Right now, one question keeps popping up in real Web3 conversations, and it’s simple: how to create a crypto wallet that people actually trust and don’t abandon. The market is growing fast as we head into 2026. It was $13.11B in 2025, and projections now push it to $77.17B by 2033, growing at a 24.8% CAGR, driven by institutions, clearer rules, and AI products, but that growth also raises the bar.

At the same time, things break. In 2025 alone, crypto hacks crossed $2.935B in losses, and while incidents fell from 410 to around 200, the average hit jumped to nearly $15M. The Trust Wallet Chrome exploit of $7M and the $1.5B Bybit breach made it clear that even big names can fail, which is why anyone thinking about crypto wallet development has to focus on trust before features.

This guide comes from production work, as we walk through architecture, security trade-offs, and patterns we’ve seen hold up under pressure. So, whether you’re shaping an MVP or working out a Smart Crypto Wallet at scale, the goal should be to build something that survives real users, real volume, and real money.

Key Takeaways

- The hardware wallet market is moving toward $914.29M by 2026, but after 200 security incidents in 2025 and $2.935B lost, speed alone clearly doesn’t matter, but audited multi-sig does.

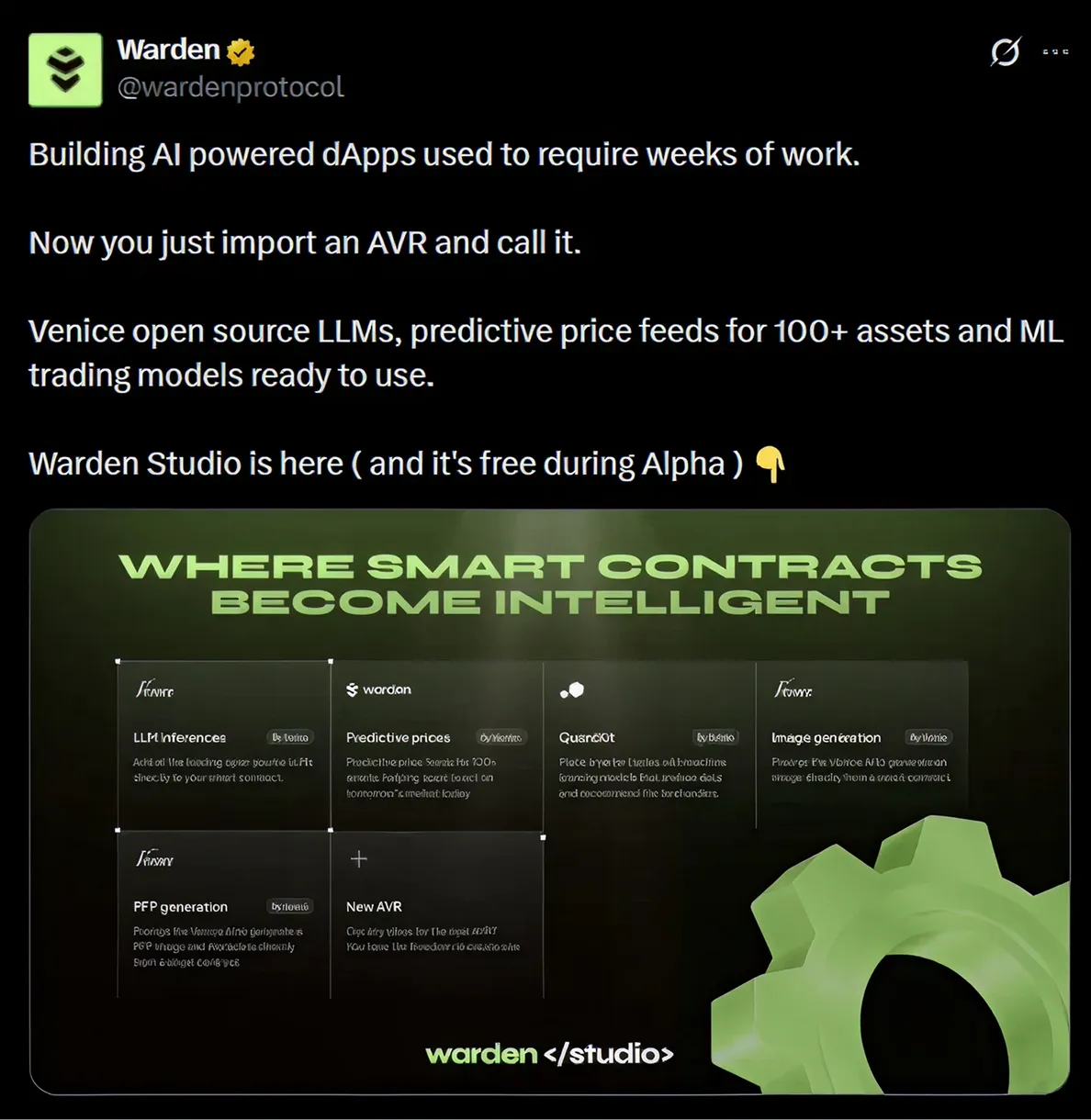

- AI-integrated smart crypto wallet features, like predictive yield farming, showed 40 to 60% lower churn in early Warden Protocol pilots, but only when on-chain checks were used to stop oracle games.

- Revenue starts from day one when staking fees, token-driven dApps, and premium AI features are combined, and this can push 20–30% margins while keeping users active 2–3x longer.

- By 2026, almost 60% of wallets will need KYC/AML hooks, so adding modular compliance layers now is critical to stay institution-ready and future-proof.

Why Now Is the Right Time for Blockchain Wallet Development?

2026 feels like the start of something big for crypto, almost like the institutional era is finally here. As Grayscale is forecasting wider ETF access, and there are rumors that Big Tech players, like Apple and Google, could roll out native wallets by mid-year. Even stablecoin supply could double by the end of the year, according to Dragonfly Capital, which means demand for AI-powered crypto wallet integration that handles tokenized real-world assets is only going to spike.

