The insurance business has traditionally been one of the most data-intensive. With a significant quantity of customer data, claims data, and other types of information, insurers are using artificial intelligence (AI) to simplify their operations and improve consumer experiences. The insurance sector is not indifferent to artificial intelligence. AI life insurance has revolutionized risk management, underwriting policies, and other traditional insurance procedures. AI has had a tremendous influence on the insurance industry, allowing insurers throughout the world to adopt innovative methods and achieve remarkable efficiency.

According to Forbes, the efficiency of operations in the insurance industry has grown by 60%, with a 99.99% rise in claims accuracy and a 95% improvement in customer satisfaction. Furthermore, AI in the insurance business is expected to attain a value of USD 35.77 billion by 2030, growing at a CAGR of 33.06%.

AI-powered solutions have helped insurers simplify claims processing, fraud detection, and underwriting, amongst other things. This blog will take a closer look at the function and use of AI in insurance, including its advantages, use cases, impact, and current trends.

Understanding the Need for AI in Insurance

Previously, insurance was linked with copious amounts of documentation, time-consuming meetings, submitting complex claims, and expecting months for a judgment.

Artificial intelligence in insurance has introduced automation, which has begun to reestablish trust in insurance companies. Businesses are currently using AI solutions for insurance to boost business development, eliminate risks and fraud, and automate key business operations to cut total costs.

AI in health insurance is also pivotal in optimizing operations, enabling insurers to offer tailored premium pricing by leveraging comprehensive data insights. Furthermore, AI streamlines the underwriting process, reducing human intervention and facilitating direct connections between applicants and health insurance carriers for enhanced efficiency.

Read Blog: Generative AI in Healthcare

In summary, AI insurance benefits both insurers and policyholders. Here’s how.

- AI in the insurance sector improves insurers’ ability to analyze risks, identify fraud, and eliminate human mistakes.

- AI in insurance improves and streamlines customer service while also making claims processing easier and faster.

- Underwriting procedures can be improved with AI disruption and less human involvement.

- Using AI and ML in insurance allows underwriters to measure risk better and offer more personalized premium pricing.

- Furthermore, AI in the insurance sector optimizes the process of linking applicants with insurers directly, making the process simpler.

How Does Artificial Intelligence Add Value to the Insurance Sector?

The insurance sector must integrate modern technologies such as metaverse, blockchain, artificial intelligence, robotic process automation, and others in order to remain competitive and relevant. Let us look at how the use of the latest technologies might improve the current time-consuming and exhausting insurance process. However, bringing value to the existing process makes sense when the implementation of Gen AI in insurance industry yields tangible advantages. Let’s examine a few of them:

-

Optimized Claim Processing

Claims processing is a difficult procedure. Agents must examine numerous policies and understand them in depth in order to estimate how much the customer will get for the claim. AI for insurance can handle such automated operations, reducing mistakes and claim processing time.

As companies embrace emerging technologies like AI, RPA, and IoT, operational efficiency is heightened, allowing insurers to tap into a plethora of IoT devices such as smart home assistants, fitness trackers, and healthcare wearables. This AI and Insurance if worked together facilitates seamless data collection, enabling insurers to stay closely connected with policyholders and derive comprehensive insights crucial for informed decision-making in underwriting and claim management, ultimately mitigating risks.

-

Assessing Risk

The underwriting procedure mostly relied on the applicant personally filling out routine paperwork. There is always the potential that the candidate is dishonest or makes errors, which might result in an erroneous risk assessment.

According to research, the advantages of AI in insurance, particularly underwriting, include the capacity to:

- Model a future market with 83% accuracy.

- Reduce processing time in underwriting by 10-fold.

- Boost case acceptance by 25%.

-

Fraud Detection and Prevention

The vast insurance sector receives almost $1 trillion in premiums each year. With this magnitude, the fraud rate is very large. Non-health insurance fraud is expected to cost more than $40 billion per year, raising premiums by $400 to $700 per household.

Gen AI in insurance is transforming fraud detection and prevention. Analyzing vast volumes of data can reveal unusual trends and warn insurers of suspected fraud in real time. It assists insurers in reducing risks, minimizing financial losses, and ensuring the authenticity of their operations. AI enables insurers to safeguard policyholders from false claims.

-

Reporting of Claims

In Insurance claim filing, AI can manage the first notification of loss with little to no assistance from humans, allowing insurers to allocate, route, report, and prioritize claims.

