Look, if you’ve been following the Middle East tech scene at all, you already know something’s shifted in Dubai. It’s not just another city betting on blockchain development anymore; it’s the place where oil money is actually becoming digital money, and that changes everything for Web3 founders and enterprises looking to scale.

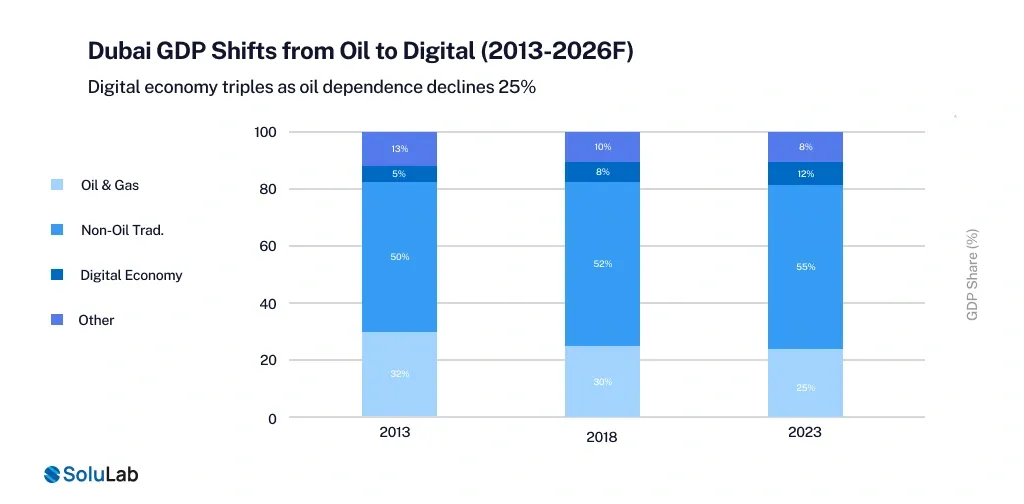

| And Dubai’s economy is officially transitioning from oil to digital non-oil sectors, hitting 5.3% growth in 2026, with the digital economy now representing 12-13% of the economy and targeting 20% by 2031. Real data, real momentum. |

Let me be straight with you: when we talk about the dubai and cryptocurrency, we’re not talking about the Wild West crypto moves of five years ago. This is institutional-grade infrastructure built by people who understand both traditional finance and decentralized systems, and are building a Dubai cryptocurrency hub. So let’s understand how the shift is actually impacting the web3 ecosystem.

Key Takeaways

- The UAE ranks #5 globally in crypto adoption with 3.78 million users (39.13% penetration rate), and that’s growing.

- You now have the clearest regulatory path in the world, like VARA (Virtual Assets Regulatory Authority), and the updated DFSA framework (effective January 12, 2026).

- Real estate tokenization is moving from experiment to mainstream.

- Cryptocurrency exchanges like Bybit, Binance (Abu Dhabi Global Market), and Crypto.com have already moved their headquarters here.

How Did Dubai Move From Oil Wealth To Digital Gold Through Crypto Adoption?

Here’s the thing nobody talks about clearly: the world’s financial infrastructure is being rebuilt in front of our eyes, and cryptocurrency of Dubai isn’t just watching, it’s building it.

For decades, Dubai built its economy on oil, but that’s changing. Oil now represents 25% of the economy, down from over 30% just a decade ago. That’s not a small shift; that’s an entire economic restructuring, and the government didn’t leave it to chance. They deliberately invested in becoming a Web3 hub.

Dubai’s cryptocurrency hub emerged because the UAE government made a strategic decision: if traditional finance can be digitized, so can real assets. Property. Commodities. Bonds. Everything.

This isn’t BS. In May 2025 alone, Dubai recorded AED 66.8 billion ($18.2 billion) in real estate transactions, a 44% year-on-year increase. Then they decided to make that market liquid through tokenization, and it worked. The first project using the government’s Prypco Mint platform sold out in two minutes, with investors from 35 nationalities on the waitlist.

