- AI Development

- AI App Development

- AI Consulting

- AI Software Development

- ChatBot Development

- Enterprise AI ChatBot

- AI Chatbot Development

- LLM Development

- Machine Learning Development

- AI Copilot Development

- MLOps Consulting Services

- AI Agent Development

- Deep Learning Development

- AI Deployment Services

- Deep Learning Consulting

- AI Token Development

- AI Development Company

- AI Development Company in Saudi Arabia

- AI Integration Services

- Hire Blockchain Developers

- Hire Full Stack Developers

- Hire Web3 Developers

- Hire NFT Developers

- Hire Metaverse Developers

- Hire Mobile App Developers

- Hire AI Developers

- Hire Generative AI Developers

- Hire ChatGPT Developers

- Hire Dedicated Developers

- Hire Solana Developer

- Hire OpenAI Developer

- Hire Offshore Developer

- About Us

- Networks+

- Smart Contracts +

- Crypto currency +

- NFT +

- Metaverse +

- Blockchain+

- Mobile Apps +

- WEB +

- Trending +

- Solutions +

- Hire Developers +

- Industries +

- Case Studies

- Blogs

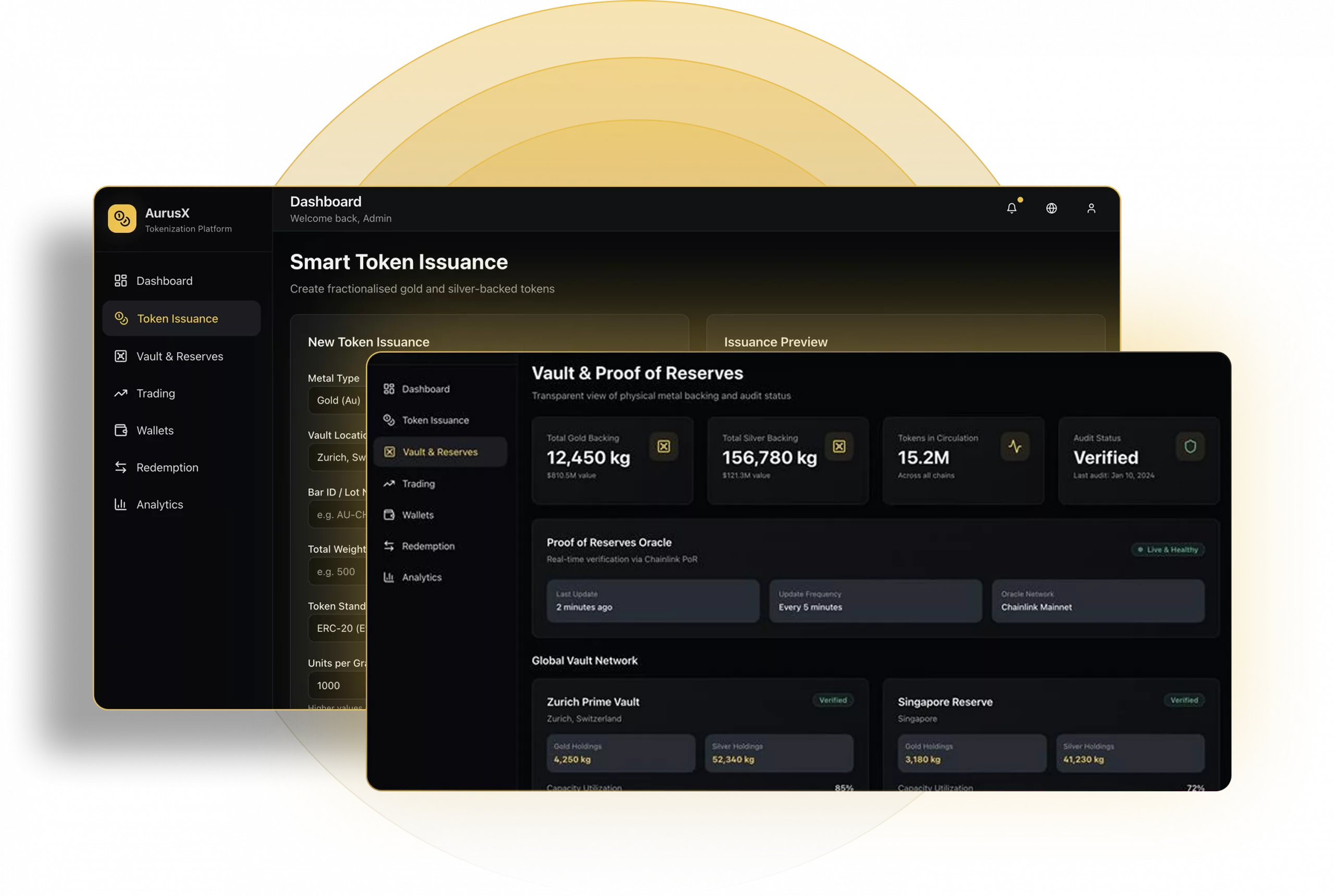

Digitizing Gold & Silver: A Tokenization Success Story

An asset-tokenization platform for gold and silver that enables fractional ownership, 24/7 global trading, and seamless digital-asset integration, making precious-metal investing simple, fair, and accessible.

Services Provided

Tokenization Consultation

Smart Contract Development

Asset-Backed Token Integration

Multi-Chain Token Infrastructure

Wallet Integration

UX/UI Design

Client Vision

Our client envisioned transforming how people invest in precious metals. Instead of traditional gold or silver bars locked in vaults, they wanted to create a platform where anyone, retail or institutional, could own, trade, and redeem tokenised gold and silver, easily and transparently.

They saw high entry costs, limited liquidity, and poor accessibility as major barriers. Their goal: a platform that brings the stability of physical gold and silver together with the flexibility of digital assets, opening new business models and investor segments.

The Market Challenges

Although precious metals have held value for centuries, the current model suffers from friction and exclusion. For a metal-backed platform to succeed, it needed to address these core issues.

1. High entry costs and storage fees for physical metals.

2. Limited trading hours and slow settlements.

3. Hard to integrate gold and silver into DeFi ecosystems.

4. Low trust and transparency in asset backing and custody.

The Core Requirements

To bring our client’s vision to life, the platform had to meet several essential requirements. It needed to bridge the gap between physical gold and silver markets and modern digital finance, ensuring trust, transparency, and liquidity at every step.

Fractional Ownership

Allow users to purchase small gold or silver units instead of full bars. Lower barriers to entry, expand participation.