As clients may report events from any device, anywhere, at any time, chatbots can effectively streamline the claim reporting process. Build Chatbots with AI capabilities have the ability to distribute information for additional processing.

-

Investigation and Management of Insurance Claims

AI and ML in insurance may be used in conjunction with various applications to automate the identification of fraudulent activities process, saving time and money, by controlling every step of the process, including data collection, claims processing, authorizations, permits, payment tracking, and recovery tracking.

Artificial Intelligence in insurance processes can efficiently manage and enhance a range of functions.

-

Enhanced Standard Procedures

Customer service in the insurance sector has undergone a radical transformation because to artificial intelligence. As was also previously noted, chatbots are the simplest way to start a process and distribute information toward the next aligned step without the need for human participation, making the process quick, easy, and error-free.

Chatbots driven by AI have the ability to upsell and cross-sell items based on a customer’s past purchases and profile. Operations may be readily scaled up while using human resources in higher-profile positions by automating the repetitious process.

-

Better Way to Estimate Losses

Damage assessment is now simpler than ever thanks to recent developments in AI technology, such as machine learning, deep learning, and optical character recognition (OCR). It is possible to ascertain the degree of the damage quickly and effectively by just uploading a picture of the damaged object.

Furthermore, these technologies enable the prediction of prospective losses and the provision of insightful advice.

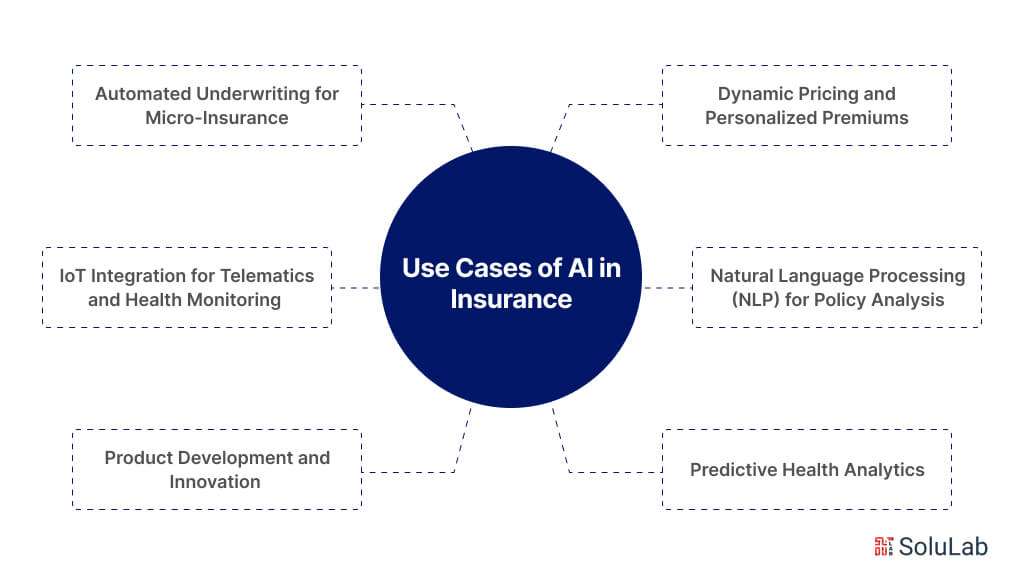

Use Cases of AI in Insurance

There are various AI use cases in insurance. These use cases show AI is transforming various aspects of the insurance industry, from risk management and underwriting to customer service and product innovation, ultimately driving efficiency, profitability, and customer satisfaction.

Here are some of the AI in insurance use cases:

Customer Segmentation and Targeted Marketing: AI-driven analytics identify distinct customer segments based on demographic, behavioral, and psychographic factors. Insurers can then tailor marketing campaigns and product offerings to specific customer segments, improving engagement and conversion rates.

- Dynamic Pricing and Personalized Premiums: AI algorithms analyze individual risk factors and behavioral data to dynamically adjust insurance premiums in real time. This personalized pricing approach rewards safer behaviors and incentivizes policyholders to take proactive measures to reduce risks.

- Automated Underwriting for Micro-Insurance: AI-powered underwriting models streamline the assessment of small, low-premium insurance policies, such as micro-insurance products for low-income individuals. By automating underwriting decisions, insurers can offer affordable coverage to underserved populations while maintaining profitability.

- Natural Language Processing (NLP) for Policy Analysis: AI-powered NLP tools can parse and analyze complex insurance policies to extract key information, such as coverage limits, exclusions, and terms. This helps insurers quickly understand policy details and make informed decisions during underwriting and claims processing.

