Today, cryptocurrency trading is no longer a niche activity but a global financial force. While decentralized platforms are gaining traction, centralized cryptocurrency exchanges (CEXs) remain the backbone of digital asset trading, offering liquidity, user-friendly interfaces, and faster transactions that attract both beginners and professional traders.

However, building a centralized exchange isn’t as simple as deploying trading software. With evolving regulations, growing security threats, and rising user expectations, launching a successful CEX requires careful planning, robust technology, and a compliance-first approach.

In this guide, we’ll break down the step-by-step process of building a centralized crypto exchange, explore the essential features, and highlight how expert development partners like SoluLab can help you turn your vision into a secure, scalable, and profitable reality.

What is a Centralized Exchange (CEX)?

A Centralized Cryptocurrency Exchange (CEX) is a digital platform where users can buy, sell, and trade cryptocurrencies through an intermediary — the exchange itself. Unlike decentralized exchanges, where transactions occur directly between users, a CEX acts as the middleman, managing order books, holding funds, and ensuring trades are executed quickly and securely.

Popular examples include Binance, Coinbase, and Kraken, all of which rely on a centralized structure to provide high liquidity, customer support, and advanced trading tools.

The Rise of Centralized Exchanges

In the crypto ecosystem, Centralized Exchanges (CEXs) function much like traditional banks — acting as trusted intermediaries that safeguard user assets, process trades efficiently, and ensure liquidity is always available. While decentralized exchanges (DEXs) have been gaining attention, the majority of retail and institutional traders still gravitate toward centralized platforms for one simple reason: trust backed by performance.

Why CEXs Still Lead the Pack in 2026?

- Deeper Liquidity: Tighter spreads, minimal slippage, and better trade execution.

- Faster Transactions: Centralized order-matching engines enable near-instant trade settlement.

- Accessible for All: Intuitive interfaces make it easy for both beginners and professionals to trade confidently.

- Industry Benchmarks: Giants like Binance, Coinbase, and Kraken have redefined the trading experience — proving that a successful exchange requires far more than just a token swap feature.

For newcomers aiming to compete, launching a CEX today means blending security, compliance, and innovation into one seamless trading platform — the very formula top blockchain developers like SoluLab specialize in delivering.

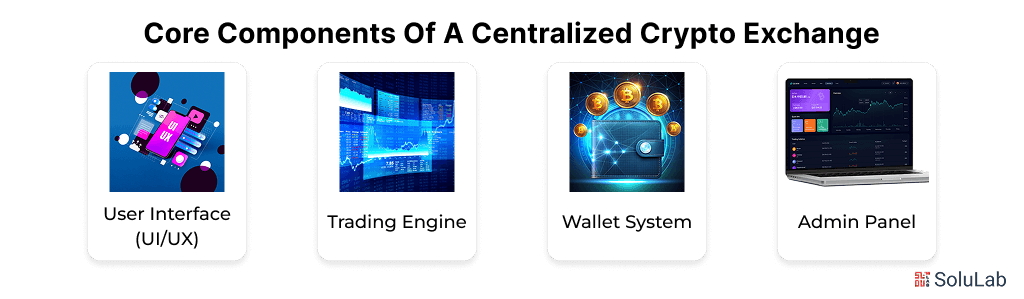

Core Components of a Centralized Crypto Exchange

A successful CEX isn’t just about connecting buyers and sellers — it’s about building a robust, secure, and intuitive ecosystem. Every high-performing exchange is built on four essential pillars:

a. User Interface (UI/UX)

Your interface is your first impression — your digital handshake. A well-designed UI must deliver:

- Clean, intuitive dashboards for effortless navigation.

- Streamlined workflows that make trading simple, even for first-time users.

- Mobile responsiveness so users can trade on the go without sacrificing functionality.

b. Trading Engine

Think of this as the brain of your exchange — the powerhouse that keeps everything running smoothly. An effective trading engine must:

- Instantly and accurately match buy/sell orders.

- Handle high volumes and simultaneous user activity without lag.

- Process trades with low latency to maintain price accuracy.

