Decentralized exchanges are quickly becoming the go-to option in the DeFi space, enabling users to trade digital assets directly while maintaining full control and transparency. By the end of January 2026, platforms like these were handling over $140 billion in trades per week, with more than $24 billion locked into them, according to DefiLlama. That kind of activity shows how far they’ve come and how much trust users are putting into them.

What’s driving that shift? It’s simple—people want more control over their money. They want privacy, freedom, and the ability to manage their assets without relying on someone else. That’s exactly what DEXs offer, which makes them super appealing to both users and businesses trying to build something in the blockchain space.

Building a DEX isn’t as simple as flipping a switch. It takes careful planning, the right tech, and a solid understanding of what users expect. Costs can vary widely depending on the platform’s complexity and the features you want to offer. In this blog, we’ll explore what goes into launching a DEX and break down the factors that influence the overall decentralized exchange development cost.

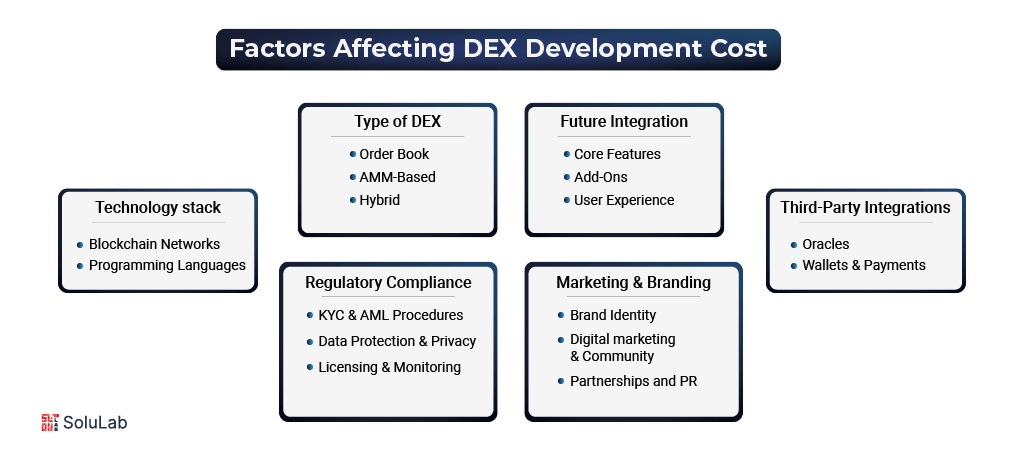

Factors Affecting DEX Development Cost

If you’re planning to launch your decentralized crypto exchange, the first thing to understand is that there’s no fixed price tag. The total cost depends on several moving parts, from the tech you use to the features you include, and even how you handle regulations and marketing. Let’s go through the most important factors that shape your budget:

Technology Stack

The kind of tech you use plays a huge role in both the performance and cost of your DEX. Since everything here runs on code, with no centralized party involved, it’s important to choose tools that are fast, secure, and scalable.

- Blockchain Networks: Ethereum is still a go-to for many developers, thanks to its mature ecosystem. But if you’re looking for faster transactions with lower fees, you might want to consider alternatives like Solana or Binance Smart Chain. These networks are gaining traction and can help you avoid the congestion and high gas costs that Ethereum is known for.

- Programming Languages: Solidity (for Ethereum) and Rust (for Solana) are among the most commonly used. Other languages like Go and Python also have their place, depending on your architecture. Keep in mind, skilled blockchain developers are in short supply, especially those who really know the ins and outs of these languages. This scarcity often pushes up development costs.

If you’re using a more advanced tech stack, you can expect this stage to cost somewhere between $5,000 to $7,000. It’s a smart idea to work with a decentralized exchange (DEX) development company in the USA that understands how to balance performance with cost-efficiency.

Type of Decentralized Exchange

The type of DEX you decide to build has a direct impact on complexity—and by extension, your budget.

- Order Book DEX: This is the most traditional type, similar to what centralized exchanges use. Buyers and sellers place orders, and a matching engine pairs them. It’s reliable but takes some serious backend logic and algorithmic muscle.

- AMM-Based DEX: This one works differently—trades are made against liquidity pools instead of waiting for someone to take the other side of the trade. It simplifies the trading process for users but requires robust smart contracts and careful incentives for liquidity providers.

- Hybrid DEX: If you want the speed of a centralized platform and the control of a decentralized one, a hybrid setup might be your best bet. But be prepared—this combination demands extra layers of architecture and typically costs more to build.

Depending on the approach, you’re looking at $2,500 to $3,500 just to set up the core exchange mechanism. An experienced DEX developer can help you choose the right model based on your target audience and use case.

