High entry costs, endless paperwork, and the lack of liquidity make it difficult for average investors to get in. Additionally, the complications of cross-border transactions and traditional property investment start to feel out of reach.

That’s where Real Estate Tokenization can help. It simplifies property ownership by converting assets into digital tokens. Anyone can buy a fraction of a property, even if they can’t afford the whole thing. It removes the middlemen, makes transactions transparent, and opens doors for global investors.

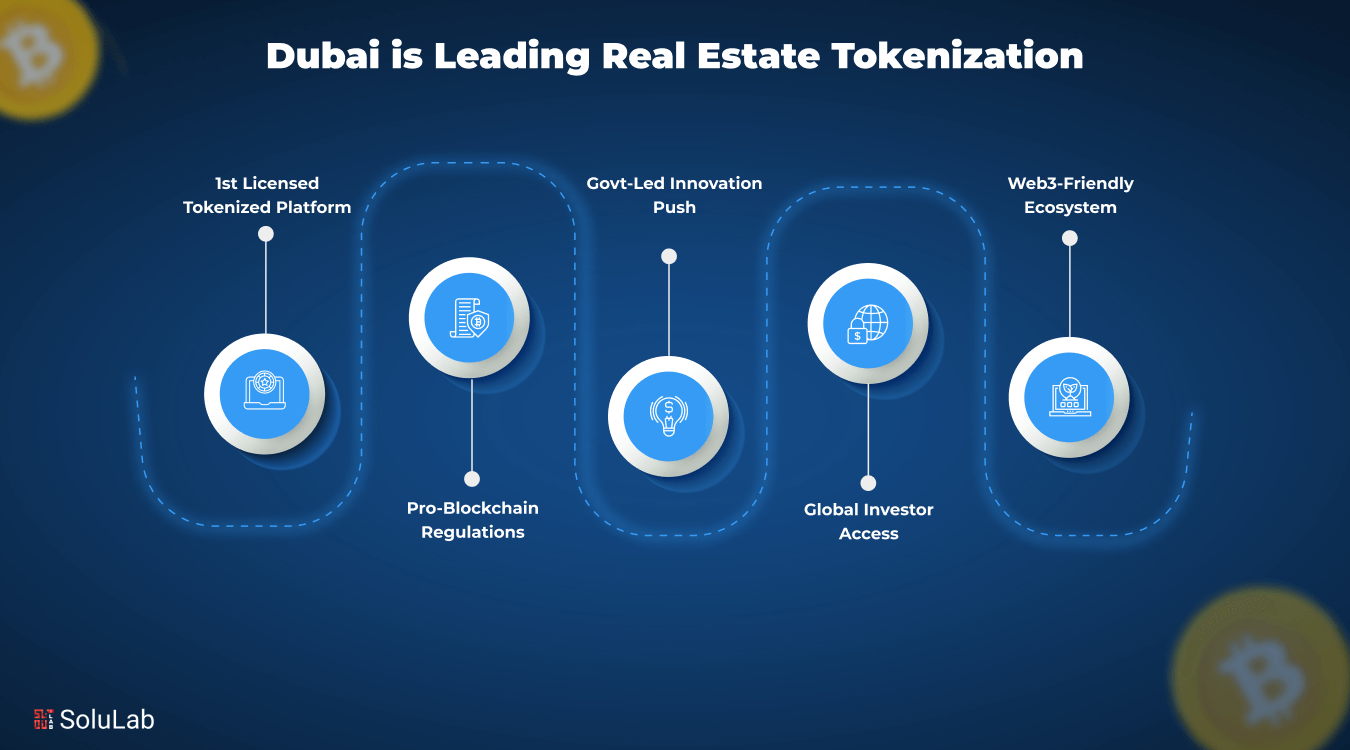

And no one is doing it quite like Dubai. With its tech government, real estate sector, and growing Web3 ecosystem, Dubai is setting the global standard for tokenized real estate in 2026.

In this blog, we’ll explore how Dubai is leading the charge, the key projects driving the change, and what it means for investors like you.

Overview of Dubai’s Real Estate Market

Dubai’s real estate market is one of the fastest-growing in the world. The city has grown to be a popular destination for both domestic and foreign investors because of its government support, tax-free incentives, and tourism. From luxury apartments to commercial spaces, Dubai offers a wide range of property options.

| In May 2025 $3 billion RWA deal between MultiBank Group, MAG, and Mavryk brought major luxury assets onto a regulated token marketplace. |

The demand is high due to its modern infrastructure, safety, and high rental yields. Many real estate companies in Dubai are now exploring smart technologies and tokenization to attract global buyers. Whether you’re investing or buying a home, Dubai’s property market has long-term potential and innovation-driven growth

Why is Dubai Embracing Tokenized Real Estate?