- Support multiple order types — market, limit, and stop-limit — with real-time updates across user dashboards.

c. Wallet System

Your wallet system is more than just a balance display — it’s the digital vault protecting your users’ assets. A secure setup includes:

- Hot wallets for instant access during trades.

- Cold wallets are stored offline to prevent breaches.

- Multi-currency support with seamless switching between assets.

A smart fund management system automates transfers between hot and cold wallets, keeping exposure low while ensuring liquidity.

d. Admin Panel

The admin panel is your team’s mission control. A strong back-end panel should enable you to:

- Approve and manage KYC documentation.

- Set trading limits and tiered access for different user levels.

- Add, remove, or pause token listings with full audit trails for compliance.

A CEX is only as strong as its foundation — and these components form the framework that determines its security, speed, and user trust.

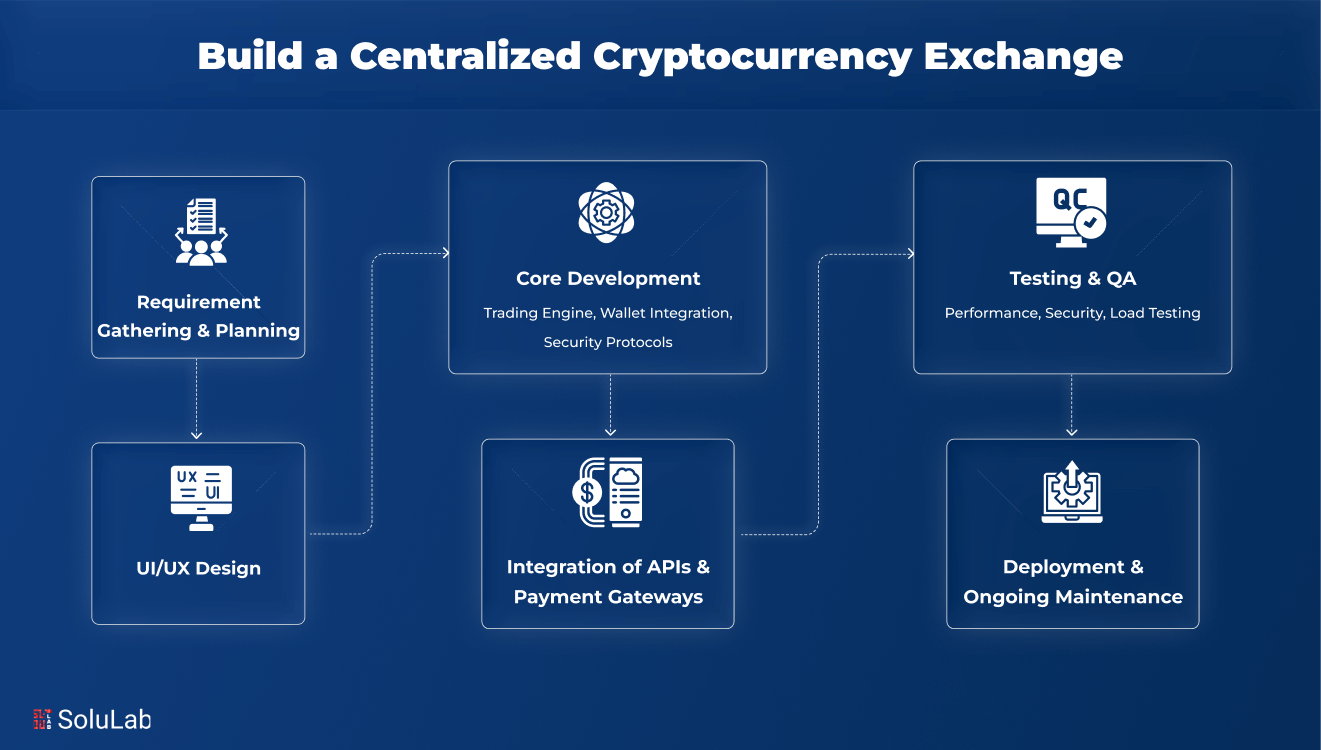

Development Process of Centralized Crypto Exchange

The development of a centralized cryptocurrency exchange has many components. Each stage requires careful attention. Let’s check the following details to know all the steps needed.