Feature Integration

Adding features is where the project takes shape—and where the costs start to stack up. Beyond the basics like wallet connectivity and token swaps, there are some advanced tools and user options you might want to include:

Must-have Features:

- Wallet Integration

- Trade Execution

- Liquidity Pools

- Token Swapping

- DeFi Staking

- Smart Contract Automation

- Cross-Chain Interoperability

- Custom Token Launchpad

- Order Matching

- Basic Analytics

- Token Diversity

Add-ons That Boost Engagement:

- Cross-Chain Swaps

- NFT Trading Support

- Fiat On-Ramp Integration

- Real-Time Analytics

- Social Trading Tools

- Multi-language Support

- Gamification Mechanics

- Loyalty Programs

- Governance Token System

- Mobile App Support

- Gas Fee Optimization

The more interactive and user-friendly your platform, the more likely you are to stand out as one of the best decentralized exchange options out there. But keep in mind—more features mean more time, more testing, and a bigger bill. On average, you can expect this phase to cost $3,500 to $4,500, depending on your final scope.

Third-Party Integrations

To deliver a smooth and reliable user experience, you’ll need to plug in several external tools and APIs. While these boost the platform’s capabilities, they do come with added costs.

Common Integrations Include:

- Oracle Services: Tools like Chainlink help keep asset prices accurate by pulling data from external sources.

- Wallet Support: MetaMask, Trust Wallet, Exodus, and others are essential for enabling crypto storage and access.

- Payment Gateways: Services like BitPay and Coinbase make it easier for users to deposit or withdraw funds.

- Analytics Tools: Platforms like Dune Analytics help track user behavior, platform performance, and more.

For third-party integrations, budget around $1,500 to $2,500. Partnering with a decentralized crypto exchange provider who already has experience integrating these tools can make this part easier and more efficient.

Regulatory Compliance

Even though DEXs operate without a central authority, they’re not exempt from government oversight. Different countries have different rules, and if you want to operate legally, you’ll need to comply.

Here are a few key areas to plan for:

- KYC and AML Procedures

- Data Protection and Privacy Rules

- MSB Licensing (in some regions)

- Tax Reporting and Documentation

- Sanctions and Restricted Address Monitoring

- General Consumer Protection

The legal and compliance part of the build usually adds $1,500 to $2,500 to your budget, depending on where your users are located and how strict the local laws are.

Marketing and Branding

Launching a DEX is one thing—getting people to actually use it is another. Without a clear strategy for branding, user acquisition, and education, it’s easy for a great platform to get lost in the noise.

What this might include:

- A strong brand identity (name, logo, positioning)

- Digital marketing (SEO, PPC, influencer campaigns)

- Community building on platforms like Telegram, Discord, and X

- Partnerships and ecosystem integrations

- Public relations and media exposure

Hiring a capable marketing team or agency will be critical in shaping how your exchange is perceived. It’s a long-term investment, but a necessary one to build credibility and trust. Every decision you make—from blockchain choice to UI features—affects the final cost of your DEX. If you’re working with a trusted partner from day one, it becomes a lot easier to make smart trade-offs without compromising on quality.

If you’re still exploring your options, working with a decentralized exchange (dex) development company in the USA that’s already helped others succeed is a great way to start on the right foot.

