Why can we stream a movie in seconds, but still need weeks of paperwork to invest in property or art? As technology reshapes every corner of our lives, the way we own and trade assets is finally catching up. Asset tokenization is making it possible to digitize everything from real estate to private equity, offering more people a chance to invest in markets that were once out of reach.

And it’s not just a trend. In 2025, the global value of tokenized assets topped $2.1 trillion, and experts project it could climb past $7 trillion by 2030. This rapid growth drives demand for token standards supporting compliance, security, and real-world ownership. Although ERC20 laid the path, more recent standards like as ERC1400 and ERC3643 are taking over to address the intricate requirements of regulated assets.

One reason ERC3643 is gaining traction is its use of a decentralized identity framework (ONCHAINID), which allows only verified users to hold or transfer tokens. That makes it a strong fit for financial institutions and regulated markets where compliance isn’t optional.

In this blog, we’ll explore the key differences between ERC20, ERC1400, and ERC3643, and help you decide which one is best suited for your tokenization goals. So, let’s get started!

Overview of ERC Token Standards

Ethereum has established itself as the preeminent blockchain for the creation of digital assets. Central to this system are ERC (Ethereum Request for Comment) standards and technical specifications that guarantee tokens function uniformly and reliably inside the Ethereum ecosystem.

Each ERC standard fulfills a distinct function. By creating the first standardized architecture for fungible tokens, ERC-20 made it easier for wallets and exchanges to trade and operate together. NFTs were based on the ERC-721 architecture, which gave each token a unique identity.

New standards have been developed to support permissioned tokens as blockchain technology moves into regulated and commercial contexts. Developers are currently emphasizing token standards for real-world assets (RWAs) with practical applications in consideration. ERC-3643 has garnered attention for enhancing compliance and modular design in tokenized securities, real estate, and other physical or regulated assets.

Ultimately, ERC standards are the foundation of asset tokenization. Tokenization, whether denoting fractional ownership in real estate, equity in a business, or gold reserves, depends on these criteria to guarantee confidence, liquidity, and usefulness.

About ERC-3643: The De Facto Standard

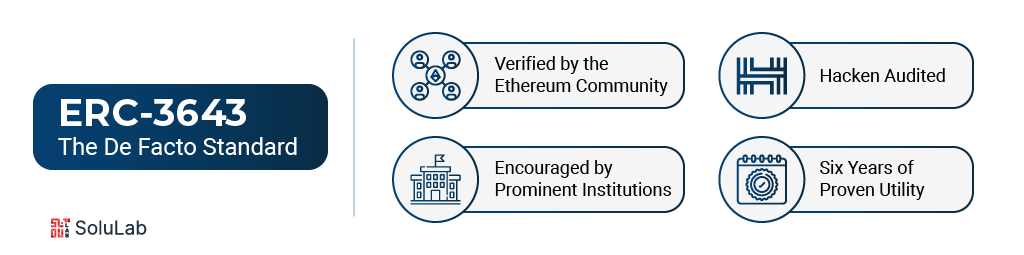

ERC-3643 has become one of the few standards that has really shown its worth in the real world and on paper when it comes to significant, enterprise-ready tokenization. This protocol has the support, track record, and technical depth to be relied upon at scale, in contrast to many others that are still becoming established.

ERC-3643 is the standard that most teams are using, regardless of whether they are developing for regulated markets or seeking a compliant method to add real-world assets to the chain. This is the reason:

- Verified by the Ethereum Community: This standard has earned the trust of EVM developers and is regarded as a mature, production-ready protocol, holding the title of “Final” in the Ethereum ecosystem.

- Hacken Audited: The ERC3643 token standard’s technical integrity is shown by its perfect 10/10 audit score, which also demonstrates its solid security basis for managing valuable digital assets.

- Encouraged by Prominent Institutions: To promote the implementation of ERC-3643 worldwide, Apex Group, Invesco, Aztec, CMS, DLA Piper, and Polygon have teamed together under a charity.

- Six Years of Proven Utility: ERC-3643 tokens are a reliable choice for enterprise-grade tokenization because of the standard’s strong track record, which has enabled the tokenization of more than $28 billion in assets.

