When artificial intelligence meets blockchain, it opens up entirely new possibilities. Think of platforms that can turn real-world assets into fractions you can invest in, manage, and trade easily. These AI tokenization platforms are helping to change how businesses, startups, and enterprises access, value, and monetize assets.

By combining smart algorithms with distributed ledger technology, AI tokenization brings liquidity, transparency, and scalability. In this blog, we’ll explore how to develop AI tokenized platforms, why they matter, the benefits for startups, and what’s coming next.

What Are AI Tokenization Platforms?

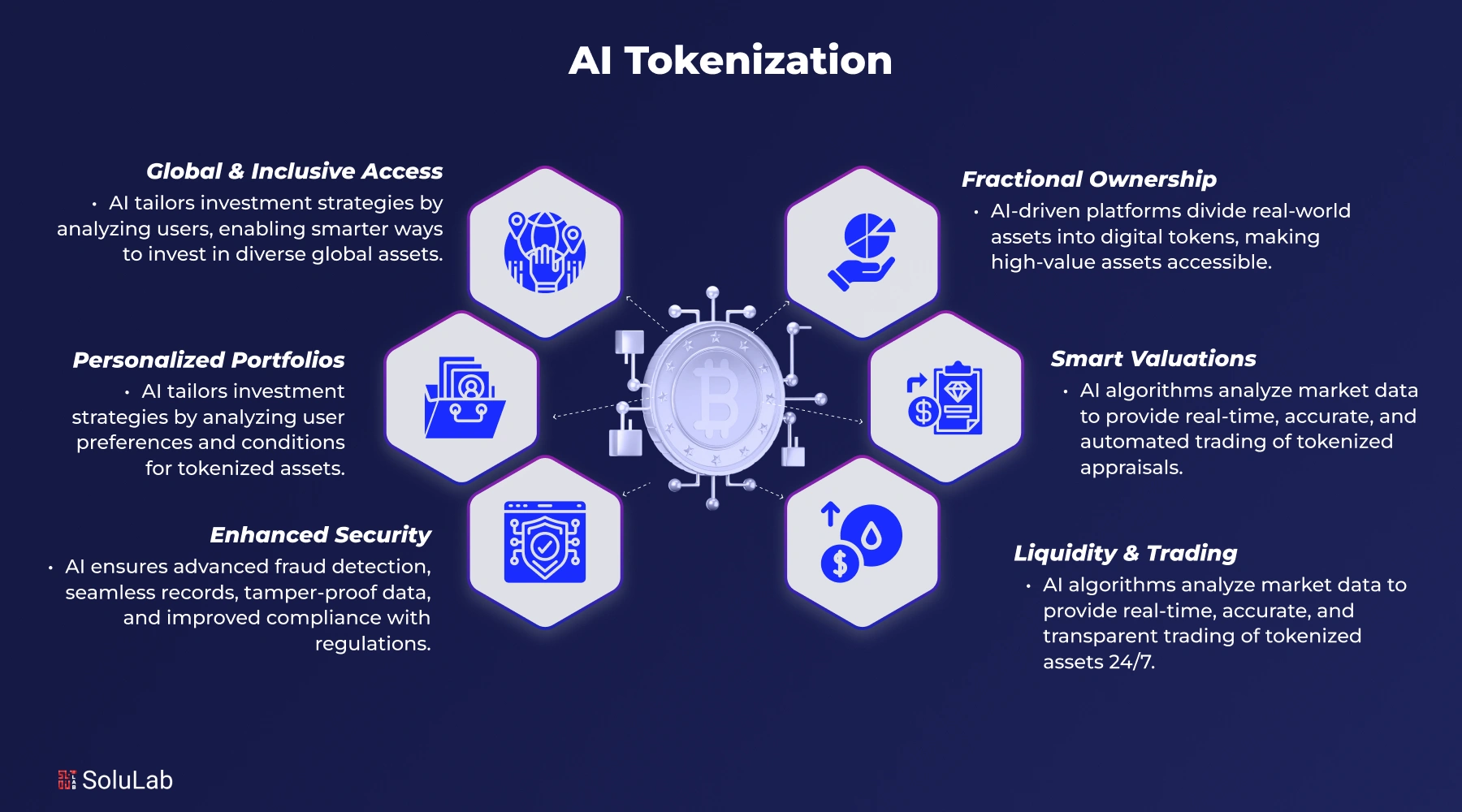

AI tokenization platforms bring together artificial intelligence and blockchain architecture to convert real-world or digital assets into tokens on-chain. These assets can then be fractionalised, traded, and managed with far greater agility than the traditional route. Here’s a breakdown:

- Fractional ownership: The platform divides an asset into digital tokens, each representing a share of the whole. That means smaller investors or business units can participate, not just large institutions.