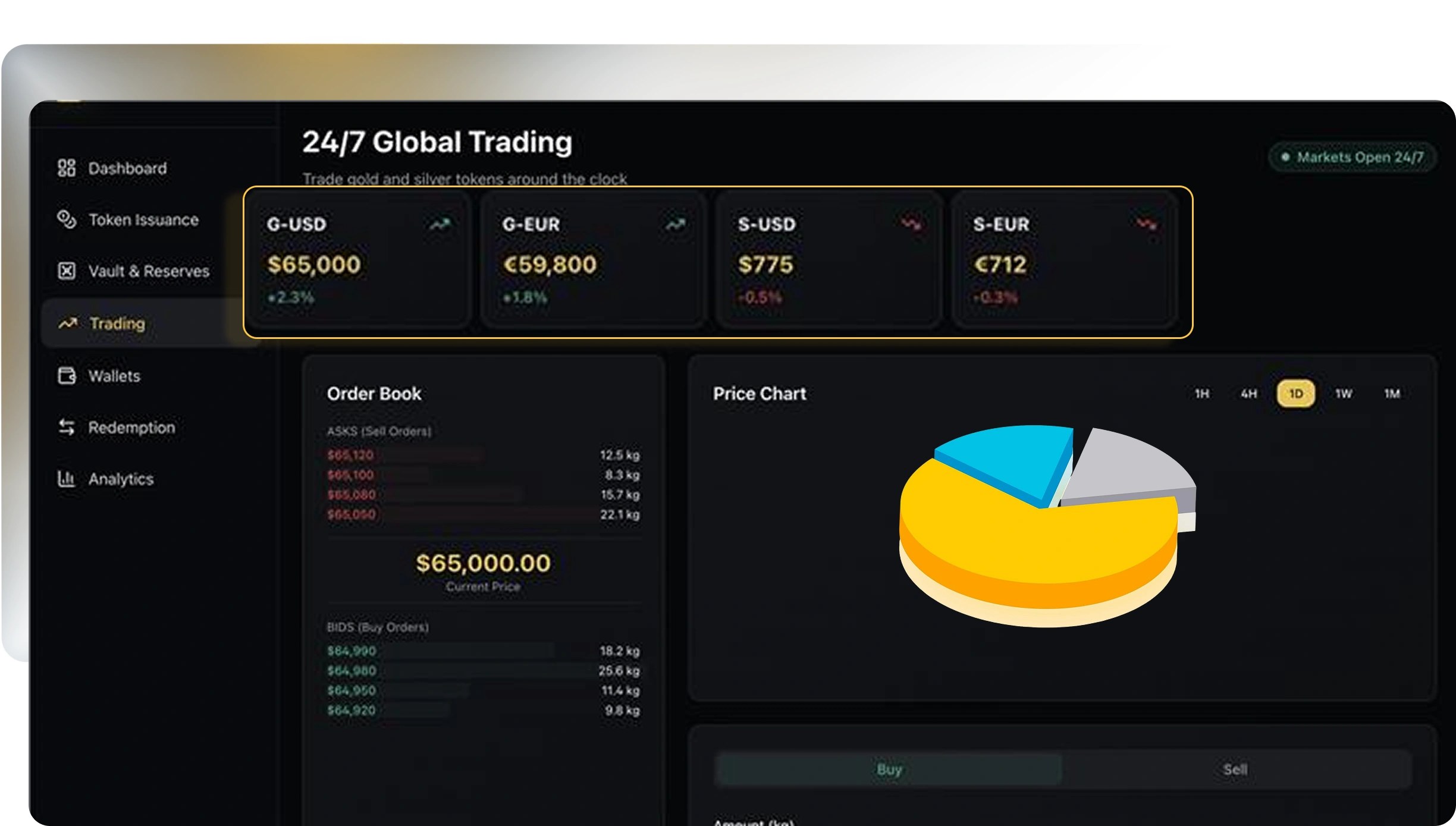

24/7 Digital Trading

Provide round-the-clock global trading with instant settlement. Ensure high liquidity so users can enter or exit positions anytime.