1. Initial Planning and Research

Every successful exchange starts with planning. Teams define business goals, user profiles, and core functionalities. Will it support fiat deposits, margin trading, or just crypto-to-crypto? Understanding regulations for each target region is crucial.

The roadmap is laid out with timelines, cost estimates, legal support, and milestones to align business goals with development execution from the very beginning.

2. Regulatory and Compliance Mapping

Complying with financial laws is non-negotiable. Countries have different crypto rules, so identifying licensing needs, registration processes, and anti-money laundering (AML) frameworks early is vital.

Planning includes integrating identity verification (KYC), transaction monitoring, and AML checks that satisfy global regulations.

Legal advisors and compliance consultants are involved even before development begins to avoid risks later.

3. Feature Definition and Exchange Type

Developers work with stakeholders to finalize the exchange’s core features. This includes spot trading, order types, fiat on-ramp support, liquidity solutions, and token listing processes.

Teams also choose between custom-built platforms and white-label options. A clear product specification document is created, outlining every expected function and integration, from APIs to user account management.

4. Tech Stack Selection

The tech stack forms the foundation of the exchange. Languages like Go, Node.js, or Rust are chosen for backend performance. Frontends use React or Vue.js to ensure responsive design.

Databases like PostgreSQL or Redis handle user sessions and trading data. The right tech ensures the platform is fast, scalable, secure, and easy to maintain long-term.

5. Blockchain and Token Support

Exchanges need to support multiple tokens and chains. Integration is done using blockchain APIs and SDKs for Ethereum, Solana, BNB Chain, and more. Developers set up wallet modules to accept ERC-20, BEP-20, and native tokens.

These integrations enable smooth deposits, withdrawals, and balance management with blockchain confirmations and gas fee optimization for efficiency.

Read Our Blog Post: How to Launch a Crypto Exchange in Switzerland?

6. Designing User Experience (UI/UX)

User interface design focuses on clarity, accessibility, and speed. Designers create wireframes for trading views, wallets, and dashboards. The goal is to help both beginners and experienced traders navigate effortlessly.

Tools like Figma or Adobe XD are used to build and test responsive designs for web and mobile, ensuring a seamless user experience across all devices.

7. Trading Engine Development

The trading engine is the system’s core. It matches buy and sell orders using algorithms that ensure high-speed execution. It must support different order types like market, limit, and stop-limit.

Latency optimization and load balancing are added to handle massive concurrent trades. The engine also manages real-time order book updates and price discovery mechanisms.

8. Wallet Infrastructure Setup

Hot wallets manage live user transactions, while cold wallets offer offline storage for security. Wallet infrastructure includes private key encryption, transaction broadcasting, and auto-syncing of balances. Systems must prevent double-spending and provide instant wallet-to-exchange fund transfers.

Multisig setups and hardware wallet integrations ensure maximum protection for both platform and customer assets.

9. KYC/AML Integration

KYC and AML systems are integrated using services like Sumsub, Shufti Pro, or Jumio. Users upload identity documents, take live selfies, and pass region-specific compliance checks. Real-time verifications ensure fast onboarding.

AML tools monitor user behavior and flag suspicious activities. These tools run continuously in the background and adapt based on evolving regulatory requirements.

10. Admin and Monitoring Panel

Admin panels allow exchange staff to manage users, approve KYC, suspend accounts, set trading limits, and monitor system health. Activity logs, fraud alerts, and trade flow analytics are part of this panel.

Developers also integrate dashboards for real-time performance stats, allowing quick responses to anomalies or spikes in user activity.

11. API Development and Testing

REST and WebSocket APIs are built for external traders, bots, and partners. These APIs allow market data access, trading, and account operations. Rate limiting, permissions, and key rotation are implemented for security.

Developers run unit, integration, and performance tests. Load testing simulates thousands of users to ensure stable performance during high traffic.

