Blockchain technology has emerged as a revolutionary force across various industries, transforming traditional systems and unlocking new opportunities for innovation. In the automotive and health insurance sectors, blockchain’s potential to enhance transparency, security, and efficiency is garnering significant attention. Both industries face challenges related to data management, fraud prevention, and complex transactions, and blockchain solutions are poised to address these issues head-on.

Similarly, in the health insurance domain, blockchain holds immense promise in revolutionizing the way data is managed and shared. With patient information scattered across various healthcare providers and insurers, interoperability and data security become paramount concerns. Blockchain technology provides a unified and secure platform, allowing authorized stakeholders to access patients’ health records in a tamper-proof and privacy-preserving manner.

In this era of digital transformation, blockchain’s potential in the automotive and health insurance industries is undeniable. As these sectors embrace this disruptive technology, they are set to witness a profound shift towards greater efficiency, transparency, and trust in their operations, ultimately benefiting both businesses and consumers alike.

Read Also: What are the Benefits of Using Digital Identity with Blockchain in the Future?

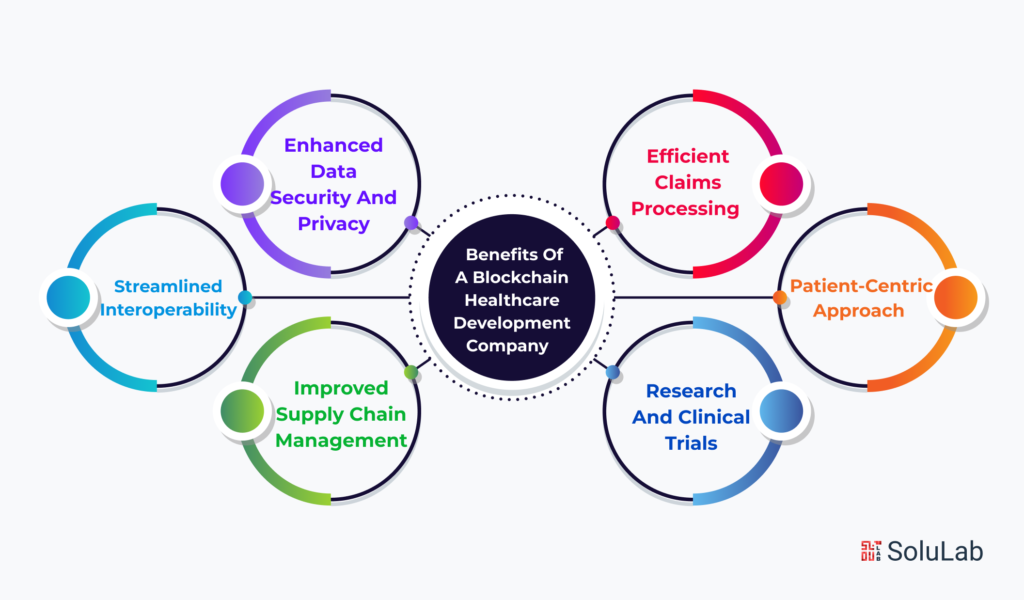

What are the Benefits of a Blockchain Healthcare Development Company?

Blockchain technology has made significant strides in various industries, and the healthcare sector is no exception. As healthcare organizations seek more secure, transparent, and efficient ways to manage patient data and streamline processes, blockchain solutions offer a wide array of benefits. Engaging a specialized blockchain healthcare development company can prove to be a game-changer for healthcare providers, patients, and other stakeholders. Here are some key advantages of opting for a blockchain healthcare development company:

-

Enhanced Data Security and Privacy

One of the most significant benefits of blockchain technology in healthcare is its ability to ensure data security and privacy. Traditional healthcare systems often face security breaches and data leaks, exposing sensitive patient information. Blockchain’s decentralized and encrypted nature makes it extremely difficult for unauthorized individuals to access or tamper with data. Every transaction is recorded in a secure and immutable manner, providing healthcare providers and patients with peace of mind knowing that their data is safeguarded against cyber threats.

-

Streamlined Interoperability

Blockchain promotes interoperability by creating a single, unified platform for sharing and accessing patient data across different healthcare providers and facilities. This seamless exchange of information enhances care coordination and eliminates data silos, enabling healthcare professionals to make better-informed decisions and deliver more personalized and efficient care to patients. It also reduces administrative burden and redundant paperwork, leading to cost savings for healthcare organizations.

