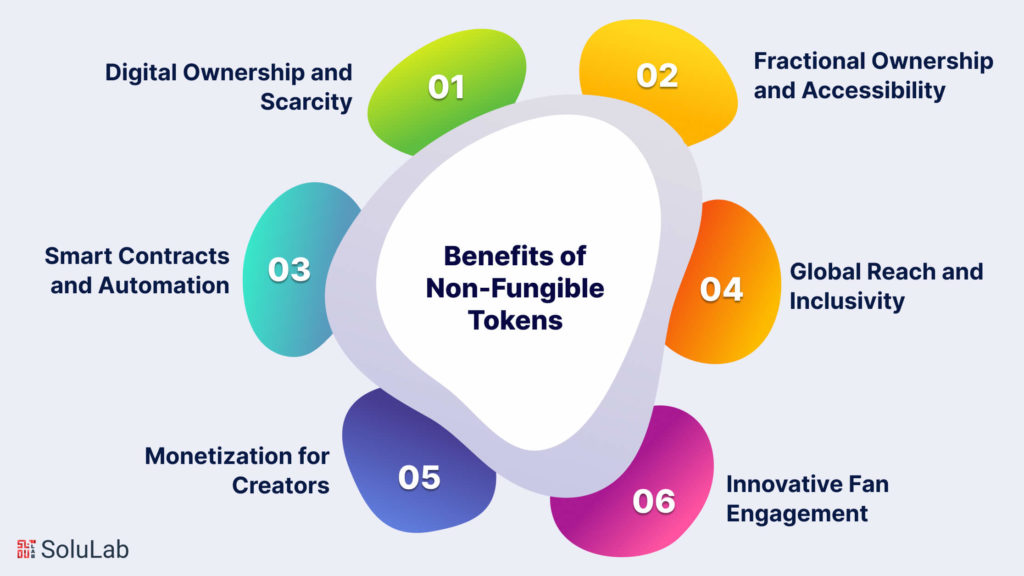

In the dynamic realm of the digital economy, the advent of Non-Fungible Tokens (NFTs) has proven to be nothing short of revolutionary. These unique cryptographic tokens, built on the foundation of blockchain technology, are reshaping the landscape of digital ownership and creative expression. At the core of this transformative journey are Smart Contracts, the ingenious self-executing contracts encoded with predefined rules that underpin NFT development. NFTs represent a paradigm shift in the way we perceive and interact with digital assets. Unlike traditional cryptocurrencies such as Bitcoin or Ethereum, NFTs are indivisible and irreplaceable, each possessing a distinctive value and uniqueness. This uniqueness is ensured through the application of Smart Contracts, which imbue NFTs with verifiable authenticity, scarcity, and ownership.

Central to the concept of NFTs is the application of Smart Contracts, which act as the building blocks for the creation and management of these digital assets. Smart Contracts facilitate trustless and transparent transactions, automating the minting, transfer, and ownership processes of NFTs. Through the integration of Smart Contracts, NFTs redefine digital ownership, guaranteeing the rightful attribution and transfer of assets in a secure and decentralized manner. The applications of NFTs span a diverse spectrum, transcending traditional boundaries and finding resonance across various industries. From the world of digital art, real estate, and intellectual property to the realms of gaming and entertainment, NFTs are catalyzing new possibilities for creators, investors, and enthusiasts alike.

Gaming experiences have undergone a metamorphosis with the integration of NFTs. In-game assets, characters, and virtual items are now tokenized, enabling players to truly own and trade their digital possessions. The intersection of NFTs and gaming has given rise to play-to-earn models, revolutionizing the dynamics of virtual economies. The emergence of NFT marketplaces has provided a digital arena for creators to showcase, auction, and sell their NFTs. These platforms operate on blockchain technology, employing Smart Contracts to ensure secure, transparent, and efficient transactions. NFT marketplaces serve as vibrant ecosystems, connecting creators with a global audience of collectors and investors.

Digital wallets play a pivotal role in the NFT ecosystem, serving as secure repositories for these digital treasures. Ensuring the safe storage and seamless transfer of NFTs, digital wallets empower users to engage in the burgeoning world of digital art, gaming, and collectibles with confidence For artists, NFTs represent a groundbreaking avenue to tokenize and monetize their digital creations. The tokenization of digital art not only ensures provenance and authenticity but also opens up new revenue streams through the automated enforcement of royalties via Smart Contracts. As we embark on this exploration of NFTs, Smart Contracts, and their multifaceted applications, we delve into the ever-evolving landscape of digital ownership and creative expression. Join us in uncovering the intricacies of NFT development, the innovative use cases that are reshaping industries, and the role of Smart Contracts in fostering a decentralized and transparent future. This journey promises to unravel the boundless potential of NFTs, transcending the digital realm and leaving an indelible mark on the way we create, exchange, and value digital assets.