Physical Asset Custody

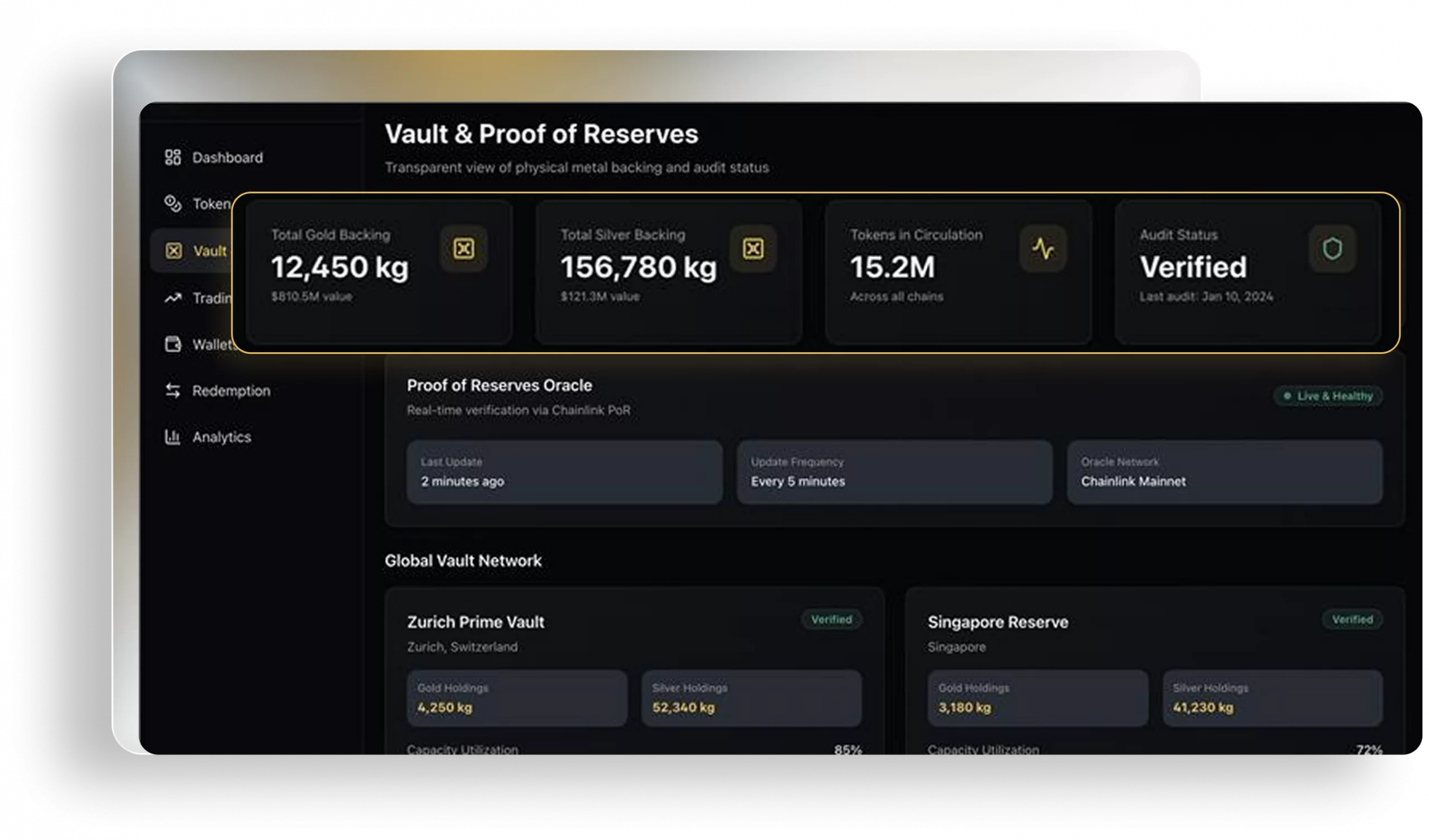

Back every token with verifiable vault-held metals. Maintain transparent proof of reserves and third-party audits.

Audit-Backed Tokens

Link each token directly to audited physical reserves. Conduct regular third-party audits and publish proof-of-reserves for complete transparency.

Multi-Chain Tokenization

Deploy tokens across multiple blockchain networks for cross-chain flexibility and wider ecosystem access.

Wallet Integration

Integrate non-custodial and custodial wallets, enabling users to store, trade, or transfer their metal-backed tokens easily and securely.

User-Centric Platform

Deliver a simple interface with smooth onboarding, clear redemption flows, and real-time portfolio visibility.

Business Model Flexibility

Enable multiple revenue channels including token issuance, trading fees, and subscription-based services.