Read Also: Top 10 Applications of Natural Language Processing

- IoT Integration for Telematics and Health Monitoring: Insurers leverage IoT devices such as telematics in automobiles and health monitoring wearables to gather real-time data on policyholders’ behaviors and health conditions. This data informs risk assessment, pricing strategies, and incentive programs, promoting safer behaviors and healthier lifestyles among policyholders.

- Product Development and Innovation: AI-driven insights help insurers identify market trends, customer preferences, and emerging risks, facilitating the development of new products and services tailored to evolving consumer needs. This fosters innovation and competitiveness in the insurance market.

- Predictive Health Analytics: AI in health insurance analyzes health data from wearable devices, electronic health records, and other sources to identify patterns indicative of potential health risks or chronic conditions. Insurers use predictive health analytics to intervene early, offering proactive health management programs and preventive care services to policyholders, ultimately improving health outcomes and reducing healthcare costs.

Top Trends and Innovations Driven by AI Changing the Insurance Industry

The application of different AI technologies will require the insurance business to climb a steep learning curve in order to reach new heights. People who have insurance will also be impacted, in addition to the insurance companies. Here are a few of the trends:

-

High Personalization

Insurance businesses may now provide highly customized plans and solutions that are tailored to the individual demands of each consumer thanks to AI’s ability. By examining data on lifestyle, behavior, and preferences, artificial intelligence (AI) systems may generate personalized insurance solutions. In the cutthroat market of today, maintaining and gaining new clients depends on this degree of customization.

-

Explosion of Data from Networked Devices

A huge increase in data creation has been caused by the proliferation of connected devices. Massive amounts of data are being collected and transmitted by IoT sensors and smart devices, leading to a data explosion. This offers possibilities and problems for handling, evaluating, and making decisions using this data. Businesses must manage this flood of data well in order to remain competitive in the modern digital environment.

-

Extended Reality

The next generation of virtual reality is called extended reality. It won’t be required for the insured object to be present in person at the location. AI technology will be used to conduct a virtual examination following the filing of the claim. Better rates will be simpler to generate if the safety features of the car that needs insurance are known.

-

Data Accuracy

In AI, data is king. Artificial intelligence (AI) is the process of gathering data from many sources and interpreting it. Better business judgments may be made, nevertheless, if the data is reliable and exact. Accurate data may be used by insurance firms to reduce risks and fraud before they happen.

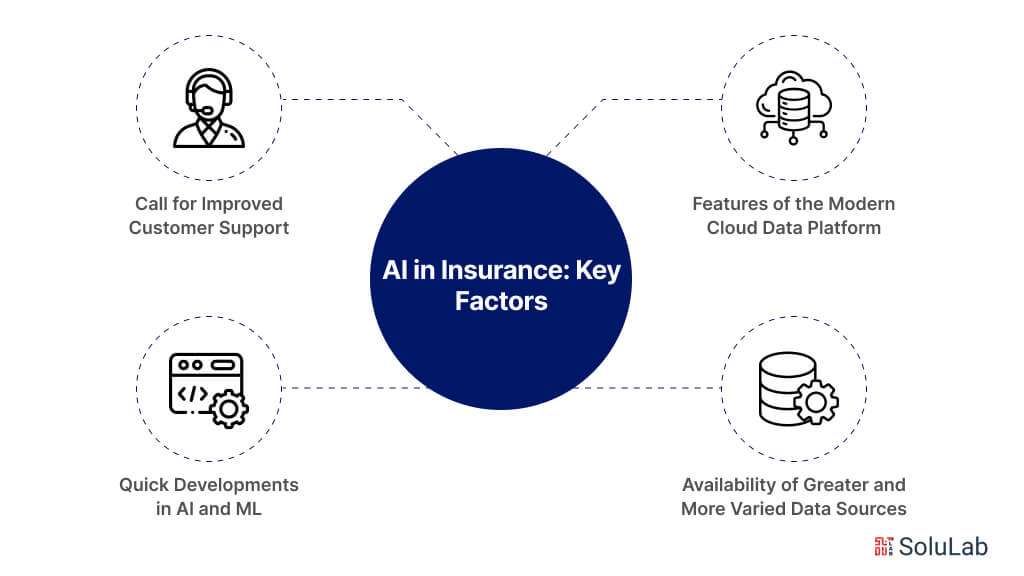

Factors Driving Implementation of AI in Insurance Industry

AI-powered solutions are increasing insurers’ market share and profitability. This technology is being used in the insurance industry due to a number of factors.