At the same time, the Web3 market itself is projected to reach $31.18 billion in 2025 and could jump to $393.42 billion by 2032, growing at a 43.65% CAGR, which is huge for anyone thinking about building a wallet now. The post-2025 bear markets pushed out weak players, which left room for stronger, more resilient projects.

For enterprises, convergence is becoming critical, as AI agents can now mimic crypto trades through the Warden Protocol, which means you can build a crypto wallet integrated with AI that not only automates compliance checks but also predicts asset flows, helping teams act faster and reduce mistakes.

And while this opens huge opportunities, the window to act is narrowing, because regulations like the EU’s MiCA will tighten by Q2 2026, which favors intelligent crypto wallet development that’s both compliant and truly scalable. At the same time, Bitcoin’s price projection between $130,000 and $250,000 by year-end is driving institutional urgency.

Even some security audits show that 80% of top wallets now rely on React Native for cross-platform delivery, which means multi-chain wallet development and non-custodial keys are no longer optional as they’re essential for any serious build. Here’s a sneak peek at the numbers shaping the space:

| Factor | 2025 Baseline | 2026 Projection | Implication for Builders |

| Market Size | $13.11B | $77.17B by 2033 | Scale for 5x user growth, while embedding AI for differentiation |

| Hack Losses | $2.935B in 200 incidents | Avg $15M per event; focus on audits | Multi-chain support and non-custodial keys are essential |

| AI Adoption | 20% of wallets | 60% with agents by Q3 | Verifiable off-chain compute via Warden/AVR |

| Institutional TVL | $500B | $2T+ projected | KYC/AML modules with RWA tokenization hooks are mandatory |

| Web3 Users | 5–10M MAU dApps | 15M+ projected | User retention is existential, as by Day 7, 80% users drop off. |

How to Build a Crypto Wallet That Users Like?

Making a wallet comes down to trust, security, and how easy it is to use. First, you have to decide whether you want a custodial wallet or a non-custodial wallet where users keep full control.