Regulatory Compliance

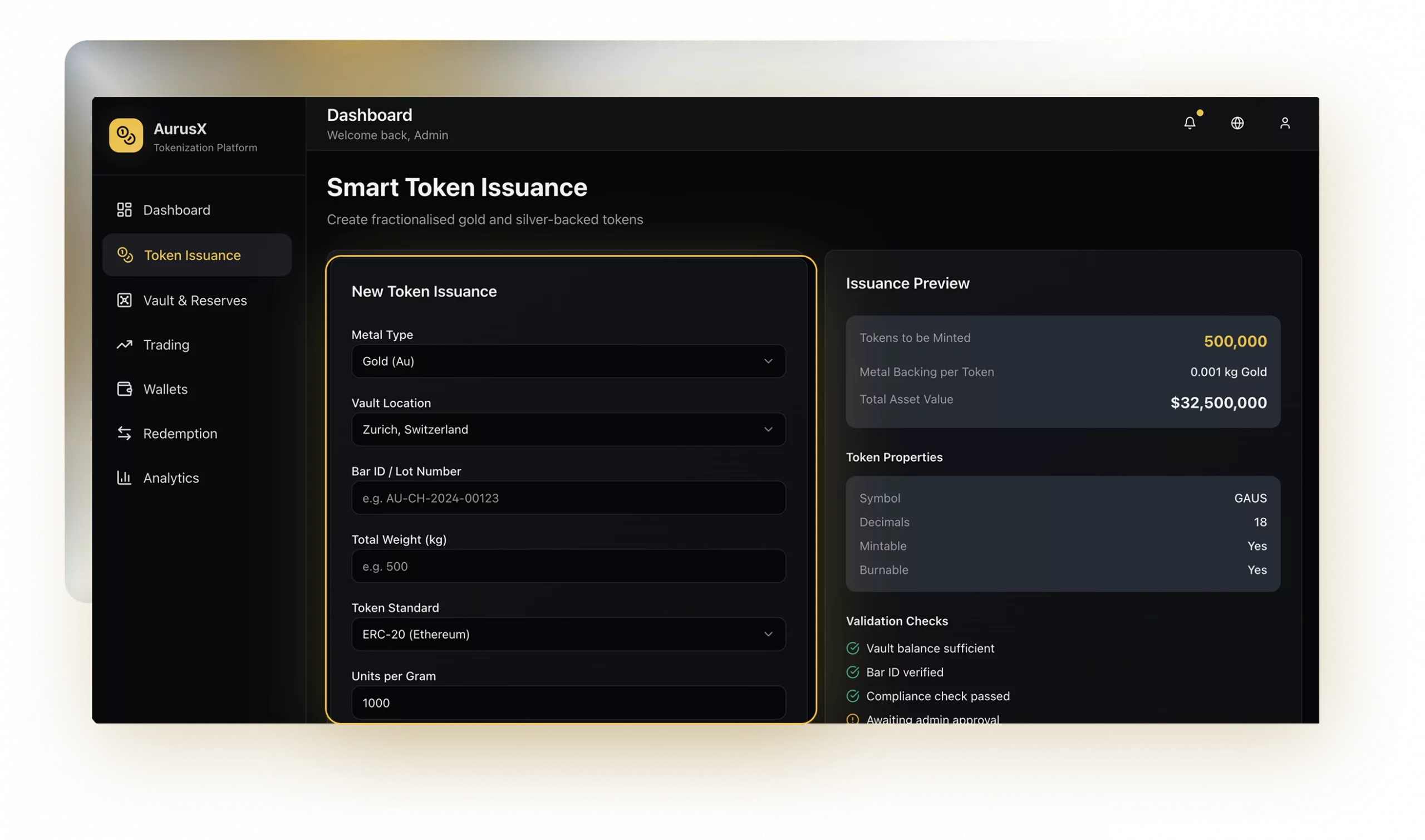

Implement full KYC, AML, and audit procedures to meet financial regulations and build investor confidence.

Solution Provided: The Gold & Silver Tokenization Platform

We built a full-stack gold & silver tokenization platform that delivered both business-ready and user-centric results. Below is how we executed it for our client.

Smart Token Issuance & Fractionalisation

Tokens were created where each unit represents a defined gram or ounce of metal. Fractional ownership was built into let users invest at lower levels, democratising precious-metal investment.

Vault Integration With Proof of Reserves

We connected with licensed vault custodians. The backend verifies that every token minted is backed by corresponding metal reserves, with audit reports visible to users for transparency.

24/7 Global Digital Trading

The platform supports trading of gold & silver tokens around the clock, unlocked across borders, and with digital wallet support, no need for physical movement until redemption.