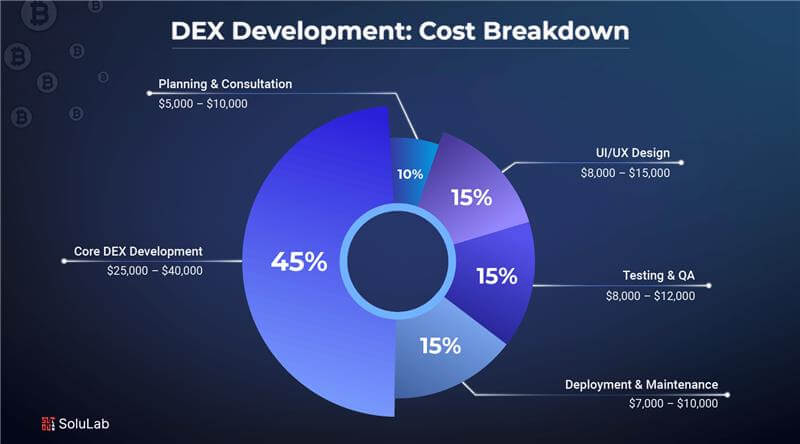

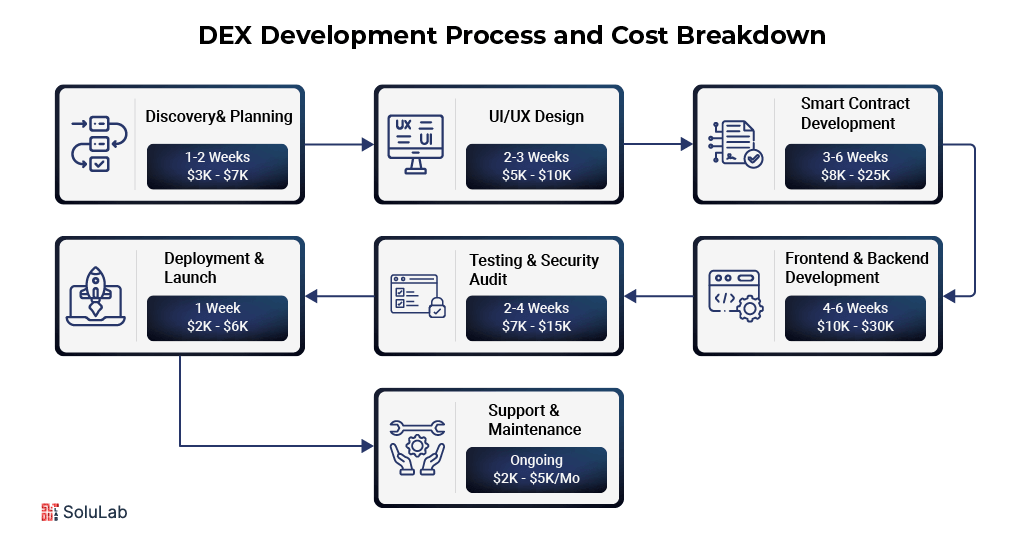

Development Process and Cost Breakdown for a Decentralized Exchange

Building a decentralized exchange isn’t something that happens overnight. It involves multiple stages, from initial research to final deployment, each with its own set of tasks, timelines, and costs.

It’s not just about hiring a few developers and writing some code. A solid decentralized exchange goes through several well-defined phases before it’s ready to go live.

Let’s walk through what the process of having DEX development services looks like, step by step.

1. Discovery and Planning

This is where everything begins. Before a single line of code is written, you need to define what kind of DEX you want to build. Will it be an AMM-based model like Uniswap? Or something more complex with a built-in order book?

You’ll also want to research your target users, look at competitors, choose your blockchain (Ethereum, Solana, Polygon, etc.), and figure out your key features. This phase often involves meetings, brainstorming sessions, and a few whiteboard scribbles that eventually shape your product vision.

- Timeframe: 1–2 weeks

- Estimated Cost: $3,000–$7,000

2. UI/UX Design

Once the concept is clear, it’s time to sketch out what your platform will look like. A good DEX should be intuitive, even for people who aren’t tech-savvy. Designers create wireframes and clickable prototypes so you can visualize the user journey before any code is written.

Expect back-and-forth discussions here—this is the phase where your product starts to feel real.

- Timeframe: 2–3 weeks

- Estimated Cost: $5,000–$10,000

3. Smart Contract Development

This is the technical heart of your exchange. Smart contracts handle everything – token swaps, liquidity provision, fee distribution, staking logic, and more. These need to be built from scratch (or forked and modified from existing codebases), tested thoroughly, and optimized to minimize gas usage and potential exploits.

This step requires experienced remote blockchain developers. If you’re working with a reliable DEX development services provider, they’ll walk you through best practices and likely recommend getting contracts audited by a third party.

- Timeframe: 3–6 weeks

- Estimated Cost: $8,000–$25,000+

4. Frontend and Backend Development

Now it’s time to connect everything and bring your platform to life. Frontend developers turn your design into a working web application, while backend devs handle database interactions, server logic, and admin panels.

Wallet integrations, charts, transaction tracking, notifications—this is where all the “magic” that users interact with gets built.

- Timeframe: 4–6 weeks

- Estimated Cost: $10,000–$30,000

5. Testing and Security Audit

Before going live, every feature and function needs to be tested—not just once, but thoroughly. Smart contracts are reviewed line by line. The frontend is tested for bugs, responsiveness, and usability.

Third-party auditors are often brought in at this stage to ensure the smart contracts are secure. This step might seem like a slowdown, but skipping it could cost you a lot more if there’s a vulnerability after launch.

- Timeframe: 2–4 weeks

- Estimated Cost: $7,000–$15,000+

6. Deployment and Launch

Once everything is greenlit, it’s time to deploy. This includes launching the smart contracts on the mainnet, making your site publicly available, and setting up connections with price oracles, block explorers, and liquidity pools.

You’ll also need to make sure users can easily connect their wallets and that your interface is intuitive on both desktop and mobile.

- Timeframe: 1 week

- Estimated Cost: $2,000–$6,000

7. Post-Launch Support and Maintenance

Even after your platform is live, the work isn’t over. Bugs pop up, users request new features, and as the market evolves, so should your DEX. That’s why ongoing support is critical, especially if you’re dealing with real money and high trade volumes.

