In traditional tokenization, high entry barriers, lock-in periods, and a lack of liquidity always discourage new investors. This made enterprises search for new solutions, which is where hedge fund tokenization comes into the picture. Hedge funds attract investors with easily accessible digital assets. Its advanced strategy and potential for consistent returns make it a popular choice among traders.

| The 4th Annual Global Crypto Hedge Fund report states that: “The percentage of crypto hedge funds with AuM over US$20 million increased in 2021 to 59%, from 46%. This is significant as $20m is the threshold for ‘critical mass’ in the traditional hedge fund world.” |

The high liquidity and transparent solutions make hedge fund tokenization an innovative platform. Let’s delve deeper to know more about it!

What is Hedge Fund Tokenization?

Hedge fund tokenization means converting ownership of a hedge fund into digital tokens on a blockchain. Let’s check what the features are:

Key Features

- Digital tokens represent ownership in hedge funds.

- Each token reflects a portion of the portfolio.

- Improves transparency, accessibility, and liquidity.

- Reduces paperwork and intermediary involvement.

- Expands global investor participation.

How Does It Differ From General Tokenized Funds?

Tokenized funds, such as ETFs and mutual funds, are traditional and prone to fraud. Hedge funds are also one of the types of tokenized funds, but their tokenization is advanced and growing with technology. Let’s check the details below:

Key Differences

- Hedge funds use advanced strategies like long-short equity, arbitrage, and quantitative trading.

- Tokenized hedge funds make these strategies accessible in digital form.

- Hedge fund tokens are often limited to accredited or sophisticated investors.

- Smart contracts define subscriptions, redemptions, and fee structures.

- Advanced compliance and regulatory oversight are mandatory.

| Aspect | Hedge Fund Tokenization | General Tokenized Funds |

| Purpose | Focused on alternative assets, high-risk/high-reward strategies | Broad exposure to stocks, bonds, or ETFs |

| Investor Base | Accredited/qualified investors (restricted access) | Retail + institutional investors (wider access) |

| Liquidity | Limited, may have lock-up periods | Higher liquidity, often easier to trade |

| Transparency | Uses blockchain for improved reporting & audits | Basic transparency, depends on fund type |

Why Hedge Fund Tokenization Matters in Business Growth?

Many businesses search for innovative, problem-solving platforms within their budget. This opens doors for the global market. Here is how hedge fund tokenization helps your business to gain investments.

Business Growth Advantages

- Attracts global investors without geographical restrictions.

- Cuts operational costs by eliminating unnecessary intermediaries.

- Strengthens business reputation through blockchain-backed solutions.

- Provides liquidity and compliance built for secure operations.

- Enables a scalable and sustainable investment framework.

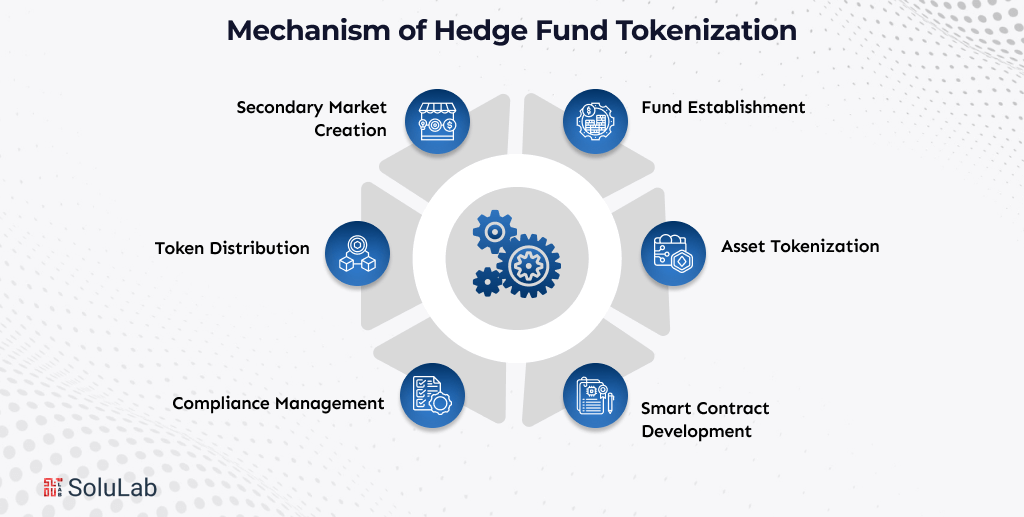

Mechanism of Hedge Fund Tokenization

We have heard about tokenization working; now, let’s see the hedge fund tokenization mechanism. Also, how it ensures user security, compliance, and trust.