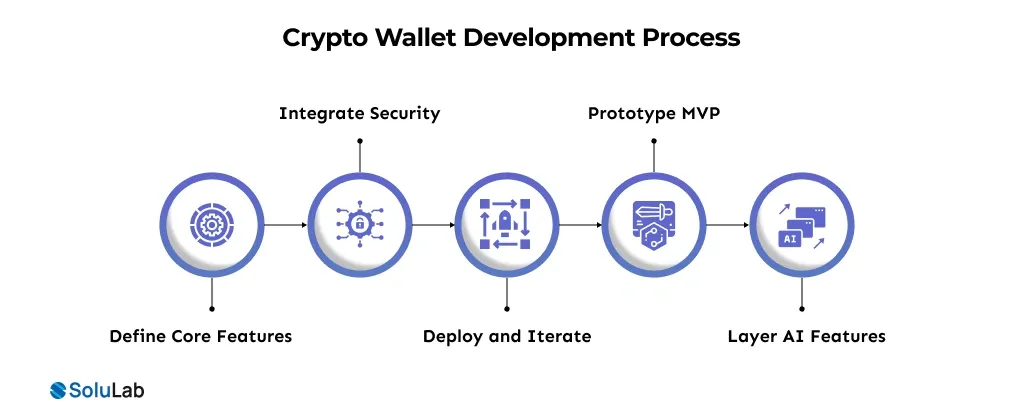

Most devs, about 80%, pick non-custodial, with seed phrases and recovery options, because that’s what actually earns trust. Chainalysis shows that in 2025, wallet theft is 20%, down from 44% in 2024, which proves that good key management works and even saves money. Knowing that, we built a five-step process for making wallets that are production-ready, secure, and simple enough for users to stick with.

Step 1: Define Core Crypto Wallet Features first

A wallet only works if the basics are solid. Users leave when transactions get messy, so things like multi-chain support (Ethereum, Solana, Base, Polygon), mempool previews, and smooth UX matter a lot. Key features include:

- Seed phrase generation following BIP-39, with an optional passphrase for extra security. Users can recover assets safely and truly own them.

- Multi-chain RPC infrastructure using providers like Infura or Alchemy, built for near-continuous uptime (99.99%) so users don’t get stuck.

- Smart gas-fee estimation for Layer-2 networks like Arbitrum, Base, and Optimism. Costs can drop up to 90%, but proper validation is needed so transactions succeed.

- Biometric authentication, like Face ID or fingerprint, keeps the wallet safe and reduces phishing risks, which is key for high-value accounts.

- QR code scanning prevents address-poisoning attacks, which caused over $76M in losses in Q4 2025, making sure funds always go to the right place.

These make the wallet ready for real users and set the foundation for the crypto wallet app development on the blockchain guide.

Step 2: Prototype Your MVP with Solid Foundations

Now it’s time to see if your wallet actually works. Test user flows, blockchain stuff, and security. Doing this early saves a lot of headaches later and shows if it can scale.

- React Native for Mobile: Using this, we can make iOS and Android at the same time. Around 60% of wallet use is on mobile (PatentPC), so this keeps things consistent and saves time.

- Figma Community Templates: Use ready-made templates to speed up design. Teams usually save 3-4 weeks on wireframes and UI, which gets you to MVP faster.

- Beta Testing with Real Users: Try it with 100 people. Usually, about 40% of UX problems show up. Fix them now, and you avoid bigger issues later.

Also, now you see the crypto wallet development cost clearly. A basic MVP is roughly $15,000. A full multi-chain crypto wallet can go over $45,000 depending on features and security.

Step 3: Integrate Production-Grade Security

At this point, your wallet stops being just a storage box for crypto. It needs to actually survive attacks. Audits help, but real users test everything, so you can’t cut corners. Here’s what we focus on:

- Non-custodial key management: Keys stay on the user’s device and never touch your servers.

- Multi-signature security: Enterprise setups like Gnosis Safe with 2-of-3 or 3-of-5 approvals for multi-sig wallets. Extra protection without slowing anyone down.

- Cold storage: Over 90% of assets sit in hardware wallets like Ledger or Trezor. Hot wallets are really convenient, but cold storage is peace of mind.

- Strong encryption: We use AES-256-GCM with SHA-256 hashing and salted key derivation. It sounds really complicated, but it’s just making sure keys don’t get stolen or tampered with.

- Malware & phishing checks: Automated scans run constantly to spot fake domains or shady interfaces before users even realize something’s off.

- Pre-launch stress testing: 10,000+ transaction combinations tested to catch weird edge cases.

And yes, mishandled keys are behind roughly 50% of personal crypto losses. So skipping this step is not an option.

