What makes a stablecoin secure, stable, and reliable in the eyes of people and the law? The world economy is taking new turns, and digital assets, such as cryptocurrency tokens, are evolving and gaining traction. At the same time, Hong Kong Stablecoin Regulations made users feel secure in their investments. This new Hong Kong Genius Act Stablecoin Regulation bill’s legal framework aims to provide a clear view of digital currencies.

These rules are not just about new technology and economic growth; this is about building trust, security, and global standards. The blog offers detailed information on these regulations and how they support stablecoins. Let’s begin!

Hong Kong Stablecoin Regulation Officially Enforced

What’s legal and what’s not is finally clear!

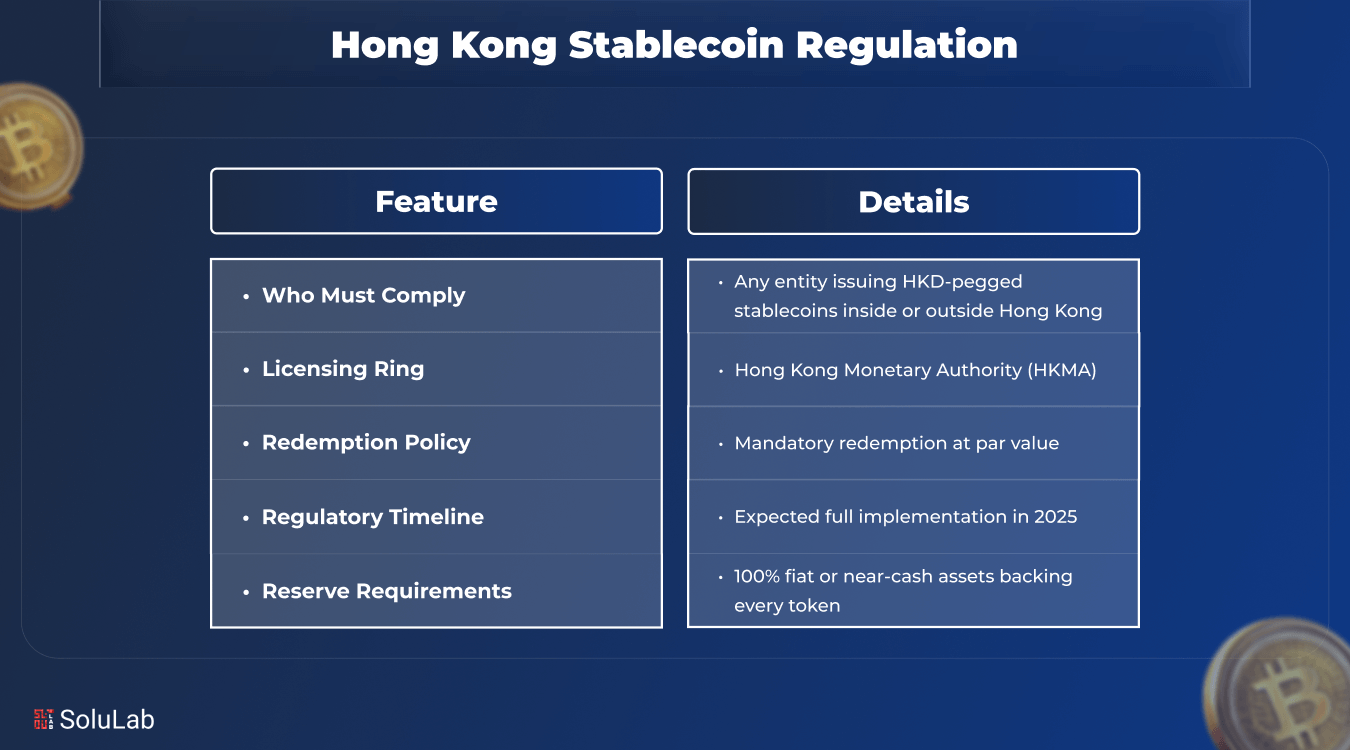

On 21 May 2025, Hong Kong’s Legislative Council passed a law that regulates the use and issuance of stablecoins. The Bill was first gazetted on 6 December 2024 and took effect after amendments by mid‑2025. The law is officially part of the Financial Institutions (Resolution) Ordinance, 2024.

With this move, the Hong Kong Monetary Authority (HKMA) now has full power to handle licensing, oversight, and enforcement related to fiat-backed stablecoins. This new ordinance gives Hong Kong an edge in becoming a global hub for responsible digital finance. The aim is to mix innovation with solid regulation of stablecoins.