For founders building Web3 solutions, whether that’s custody platforms, tokenization infrastructure, or DeFi bridges – this is the realization of product-market fit at the macro level. The actual government is making your use case mandatory

Why Cryptocurrency Of Dubai Is Becoming A Strategic Alternative To Hydrocarbons?

Let’s talk numbers because this matters for your investment thesis.

- The UAE economy is projected to grow 5% in 2026, with non-oil sectors driving 5.3% of that expansion.

- Statista forecasts UAE crypto market revenues at $254.3 million in 2025 alone, and the broader RWA tokenization market hit $25 billion+ in Q2 2025 – a 245x increase from 2020 to 2025.

That’s not linear growth, that’s exponential adoption. Here’s where it gets real for CXOs and enterprise decision-makers – Dubai’s economic digital transformation isn’t a marketing tagline. It’s government policy with AED 100 billion (approximately $27 billion USD) in annual digital transformation value as part of the D33 Economic Agenda. That’s capital that needs infrastructure; that’s your addressable market.

The non-oil economy in 2026 will represent roughly 75% of GDP and is growing faster than oil. Tourism, logistics, real estate, financial services, and now digital assets. Tourism is booming (Expo City legacy), ports are at record throughput (Jebel Ali, Khalifa Port), and financial services are expanding. Even Banks have the lowest loan-to-deposit ratio in the GCC, which means liquidity. Which means opportunity.

Also, Bybit moved its global headquarters to Dubai in 2023 and has been actively hiring ever since. Their trading volume in MENA surpassed $33.5 billion in their first year. Binance announced in December 2025 that its global platform governance is moving to Abu Dhabi Global Market (ADGM). Crypto.com is operating with cryptocurrency license in Dubai. These are the three biggest crypto companies on the planet, and they’re consolidating operations in the UAE.

How Does Dubai’s Regulatory Stack Enable Oil-To-Digital-Gold Growth in Dubai Cryptocurrency?

Most articles about Dubai’s crypto scene gloss over regulation like it’s boring compliance work. It’s not. Your entire competitive advantage lives here.

1. Virtual Assets Regulatory Authority (VARA) —

VARA was established under Law No. 4 of 2022, and it’s the world’s first dedicated virtual assets regulator. That matters because it means the framework was built for the digital age from the ground up, not retrofitted from 1990s securities law.

Here’s what VARA Dubai crypto licensing actually gives you: an eight-activity licensing model (Advisory, Broker-Dealer, Custody, Exchange, Lending/Borrowing, Payment/Remittance, VA Management, Investment Services), mandatory AML/CFT compliance, and a two-step licensing process that’s clear. No guessing or regulatory arbitrage games.

The May 2025 VARA rulebook update, the most comprehensive since launch, formalized tokenization dubai under a new ARVA classification (Asset-Referenced Virtual Assets). This is the regulatory permission structure for real estate, commodities, bonds, and fund tokenization. It’s now the law.

Read more: How Hedge Fund Tokenization Can Empower Your Business?

One thing people miss: VARA updated its Compliance and Risk Management Rulebook to mandate the FATF Travel Rule for all VASPs. This isn’t optional. Every virtual asset service provider operating in Dubai must collect and transmit verified originator and beneficiary data for every transaction. By June 2025, that was mandatory. This is why institutional capital trusts Dubai; compliance is baked in.

2. DIFC (Dubai International Financial Centre) —

If VARA is a domestic regulation, DIFC is Dubai’s offshore financial hub. The Dubai Financial Services Authority (DFSA) oversees it, and as of January 12, 2026, it updated the Crypto Token regulatory framework in a way that matters.

The old model: DFSA maintained a Recognised Crypto Tokens list – basically a whitelist of tokens you could legally trade in DIFC. It was safe but restrictive.

The new model (effective today, literally):

- Firms are now responsible for their own token suitability assessment.

- You document why a token meets DFSA criteria.