Step 4: Layer AI-Integrated Smart Crypto Wallet Features

AI turns the wallet into something alive. It’s no longer passive, as it guides users, stops mistakes, and keeps them active. A few we include:

- Automated DCA: Say you want to buy $LMTS over a week. The wallet splits purchases, handles timing, and does all the math. You set it once and can forget it. No tracking, no stress.

- Predictive Yield Insights: The wallet watches on-chain activity constantly and spots opportunities before returns dip. It gives users an advantage, helping them act faster and smarter.

- Real-Time Fraud Detection: Any unusual or suspicious transaction triggers an instant alert, any time of day. Users can jump on it immediately, preventing losses and keeping funds safer.

- Voice Transactions: You just say, Send $1000 USDC to this address, confirm with biometrics, and it’s done. Fast, secure, and perfect if speed matters, but safety can’t be compromised.

- Smart Alerts: When gas fees drop below 30 gwei, the wallet sends a ping so users can save on transactions and act cost-effectively.

It’s subtle, but this layer keeps people confident, engaged, and using the wallet for the long haul. Here are the AI Feature ROI Metrics of 2025:

| Impact Area | Without AI / Standard Wallets | With AI-Enhanced Wallet |

| Churn Reduction | High 30-day abandonment | 40 to 60% lower user churn |

| Premium Conversion | Limited upgrade intent | 25% increase in premium tier conversions |

| Day-7 Retention | 5 to 10% baseline retention | 25 to 35% retention driven by AI engagement |

| Security & Error Prevention | Reactive security measures | Around 80% of phishing attempts blocked pre-execution |

Step 5: Deploy & Iterate on Mainnet

When we push to mainnet, we don’t just flip a switch. We watch how people actually use it, and if something feels slow or confusing, we jump in. That’s how we roll out fixes or new features without annoying anyone.

- We always start on testnets first, Chiado or Sepolia, because running 10,000 transactions at once shows us where things bottleneck. Better to find those problems here than with real users.

- We check everything with Dune analytics. Daily active users, gas usage, network patterns, almost all of it. Changes come from what’s really happening, not guesses or assumptions.

- Scaling is handled with Kubernetes, so even 100,000+ users won’t break the system. And circuit breakers can stop a small RPC glitch from taking the whole thing down.

- Every release gets at least two audits. We stick to OpenZeppelin contracts as the baseline. Keeps security consistent and users trusting the wallet.

And we iterate constantly. Bugs get squashed, exploits patched, features improved. Over time, it all keeps the wallet smooth, reliable, and safe, without anyone noticing we even fixed something.

Additional Factors to Notice When Building a Crypto Wallet

Once the basics are clear, this is where things usually start to break or shine. These details don’t look big on paper, but they decide whether users trust the wallet or quietly leave after a few tries.

1. Nonce Management

This one causes more damage than people expect. Around 30% of failed transactions happen because nonces collide, especially when traffic spikes. Libraries like Ethers.js handle this well, but once teams try custom logic under load, things can spiral fast, and failures start chaining.

2. Gas Optimization for Layer 2

Layer 2s like Base are great, cutting fees by almost 90%, but they’re not fire-and-forget. Transactions can look final and still roll back if the sequencer fails. You need to watch finality, test edge cases, and keep fallback RPCs ready, or surprises will happen.

3. Mobile-First Imperative

About 60% of users come in through iOS or Android, so desktop-first thinking hurts retention. Small buttons, tight menus, and rushed layouts lead to mistakes, and phishing thrives in that chaos. Designing touch-first isn’t a nice-to-have anymore, it’s survival.

4. Biometric Auth Requirement

Biometrics genuinely help here, cutting phishing incidents by nearly 70%. Face ID and fingerprint auth work smoothly across iOS and Android, and if you add behavior signals like swipe or typing patterns, trust improves even more. Not required, but very effective.

5. Cold-Start User Retention

This is where most wallets lose people. Roughly 70% of users leave if they open the app and see nothing useful. Small wins matter, show earning options like earn 4% USDC on Aave, reward simple actions, and prove value immediately, or they won’t return.

6. Wearable Payment Integration

Wearables are finally becoming real in 2026, not just a gimmick. Letting users check balances or approve actions on Apple Watch or Wear OS removes friction. Even small features like this can lift retention by 15–20%, and those gains compound over time.