- AI-driven valuation and monitoring: AI algorithms analyse data, market trends, and historical performance to value assets, monitor risk, and run compliance checks, rather than relying solely on manual processes.

- Blockchain registration and trading: Once tokenised, the asset’s ownership and transactions are recorded on a blockchain, which provides immutability and transparency.

- Smart contract automation: Ownership transfers, royalty payouts, or usage rights can be governed by smart contracts, so fewer intermediaries and faster execution.

- Compliance and risk controls: By embedding AI-based asset tokenization rules (e.g., KYC/AML checks) and blockchain audit trails, these platforms aim to meet regulatory standards while simplifying operations.

Market Trends Shaping AI Tokenization in 2025

The growth of tokenization, and by extension, AI-powered tokenized ownership, has been notable. For decision-makers in finance, tech, and startups, the numbers indicate rising opportunity.

- The global tokenization market is estimated to move from roughly USD 3.38 billion in 2024 to about USD 4.1 billion in 2025.

- Some forecasts suggest tokenized assets (real-world assets on blockchain) are already in the “low tens of billions” range by mid-2025 for institutional pilots; under more optimistic assumptions, this could scale into the trillions over the next decade.

- In India specifically, the asset tokenization market is projected at around USD 122.4 million in 2025, rising to USD 222.3 million by 2032 (CAGR approx 8.9%).

- Growth drivers include: increasing institutional interest, demand for liquidity in illiquid assets, regulatory clarity (in some jurisdictions), and advancing blockchain/AI infrastructure.

- On the technology side, the convergence of AI for asset valuation and blockchain for record-keeping is creating new product categories: tokenized funds, fractional real-estate investments, art/collectible shares, commodity tokens.

These trends indicate that AI tokenization is becoming a business tool. For startups and enterprises thinking of tokenization development, the window is open.

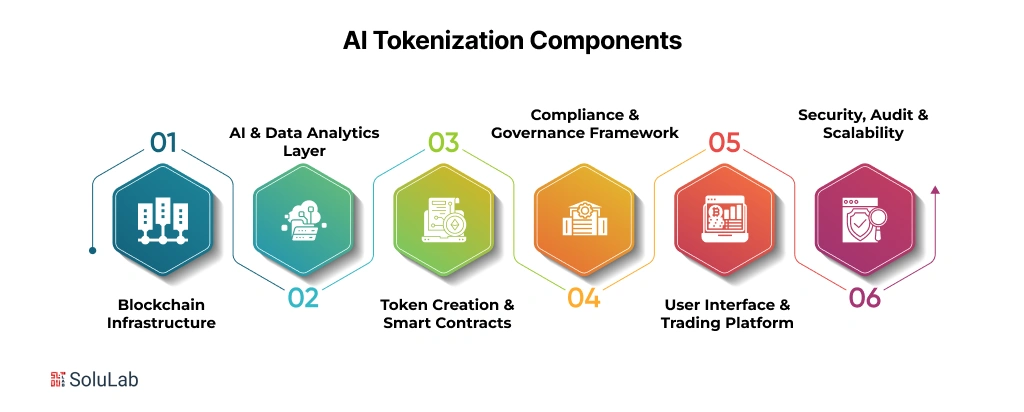

To build a strong foundation for AI tokenization, several technical and operational components must align seamlessly. Let’s check what and how they work in enhancing the tokenization of assets.

Key Components Behind Effective AI Tokenization

For startups or enterprises looking to build or adopt tokenization platforms, understanding the core components is essential.