12. Deployment and Post-Launch Scaling

After developing the platform is deployed on ie, AWS or GCP cloud services using Docker and Kubernetes. This test is mainly to test the scalability of the system. Monitoring tools like Grafana and Prometheus are used to track the time, errors, and latency os the platform.

The support team handles the user challenges, and developers work based on the feedback received. At last, new features such as staking, referral bonus, offers, and margin trading are added.

Must-Have Features for Centralized Cryptocurrency Exchange Development

Your users expect more than just a basic trading window. To compete with established players and deliver real value, your Centralized Crypto Exchange should offer a full suite of modern, secure, and high-performance features.

Let’s break down the essentials:

1. Seamless Registration, Login, and KYC/AML Integration

The user onboarding process sets the tone for your entire platform. A good experience should:

- Be smooth and fast; users should be able to create an account in minutes.

- Include KYC (Know Your Customer) verification using government IDs, selfies, and automated checks.

- Comply with AML (Anti-Money Laundering) standards to detect suspicious behavior early.

Tools like Sumsub, Shufti Pro, or Jumio can automate this while keeping friction low. Remember: compliance isn’t optional. But the experience shouldn’t feel like applying for a loan.

2. Real-Time Trading Charts, Order Books, and Market Data

Your users need to make smart trading decisions and they need tools to do that.

Include:

- Live price charts with multiple indicators (candlesticks, moving averages, RSI, etc.)

- A detailed order book showing bid/ask depth

- Trade history and price movement summaries

- Custom timeframes, drawing tools, and volume overlays

Integrating tools like TradingView or custom chart engines helps here. This is where pro traders spend most of their time, make it powerful, fast, and customizable.

3. Deposit and Withdrawal System (Crypto + Fiat)

If users can’t move money in or out easily, they won’t use your platform. It’s that simple.

You’ll need:

- Crypto deposits/withdrawals: Fast, reliable wallet integrations with status tracking and blockchain confirmations.

- Fiat on-ramps/off-ramps: Connect to payment gateways (like Stripe, MoonPay, or local banks) to support fiat deposits and withdrawals in USD, EUR, INR, etc.

- Built-in controls for transaction fees, withdrawal limits, and fraud checks.

Also, show pending and completed transactions clearly in user dashboards. Transparency builds trust.

4. API Access for Algo Traders and Institutions

Professional and institutional traders need API access to automate strategies.

You should offer:

- REST and WebSocket APIs for market data and order execution

- Clear documentation with example calls

- High rate limits for premium accounts

- API key management with granular permissions

APIs aren’t just a bonus, they’re a revenue opportunity. You can offer tiered access, analytics, and even white-labeled trading bots as add-ons.

5. Two-Factor Authentication (2FA), IP Whitelisting, and Session Logs

Security should feel invisible but strong.

These tools do just that:

- 2FA (Google Authenticator, SMS, or Email) for login, withdrawals, and API calls.

- IP whitelisting to allow access only from approved devices or networks, especially useful for institutional traders.

- Session logs that show when and where the account was accessed. Users can revoke access if they notice something unusual.

These features dramatically reduce the risk of account takeovers. They’re essential if you want to be taken seriously.

6. Security Architecture

Security isn’t a feature you tack on at the end it’s the foundation your entire exchange stands on. Without it, you’re handing hackers and bad actors an open invitation.

Here’s what it takes to secure a Centralized Crypto Exchange the right way:

- End-to-end encryption protects all sensitive data, whether it’s moving across networks or sitting in your database. Think user credentials, transaction history, API keys, everything encrypted by default.

- Secure API frameworks like OAuth2 and JWT ensure only verified apps and users can access critical systems. Combine this with tight access controls and permission-based routing.

- DDoS protection, bot filtering, and rate limiting keep your platform online when traffic surges, whether from real users or malicious actors. This helps maintain uptime during peak volumes.

- Cold storage with multi-signature wallets keeps the bulk of your user funds offline, where they’re safest. With multi-sig, no single person can access or move funds alone, adding another layer of defense.