Most teams allocate a monthly budget for updates, feature rollouts, and security monitoring.

Estimated Cost: $2,000–$5,000 per month

Tips on How to Reduce Your DEX Development Costs

Developing a decentralized crypto exchange can require substantial capital investment, especially when aiming to build a secure, scalable, and feature-rich platform. However, there are effective strategies to optimize your development process and manage expenses without compromising on quality or performance. Below are several best practices that can help reduce your overall DEX cost while ensuring your project remains competitive.

1. Begin with a Minimum Viable Product (MVP)

One of the most effective ways to control initial development costs is by launching a Minimum Viable Product (MVP). This approach allows you to release a basic version of the exchange with essential functionalities such as wallet integration and token swaps. By launching with core features first, you can test market viability and user engagement before allocating additional resources for advanced capabilities.

2. Choose the Right Blockchain Network

The selection of a blockchain network significantly impacts the Decentralized Exchange Development cost. For instance, Ethereum, while robust and widely adopted, incurs higher gas fees and longer processing times. Alternative networks such as Solana and Binance Smart Chain offer improved scalability and lower transaction costs, making them suitable choices for cost-sensitive projects.

3. Use Open-Source Frameworks

Utilizing existing open-source frameworks can greatly reduce development time and expenditure. Projects like Uniswap and PancakeSwap provide open-source code that can be adapted to meet your specific requirements. With proper customization and security audits, these frameworks can serve as a reliable foundation for your platform.

4. Work with Skilled and Specialized Developers

While opting for lower-cost developers might appear budget-friendly, it often leads to increased expenses due to revisions, inefficiencies, or security vulnerabilities. Hiring experienced developers—especially those with direct expertise in decentralized crypto exchange development—ensures higher code quality, reduced errors, and better long-term value.

5. Automate Operational Workflows

Wherever feasible, automate platform functionalities such as trade execution, liquidity pool management, and reward distribution. Automation reduces the need for manual intervention and enhances operational efficiency, resulting in lower long-term maintenance costs.

6. Consider White-Label Solutions

White-label DEX platforms can provide a fast and cost-effective route to market. These pre-built solutions allow businesses to deploy their exchange with minimal technical overhead, while still offering flexibility for customization. They are especially beneficial for startups aiming to validate their concept before investing in a custom build.

7. Prioritize Feature Development

It is advisable to focus on mission-critical features during the initial build. While it may be tempting to integrate a wide range of advanced tools, such as NFT trading modules or gamified rewards systems, these should be implemented only when user demand justifies the investment. Strategic feature planning ensures optimal use of resources.

The Bottom Line

The cost of developing a decentralized exchange depends on a wide range of variables, each shaping the final budget in significant ways. From the selection of blockchain networks and smart contract complexity to third-party integrations and compliance obligations, every component adds to the overall scope. Hidden costs such as security audits, infrastructure maintenance, and user support are often underestimated but crucial for long-term success. A well-structured approach that prioritizes core functionalities while allowing room for future scalability is essential for launching a sustainable DEX platform.

SoluLab offers comprehensive support for organizations looking to enter the decentralized exchange space. As a trusted DEX development company, SoluLab delivers secure, high-performance platforms tailored to specific project goals. With a focus on smart contract development, DeFi protocol integration, and regulatory best practices, the team ensures that each platform is built to scale with confidence and integrity.

FAQs

1. Is it possible to launch a DEX with a small team?

Yes, it is. Many early-stage decentralized exchanges have been built by small teams, especially when starting with a minimal feature set. What matters most is having people who understand blockchain development well and are clear on the product’s direction. As long as the technical foundation is solid, the team can grow over time based on needs.

2. Do I need my token to launch a DEX?

Not necessarily. Some DEXs launch without their token and focus purely on facilitating token swaps and liquidity. That said, having a native token can open up more opportunities, like rewarding liquidity providers, enabling governance, or supporting staking features—but it’s something that can be added later if needed.

3. Can I integrate a DEX into an existing crypto platform?

Yes, integration is possible and quite common. If there’s already a wallet, portfolio tracker, or decentralized finance dashboard in place, a DEX module can be added to expand functionality. The integration work will depend on your current architecture and how flexible it is with new components.

4. What kind of support does a DEX need after it goes live?

Once a DEX is launched, support becomes just as important as the development itself. That includes routine maintenance, handling user queries, upgrading smart contracts, and keeping up with changes in wallet standards or blockchain protocols. Many teams also stay active in their community channels to help guide users and gather feedback.

5. How competitive is the DEX space right now?

It’s a growing space, but there’s still room for innovation. While big names dominate certain chains, many users are looking for platforms that are easier to use, offer better token options, or support specific communities. A clear value proposition and good user experience can still help a new DEX stand out.