The Real Cryptocurrency Wallet Development Cost

When people ask how much it costs to build a crypto wallet, they usually expect a clean number. In reality, cost depends on what kind of wallet you’re building, how serious you are about security, and whether this is an experiment or a real business meant to scale. Here’s what wallet development actually looks like in 2026:

Cost Breakdown by Wallet Type (2026)

| Wallet Type | Estimated Cost | Features | Timeline |

| Custodial MVP | $15k–$45k | Basic send or receive, centralized key storage | 2–3 months |

| Non-custodial MVP | $25k–$50k | Seed phrases, self-custody, basic multi-chain | 3–4 months |

| Multi-chain Non-custodial | $35k–$75k | Ethereum, Solana, Polygon, Base, DeFi hooks | 4–6 months |

| AI-Integrated Smart Crypto Wallet | $55k–$120k | AI agents, predictive analytics, voice flows | 6–8 months |

| Enterprise-Grade (KYC / AML / Compliance) | $75k–$250k | Institutional features, audits, and regulatory layers | 8–12 months |

These numbers assume production-grade builds, not just demo apps. Once you move beyond a basic wallet, complexity rises quickly.

Tech Stack Behind a Production-Grade Crypto Wallet

Before getting into features or UI, it helps to understand what actually runs a wallet behind the scenes. This stack is what we use when the goal is stability, scale, and long-term user trust, not just demos.

| Layer | What We Use | Why It Makes Sense |

| Frontend (Mobile & Web) | React Native, Flutter, React 18 + TypeScript | Most wallet usage is mobile around 60%, so React Native fits naturally, while TypeScript keeps web stable. |

| UI Layer | Tamagui, shadcn/ui | Fast, consistent UI without overbuilding design systems. |

| Backend | Node.js, Python FastAPI | Node scales reliably, so FastAPI works well for async, and AI-heavy flows. |

| API & Messaging | AWS API Gateway / Kong, Redis, RabbitMQ | Smooth auth, rate limits, and real-time transaction updates. |

| Database | PostgreSQL, Redis | Clean transaction data with fast caching where needed. |

| Blockchain Layer | Ethers.js v6+, Web3.js v4+, Solidity, OpenZeppelin | Safer defaults and battle-tested smart contracts. |

| Node / RPC Infrastructure | Alchemy, Infura, Geth, Erigon | Managed RPCs early on, self-hosted nodes at scale. |

| Multi-Chain Support | Ethereum, Polygon, Arbitrum, Base, Optimism, Solana | Native EVM support with stable Solana integrations. |

| AI Layer | Venice.ai, OpenAI, TensorFlow Lite | Privacy-first AI with optional on-device inference. |

| Analytics & AI Logic | Scikit-learn, Prophet | Lightweight models for insights and alerts. |

| Key Management & Security | CloudHSM, Fireblocks, AES-256-GCM, TLS 1.3 | Strong key security with no shortcuts. |

| Secrets & Dependency Safety | HashiCorp Vault, AWS Secrets, Snyk | Locks down secrets and catches risky dependencies early. |

| Deployment | Kubernetes (EKS / GKE), GitHub Actions | Predictable scaling and clean deployments. |

| Monitoring & Uptime | Prometheus, Grafana, ELK, Sentry, Cloudflare | Issues show up early, not after users complain. |

| Payment | X402 protocol | Enables secure, decentralized multi-chain transfers without complex bridges. |

Custom vs. Ready-Made Crypto Wallets: Which Wallet You Should Choose?

Deciding between building a wallet from scratch or going white-label really comes down to control, speed, and long-term value. Let’s see which one is right for you:

| Aspect | Custom Build (From Scratch) | White-Label SDK (SDK.finance, BitGo, Fireblocks) |

| Initial Cost | $120k–$300k+ | $50k–$150k |

| Time to Market | 4–8 months | 2–4 weeks |

| Customization | Unlimited, tailor Crypto Wallet Features to your niche | Limited but stuck with vendor constraints |

| Vendor Lock-In | None, you own the code | High, but you follow their roadmap |

| Security Audit | You own the risk; hire auditors ($50k) | Vendor-audited but inherit their liability |

| AI Integration | Build Warden-like custom agents | Limited, maybe a ChatGPT plugin only |

| Long-Term ROI | 2–3x better if scaling to millions | Break-even at 100k+ users |

| Best For | Enterprises needing AI-integrated wallet development services | Startups testing MVP; rapid market entry |

If you’re targeting Fortune 500 clients, need full control, or want to focus on niche areas like RWA tokenization that most SDKs can’t handle, going custom usually makes sense, especially when planning Web3 Crypto Wallet Development with proprietary AI, because it avoids vendor lock-in and helps differentiate your product. If your 3-year valuation goal is $100M+; basically, custom pays off when you want to own every feature and scale with confidence.