Deep Dive on ERC-20 Token Standard

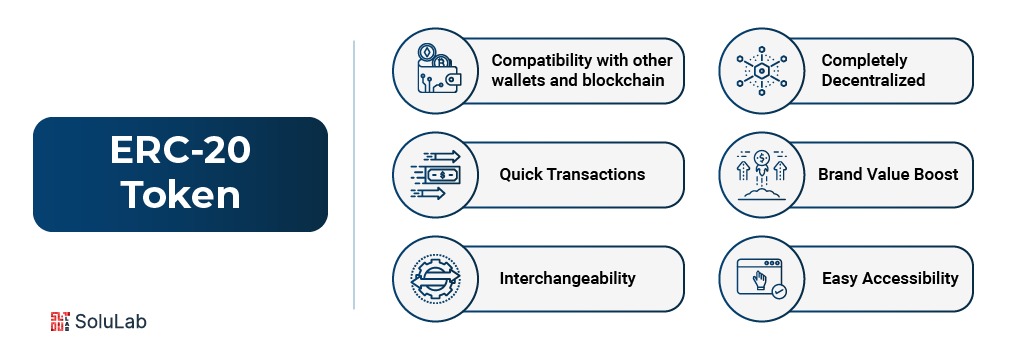

ERC-20 is definitely the most fundamental of all Ethereum token specifications. Launched in 2015, it established the foundation for the bulk of currently circulating tokens, including USDC, Chainlink, and several governance tokens with which you may have interacted.

The significance of ERC-20 lies not just in its extensive usage but also in its adaptability throughout time.

- Initially, ERC-20 mostly facilitated utility and payment tokens. Currently, it has considerable importance in more regulated areas, such as real estate tokenization, where fractional ownership of property may be represented as ERC-20 compatible tokens. These tokens facilitate investor access to high-value assets and enhance liquidity in a typically illiquid market.

- Considering the development of newer standards, ERC-20 remains effective in several institutional applications. Although it lacks inherent support for KYC or transfer limitations, developers frequently construct compliance layers atop it, particularly when utilizing it as a token standard for RWA tokenization. Its extensive ecosystem support renders it a viable option for connecting traditional assets with blockchain, applicable to commodities, funds, or debt instruments.

- In addition to banking, ERC-20 tokens are now integrated into several domains, including supply chain applications and gaming economies. The protocol’s uniform functionality across smart contracts enables developers to concentrate on innovation without concerns regarding compatibility challenges.

In summary, ERC-20 not only influenced the first token economy but also continues to grow alongside it. Its equilibrium of simplicity, adaptability, and extensive endorsement renders it a fundamental component in the continuous development of tokenized ecosystems.

Understanding ERC-1400 Token Standard

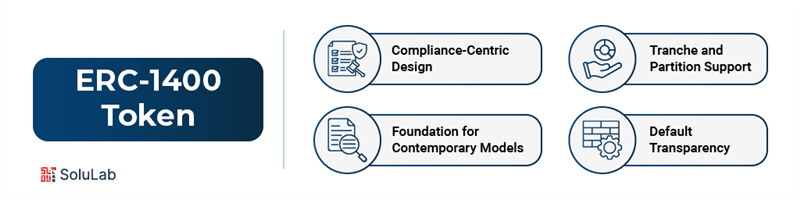

As blockchain technology advances, the demand for compliance-oriented token frameworks has intensified, particularly for regulated financial products. ERC-1400 is precisely where it becomes relevant. The ERC-1400 token standard is designed to accommodate security tokens and institutional-grade assets. It was crafted to satisfy the requirements of organizations that cannot forfeit either flexibility or legal integrity.

- Compliance-Centric Design: The ERC-1400 token standard enables issuers to implement regulations such as investor eligibility, lock-up durations, and jurisdictional access directly via smart contracts while maintaining interoperability with Ethereum.

- Tranche and Partition Support: In contrast to ERC-20, ERC-1400 may administer several share classes or asset sectors within a singular token contract, rendering it suitable for structured products and fund administration.

- Default Transparency: The standard facilitates on-chain documentation, enabling issuers to directly associate legal agreements or investor disclosures with tokens, guaranteeing openness for all stakeholders.

- Foundation for Contemporary Models: Numerous advancements in smart contracts in ERC-3643 are predicated on the concepts established in ERC-1400, although they offer enhanced flexibility for permissioned, enterprise-level tokenization across several jurisdictions.