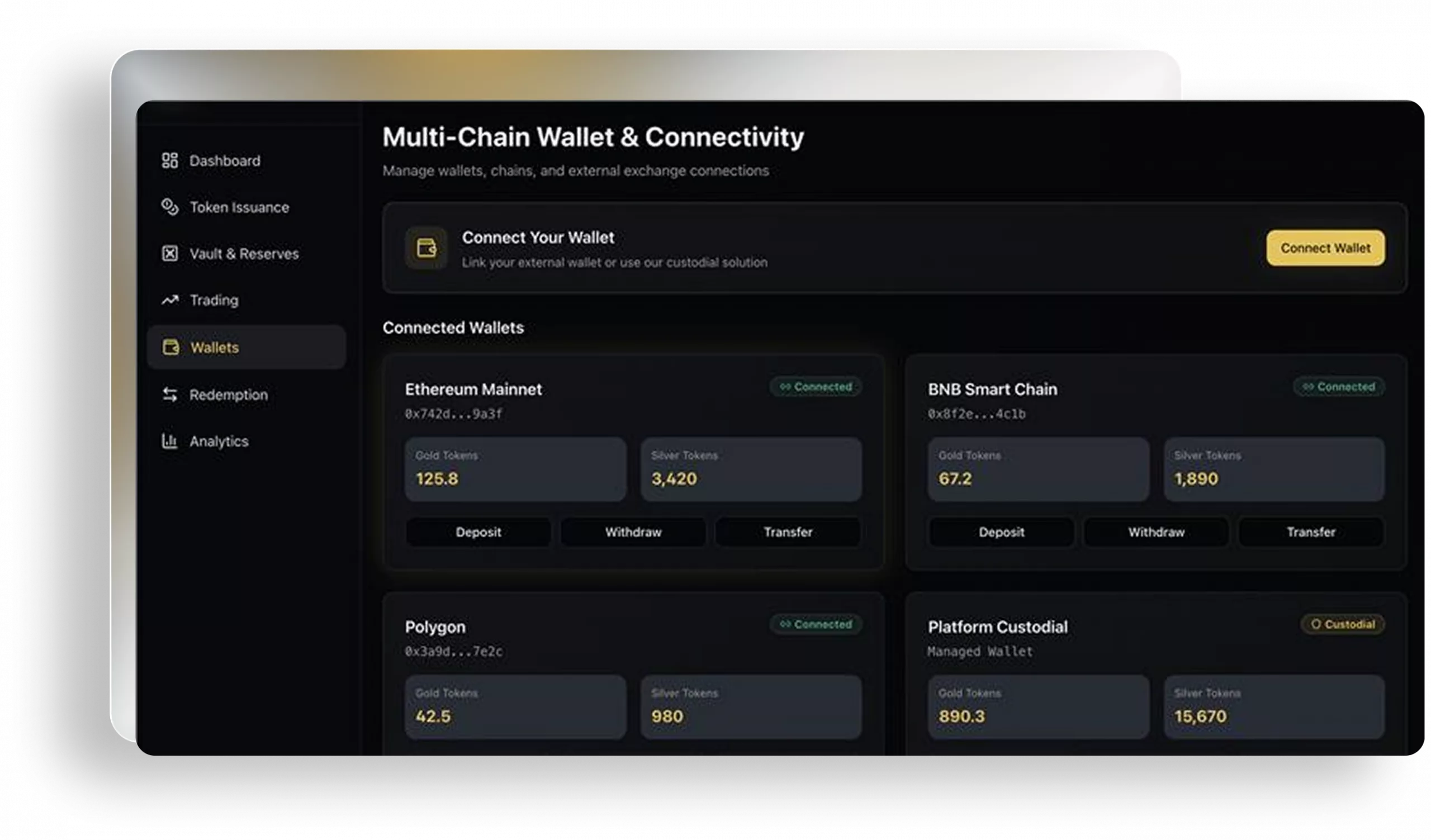

Multi-Chain Wallet & Exchange Connectivity

Tokens live on one or more blockchain networks, enabling users to hold, transfer, or exchange them via the platform wallet or supported external wallets/exchanges, opening new DeFi use cases and liquidity paths.