1. Fund Establishment

A legal entity is created to manage the hedge fund. This entity ensures compliance with financial regulations.

2. Asset Tokenization

The hedge fund’s assets are represented as digital tokens on blockchain platforms. These assets may include equities, bonds, real estate, or alternative investments.

3. Smart Contract Development

Smart contracts govern fund operations. They define investor subscription, redemption, fee structure, and distribution of returns.

4. Compliance Management

KYC and AML checks are essential. The fund must follow regulations on token issuance, investor onboarding, and reporting.

5. Token Distribution

Investors receive tokens through private or public offerings, depending on jurisdictional regulations.

6. Secondary Market Creation

Tokens can later be traded on secondary markets. This provides liquidity and allows investors to exit without waiting years.

This workflow makes sure of your customer’s security, transparency, and complete ownership of their profile.

Use Cases of Hedge Fund Tokenization

The application of tokenization in hedge funds extends beyond efficiency; it also opens new possibilities for fund managers and investors.

1. Diversified Portfolios

Retail investors can participate in hedge funds by investing smaller amounts. This democratizes access while helping them diversify across complex investment strategies.

2. Global Participation

Tokenized hedge funds operate on blockchain networks accessible worldwide. Cross-border investors can invest without facing traditional jurisdictional restrictions, broadening market reach for fund managers.

3. Business Scaling

Asset managers can expand their operations faster by leveraging tokenized structures. Lower operational costs and global onboarding make funds more scalable and investor-friendly.

4. Exposure to Alternative Assets

Tokenized hedge funds can include traditionally illiquid investments like private equity, real estate, and commodities. This widens investor choices and provides exposure to asset classes once limited to institutions.

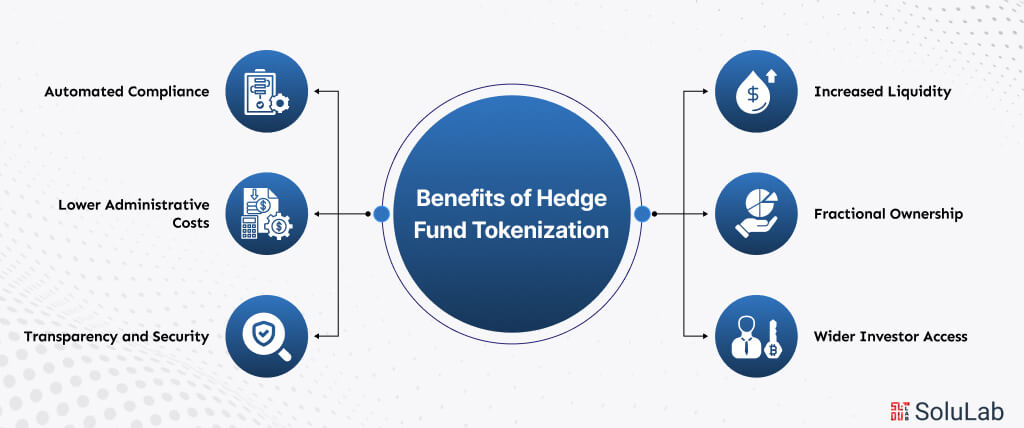

Benefits of Hedge Fund Tokenization

Hedge fund tokenization has many advantages for investors and enterprises. Here are some of the benefits.

1. Increased Liquidity

Tokenized hedge funds allow investors to trade ownership units on secondary markets. This reduces traditional lock-in periods and provides flexibility for entering or exiting investments without waiting years.

2. Fractional Ownership

By splitting fund ownership into smaller digital units, tokenization enables fractional investing. This lowers entry barriers, allowing participation with limited capital while supporting portfolio diversification.