But white-label is better when speed and budget matter more than control, launching an MVP in under 3 months, keeping costs under $50k, or targeting retail users with a commodity product all point to white-label, and since vendors absorb most liability, the risk is lower, which makes it a smart choice for early traction without over-investing.

How Zengo Redefined Intelligent Crypto Wallet Development Using MPC and AI?

Zengo was launched in 2018, built by Israeli security veterans from the NSO Group, and from day one, they went against what everyone else was doing. No seed phrases at all. Instead of storing private keys, they used MPC (multi-party computation), which splits keys across different servers. So even Zengo itself can’t touch user funds, and that single decision quietly raised the bar for crypto wallet security across the industry.

What’s more interesting is how that decision aged. Between 2023 and 2025, Zengo crossed 1M+ active users and still kept a zero-breach record over seven years. No funds were lost to hacks on the wallet side, although DeFi risks outside the wallet stayed with users, as expected. Even Partnerships with Alchemy in 2024 helped them scale nearly 10x, but the core system remained the same, which speaks volumes about how solid the architecture was from the start.

Security alone wasn’t enough, so Zengo leaned into AI as part of its MPC crypto wallet development stack.

- Transactions over $5k going to new addresses get flagged within 30 minutes, which catches problems early.

- The wallet also suggests yield options, like Lido at 3.2% for 30 days, so users don’t have to dig through protocols themselves.

- Onboarding adjusts based on a user’s risk profile, and even voice commands like Send $500 USDC to Aave work with biometric confirmation, which sounds simple but makes a real difference in day-to-day use.

All of that showed up in the numbers.

- Around 25% of users moved to the premium tier, paying $60 a year, which alone brought in about $12.5M annually.

- Retention stayed strong at 40% month-over-month, far above the usual 5–10% range, with 60-day retention crossing 30%.

- Investor interest followed, pushing valuation from $50M in 2024 to $150M+ in 2025, and media outlets like Forbes and CoinDesk started calling Zengo the security benchmark.

Conclusion

Building a crypto wallet today isn’t just about storing assets anymore. It’s about security that doesn’t crack under pressure, performance that stays smooth as users grow, and an experience people actually trust over time. Whether you’re thinking through how to create a crypto wallet from scratch or pushing toward a more AI-driven setup, the real work is in getting the foundation right early, because once users come in, fixing architecture gets expensive fast.

That’s where working with an experienced Crypto Wallet Development company really helps. Teams like SoluLab work across planning, development, and scaling, focusing on secure architecture and real-world usage, not just features that look good in a demo. For founders serious about long-term growth, choosing the right development partner early often saves months of rework and helps the product scale with confidence.

FAQs

You’ll need blockchain engineers, backend developers, and security pros who really understand private keys and signing flows, need Designers for wallet UX, and handling RPC infrastructure correctly saves a lot of headaches later duirng production.

We build security-first, bring in auditors early, and set up monitoring from day one. Compliance and maintenance are ongoing, which prevents surprises post-launch and keeps the wallet safe.

Ethereum and EVM-compatible chains like Polygon or BSC are the usual starting point. Then expand to Solana or other blockchains based on user demand and liquidity.

Yes. We support Wallet RPC infrastructure, performance tuning, and scaling as users grow from zero to millions. That keeps the wallet smooth, reliable, and trustworthy, which is key for adoption and retention.

We use tried-and-true wallet architectures and secure coding flows. Planning for scale, failures, and compliance from the start keeps funds safe and avoids costly rewrites.

For MVP it will take around 10–14 weeks and for Full production wallet around 4–6 months. It depends on Chains, features, security, as each adds time. Skipping steps saves nothing, just costs more later.