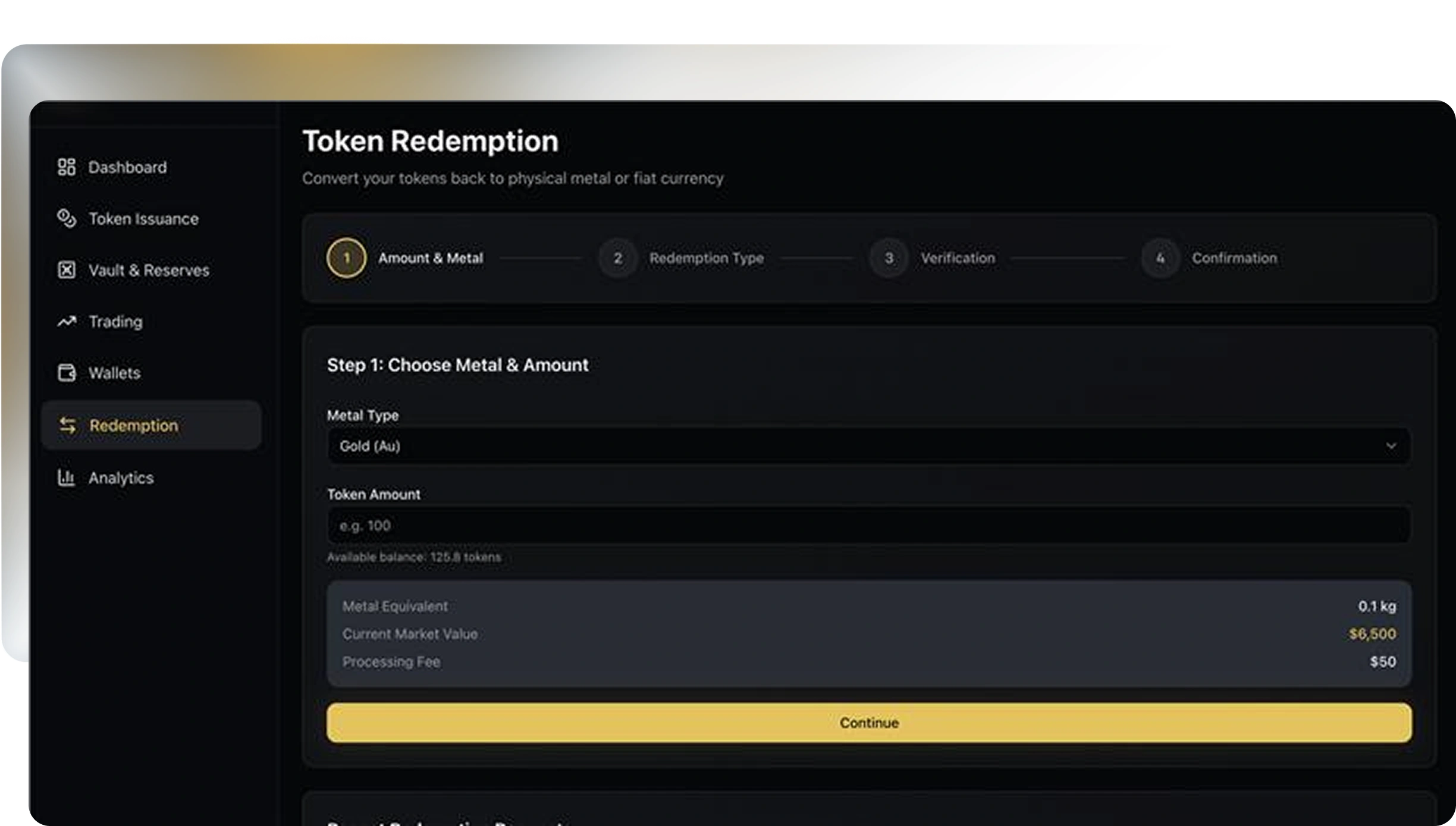

Redemption with Conversion Flow

Users can choose to redeem tokens back into physical metal or fiat currency via smooth flows. This builds trust and aligns digital-asset behaviour with traditional asset expectations.