Read Our Blog: Top 10 Startups that are Revolutionizing Healthcare Industry Using Blockchain Technology

-

Improved Supply Chain Management

Blockchain technology can play a vital role in managing pharmaceutical supply chains. By tracking the entire journey of medications, vaccines, and medical devices through the supply chain, blockchain ensures the authenticity and integrity of these products. This level of transparency helps combat counterfeit drugs and ensures that patients receive safe and legitimate medications.

-

Efficient Claims Processing

For health insurers, blockchain streamlines claim processing and fraud detection. By automating claim verification and eliminating intermediaries, blockchain reduces the time and cost involved in settling claims. The immutability of blockchain records also facilitates fraud detection, as any suspicious activity or duplicate claims can be quickly identified and flagged.

-

Patient-Centric Approach

Blockchain healthcare solutions empower patients to take control of their health data. Through blockchain-based platforms, patients can grant and revoke access to their medical records, ensuring that only authorized individuals or entities can view their information. This patient-centric approach fosters trust between healthcare providers and patients, leading to improved patient engagement and satisfaction.

-

Research and Clinical Trials

Blockchain technology can also enhance medical research and clinical trials. By creating a secure and transparent platform for sharing research data, researchers can collaborate more effectively and accelerate medical discoveries. Smart contracts on blockchain networks can automate the execution of clinical trial protocols, ensuring compliance and accuracy throughout the process.

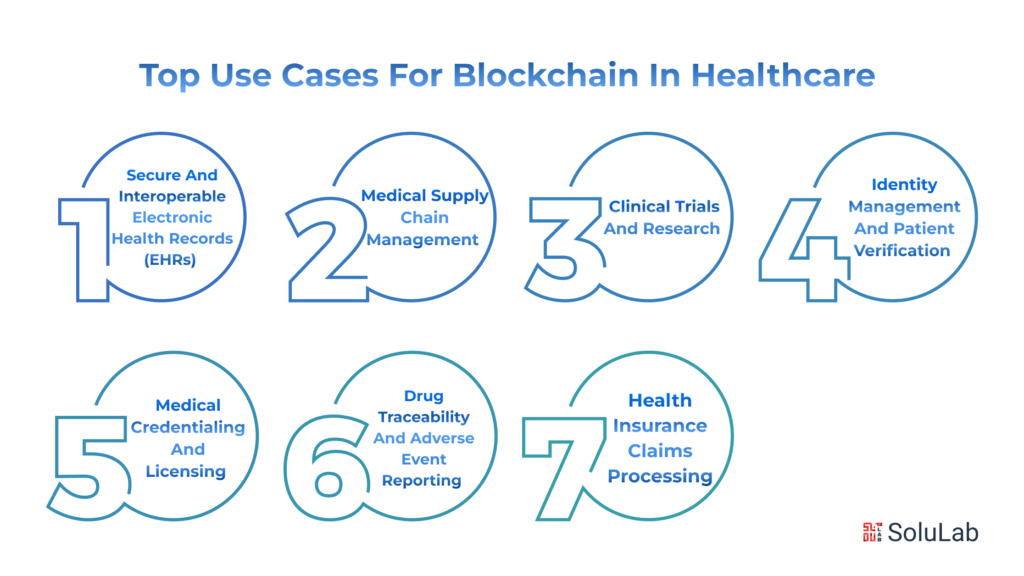

What are the Top Use Cases for Blockchain in Healthcare?

Blockchain technology has emerged as a transformative force in the healthcare industry, presenting numerous use cases that address critical challenges and revolutionize traditional processes. The immutability, security, and decentralized nature of blockchain make it an ideal fit for enhancing data management, interoperability, and patient care. Here are some of the top use cases for blockchain in healthcare:

-

Secure and Interoperable Electronic Health Records (EHRs)

Blockchain enables the creation of a secure and interoperable EHR system by providing a decentralized and tamper-proof platform for storing patient health records. Patients can grant permission to healthcare providers and institutions to access their EHRs, ensuring seamless data exchange without compromising privacy. This enhanced interoperability streamlines care coordination and allows medical professionals to access up-to-date patient information, leading to more accurate diagnoses and personalized treatment plans.

Read Our Blog Post: How Blockchain provides opportunities for healthcare?