What are NFTs?

Embark on a journey to demystify the essence of Non-Fungible Tokens. Discover how NFTs, with their uniqueness and indivisibility, redefine digital ownership, carving out a space for authenticated and scarce digital assets.

-

Unveiling the Concept of Non-Fungible Tokens

Non-Fungible Tokens (NFTs) represent a revolutionary shift in the digital paradigm, providing a unique form of digital ownership. Unlike traditional cryptocurrencies, each NFT is distinct, representing ownership of specific digital or physical items and introducing a new era of digital scarcity and authenticity.

-

Evolution and Adoption of NFTs in the Digital Era

The journey of NFTs started on the Ethereum blockchain and has since evolved into a global phenomenon. NFTs have transcended their initial roots, finding applications in art, gaming, real estate, and more. The widespread adoption speaks to the transformative potential of NFTs in reshaping various industries.

-

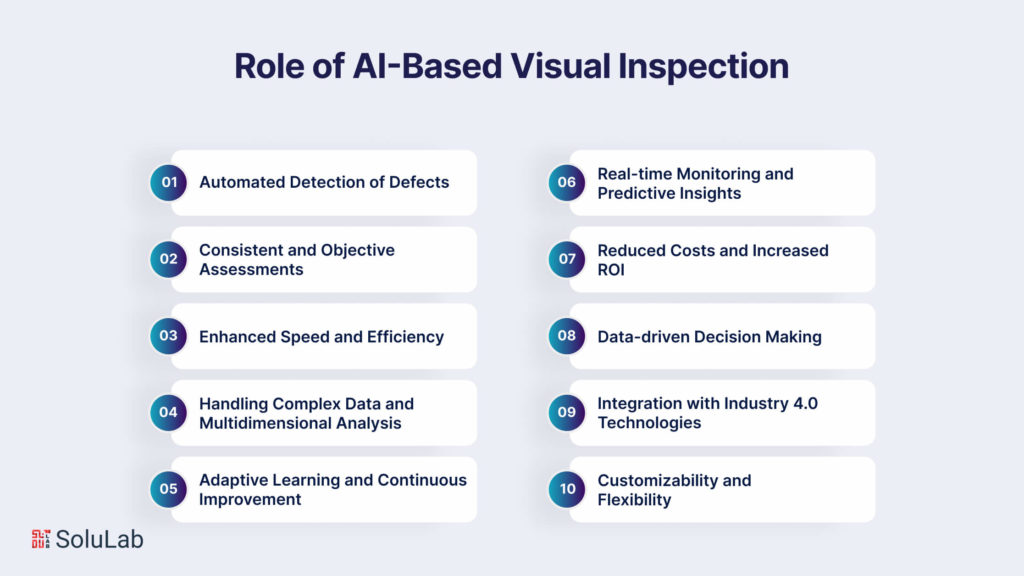

Significance of Smart Contracts in NFT Development

At the heart of NFTs lies the ingenious technology of smart contracts. These self-executing contracts, encoded with predefined rules, automate various aspects of NFT transactions, ensuring transparency, security, and efficiency in the complex world of digital ownership.

Smart Contracts in NFT Development

Delve into the core of NFT creation with Smart Contracts. Uncover the functionalities that these self-executing contracts bring to NFT development, ensuring secure, transparent, and automated processes.

-

Understanding the Role of Smart Contracts

Smart contracts form the backbone of NFT development, governing the entire lifecycle of an NFT. From the initial minting process to the transfer of ownership, smart contracts ensure the seamless execution of predefined rules, providing a trustless and efficient way to manage digital assets.

-

How Smart Contracts Ensure NFT Authenticity

Smart contracts play a crucial role in ensuring the authenticity of NFTs. By embedding unique attributes and details directly into the NFT’s code, smart contracts prevent duplication and fraud. This not only enhances the collectible value of digital assets but also establishes a verifiable provenance.

-

Smart Contract Innovations in NFTs

Ongoing innovations in smart contract technology are expanding the capabilities of NFTs. Features like programmable royalties, which reward creators for secondary sales, and dynamic attributes that can change over time showcase the adaptability and versatility of smart contracts in the NFT ecosystem.