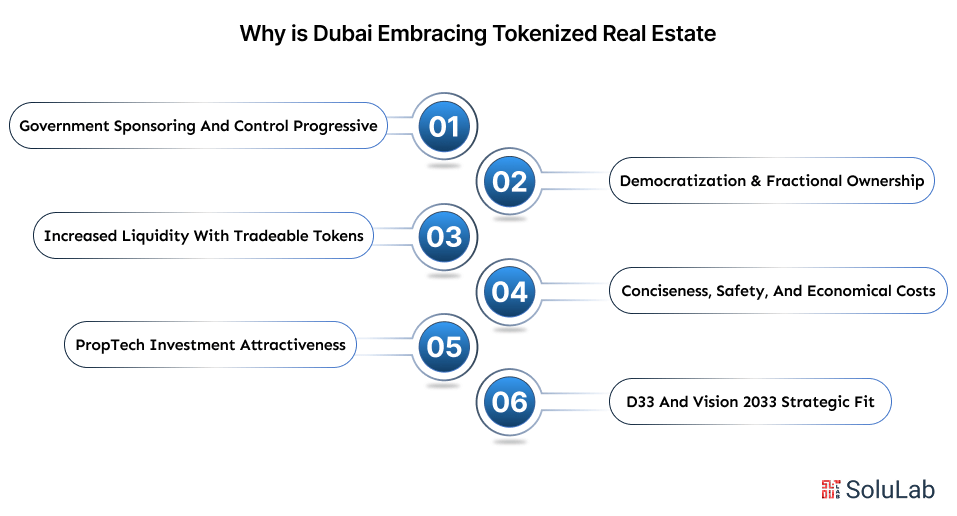

Here’s an overview of the reasons why Dubai is a major participant in tokenizing real estate:

-

Government sponsoring and control Progressive

A legal and regulatory sandbox has been created by Dubai Land Department (DLD), VARA, and the Central Bank, as well as Dubai Future Foundation (DFF), to make property ownership through the tokenization process safe and compliant.

-

Democratization & fractional ownership

The result of tokenizing a high-value property can be that it is broken down into sufficiently affordable pieces (e.g., AED 2,000) to open up to retail investment and be open to international capital.

-

Increased liquidity with tradeable tokens

Digital property tokens (such as BTC) are transacted on platforms where an investor can sell and buy with fast liquidation times, similar to a stock market.

-

Conciseness, safety, and economic costs

Tamperproof records, automated compliance, reduced counterparty risk, and declined prices are features of smart contracts running on blockchain that can be applied in Dubai real estate property transactions

-

PropTech Investment Attractiveness

Billion-dollar tokenization initiatives have been introduced by big companies such as DAMAC and MAG. This, in combination with blockchain-oriented policies, can make Dubai a global real-world asset.

-

D33 and Vision 2033 strategic fit

The tokenized real estate is in line with the Dubai Economic Agenda D33 and Real Estate Strategy 2033, which is expected to achieve AED 60billion ( 16billion) in tokenized volumes by 2033

Read More: Top Countries to Launch Real Estate Tokenization Platform

How Blockchain is Transforming Dubai Real Estate?

Blockchain technology is changing Dubai’s real estate tokenization services market in 2026 by improving efficiency, security, and transparency. Automating transactions, smart contracts lowers the risk of fraud and eliminates the need for middlemen. With their terms encoded into code, these contracts are self-executing agreements that guarantee all parties follow the terms.

1. Transparent, Fraud‑Resistant Transactions: Blockchain systems record every ownership change and payment immutably, reducing title fraud and ensuring verifiable property history, crucial in a market with strong demand from foreign buyers

2. Faster, Cost‑Efficient Deals via Smart Contracts: Self‑executing smart contracts automate processes like payment releases and title transfers, eliminating intermediaries and slashing transaction times from days or weeks to minutes

3. Tokenization Enabling Fractional Ownership: Digital tokens represent shares in properties, allowing investors to buy portions of high‑value assets. This boosts liquidity and lowers entry barriers

4. Cross‑Border Investment: Blockchain supports near‑instant cryptocurrency or multi‑currency payments, streamlining KYC/AML compliance, and facilitating smoother international transactions.

5. Title Deed Digitization by Dubai Land Department: The Dubai Land Department (DLD), via its blockchain platform and partnerships with VARA and Dubai Future Foundation, enables real‑time, secure title registration

6. Enhanced Security and Regulatory Assurance: Blockchain decentralization prevents tampering and cyber threats, while VARA’s regulatory oversight of tokenization platforms grants users legal confidence

7. Government‑Backed PropTech Ecosystem: Dubai’s wider blockchain strategy includes DLD, DIFC regulations, and D33/Economic Agenda initiatives all supporting a thriving PropTech environment

8. Attracting Global Crypto‑Native Investors: With approximately half of Dubai real estate sales involving crypto and increasing regulatory legitimacy, blockchain solutions are drawing in tech‑savvy global investors

Use Cases of RWA Tokenization in Dubai Real Estate

The RWA tokenization companies in Dubai are changing the real estate market as the ownership of property will be digital, making it open to more people and facilitating investment by simplifying the investment processes with the use of blockchain technology.

1. Fractional Property Investment: With fractionalized real estate ownership, Dubai property investment, a tokenization process, investors to invest in fractional parts of high-value real estate projects with a minimal capital cost and universal access to Dubai premium real estate for global investors.