-

Medical Supply Chain Management

Blockchain can significantly improve the management of pharmaceutical and medical supply chains. By creating an unalterable record of each step in the supply chain, from manufacturing to distribution, blockchain ensures the authenticity and quality of medications and medical devices. This transparency helps combat counterfeit drugs, reduce the risk of medical errors, and enhance patient safety.

-

Clinical Trials and Research

Blockchain simplifies the process of conducting clinical trials and medical research. Smart contracts on blockchain networks can automate consent management, data sharing, and compliance with trial protocols. This automated approach streamlines data collection, analysis, and verification, accelerating the pace of medical research and improving the efficiency of clinical trials.

-

Identity Management and Patient Verification

Blockchain offers a secure solution for managing patient identities and verifying patient information. Patients can have a unique digital identity on the blockchain, ensuring that their medical history and personal data remain protected and verified. This reduces the risk of medical identity theft and fraud, allowing healthcare providers to deliver better-targeted care.

-

Medical Credentialing and Licensing

Blockchain simplifies the process of medical credentialing and licensing for healthcare professionals. Credentials, licenses, and certifications can be securely stored on the blockchain, and verification of these qualifications becomes more efficient and accurate. This helps healthcare organizations ensure that their staff members are qualified and compliant with regulatory requirements.

-

Drug Traceability and Adverse Event Reporting

Blockchain technology can facilitate the tracking and tracing of pharmaceuticals throughout the supply chain. It enables the recording of every transaction involving a drug, from manufacturing to dispensing, providing an auditable record of the drug’s journey. Additionally, adverse event reporting can be improved by utilizing blockchain to capture and share real-time data on drug reactions, enabling faster responses and improved drug safety.

Read Also: Top Healthcare Blockchain Companies

-

Health Insurance Claims Processing

Blockchain streamlines health insurance claims processing, reducing administrative overhead and enhancing fraud detection. Smart contracts can automate claim verification and settlement processes, making the system more efficient and reducing the time taken to process claims. The transparency and immutability of blockchain records also aid in identifying fraudulent claims and mitigating risks.

What are the Constraints of Utilizing Blockchain in Health Insurance?

While blockchain technology offers a plethora of benefits for the healthcare industry, including health insurance, certain constraints, and challenges need to be carefully considered. As with any emerging technology, there are hurdles to overcome to ensure successful implementation and integration. Here are some of the key constraints of utilizing blockchain in health insurance:

-

Regulatory and Compliance Issues

The healthcare industry is highly regulated, and the introduction of blockchain technology must navigate various legal and compliance challenges. Data privacy and security regulations, such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States, impose stringent requirements on handling sensitive patient data. Integrating blockchain in health insurance must align with these regulations to protect patient privacy while enabling secure data sharing and accessibility.

-

Data Standardization and Interoperability

Blockchain’s potential in health insurance lies in creating a decentralized and interoperable system for sharing patient data across different providers and insurers. However, achieving true interoperability requires the standardization of data formats and protocols. The lack of standardized data in the healthcare sector may hinder the seamless exchange of information, making it challenging to fully leverage the benefits of blockchain technology.

Check Out Our Press Release: SoluLab Bridging the Gap Between Technology And Innovation

-

Scalability and Transaction Throughput

Blockchain networks, especially public ones, often face scalability issues and limited transaction throughput. In the context of health insurance, where numerous transactions occur daily, a blockchain’s capacity to handle a high volume of data becomes crucial. Scalability solutions, such as sharding or off-chain processing, need to be implemented to ensure that blockchain networks can accommodate the demands of the health insurance industry effectively.

-

Data Onboarding and Integration

Migrating existing data and systems to a blockchain-based infrastructure can be a complex process. Health insurers have vast amounts of historical data that need to be carefully onboarded onto the blockchain while maintaining data integrity and accuracy. Additionally, integrating blockchain with legacy systems and electronic health record (EHR) platforms can present technical challenges that require meticulous planning and execution.

-

Cost and Resource Investment

Implementing blockchain technology in health insurance requires significant investment in terms of time, resources, and expertise. Developing and maintaining a robust blockchain network necessitates specialized skills, including blockchain development, cybersecurity, and data management. The initial costs and ongoing operational expenses can be substantial, and healthcare organizations must weigh these expenditures against the potential benefits.