- Regular third-party audits and penetration testing catch vulnerabilities before attackers do. If you’re not constantly testing your own system, someone else eventually will.

- Real-time monitoring and alert systems help you catch threats in the moment, not after the damage is done. Automated detection paired with human oversight creates a proactive security posture.

Legal and Regulatory Compliance to Adhere for Crypto Exchanges

Crypto might be borderless, but regulation isn’t. Every region has its own framework, and ignoring it isn’t an option, it’s a fast track to shutdown.

- Licensing comes first. In the US, you’ll need to register as a Money Services Business (MSB) with FinCEN. In the EU, that likely means a VASP license. In the UAE, look to regulators like VARA and ADGM. Each has its own paperwork, audit process, and ongoing reporting requirements.

- AML and KYC checks aren’t just checkboxes; they’re legal safeguards. Integrate automated identity verification tools like Chainalysis, Sumsub, or ShuftiPro to monitor transactions and flag suspicious activity without slowing down onboarding.

- Data privacy regulations like GDPR (EU) and CCPA (California) demand clear communication. Users should know what data you’re collecting, why, and have the power to export or delete it at any time.

- Legal guidance isn’t optional. Partner with crypto-savvy lawyers early to map out your compliance game plan. Waiting until after launch to “figure it out” can cost you licenses, users, and millions in fines.

Revenue Model of Centralized Crypto Exchange Platforms

A well-built exchange isn’t just a tech product; it’s a business. Here’s how a Centralized Crypto Exchange turns traffic into revenue:

- Trading fees are your primary income stream. Most platforms use a maker-taker model, rewarding liquidity providers (makers) with lower fees while charging slightly more to takers. Volume-based discounts can help attract big traders.

- Deposit and withdrawal fees offer steady income, especially if you support multiple fiat and crypto assets. You can set dynamic rates based on network congestion or asset type.

- Token listing fees are another major source, especially from new crypto projects eager for visibility. Some exchanges even offer tiered listing packages with optional marketing boosts.

- Premium features like margin trading, high-speed APIs, advanced analytics, and pro dashboards can be monetized through subscriptions or membership tiers.

The key is balance. Diversify your revenue streams without making users feel nickel-and-dimed. A transparent, scalable model builds trust and long-term sustainability.

Final Thoughts

Centralized Cryptocurrency Exchange Development isn’t just about building software. It’s about building trust, utility, and long-term value. Whether you’re targeting day traders, institutions, or the next billion crypto users, you need to nail the execution.

At SoluLab, we specialize in Centralized Crypto Exchange Development, from building secure trading engines to deploying compliant, scalable infrastructures. Whether you’re starting fresh or looking to upgrade an existing platform, we bring technical expertise and blockchain know-how to every step of the journey.

Our team has worked with leading fintechs and crypto startups across the globe. Let’s build something that actually lasts. Want to launch your own crypto exchange? Let’s talk.

FAQs

1. How long does it take to build a centralized crypto exchange?

Generally, to build a featured centralized crypto exchange takes 4 to 6 months. However, this depends on your business requirements (fully custom takes more time compared to using white-labeled tools) and your budget.

2. Is it legal to operate a centralized crypto exchange?

Yes, it’s legal in many countries, but only if you meet local law, register with regulators, and maintain licenses like MSB, VASP, or their equivalents based on your operational region.

3. What’s the difference between a white-label exchange and a custom-built one?

White-label exchanges are plug-and-play and faster to launch, but offer limited control. Custom platforms take more time but give you full freedom to design features and scale your way.

4. How can I make my crypto exchange secure?

Security isn’t optional, it’s the basic requirement of every user. So, using encrypted data storage, multi-signature wallets, anti-DDoS layers, and real-time monitoring keeps the privacy of the customer safe. Also, running regular audits to keep hackers out.

5. How do I choose the right tech stack for my crypto exchange?

The right tech stack depends on your goals, but go for scalable, secure tools, like Node.js or Go for backend, React for frontend, and PostgreSQL or Redis for robust data handling.