The DFSA doesn’t prescribe the list anymore. This gives you flexibility but demands governance rigor. For enterprise decision-makers, this shift, from DFSA-led assessment to firm-led assessment, is huge. It means:

- You can move faster as an institution.

- Your compliance team becomes your competitive advantage, not the regulator’s approval.

The framework aligns with international best practices (EU MiCA, Singapore’s frameworks) rather than being idiosyncratic. The DFSA recognizes three fiat crypto tokens now: USDC, EURC, and RLUSD. These are your stablecoin anchors for regulated trading in DIFC.

Why This Matters vs. Other Hubs

Singapore has clarity but restrictive tokenization rules. Hong Kong has a capital but regulatory uncertainty. New York has reach but regulatory overhead. London has institutions, but MiCA complexity.

Dubai has clarity + capital + institutional adoption + tokenization-first regulation + zero crypto tax. That’s not marketing. That’s a competitive fact.

Why Is Dubai Real Estate Becoming The Flagship Use Case For Cryptocurrency?

Let me tell you about May 2025 because it’s the moment this stopped being theory.

- On May 1, 2025, MAG (a real estate giant), MultiBank Group, and Mavryk (a blockchain infrastructure firm) signed a $3 billion RWA tokenization agreement. Basically, we’re going to tokenize real estate and make it liquid.

- On May 19, VARA updated its rulebook to formally regulate RWA tokenization.

- On May 25, the Dubai Land Department, the Central Bank of the UAE, and the Dubai Future Foundation launched Prypco Mint, a government-backed platform to tokenize real estate title deeds.

Three different parties, same week, coordinated signal: Dubai real estate tokenization is now infrastructure, not experiment. Here’s how it works:

- You have a property worth $500,000.

- The DLD registers it on the blockchain via Prypco Mint.

- It gets tokenized into 1,000 digital units.

- Each unit represents fractional ownership.

- Investors can buy as little as AED 2,000 (~$545).

- Settlement is automated.

- Income distribution is smart-contract-based.

The first project on this platform:

- Sold out in 2 minutes.

- 149 investors from 35 nationalities participated.

- The waitlist was over 10,000.

Now, scale this: Dubai’s real estate market is projected to reach AED 60 billion ($16.3 billion) in tokenized transactions by 2033, about 7% of total market activity. But here’s the thing: if the model works (and early data suggests it does), that 7% projection is conservative. We might see 15-20% by 2033, which means $30-40 billion in annualized tokenized real estate volume.

That’s developer infrastructure revenue, and that’s a custody platform opportunity. That’s settlement rails revenue. That’s what enterprise decision-makers are betting on.

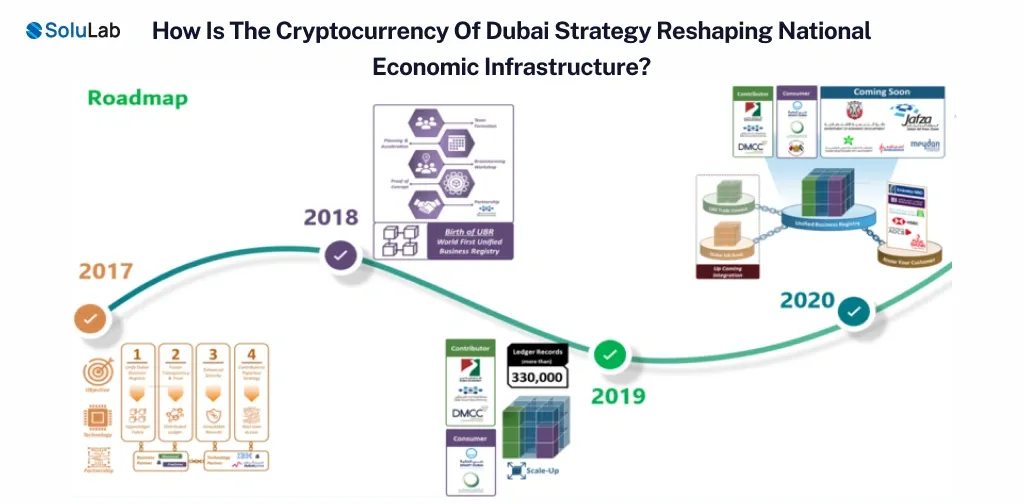

How Is The Cryptocurrency Of Dubai Strategy Reshaping National Economic Infrastructure?