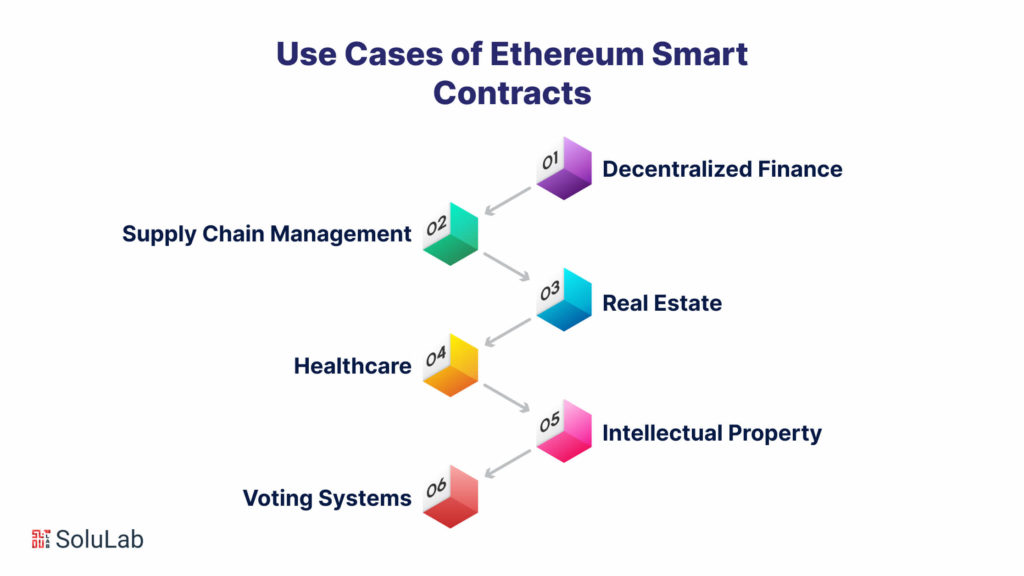

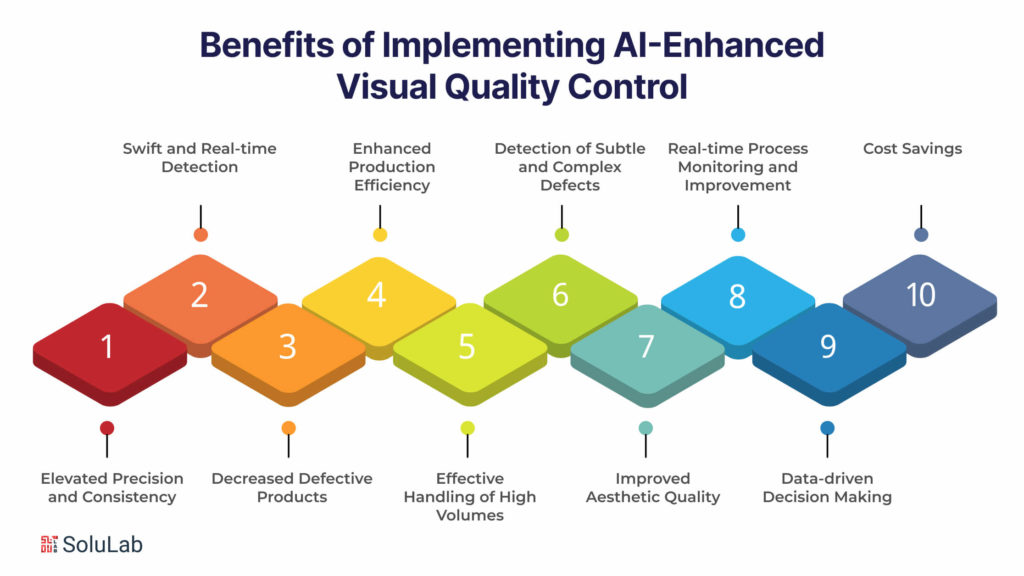

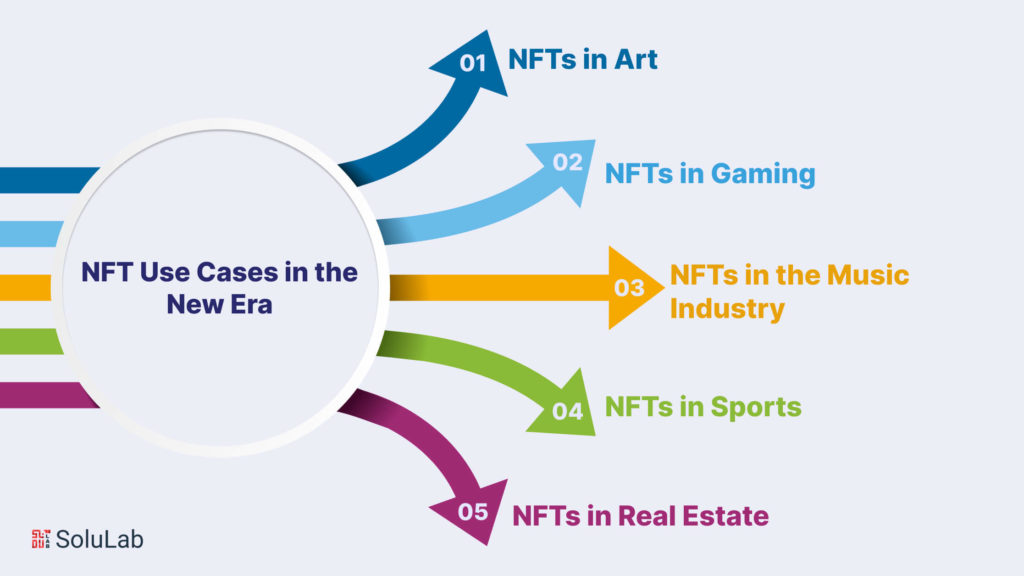

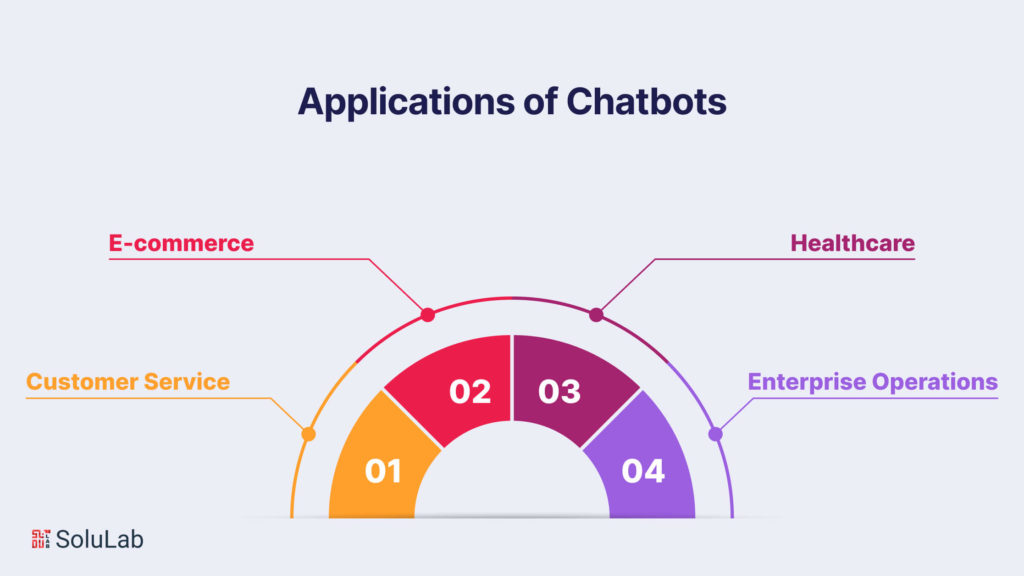

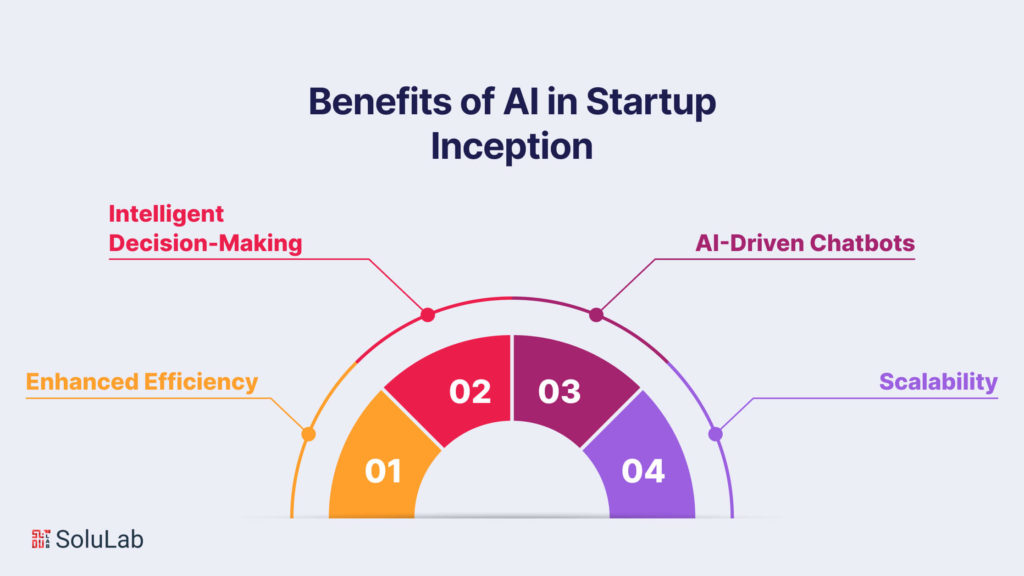

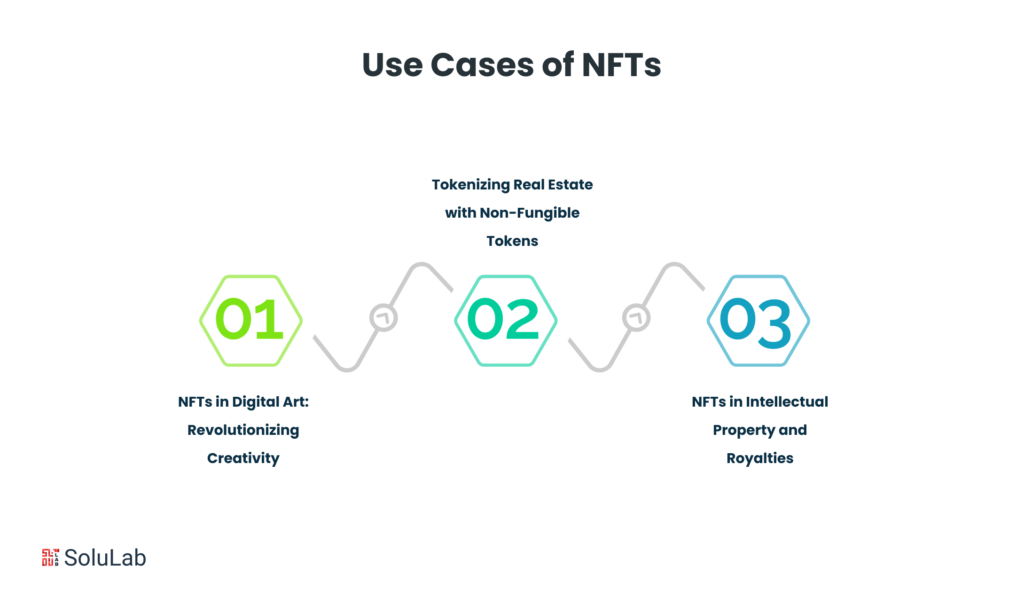

Use Cases of NFTs

Explore the myriad applications of NFTs that transcend traditional boundaries. From real estate to intellectual property, NFTs are catalyzing innovation and reshaping the dynamics of ownership in various industries.

-

NFTs in Digital Art: Revolutionizing Creativity

NFTs have ushered in a new era for digital artists, providing a decentralized platform to tokenize and sell their work. Each NFT represents a unique piece of art, allowing creators to retain ownership, receive royalties, and connect directly with a global audience.

-

Tokenizing Real Estate with Non-Fungible Tokens

The real estate industry is experiencing a transformative wave with the integration of NFTs. These tokens facilitate fractional ownership, streamline transactions, and enhance transparency, offering investors a novel way to engage with real estate assets on blockchain platforms.