2. Secondary market liquidity: Physical securities can be sold on digital platforms, and investors can redeem their position with greater ease than in real-world property dealings, leading to increased liquidity in the markets.

3. Cross-Border Investment Access: Ease in investing, Foreign investors will easily engage in the Dubai real estate market with no complicated systems of legislation, but rather, provide ease of ownership through blockchain and legal visibility by the VARA and DLD.

4. Efficient Capital Raising for Developers: Smart Capital Raising Building Companies Developers will be able to raise funds efficiently, quickly, and without the provision of traditional financing mechanisms by means of tokenizing assets to issue to retail and institutional investors.

5. Automated Income Distribution: Automatic allocation of rental Smart contracts, property-backed digital assets can automatically distribute the rental income to anyone who holds the token, to ensure transparency, minimize administration overheads, and customer trust in the asset itself.

Read Blog: Daos in Real Estate Tokenization

RWA Leading Platforms and Projects in Dubai

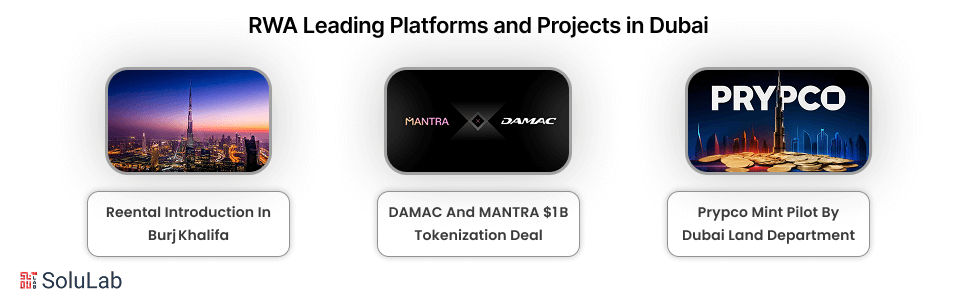

Here are three leading Dubai real estate tokenization platforms and initiatives operating in Dubai’s real estate sector:

-

Reental Introduction in Burj Khalifa

Spanish fintech Reental has launched in Dubai with a tokenized investment in a ~€7 million Burj Khalifa property, allowing participation from €100 upward, offering enhanced liquidity and over 13% returns.

-

DAMAC and MANTRA $1 B Tokenization Deal

Dubai’s DAMAC Group is partnering with blockchain platform MANTRA to tokenize at least $1 billion worth of real estate and data‑centre assets in 2025, enabling investors to trade tokens representing property shares on-chain.

-

Prypco Mint Pilot by Dubai Land Department

The Dubai Land Department’s pilot on the Prypco Mint investment platform (in collaboration with VARA and Zand Digital Bank) offers UAE ID holders tokenized shares of ready‑to‑own property starting at AED 2,000, with plans to extend access globally

Future Outlook: Dubai RWA Real Estate in 2026 and Beyond

By 2026 and beyond, we’re likely to see real-world asset (RWA) tokenization become the norm rather than the exception. Imagine owning a part of an apartment for just a few thousand rupees, yes, that’s what tokenization makes possible.

With government initiatives like the Dubai Blockchain Strategy and support from the Dubai Land Department, the foundation is already laid. International investors are finding it easier than ever to enter the market, due to digital onboarding and fractional ownership.

As crypto adoption grows and regulations evolve, we can expect a more secure, efficient, and inclusive real estate ecosystem. For developers, this opens up new funding models. For buyers, it lowers entry barriers. And for Dubai? It solidifies its place as a global leader in real estate innovation.

Conclusion

In 2026, Dubai is leading the global shift toward real estate tokenization. By embracing blockchain, smart contracts, and fractional ownership, the city is making property investment more accessible, transparent, and efficient. Government support and strategic partnerships with Web3 platforms are accelerating this transformation.

Investors can now enter the market with lower capital while enjoying faster, secure transactions. As more real estate companies in Dubai adopt this model, the city is setting a strong example for the future of property investment worldwide.

SouluLab, real estate tokenization development company, can help you own a part of Dubai property, ensuring full safety. Contact us today to discuss further.

FAQs

1. What is real estate tokenization?

Real estate tokenization is the process of converting physical property ownership into digital tokens on a blockchain, allowing fractional ownership and easier trading.

2. What platforms are active in Dubai’s tokenization space?

Key players include Reental, DAMAC–MANTRA partnership, and the Prypco Mint pilot backed by Dubai Land Department and Zand Bank.

3. Is real estate tokenization safe?

Yes, blockchain-based transactions are secure and transparent. Smart contracts automate the process and ensure legal compliance, reducing the risk of fraud.

4. Are returns from tokenized real estate taxable in Dubai?

Dubai offers tax-free investment returns for most real estate transactions, making it highly attractive for international investors.

5. How much money is needed to invest in tokenized real estate?

Investment amounts can start as low as AED 2,000 (~$550 USD), depending on the platform and property.