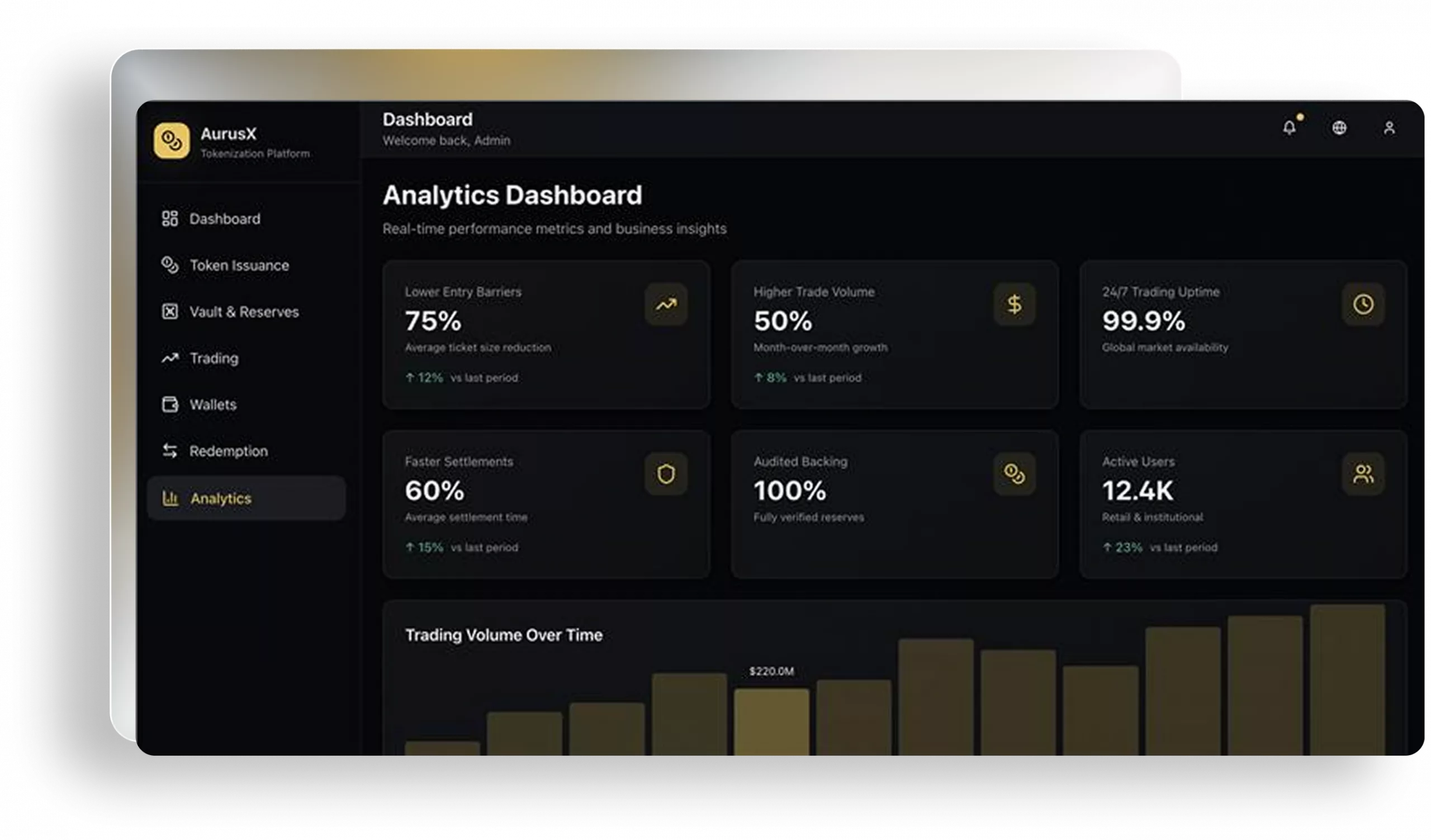

Business-Friendly Dashboard & Analytics

We provided a dashboard for both users and administrators showing token holdings, metal reserves, trading volume, redemption requests, and risk metrics, empowering better decisions and business oversight.

Build Your Own Gen AI-Powered Agentic AI Platform