-

NFTs in Intellectual Property and Royalties

Beyond visual art, NFTs extend to intellectual property, including patents, trademarks, and copyrights. Creators can tokenize their intellectual assets, embedding royalty structures into smart contracts to ensure fair compensation for their work, whether it’s transferred or licensed.

Applications of NFTs

Unleash the potential of NFTs as we explore their applications across diverse sectors. Witness how these tokens are transcending traditional limitations, offering a new paradigm for creators, investors, and collectors.

NFTs in Gaming: Transforming the Gaming Industry

The gaming industry is undergoing a monumental transformation with the integration of NFTs. In-game assets, characters, and skins can now be tokenized, allowing players to truly own and trade their digital possessions across different gaming platforms. This introduces a new era of player-driven economies and ownership.

Tokenizing Collectibles: From Trading Cards to Virtual Items

NFTs are revolutionizing the concept of collectibles by digitizing traditional items such as trading cards, stamps, and memorabilia. These digital collectibles can be bought, sold, and traded globally, fostering a vibrant online marketplace that transcends geographical boundaries.

NFTs in the Music Industry: Ownership and Royalties

Musicians and artists are leveraging NFTs to redefine the music industry. Through tokenization, artists can grant fans ownership of exclusive tracks, concert tickets, and merchandise. Smart contracts automate royalty distributions, ensuring fair compensation for creators with every transaction.

NFTs in Gaming

Step into the virtual realms where NFTs are revolutionizing gaming experiences. Dive into the world of play-to-earn models, tokenized in-game assets, and the transformative impact of NFTs on the gaming industry.

-

The Rise of Play-to-Earn Games with NFT Integration

Play-to-earn games represent a groundbreaking concept where players can earn real value through in-game activities. NFTs play a crucial role by facilitating true ownership of in-game assets, creating economic opportunities for players and disrupting traditional gaming models.

