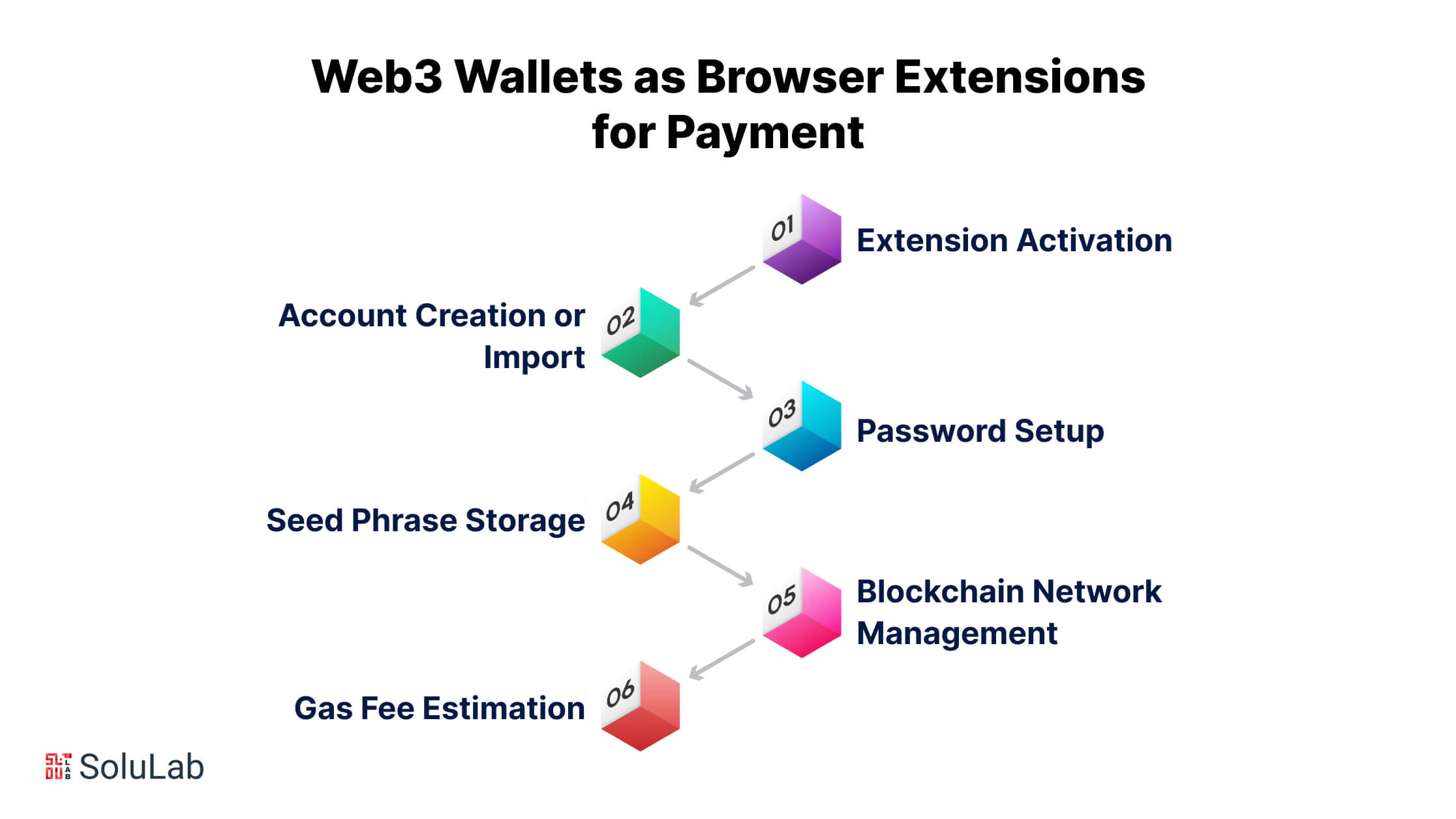

Using Web3 Wallets as Browser Extensions for Payment

Enabling seamless Web3 payment solutions through browser extensions involves a straightforward user process:

-

Extension Activation

Users initiate the process by downloading and activating the designated browser extension.

-

Account Creation or Import

Upon activation, users have the option to create a new account by setting up a wallet password. Alternatively, they can import an existing account using its private key.

-

Password Setup

For new accounts, users establish a wallet password distinct from the private key, enhancing security.

-

Seed Phrase Storage

After password setup, the wallet displays a seed phrase. Users must securely store this phrase to enable account restoration and fund recovery if necessary.

-

Blockchain Network Management

The wallet provides the flexibility to switch between blockchain networks, such as Mainnet, Testnet, and Devnet, and supports the addition of custom networks and localhost configurations.

-

Gas Fee Estimation

When making a transaction through a decentralized application (dApp), a transaction screen appears, showcasing the estimated gas fee required for blockchain modifications. This fee is deducted from the native token balance (e.g., ETH for Ethereum) associated with the connected blockchain.

Incorporating these steps ensures a user-friendly and secure experience for executing transactions using web3 wallets as browser extensions, facilitating easy access to decentralized financial ecosystems.

What Does a Web3 QR Code Mean?

Web3 QR codes may be used to accomplish several functions, such as saving a link to the blockchain account data on the explorer of that blockchain and enabling payments or asset transfers to other accounts. To transfer money, assets, or ether to another account using Metamask, each account has a QR code that can be scanned. Along with any other necessary information, the QR code typically comprises the public key for the account. It serves as an alternative in this instance to utilizing an account’s public key to transfer money to it.