Here’s something enterprise decision-makers need to understand: this isn’t just a crypto market growing, as the government itself is going digital. The UAE government targets 50% of all transactions on blockchain. That’s not a goal for 2030,that’s happening now. The Central Bank launched the Digital Dirham program. Document processing alone represents 5.5 billion dirham annually in potential savings through blockchain automation.

Supply chain, logistics, healthcare, and real estate registration, all moving on-chain through official channels. When government is your customer, that’s TAM you can’t ignore.

How is DeFi Driving Institutional Strategy Within The Dubai Cryptocurrency Ecosystem?

🇸🇦RIPPLE TO EXPAND INTO SAUDI ARABIA

— Coin Bureau (@coinbureau) January 26, 2026

Ripple partnered with Jeel, the innovation and technology arm of Riyad Bank, has partnered with Ripple to explore blockchain applications for financial services across Saudi Arabia. pic.twitter.com/H6TWX9ecle

The shift from retail-driven crypto to institutional-driven crypto is real here. Every top crypto exchange has a derivatives platform, custody offering, and OTC desk. Bybit publishes weekly volume reports. Binance has institutional sales teams, even Ripple has partnered up with Jeel.

But the more interesting move is DeFi development. Tokenized lending protocols, fractional reserve systems, and automated market making for real assets, this is where Dubai’s regulatory clarity and capital combine to create infrastructure.

When VARA’s May 2025 rulebook formalized RWA lending and borrowing, it opened the door for DeFi protocols to operate in Dubai with institutional-grade compliance. That’s not possible in most jurisdictions.

Read Also: How to Ensure VARA Compliance in Your Blockchain Solution?

Why Founders Choose Dubai Over Global Hubs When Scaling Cryptocurrency Businesses?

Here’s where we want to be surgical because too many articles are just cheerleading.

| Dimension | Dubai/UAE | Singapore | Hong Kong | London | New York |

| Regulatory Clarity | ★★★★★ | ★★★★☆ | ★★★☆☆ | ★★★☆☆ | ★★★☆☆ |

| Tax Efficiency | ★★★★★ | ★★★★☆ | ★★★★☆ | ★★★☆☆ | ★★☆☆☆ |

| RWA Tokenization | ★★★★★ | ★★★☆☆ | ★★★☆☆ | ★★★☆☆ | ★★★☆☆ |

| Institutional Presence | ★★★★☆ | ★★★★★ | ★★★★☆ | ★★★★★ | ★★★★★ |

| Adoption Rate | 39% | 28% | 22% | 18% | 21% |

| Global Ranking | #5 | #1 | #7 | #3 | #2 |

| Capital Inflow (24 mo) | $30B+ | $25B+ | $18B+ | $22B+ | $28B+ |

But here’s the strategic play: if you’re building tokenization infrastructure for real assets (real estate, private equity, commodities, bonds), Dubai is the only jurisdiction with:

- Clear regulatory permission (VARA ARVA framework)

- Government-backed pilots (Prypco Mint)

- Institutional capital is ready to deploy

- Zero tax arbitrage against your investors

- Free zones that let you operate 100% foreign-owned

That’s not an incremental advantage, that’s structural.

Read More: Layer-1 Vs. Layer-2: The Blockchain Scaling Solutions

Why are Enterprises Choosing Dubai When Working With A Blockchain Product?