Aligns innovation with public trust

Hong Kong wants to allow crypto growth, but not without strong checks. The government said it’s committed to supporting financial technology, but public safety and user protection come first. Christopher Hui, Secretary for Financial Services and the Treasury, made this clear during the reading. He said:

“We want to encourage innovation, but we must make sure that stablecoins meet the standards before they go public.”

He also said stablecoins should not be used by the public unless their stability and safety are legally ensured. This law reflects the need to earn user trust, not just market attention.

What the Hong Kong Stablecoin Regulation Bill Covers Exactly?

A reliable legal framework always provides trust and a secure platform to the people and investors. Let’s check how the Hong Kong stablecoin bill provides stability.

-

Only fiat-backed stablecoins are allowed

The law clearly limits which types of stablecoins are legal. Only fiat-backed stablecoins are allowed. This means that every stablecoin must have one-to-one backing by a traditional currency, like the Hong Kong dollar or US dollar.

Each coin must match its reserve value exactly. For example, an HK$1 stablecoin must be backed by HK$1 in cash or equivalent. This rule avoids the risk of unstable or synthetic coins entering the payment system.

-

No room for algorithmic tokens

Algorithmic stablecoins are banned under the new law. These include coins like TerraUSD, which collapsed in 2022. Hong Kong regulators say such tokens are too risky because they don’t have reliable reserves.

The law prevents any issuer from creating a stablecoin that uses market algorithms or crypto collateral to manage price. This ensures that all legal stablecoins will remain stable during market shocks.

-

Payment use-cases are the main focus

The new regulation only covers stablecoins used for payment or settlement purposes. If a token is designed for investment, trading, or speculation, the law does not currently cover it.

According to the HKMA, the goal is to allow stablecoins to be used like digital cash. That’s why the regulation targets coins that may become part of public transactions, like buying goods or paying for services. This focus keeps the law clear and practical, without slowing down innovation elsewhere in crypto markets.

Licensing Explained for Stablecoin Issuers

As the bill has already passed, now investors and companies should register and get a proper license. Let’s see how to do that.

1. Issuers must apply through the HKMA

Any company or person wanting to issue a stablecoin in Hong Kong must get a license from the HKMA. This process is mandatory. The HKMA will soon release full licensing guidelines. These will include all forms, timelines, and required documents. This rule applies to both local and foreign firms operating in Hong Kong.

2. Fit-and-proper and reserve conditions apply

The licensing process checks whether issuers are fit and proper. This includes their experience, financial soundness, and clean track record. The company must also maintain enough reserve assets to back all issued coins. These reserves must be held in liquid, low-risk fiat assets. This ensures that user funds remain safe, even if the issuing company has financial trouble.

3. Issuance restricted without a valid license

No one is allowed to issue or promote a stablecoin for public use without a license. This applies to companies and individuals. Issuing a stablecoin without approval is now a criminal offense. HKMA said penalties could include fines and imprisonment, though exact numbers will be clarified in upcoming notices. This is designed to stop bad actors before they reach the public.

Hong Kong Stablecoin Regulation Distributor Rules

If you are an entrepreneur thinking of starting a digital assets company, then you must know the following regulations.

-

Distributors defined under the law

The law does not just focus on issuers. It also covers distributors, entities that promote, sell, or provide access to stablecoins in Hong Kong. Banks, payment companies, and crypto platforms may fall under this label.

Distributors must also follow HKMA rules and may need to register or obtain specific licenses in the future. This adds another layer of protection for users interacting with stablecoins.

-

Foreign stablecoins require prior approval

Stablecoins issued overseas, like USDT (Tether) or USDC, must get HKMA approval before being distributed in Hong Kong. Without prior approval, foreign stablecoins cannot be legally accessed or used by Hong Kong residents. HKMA says this is key to ensuring foreign coins also meet local safety standards.

-

Retail access is not yet guaranteed

Retail investors can’t use stablecoins freely, yet. The HKMA says it will launch public consultation before allowing stablecoins for widespread public use. Officials want to hear from banks, fintech firms, and everyday users before making a final decision. This gives regulators time to study user impact and address concerns.