-

Tokenized In-Game Assets and Virtual Real Estate

NFTs empower gamers to truly own their in-game assets, whether it’s powerful weapons, unique skins, or rare characters. Virtual real estate markets are emerging, allowing players to buy, sell, and develop digital properties within the gaming universe. This not only enhances the gaming experience but also opens up new revenue streams for players.

-

Challenges and Opportunities in NFT Gaming

While the integration of NFTs in gaming presents exciting possibilities, it comes with its set of challenges. Scalability, interoperability, and environmental concerns are among the issues that need to be addressed for the gaming industry to fully realize the potential of NFTs. Overcoming these challenges will unlock new opportunities and shape the future of gaming.

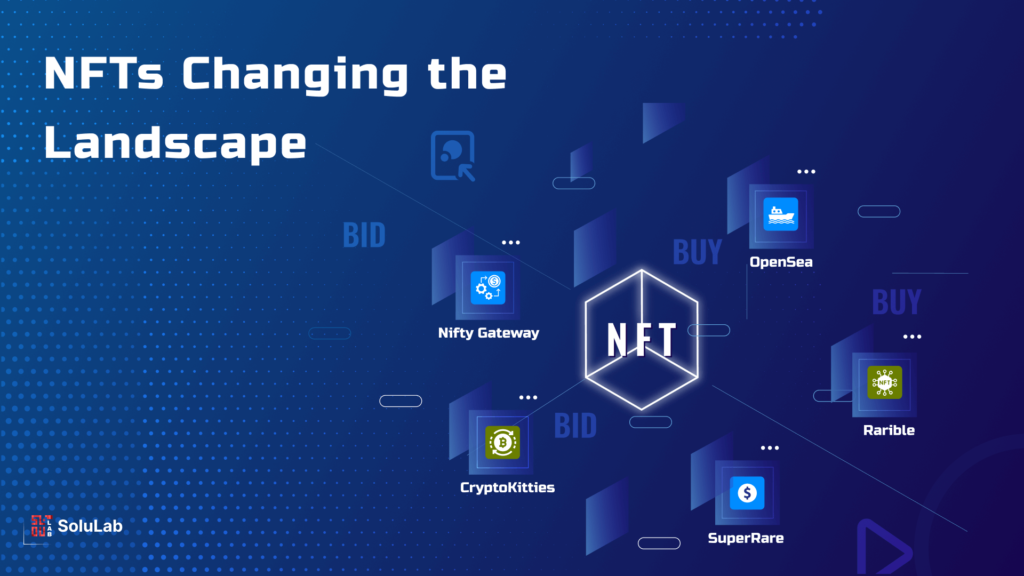

NFT Marketplaces

Embark on a tour of digital marketplaces dedicated to NFTs. Explore how these decentralized platforms serve as hubs for creators, collectors, and investors, fostering a global exchange of digital assets.