3. Wider Investor Access

Blockchain-based tokenized platforms can reach a global audience. Both institutional and accredited investors gain easier access, bypassing traditional geographical and regulatory restrictions.

4. Transparency and Security

Blockchain ensures every transaction and ownership record is immutable and verifiable. This minimizes risks of fraud, enhances investor confidence, and establishes a secure investment environment.

5. Lower Administrative Costs

Tokenized structures reduce dependency on intermediaries such as custodians, transfer agents, and clearinghouses. Automated settlement processes cut down paperwork, legal overhead, and transactional expenses.

6. Automated Compliance

Smart contracts enforce Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols. Automated compliance reduces manual errors, ensures regulatory alignment, and streamlines fund operations.

Real-World Examples in Tokenized Hedge Funds

Tokenized hedge funds are no longer experimental ideas. Several pioneering institutions and firms have already implemented them, proving their viability and potential.

1. BlackRock

BlackRock launched the world’s first tokenized credit fund in partnership with Coinbase in 2022. The initiative demonstrated that even the largest asset managers are willing to adopt blockchain for hedge fund-style strategies. The fund provided institutional investors with a blockchain-based entry into credit markets.

2. Mainstream One

Singapore-based Mainstream One [now Apex Group] introduced a tokenized version of its flagship hedge fund. The fund focuses on digital asset opportunities while leveraging blockchain for transparency and accessibility. It allows investors to participate in strategies that were traditionally restricted to select institutions.

3. Fluidity

Fluidity designed a tokenized fund structure targeting hedge fund-style private equity and alternative assets. The model allows fractional ownership, enabling smaller investors to gain exposure to previously illiquid and exclusive strategies.

4. Hedge Fund DAO Models

Several blockchain-native hedge funds have emerged as decentralized autonomous organizations (DAOs). These funds tokenize investor ownership, employ hedge fund strategies such as arbitrage and quant trading, and automate governance through smart contracts. The structure allows broader participation while maintaining professional fund management.

The Future of Hedge Fund Tokenization

The outlook for hedge fund tokenization is strong, with rapid adoption and technology-led transformation shaping the market.

1. Tokenized hedge funds will become standard products, supported by blockchain infrastructure for secure ownership and instant settlement.

2. Artificial intelligence will optimize hedge fund strategies through predictive analytics, risk modeling, and automated portfolio rebalancing.

3. Investor onboarding, KYC/AML compliance, fee distribution, and redemption will be handled by secure blockchain-based smart contracts.

4. Secondary trading platforms and DeFi protocols will enable global participation, fractional ownership, and near real-time liquidity.

5. Real-World Asset (RWA) tokenization will allow hedge funds to include private equity, commodities, and real estate within blockchain ecosystems.

Conclusion

As per the above details, you might have understood hedge fund tokenization and its growth. It’s not just about gaining customers, it’s about building user trust under regulatory compliance. To design such a platform, you need a partner.

We, at Solulab, the top tokenization development company, aid you in growing your business under a secure framework. We help you design a cutting-edge blockchain tokenization platform that can transform your growth curve.

Contact our expert team to discuss your unique business idea!

FAQs

1. What is hedge fund tokenization?

Hedge fund tokenization means converting fund ownership into digital tokens on a blockchain. It makes hedge funds easier to access, more transparent, and provides flexibility for investors through improved liquidity.

2. How does a tokenized hedge fund benefit investors?

It offers fractional ownership, global access, faster transactions, and reduced lock-ins. Investors can enter or exit more freely while enjoying transparent fund management and lower administrative costs.

3. Are tokenized hedge funds safe and regulated?

Yes, tokenized hedge funds follow the same compliance rules as traditional funds. Blockchain adds transparency, while KYC and AML ensure safety, investor trust, and adherence to regulations.

4. Can AI improve tokenized hedge funds?

Absolutely. AI can help predict risks, automate valuations, and optimize investment strategies. When combined with blockchain, it creates smarter, more adaptive tokenized hedge fund structures.

5. Why choose SoluLab for hedge fund tokenization services?

SoluLab provides secure, custom-built tokenization platforms tailored to businesses. With blockchain expertise and compliance-ready solutions, we help hedge funds scale globally while maintaining trust, transparency, and investor confidence.