-

Resistance to Change

The healthcare industry is traditionally conservative when it comes to adopting new technologies. Embracing blockchain may encounter resistance from stakeholders who are skeptical of the technology’s efficacy or who are accustomed to conventional systems. Overcoming this resistance requires effective education, communication, and demonstration of the tangible advantages that blockchain can bring to health insurance operations.

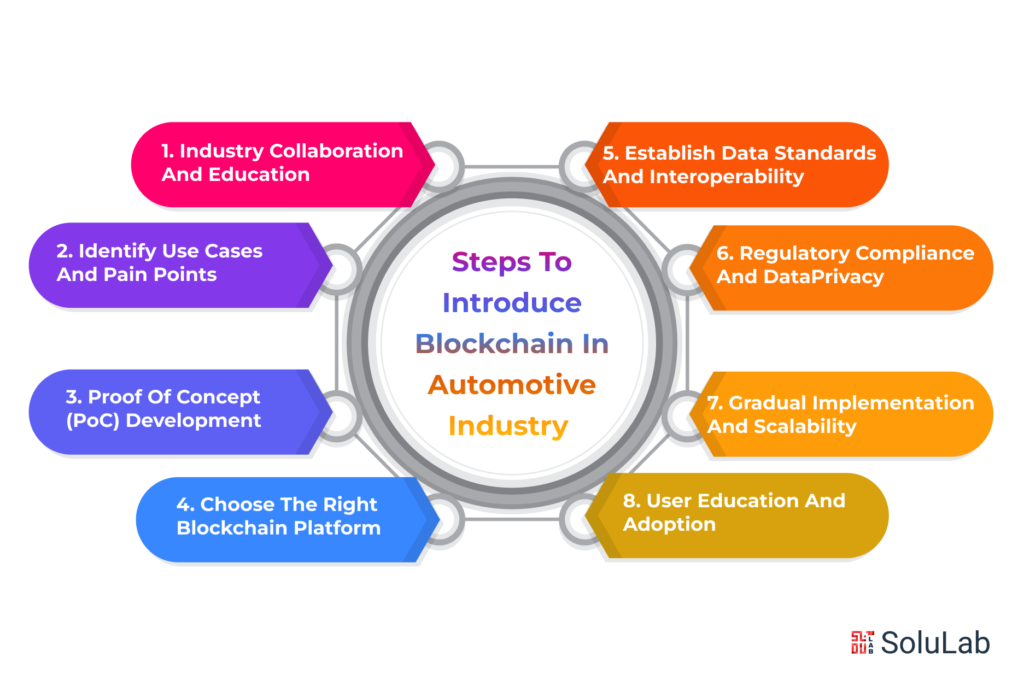

What Steps can we take to Introduce Blockchain in Automotive Industry?

Blockchain in the automotive industry is ripe for disruption, and blockchain technology has the potential to revolutionize various aspects, including supply chain management, vehicle history tracking, and digital identity verification. To successfully introduce blockchain in the automotive sector, several key steps must be taken. Let’s explore the critical measures that can pave the way for the seamless integration of blockchain technology:

Read Also: Top 14 Blockchain-Based Automotive Startups

-

Industry Collaboration and Education

The first step is to foster collaboration among stakeholders in the automotive industry. This includes automakers, suppliers, dealerships, and other key players. Industry-wide cooperation can help create a shared understanding of blockchain’s potential and the specific challenges it can address. Additionally, organizing workshops, conferences, and educational sessions to familiarize participants with blockchain technology and its applications will be instrumental in driving adoption.

-

Identify Use Cases and Pain Points

Understanding the pain points and inefficiencies in the automotive industry is crucial in determining the most appropriate use cases for blockchain in the automotive industry. Conducting thorough research and analysis to identify areas where blockchain can bring the most significant benefits, such as tracking vehicle parts authenticity, improving supply chain transparency, or enabling secure and efficient peer-to-peer vehicle sales, is essential.

-

Proof of Concept (PoC) Development

Developing a Proof of Concept (PoC) is an effective way to validate the feasibility of blockchain applications in the automotive sector. A PoC allows stakeholders to test the technology on a smaller scale, identify potential challenges, and assess the impact of blockchain on existing processes. It provides valuable insights before making substantial investments in full-scale implementation.