-

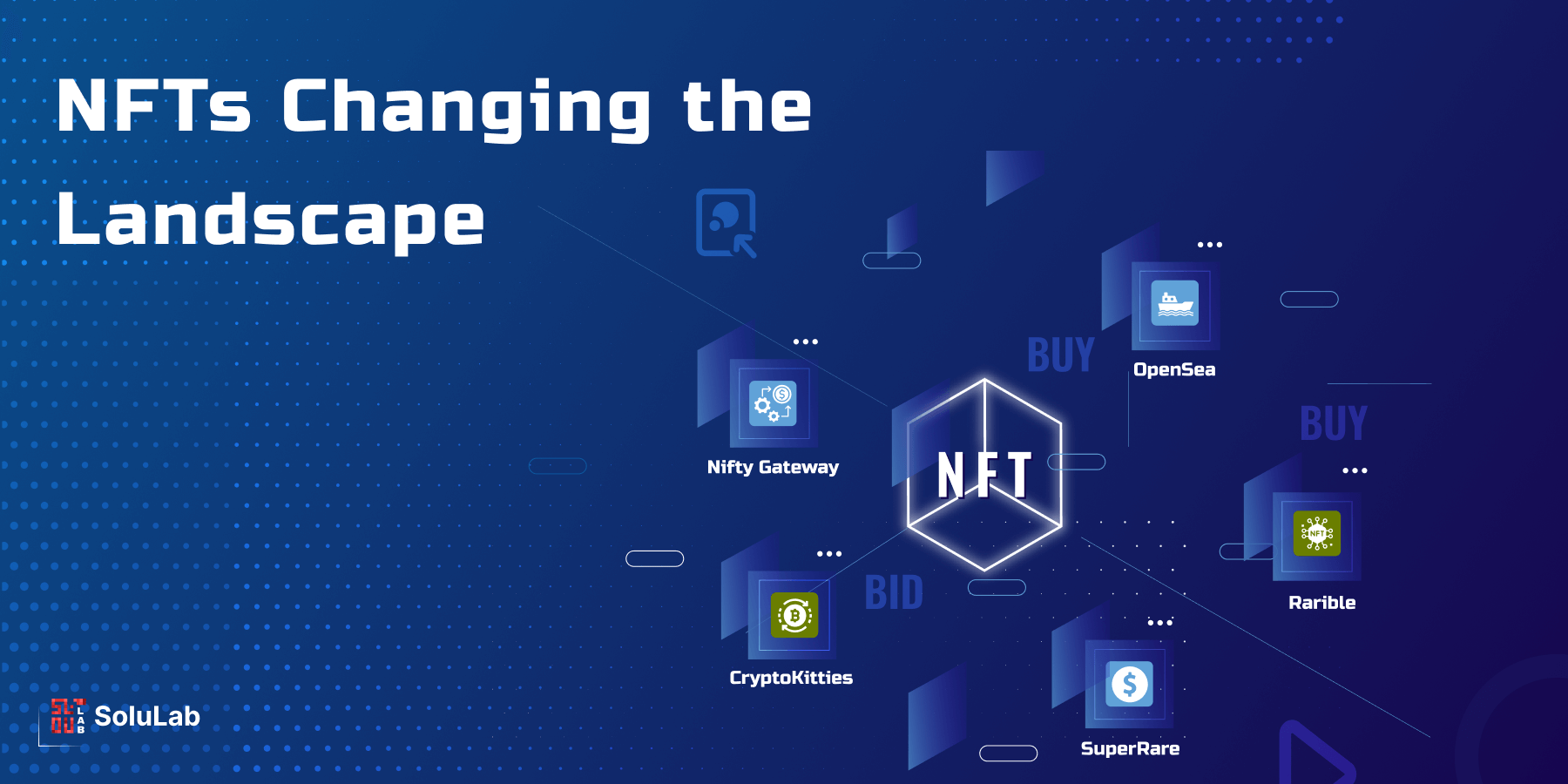

Overview of Leading NFT Marketplaces

NFT marketplaces have become the focal point for creators and collectors to engage in the buying, selling, and trading of NFTs. Each marketplace has its unique features, community dynamics, and focus, contributing to the vibrant and diverse NFT ecosystem.

-

How NFT Marketplaces Operate?

NFT marketplaces operate on blockchain technology, providing a decentralized environment for users to list, discover, and transact NFTs. These platforms offer a user-friendly interface, smart contract integration, and secure digital wallets, creating a seamless experience for participants in the NFT marketplace.

-

Emerging Trends in NFT Marketplace Development

The NFT marketplace landscape is dynamic, with constant innovations and trends shaping its evolution. From curated drops and social token integration to environmental sustainability initiatives, NFT marketplaces are adapting to meet user expectations and address broader industry challenges.

NFT Marketplace Platforms

Discover the platforms that facilitate the buying, selling, and auctioning of NFTs. Witness how these marketplace platforms leverage blockchain technology and Smart Contracts to ensure secure and transparent transactions.

-

Building NFT Marketplace Platforms: Key Considerations

Entrepreneurs and developers looking to enter the NFT marketplace space must consider various factors. Blockchain compatibility, smart contract functionality, user experience design, and community-building features are critical considerations for successful NFT marketplace platforms.

-

Features and Functionalities of Successful NFT Marketplaces

Successful NFT marketplaces prioritize features such as gas-free transactions, curation tools, social engagement features, and integration with decentralized finance (DeFi) protocols. These functionalities enhance the overall user experience, foster community engagement, and contribute to the growth of the NFT marketplace ecosystem.

-

Case Studies of Successful NFT Marketplace Platforms

Examining case studies of successful NFT marketplaces provides valuable insights into their strategies, challenges, and growth trajectories. Platforms like OpenSea, Rarible, and Mintable have paved the way for innovative marketplace development, setting benchmarks for others in the rapidly evolving NFT space.

Digital Wallets for NFT

Navigate the digital landscape where digital wallets play a crucial role in safeguarding NFTs. Learn how these wallets ensure secure storage and seamless transfer of digital treasures, empowering users to engage confidently in the NFT ecosystem.

-

The Role of Digital Wallets in NFT Transactions

Digital wallets play a pivotal role in the NFT ecosystem, serving as secure storage for NFTs and facilitating interactions with blockchain networks. The choice of a digital wallet influences the user experience, security, and accessibility of NFTs.