-

Blockchain Infrastructure

You’ll need a secure, scalable AI and blockchain tokenization that supports smart contracts and asset registration. Whether you choose Ethereum, Polkadot, Solana, or a private chain, each has trade-offs in cost, speed, and developer ecosystem.

-

AI & Data Analytics Layer

This layer encompasses asset valuation models, risk assessment engines, and compliance monitoring modules. Machine learning in asset tokenization can analyze market data, asset history, and macro-trends, providing real-time insights.

-

Token Creation & Smart Contracts

Here, you define the logic of how tokens are created, fractioned, transferred, and destroyed. Smart contracts enforce ownership rules, payout structures, and can automate the redistribution of assets (e.g., dividends or royalties).

-

Compliance & Governance Framework

Tokenization often intersects with securities law, regulatory oversight, and investor verification. Your platform should have embedded KYC/AML flows, audit logs, permissioning, and governance modules for token issuers and investors.

-

User Interface & Trading Platform

End users, whether asset originators, investors, or traders, need a clean interface. That means dashboards, asset explorer, token-wallet integration, trading module, and transparent analytics. Streamlined UX improves adoption.

-

Security, Audit & Scalability

Tokenization handles value, so security is non-negotiable. Encryption of data, secure key management, regular audits, anti-fraud AI monitoring, and architecture that scales under load are critical.

Benefits Of Asset Fractionalization Through AI Platforms For Startups

Picking the right benefits to highlight for startups and smaller enterprises can make adoption decisions easier.

-

Access to High-Value Assets

For a startup that cannot afford to buy entire properties or large-scale art or venture-fund shares, fractional ownership via tokenization opens doors. With AI tokenized platforms, parts of expensive assets become accessible.

-

Increased Market Liquidity

Traditionally illiquid assets (like real estate or fine art) meant long lock-in periods. Tokenizing those assets enables trading in smaller units, provides secondary market options, and hence gives startups more flexibility.

-

Transparency and Trust

Blockchain records provide tamper-resistant logs of who owns what, and AI systems help ensure the process remains compliant and tracked. For startups working with investors, this builds credibility.

-

Lower Transaction Costs

By automating valuations, transfers, compliance checks, and smart contract enforcement, many intermediaries (brokers, custodians, and manual compliance teams) are reduced. That means startups spend less time and money per transaction.

-

Portfolio Diversification and Innovation

Startups can experiment with multiple assets or tokenized datasets via tokenization in AI models. This provides flexibility and innovation potential.

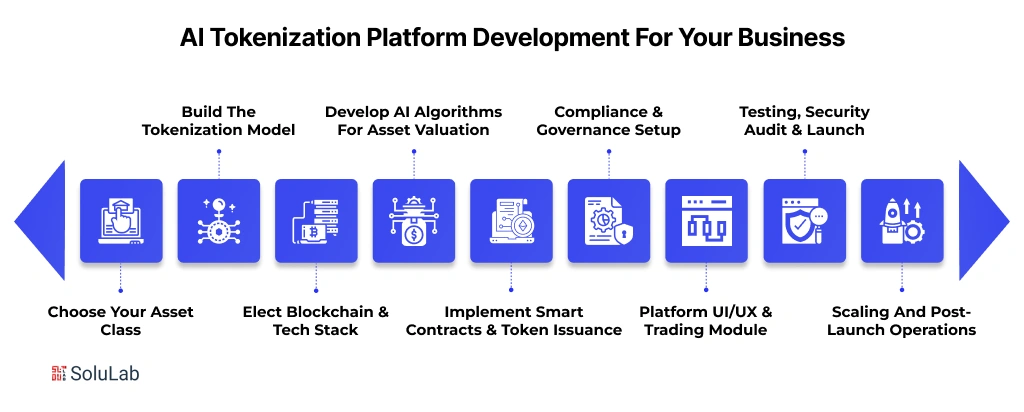

How To Build an AI Tokenization Platform For Your Business?

Here is a rough roadmap with different tiers, basic, MVP, and advanced, with realistic timeframes and approximate cost ranges (depending on geography and vendor rates).

1. Choose Your Asset Class

Decide whether you’ll tokenize real estate, art, commodities, financial instruments, or even AI models/data. The choice influences legal, valuation, and technical approach.