Related: How AI and Blockchain are Shaping the Future of QR Codes?

What Does Web3 Payment “FIAT Payment On-Ramping/Off-Ramping” Mean?

Getting Started

With Web3, a user may purchase cryptocurrencies by “on-ramping,” where they can trade any fiat cash for cryptocurrency. When it comes to assisting customers who wish to utilize any blockchain or decentralized apps (dApps), on-ramping is essential. The user needs a specific cryptocurrency to pay the gas cost for any transactions they may need to conduct while utilizing a blockchain application.

When they first start using the blockchain, individuals who are unfamiliar with cryptocurrency may not have the necessary cryptocurrency in their wallets. Without simple onramps, a user would have to make arrangements for the cryptocurrency money needed to access the program while the wallet he is using waited for him to return with the necessary cash so he could begin using it. On the other hand, the majority of wallets offer the capability of on-ramping the fiat money for the necessary crypto to make the user experience smooth, and successful, and need less time.

Users may quickly change their fiat currencies (USD, INR, etc.) to the cryptocurrency in their wallets using credit or debit cards.

Wallets like Metamask leverage payment systems like MoonPay, Transak, and others to enable users to purchase cryptocurrency with debit cards, credit cards, and many other payment methods in return for their fiat money.

Off-Ramping

In Web3, “off-ramping” describes the procedure whereby a user can exchange his cryptocurrency holdings for fiat money. While the on-ramp of cryptocurrency is critical to the global spread of decentralized finance, the off-ramp of cryptocurrency is equally crucial, since consumers need to get familiar with its applications and usage.

Off-ramping enables users to recoup their fiat money by selling their digital or cryptocurrency assets on sites. Thus, users are drawn to blockchain and cryptocurrency from all over the world.

- Fiat to the Crypto Gateway: By allowing a business to accept fiat currency as payment, the fiat currency to Web3 crypto payments gateway enables the on-ramping of fiat currencies. Users can withdraw money in the cryptocurrency of their choice and vice versa.

The following is how the cryptocurrency acceptance procedure operates:

- The products are chosen by the customers and added to the cart.

- Pay for something.

- Enter the payment information by using fiat currency to fill in the blank.

- Thanks to a fiat-to-cryptocurrency payment processor, the money will be transferred and then refunded to the merchant’s wallet.

- trade into a selected cryptocurrency in real time.

- Crypto money can be withdrawn or stored by merchants.

Fiat to the Web3 crypto payments processor is a third-party payment firm that processes payments using cryptocurrency in real-time by converting fiat payment checkout data collected by the payment gateway to cryptocurrency. The information is then passed through a security check system.

Additionally, fiat onramps and offramps offer a mechanism for money transfers between individuals. One can transfer fiat money, such as USD, to another individual. The central financial authority, such as the bank, onramps the fiat into cryptocurrency and then offramps the cryptocurrency back to fiat before entering it into the recipient’s account, as opposed to sending the fiat money to the recipient in its original form.

Final Thoughts

Businesses may keep up to date with the newest technology advancements and delight modern clients by accepting web3 payments. On the other hand, web3 payment process implementation requires a great deal of patience and skill. In addition to expanding the range of currencies that may be exchanged, Web3 payments can also create new financial opportunities that go beyond simple fiat currency exchange. Accessing the financial market and investing will be made simpler by the ease with which cryptocurrency and other currencies can be paid for.

Our web3 experts at SoluLab, a web3 development company, can assist you with the whole process of developing a web3 payment solution, from consulting to creating it. Contact our team at SoluLab to learn more about our future-ready web3 solutions today.

FAQs

1. What is Web3 payment, and how does it differ from traditional online payments?

Web3 payment refers to transactions conducted on decentralized networks using blockchain technology. Unlike traditional online payments, Web3 payments provide enhanced security, transparency, and user control, utilizing smart contracts and cryptocurrencies.

2. How do I initiate a Web3 payment using a browser extension?

To initiate a Web3 payment, download and activate the compatible browser extension. Create or import an account, set up a wallet password, and securely store the provided seed phrase. Once configured, users can seamlessly make transactions through decentralized applications (dApps).

3. Can I switch between different blockchain networks using Web3 payment solutions?

Yes, most Web3 wallets allow users to switch between various blockchain networks, such as Mainnet, Testnet, and Devnet, and even add custom networks. This flexibility enables users to engage with different ecosystems and experiment with blockchain applications.

4. How can I recover my Web3 wallet and funds if I lose access?

Safeguard your Web3 wallet by storing the seed phrase in a secure location. In the event of losing access, use the seed phrase to restore your account and recover funds. Remember, never share your seed phrase with anyone, as it provides access to your entire wallet.

5. Are Web3 payments secure, and what measures are in place to protect user accounts?

Yes, Web3 payments are known for their enhanced security. Wallets are secured with a password, and the use of private keys and seed phrases adds a layer of protection. Additionally, the decentralized nature of blockchain technology reduces the risk of centralized vulnerabilities common in traditional payment systems.

6. How does SoluLab contribute to Web3 development, and what services does it offer in this domain?

SoluLab empowers Web3 development by providing comprehensive services, including blockchain development, smart contract expertise, and the creation of decentralized finance (DeFi) development solutions. Our team excels in Non-Fungible Token (NFT) development, prioritizes interoperability, and offers custom solutions tailored to clients’ unique needs. With a focus on security and strategic consultation, SoluLab facilitates businesses in embracing the decentralized future with confidence and innovation.