-

Security Measures for NFT Wallets

Security is paramount in the NFT space, and digital wallets must implement robust measures to protect users’ private keys and assets. Multisignature authentication, biometric verification, and hardware wallet integrations enhance the security of digital wallets, instilling confidence in users.

- Integration of Decentralized Identity (DID) in NFT Wallets

The integration of decentralized identity (DID) solutions in NFT wallets adds an extra layer of privacy and security. Users gain greater control over their personal information, contributing to the overall trustworthiness of the NFT ecosystem.

NFTs in Art

Immerse yourself in the intersection of NFTs and the art world. Witness the transformation of creativity and ownership as artists tokenize their digital creations, ushering in new possibilities for artistic expression and monetization.

-

NFTs as a Transformative Force in the Art World

NFTs have disrupted traditional art markets, empowering digital artists with new opportunities. Through NFTs, artists can tokenize their creations, ensuring provenance, direct engagement with buyers, and the potential for ongoing revenue through royalties.

-

NFT Art Collections and Virtual Exhibitions

NFTs enable the creation of digital art collections, allowing collectors to curate and showcase their acquisitions. Virtual exhibitions hosted on blockchain platforms provide a novel way for artists and collectors to engage with a global audience.

-

Challenges and Opportunities in NFTs for Art

While NFTs offer unprecedented opportunities for artists, challenges such as environmental concerns and market saturation need careful consideration. The art world is navigating these challenges, seeking sustainable solutions to ensure the long-term viability of NFTs in the realm of digital art. As we navigate the boundless expanse of the digital realm, the symphony of Non-Fungible Tokens (NFTs) and Smart Contracts resonates with innovation, redefining the very fabric of ownership and creativity. What began as a technological breakthrough has burgeoned into a cultural phenomenon, leaving an indelible mark across diverse sectors. At the forefront of this paradigm shift is the concept of NFTs—unique, indivisible tokens that imbue digital assets with authenticity and scarcity. Our exploration into “What are NFTs?” has revealed their transformative potential, shifting the narrative from the tangible to the digital.

Conclusion

In conclusion, the world of Non-Fungible Tokens (NFTs) has ushered in a paradigm shift in digital ownership and creative expression. Exploring the profound impact of NFTs, we delved into the core concepts such as what NFTs are, the integral role of Smart Contracts in their development, diverse use cases spanning industries, and their applications in gaming, art, and beyond.

As NFTs continue to reshape the digital landscape, SoluLab stands at the forefront of this transformative wave. Our expertise in Smart Contracts and comprehensive understanding of NFT ecosystems position us as the ideal partner for those venturing into this dynamic space. Whether you are an artist seeking to tokenize your creations, a gamer exploring the possibilities of NFTs in virtual worlds, or an enthusiast navigating the NFT marketplace platforms, SoluLab provides tailored solutions.

From conceptualizing and deploying Smart Contracts for NFT development to facilitating secure transactions through digital wallets, SoluLab empowers individuals and businesses to leverage the full potential of NFTs. As we witness the applications of NFTs evolving across various industries, SoluLab remains committed to driving innovation, providing cutting-edge solutions, and being the catalyst for your success in the NFT arena. Embrace the future of digital ownership with SoluLab – your trusted partner in NFT innovation.

FAQs

1. What exactly are NFTs, and how do they work?

NFTs, or Non-Fungible Tokens, represent unique digital assets using blockchain technology. They are indivisible and cannot be exchanged on a one-to-one basis, unlike cryptocurrencies.

2. How are Smart Contracts involved in NFT development?

Smart Contracts, self-executing agreements with coded terms, underpin NFT functionality. They automate processes like ownership transfers and royalties, enhancing transparency and security.

3. What are some practical applications of NFTs?

NFTs find applications in various fields, from real estate and intellectual property to digital art and collectibles, transforming ownership and enabling new business models.

4. Can NFTs be used in the gaming industry?

Absolutely. NFTs in gaming introduce play-to-earn models, allowing players to truly own in-game assets and fostering a decentralized gaming economy.

5. Tell us about NFT marketplaces and platforms.

NFT marketplaces are online platforms where users can buy, sell, and trade NFTs securely. They serve as hubs for digital creators, collectors, and enthusiasts.

6. How do digital wallets play a role in NFT transactions?

Digital wallets are crucial for NFT enthusiasts, providing a secure space to store, manage, and trade their digital assets. They act as a bridge between users and the NFT ecosystem.

7. In what ways are NFTs making an impact in the art world?

NFTs have revolutionized the art industry, enabling artists to tokenize their work, gain exposure, and earn royalties. This digital transformation brings new possibilities and challenges to the art market.