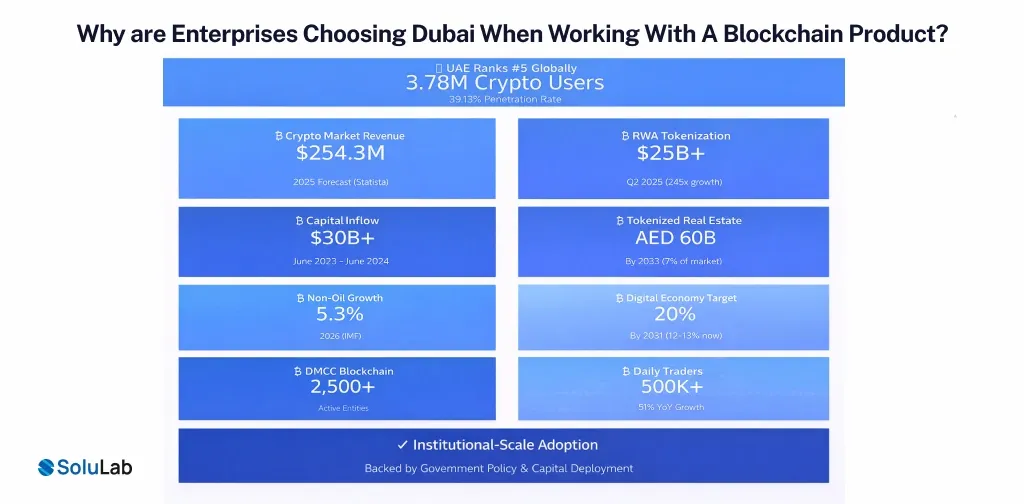

Let me give you the data because this is what CXOs actually care about:

- Total Crypto Users in UAE: 3.78 million (39.13% penetration rate)

- Crypto Market Revenue Forecast: $254.3 million (2025, Statista)

- RWA Tokenization Market: $25 billion+ (Q2 2025), 245x growth from 2020-2025

- Capital Inflow to UAE Crypto Sector: $30 billion+ (June 2023 – June 2024, economy Middle East)

- Projected Tokenized Real Estate by 2033: AED 60 billion ($16.3 billion), representing 7% of market activity

- Non-Oil Sector Growth (2026): 5.3% (IMF forecast)

- Digital Economy Growth Target: 20% of economy by 2031 (currently 12-13%)

- Blockchain Entities at DMCC: 2,500+

- Daily Crypto Traders in UAE: 500,000+ average daily (as of February 2024)

- YoY Growth in Daily Traders: 51% year-over-year increase

This is institutional-scale adoption of blockchain solutions backed by government policy and capital deployment.

What Challenges Still Block Enterprises Adopting Dubai Cryptocurrency At Scale?

Look, it’s not perfect. Here are the real challenges:

- Talent Scarcity: Blockchain developers are in high demand globally. Dubai cryptocurrency is competitive but not yet at San Francisco wage levels. This means you’re getting global-tier talent at better economics, but you’re competing with everyone else who figured this out.

- Privacy Coin Prohibition: VARA prohibits privacy coins and anonymous tokens. If your infrastructure depends on Monero or Zcash, you’re out. This is deliberate regulatory choice, not a bug.

- Market Volatility: Crypto markets are still volatile. Even with institutional adoption, a 30% correction impacts sentiment and capital deployment. Your enterprise contracts are less vulnerable than retail traders, but they’re not immune.

- Scale Challenges: DLT infrastructure isn’t infinitely scalable yet. When you’re tokenizing $16+ billion in real estate, you need settlement throughput that traditional blockchains struggle with. Layer-2 solutions, sidechains, and custom consensus mechanisms are coming, but they’re not mature.

- Regulatory Evolution: VARA and DFSA are actively updating frameworks. What’s law today might shift in 18 months. Your compliance infrastructure needs to be flexible.

Here’s what’s actually coming in Future:

- By 2026, we’ll see the first major tokenized property IPOs (secondary market trading of real estate tokens). By 2028, expect automation of rental income distribution through tokenization. By 2030, 10-15% of Dubai real estate transactions could be tokenized.