-

Choose the Right Blockchain Platform

Selecting the top blockchain platform is a critical decision. Public or private blockchain networks may be suitable depending on the specific use case and requirements. Factors to consider include scalability, security, governance, and consensus mechanisms. Collaborating with experienced blockchain development firms can aid in making the right technology choices.

-

Establish Data Standards and Interoperability

For blockchain to deliver its full potential, standardizing data formats and protocols is crucial. This promotes interoperability and ensures seamless data exchange between different participants in the automotive ecosystem. Defining data standards and adhering to industry-wide best practices will facilitate smooth integration with existing systems.

-

Regulatory Compliance and Data Privacy

Addressing regulatory compliance and data privacy concerns is paramount when introducing blockchain in the automotive industry. Given the sensitivity of personal and vehicle-related data, ensuring compliance with regional data protection laws, such as the General Data Protection Regulation (GDPR), is essential to gain customer trust and maintain legal compliance.

Read Our Blog: How Will Blockchain Transform Insurance Companies?

-

Gradual Implementation and Scalability

Rather than attempting a complete overhaul of existing systems, a gradual and phased approach to blockchain integration is recommended. Starting with pilot projects and expanding progressively allows stakeholders to learn from early successes and address any challenges that arise. As blockchain applications gain traction, scaling up to larger projects becomes more manageable.

-

User Education and Adoption

Finally, educating end-users, including customers, dealerships, and service centers, about the benefits of blockchain technology and its impact on their daily interactions with the automotive industry is crucial. By fostering awareness and demonstrating the enhanced security, transparency, and efficiency that blockchain brings, user adoption can be accelerated.

Conclusion

In conclusion, Blockchain technology has emerged as a game-changer in the automotive and health insurance industries, revolutionizing the way data is managed, transactions are processed, and trust is established. As a leading provider of cutting-edge blockchain solutions, SoluLab recognizes the immense potential of this transformative technology and its ability to bring transparency, efficiency, and security to these critical sectors.

In the automotive industry, blockchain’s decentralized and immutable ledger ensures that vehicle histories, maintenance records, and ownership details are securely stored and easily accessible to all relevant stakeholders. This enhances trust and transparency, reduces the risk of fraud, and streamlines processes, ultimately benefiting manufacturers, dealers, insurers, and consumers alike. SoluLab’s expertise in custom blockchain development services empowers automotive companies to harness this technology’s full potential and drive innovation within their operations.

At SoluLab, we are committed to pushing the boundaries of what blockchain can achieve in the automotive and health insurance sectors. Our team of experts works tirelessly to deliver innovative, scalable, and user-friendly solutions that empower our clients to stay ahead in an increasingly digital world. As these industries continue to evolve, we remain dedicated to staying at the forefront of blockchain innovation and providing our clients with the tools they need to succeed in this transformative era.

FAQs

1. What is Blockchain technology, and how is it applied in the automotive industry?

Blockchain is a decentralized and immutable ledger technology that records transactions securely and transparently. In the automotive industry, Blockchain is utilized to enhance supply chain management, vehicle data sharing, and ownership verification. By creating a tamper-proof record of vehicle history, Blockchain fosters trust and efficiency, reducing fraud and ensuring the authenticity of parts and components.

2. How does Blockchain benefit the health insurance sector?

Blockchain in health insurance revolutionizes the way medical data is managed. Patients have better control over their health records, and insurers can efficiently access verified information, streamlining the claims process. This technology improves data privacy and security, reducing instances of fraud and unauthorized access to sensitive medical information.

3. Can you recommend a blockchain healthcare development company?

Sure! If you’re looking for a reputable blockchain healthcare development company, you can explore leading firms specializing in healthcare solutions like SoluLab. Companies like SoluLab offer tailored Blockchain applications to healthcare providers, insurers, and patients, ensuring seamless integration and secure data management.

4. What are some common Blockchain healthcare solutions in the market?

Blockchain healthcare solutions encompass Electronic Health Records (EHR) management, drug supply chain tracking, clinical trials management, and patient identity verification. These solutions enhance interoperability, data accuracy, and collaboration among stakeholders, leading to improved healthcare outcomes.

5. How do Blockchain development services contribute to innovation in various industries?

Blockchain development services play a pivotal role in fostering innovation across sectors. By providing expertise in building and implementing decentralized applications, smart contracts, and consensus mechanisms, Blockchain developers help businesses harness the full potential of this transformative technology.