Read Also: RWA-backed Stablecoin

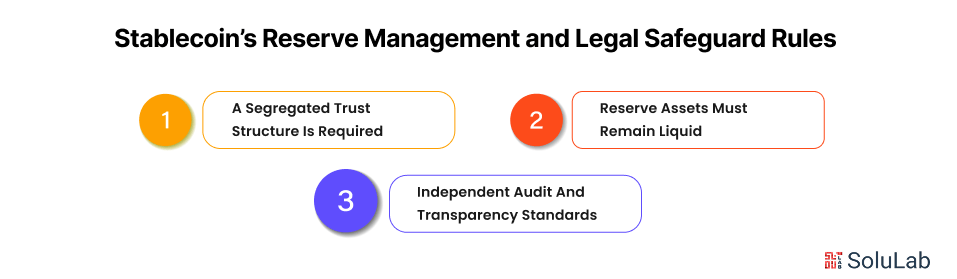

Reserve Management and Legal Safeguard Rules

Reserve Management and Legal Rules ensure that financial institutions maintain stability by managing reserves and complying with legal frameworks to protect stakeholders and the economy. Here are some rules you should be aware of:

-

A segregated trust structure is required

All reserve assets must be held in a segregated trust account, separate from the issuer’s own funds. This means even if the issuer goes bankrupt, the reserve remains protected. Issuers must work with a licensed trustee who manages these assets legally and independently. This setup builds confidence in the safety of stablecoins used by the public.

-

Reserve assets must remain liquid

Reserve assets must be highly liquid. The law specifies cash, bank deposits, or short-term government securities as acceptable. This helps prevent redemption delays during market stress. HKMA will inspect and verify asset quality regularly to avoid risk buildup.

-

Independent audit and transparency standards

Issuers must publish audit reports regularly. These audits must be conducted by independent professionals, not internal teams. They must also publish monthly reserve summaries, so users know the financial health of the stablecoin.

Read Also: UAE’s Dirham-Backed Stablecoin

Risks Covered in Hong Kong Regulation

Hong Kong’s financial regulations are intended to protect investors and institutions by defining the primary risks, ensuring honesty, responsibility, and market stability.

1. AML and CFT checks are mandatory

Issuers and distributors must comply with Anti-Money Laundering (AML) and Counter-Terrorism Financing (CFT) laws. This includes background checks, suspicious transaction reports, and strict identity verification. The regulations on stablecoins are designed to prevent criminal misuse.

2. Tech risk management needs reporting

Technical risks must be reported to the HKMA. This includes cyberattacks, code errors, wallet issues, or downtime in the system. Issuers must also perform regular system checks to identify risks early. Failure to do so may result in license suspension or penalties.

3. Conflicts must be disclosed early

If the issuer or trustee has a conflict of interest, it must be disclosed to the HKMA immediately. For example, if the issuer holds reserves with a related party bank, that must be declared and reviewed. This rule prevents abuse of user funds.

Hong Kong Stablecoin Regulation Global Context

Hong Kong’s decision toward regulating stablecoins is part of a broader worldwide motivate to bring clarity and control to the digital currency industry.

-

Compared with Singapore and Australia

Singapore has a pilot project for stablecoins under MAS, with looser rules than Hong Kong. Australia’s proposed rules are still under consultation. Hong Kong is among the first in Asia to finalize a comprehensive legal framework. This gives Hong Kong a leading position in the stablecoin race.

-

Implications for real-world asset tokens

The law also supports the future of tokenized real-world assets, including digital bonds and tokenized gold. Stablecoin regulation is the foundation for trusted asset tokenization in Hong Kong. The move ties into the city’s broader plan for Web3 finance and regulated digital markets.

-

Next steps and industry response

HKMA will soon issue detailed guidelines on license applications. It will also consult on retail usage rules. Major crypto players like HashKey, OSL, and Animoca Brands have welcomed the move. Many are already preparing to apply for licenses.

Conclusion

Hong Kong’s stablecoin regulation bill is a major leap toward safer and more reliable digital assets. With clear rules for licensing, reserves, and transparency, the city is setting a global benchmark. For businesses planning to build stablecoins that meet these standards, choosing the right development partner matters.

SoluLab, a top Stablecoin development company, specializes in creating secure, custom fiat-pegged and algorithmic tokens for DeFi, fintech, and payment platforms. With a strong focus on stability and compliance, SoluLab helps future-proof your ecosystem against market risks.

Ready to build trusted stablecoins that align with Hong Kong’s new bill? Contact us today and let’s get started.

FAQs

1. How is the Hong Kong stablecoin law changing crypto?

It brings safety and trust by requiring licenses, real backing, and clear rules, pushing crypto from wild speculation to real-world use.

2. Can this law help stablecoins become safer for everyday users?

Yes. By requiring full reserves, legal audits, and trusted issuers, the law protects users from losing money overnight.

3. What does this mean for global stablecoin projects?

They must meet Hong Kong’s high standards or stay out. This could raise global quality and safety for stablecoins everywhere.

4. Does this law help crypto go mainstream in finance?

Absolutely. With legal rules in place, stablecoins can be used in payments, lending, and real finance, not just crypto trading.

5. Will my game points or loyalty tokens need a license now?

Nope! These “limited purpose tokens” are not covered. Only stablecoins meant for real payments are regulated under the new law.