- At macro level, the UAE’s digital economy is targeting 20% of GDP by 2031. That’s AED 500+ billion in digital economy value creation. Not all of it is crypto, but blockchain and tokenization are the rails.

Why are Global Firms Choosing Dubai and Cryptocurrency For Regulated Growth?

Let’s be honest: most enterprises move when there are three signals – regulation is clear, capital is available, and peers are doing it. Dubai has all three in 2026.

- The VARA and DFSA frameworks are as clear as they get.

- Capital from institutional investors, sovereign wealth funds, and traditional finance is flowing in ($30 billion in 18 months).

- And Bybit, Binance, Crypto.com are all operating here, which means your enterprise customers can see that institutional players trust Dubai.

This is the window where first-mover advantage is still available. By 2027-2028, tokenization infrastructure will be commoditized. Right now, in early 2026, being the right infrastructure partner to DAMAC, Nakheel, or MAG Group is extraordinarily valuable. If your enterprise or startup is considering Dubai as a base for blockchain infrastructure, here’s the practical path:

- Get clarity on licensing: Visit vara.ae or difc-dfsa.org. Understand which regulatory path fits your business model.

- Connect with the ecosystem: DMCC has free-zone activation support. DIFC has a fintech/digital assets team. Attend FinTech Summit (May 2026) or Crypto Expo Dubai (September 2026).

- Hire strategically: Don’t hire 50 people on day one. Build a core team (smart contract lead, compliance lead, BD lead) from the global market, then scale locally or connect with a Blockchain development team like SoluLab to do it with ease.

- Target anchor customers: DAMAC, MAG, Nakheel, DLD itself. Get one tier-1 reference customer, then open doors at other enterprises.

- Build for scale: Use Layer-2 solutions, modular consensus, and composable infrastructure. Dubai’s real estate tokenization needs throughput.

Conclusion

Dubai’s transformation from oil economy to digital economy isn’t a metaphor, rather It’s policy with capital allocation where VARA regulates it, DFSA clarifies it, and DAMAC, MAG, Nakheel, and the Dubai government are funding it. Dubai cryptocurrency hub is real because it solves a genuine problem about how to make illiquid real assets liquid, transparent, and globally tradable. The regulation, capital, and institutional adoption are the proof.

For CXOs evaluating blockchain companies, the decision is clear: Dubai isn’t the only place to build Web3, but it’s the place with the fewest friction points right now, and a cryptocurrency development company like SoluLab can help you achieve it. The economy is shifting from extraction (oil) to infrastructure (digital assets). If you’re building that infrastructure, Dubai in 2026 is where you need to be.

FAQs

Dubai has regulatory permission for RWA tokenization (via VARA ARVA framework), government-backed pilots (Prypco Mint), institutional capital, and zero capital gains tax – all simultaneously. Singapore is more mature but less focused on tokenization, and Hong Kong has capital but regulatory uncertainty. So, Dubai has a structural advantage for tokenized asset infrastructure.

VARA has eight licensing categories. You apply via DMCC or independently if you meet the criteria. The two-step process is clear on their website, and the timeline is typically 6-12 weeks with complete documentation. Unlike most jurisdictions, they tell you exactly what they want.

VARA regulates virtual assets in Dubai proper, whereas DIFC is the offshore financial center with its own regulator (DFSA). VARA is better if you’re a crypto-native business (exchange, custody, lending), and DIFC is better if you’re a traditional financial services firm adding crypto services. Some firms hold both licenses for maximum market access.

It’s tradeable. In Dubai, Prypco Mint’s first project sold out in 2 minutes, because the Dubai Land Department and Central Bank are funding infrastructure, and Secondary market trading is happening. This is past the pilot stage – it’s a live deployment with government backing.

Zero capital gains tax on crypto trading and Zero corporate tax on crypto income (though corporate tax at 0% is actually 0% by default anyway, since the UAE has no income tax). So there is no property tax. This isn’t a gray area, it’s official policy. Your tax liability is essentially nil on crypto activities.