2. Build the Tokenization Model

After deciding on your vision/goal, build the AI tokenization model. You can partner with any AI tokenization development company that suits your budget and requirements.

3. Select Blockchain & Tech Stack

Pick your underlying AI and blockchain tokenization framework, smart-contract language, wallet integrations, and token standards (e.g., ERC-20/ERC-3643 for security tokens).

4. Develop AI Algorithms for Asset Valuation

Gather data, build or integrate ML models that can value assets, monitor risk, detect fraud, and make compliance recommendations. Train models, validate them, and ensure accuracy.

5. Implement Smart Contracts & Token Issuance

Set up contract logic, token minting/burning, ownership tracking, and transfer conditions. Ensure compatibility with wallets and exchanges if trading is planned.

6. Compliance & Governance Setup

Integrate KYC/AML modules; set roles (issuer, investor, custodian); design governance rules for token holders; work with legal counsel to ensure regulatory adherence in your target jurisdictions.

7. Platform UI/UX & Trading Module

Create dashboards for issuers and investors, build marketplace/trading logic, wallets, transaction history, and analytics. Focus on simplicity and clarity so business users can adopt without heavy training.

8. Testing, Security Audit & Launch

Run user-testing, stress test smart contracts, and perform security audits (cryptography, smart contract vulnerabilities, penetration testing). Prepare for live launch.

9. Scaling and Post-Launch Operations

Monitor performance, user feedback, legal/regulatory changes; iterate with improvements. For advanced platforms, this includes launching new asset classes and expanding globally.

Future Trends Shaping AI Tokenization And Fractionalization Markets

Looking ahead, several trends will influence how AI tokenization evolves.

- Interoperable tokenized asset ecosystems: Platforms will increasingly support cross-chain and cross-platform token trading so tokenized assets can flow between networks.

- AI-driven tokenization markets: AI will power market-maker bots, pricing algorithms, portfolio management of tokenised assets, enabling dynamic liquidity and AI-optimised trading.

- Tokenized AI models and data as assets: Beyond physical assets, AI models and datasets themselves will become tokenized, and businesses may invest in fractions of a model or dataset instead of buying outright.

- Regulatory clarity and compliance frameworks: As regulators catch up, standardised rules for tokenized securities, real-world asset tokens, and AI-asset tokens will emerge, lowering barriers.

- Embedded finance and real-world asset integration into DeFi/Web3: Tokenized assets will be used as collateral in DeFi, integrated into lending, leasing, and insurance use-cases, making the bridge between traditional finance and decentralized platforms stronger.

Conclusion

AI is always growing and driving towards innovations and integrations. To stay updated with the ongoing technology development, you need an AI and tokenization development partner. This also helps you to keep your platforms and technology compliance up to date. To help you with all these, SoluLab is here.

We, at SoluLab, the top asset tokenization platform development company, offer cutting-edge asset tokenization with AI integration services. Our tokenization solutions aid you in growing above market volatility. Our expert is always at your service to help you with the process and enhance your goals.

If you are ready with your ideas and vision, contact us today!

FAQs

1. What is AI tokenization, and why does it matter for businesses?

AI tokenization uses artificial intelligence and blockchain to convert assets into digital tokens. It helps businesses simplify ownership, improve liquidity, and attract investors through secure, fractionalized assets.

2. Can I integrate AI tokenization into my existing business platform?

Yes, you can. AI tokenization development team customizes integrations that connect easily with your current systems, ensuring smooth operation without disrupting your ongoing business processes.

3. How does SoluLab help in developing AI tokenization platforms?

SoluLab designs, develops, and deploys AI-powered tokenization platforms tailored to your business goals. We manage everything, from blockchain setup to AI valuation models and compliance automation.

4. How much does it cost to build an AI tokenization platform?

The cost depends on features and integrations. A basic version starts around $10,000, while advanced multi-asset, AI-driven platforms range higher. SoluLab provides transparent, goal-based pricing.

5. How long does it take to launch an AI tokenization platform?

A basic platform takes about 3 to 5 weeks. Advanced solutions with AI engines, compliance tools, and marketplace modules may take 3 to 4 months, depending on project scope.