Read Also: Fan Tokens

Key Differences Between ERC-3643, ERC-1400, and ERC-20

Understanding how different Ethereum token standards work and where they shine can help teams choose the right framework for their use case. Whether you’re building a tokenized fund, launching a regulated asset, or just need a simple, interchangeable token, here’s how ERC-3643, ERC-1400, and ERC-20 compare across key areas:

| Feature/Aspect | ERC-20 | ERC-1400 | ERC-3643 |

| Primary Use Case | Basic fungible tokens, DeFi projects | Security tokens, regulatory compliance | Permissioned tokens for institutional RWA |

| Compliance Support | None | Built-in identity and transfer restrictions | Advanced compliance with modular permissions |

| KYC/AML Integration | Not supported | Supported (via identity modules) | Mandatory and embedded in the transfer logic |

| Ownership | Not available | Supported (tranches) | Fully Supported |

| Legal Document Attachment | Not supported | Yes – via on-chain data references | Yes – modular legal and compliance documentation |

| Permissioned Transfers | No | Yes – rule-based transfers allowed | Yes – dynamic, rule-enforced smart contracts |

| Modularity | Very limited | Moderate | High – supports customizable compliance modules |

| Ethereum Compatibility | Fully EVM-compatible | Fully compatible | Fully compatible |

| Track Record | Active since 2015 | Used in select institutional pilots | Used to tokenize over $28B across 6 years |

| Best Fit For | Utility tokens, basic applications | Regulated securities, tokenized funds | Regulated real-world asset tokenization efforts |

Which Token Standard Is Best for Asset Tokenization?

Let’s be honest, there’s no “perfect” token standard that fits every project. It really depends on what you’re building and who it’s for. If you’re tokenizing real-world assets like real estate, equity, or even carbon credits, the standard you choose plays a huge role in how compliant, flexible, and scalable your solution ends up being.

For simple use cases, like digital art or collectibles, ERC-721 and ERC-1155 are still great choices. They’re widely supported by most NFT marketplace platforms, and they’re easy to work with if your focus is on user experience, not heavy regulation. But if you’re getting into the world of institutional finance or regulated markets, you’ll likely need something a bit more robust.

That’s where standards like ERC-1400 and ERC-3643 shine. These were designed with compliance in mind. You can build in things like KYC, permissions, identity checks, and legal ownership frameworks, all on-chain. So if you’re issuing tokenized shares in a company or fractionalizing real estate under regulatory oversight, these standards give you the control and credibility you need.

Of course, choosing the right framework isn’t something you want to wing. This is where working with a solid token development company really pays off. The right team can help you navigate the tech stack, stay compliant, and ensure the tokens you’re building today won’t cause problems tomorrow.

Wrapping Up

Asset tokenization is changing how we think about ownership, access, and investment. Whether it’s real estate, equities, or digital art, choosing the right token standard sets the tone for compliance, usability, and long-term success. ERC-20, ERC-1400, and ERC-3643 each bring something different to the table, and understanding those differences is key to launching a secure and scalable asset-backed project.

At SoluLab, we’ve worked closely with emerging Web3 ventures and enterprises as a trusted tokenization platform development company. One example is Token World, a premier crypto launchpad designed to help blockchain projects connect with investors. The platform combines an intuitive project listing interface with essential funding tools to support promising blockchain ideas from day one.

If you’re exploring asset tokenization or planning your next token-based venture, now’s the time to get your foundations right. Reach out to our team today!

FAQs

1. Why do token standards matter in asset tokenization?

Token standards define how tokens behave on the blockchain. In asset tokenization, this matters because you’re dealing with ownership, legal rights, and often real-world regulations. The right standard helps ensure tokens are transferable, secure, and compatible with wallets and exchanges, all while meeting compliance needs.

2. Is ERC-20 still relevant for modern tokenization projects?

Yes, but mostly in simpler or unregulated environments. ERC-20 is great for basic fungible tokens, like loyalty points or in-game currency. But when your project involves investor protections, legal documentation, or access control, you’ll likely need something more advanced like ERC-1400 or ERC-3643.

3. What makes ERC-3643 different from older token standards?

ERC-3643 was built with institutions in mind. It supports things like permissioned access, identity verification, and dynamic compliance rules directly through the smart contract. This makes it far more flexible and secure for handling real-world assets in a regulated environment.

4. Do I need KYC if I’m launching a tokenized asset platform?

If you’re dealing with real estate, securities, or anything involving investor funds, the answer is almost always yes. KYC ensures only verified users can participate and protects you legally. That’s why many modern token standards now include KYC functionality natively.

5. How do I choose the right token standard for my project?

Start by asking who your users are and what regulations apply to your asset. If you’re targeting open DeFi users, ERC-20 or ERC-1155 might work. But if you’re dealing with regulated assets or investor capital, you’ll want a standard that can handle compliance out of the box, like ERC-1400 or ERC-3643.