At SoluLab, we design intelligent AI orchestration systems that empower organizations to automate complex workflows using autonomous multi-agent architecture and real-time orchestration. If you’re building the next generation of AI-powered enterprise tools, our team can help you make it real.

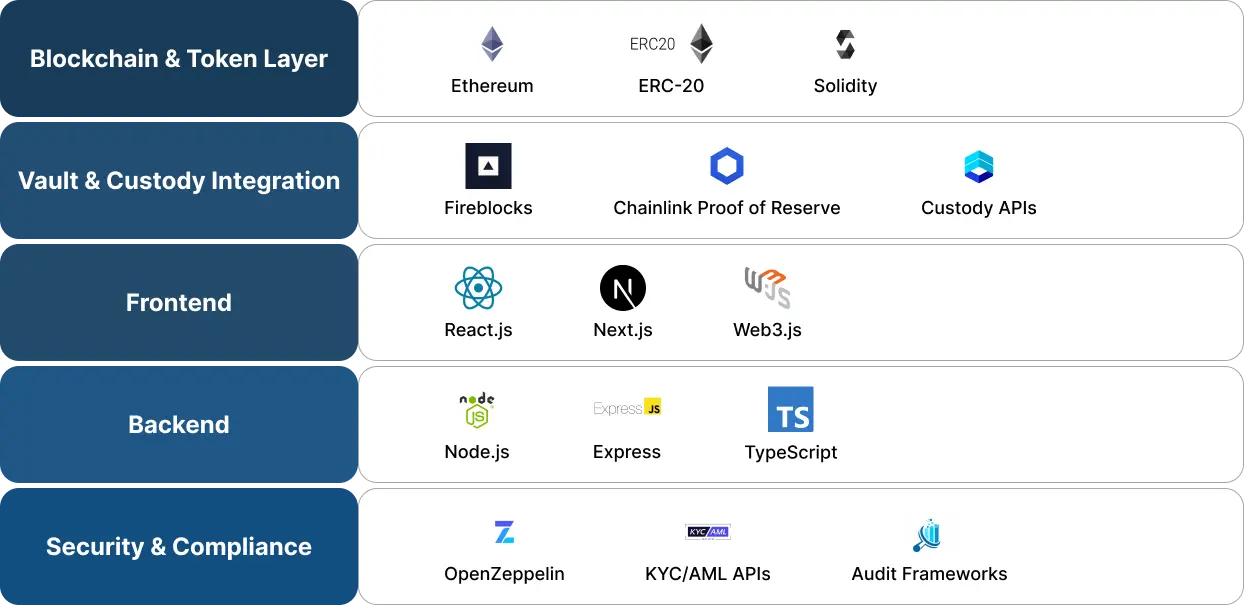

Our Top-notch Tech Stack

Architecture

What Our Clients Have to Say for Us

Inquire Now!

×