-

Quick Developments in Artificial Intelligence and Machine Learning

The rapid development of machine learning and artificial intelligence has opened up new avenues for value extraction from data. A prime example is large language modeling (LLM), a subfield of artificial intelligence that can interpret document data intelligently. Insurance companies may expedite their claims procedures and identify fraudulent claims more accurately by using LLMs. Generative AI is another example; it combines functions, data, and tools and uses reasoning to produce a response. Although generative AI is still in its early stages, it has enormous potential for the insurance sector.

-

Availability of Greater and More Varied Data Sources

There is more raw material ready to mine for value as a result of the dramatic increase in the number and diversity of data sources. As insurers complement their data with consumer credit, marketing, social networking posts, information on shopping behavior, criminal histories, prior insurance claims, and weather data, third-party information has also become more and more significant. Insurers benefit from third-party data in many ways, including better marketing strategies, risk modeling, policy underwriting, and claims handling.

-

Call for Improved Customer Support

With the help of AI-powered solutions, insurers can now provide customers with timely, individualized support that is offered around the clock, thanks to chatbots and virtual assistants. Front-line customer care systems that offer 24/7 basic help free up human agents to handle more complicated client concerns are powered by natural language processing (NLP), a sort of artificial intelligence that enables machines to comprehend and react to written and verbal communication.

-

Features of the Modern Cloud Data Platform

Massive amounts of data may be processed and stored effectively and affordably with the help of contemporary cloud data systems like Snowflake. Insurers may employ a variety of data sets for the training and improvement of their AI models because the model supports structured, semi-structured, and unstructured data. Compute power that is elastically scalable enables teams to efficiently handle AI and ML workloads.

Final Words

In conclusion, the integration of AI technologies within the insurance sector has profoundly reshaped operations, customer experiences, and risk management strategies. From streamlining underwriting processes to enhancing fraud detection and personalized customer service, AI has proven to be a transformative force. As insurers continue to embrace AI-driven solutions, they stand to unlock even greater efficiencies and competitive advantages in an increasingly digitized era. However, stakeholders need to remain cognizant of the ethical considerations surrounding AI implementation, ensuring transparency, fairness, and accountability in its usage to foster trust and mitigate potential risks.

Insurance businesses may benefit greatly from collaborating with seasoned AI development companies such as SoluLab as they endeavor to make use of AI’s capabilities and manage intricate deployment processes. Insurance companies may benefit from SoluLab’s AI technology expertise by receiving specialized solutions to handle certain business problems. These solutions can include chatbots and virtual assistants for improving client interaction, pricing model optimization, and claims processing automation. SoluLab is a trustworthy AI development company in advances the insurance industry’s transformation through modern artificial intelligence (AI) solutions, with an emphasis on innovation and customer happiness. Get in touch with us right now to start a cooperative journey toward success and learn more about how SoluLab can support your company’s AI journey.

FAQs

1. How does AI benefit insurance companies?

AI benefits insurance companies in various ways, such as automating repetitive tasks like claims processing, enabling predictive analytics for risk assessment, enhancing fraud detection, and providing personalized customer experiences through chatbots and recommendation systems.

2. Does the integration of AI in insurance reduce operational costs?

Yes, the integration of AI can significantly reduce operational costs for insurance companies. By automating manual processes, AI streamlines workflows, minimizes errors, and increases efficiency, ultimately leading to cost savings across various departments.

3. What impact does AI have on customer experiences in the insurance sector?

AI enhances customer experiences in the insurance sector by enabling personalized interactions, quicker response times, and more accurate policy recommendations. Chatbots and virtual assistants powered by AI provide 24/7 support, addressing customer inquiries promptly and efficiently.

4. How does AI help in mitigating insurance fraud?

AI helps mitigate insurance fraud by analyzing large volumes of data to identify suspicious patterns and anomalies. Machine learning algorithms can detect fraudulent claims by flagging inconsistencies in claims information, behavior analysis, and historical data comparison, thereby reducing financial losses for insurers.

5. How can SoluLab assist insurance companies in adopting AI technologies?

SoluLab specializes in AI development and offers tailored solutions to assist insurance companies in adopting AI technologies. From automating claims processing to implementing predictive analytics models, SoluLab collaborates closely with insurers to address specific business challenges and optimize processes for enhanced efficiency and customer satisfaction. Contact SoluLab today to explore how AI can revolutionize your insurance operations.