In the midst of the recent surge in interest surrounding blockchain and cryptocurrency assets, there is a growing recognition of the need for individuals, businesses, and governments to prepare themselves for the impending digital economy. For those venturing into the realm of blockchain, the topic of tokens is a common point of discussion, with numerous blogs and articles elucidating the distinctions between coins and tokens.

Presently, the spotlight is on exploring more advanced and innovative token forms, particularly Non-Fungible Tokens (NFTs). Many experts emphasize the transformative potential of NFTs in shaping the future landscape of blockchain technology. Consequently, these unique tokens have captured significant attention from users and enthusiasts across various domains.

In this article, we aim to delve into the intricacies of Non-Fungible Tokens (NFTs), unraveling their functionalities and examining their substantial contributions in diverse use cases.

So, without any further ado, let’s get started!

What are Non-Fungible Tokens?

NFT, or non-fungible token, is a specialized form of token created through cryptographic hashing methods, utilizing blockchain technology to associate with a unique digital asset that cannot be duplicated. Unlike major cryptocurrencies such as Monero, Ether, and Bitcoin, non-fungible tokens possess distinct characteristics, making them irreplaceable and non-interchangeable.

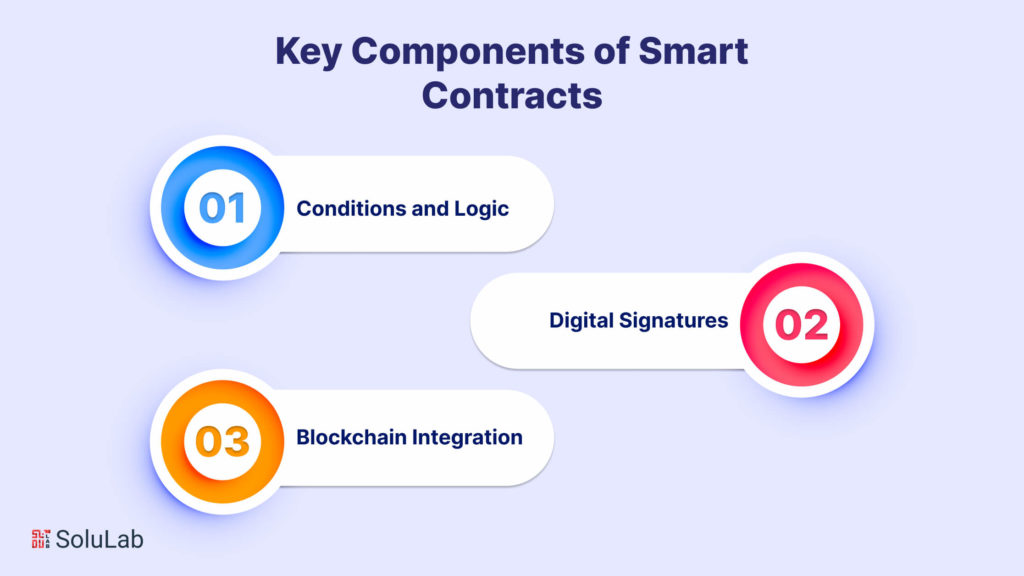

Embedded smart contracts development within NFTs play a crucial role in storing exclusive data, setting them apart from other tokens. NFTs are also characterized by their indivisibility; unlike Bitcoins, they cannot be sent in fractional denominations. Consequently, sending a portion of a specific NFT to another person is not feasible.

The uniqueness of non-fungible tokens grants them a distinctive role in the blockchain landscape, particularly in the context of the significant shift toward the next era of blockchain digital transformation. As enterprises gradually embrace blockchain integration into their operations, NFTs emerge as revolutionary entities.

Types of NFT Marketplaces

Non-fungible tokens (NFTs) come in various types, each serving different purposes and applications. Here are some common types of NFTs:

-

Token Standards

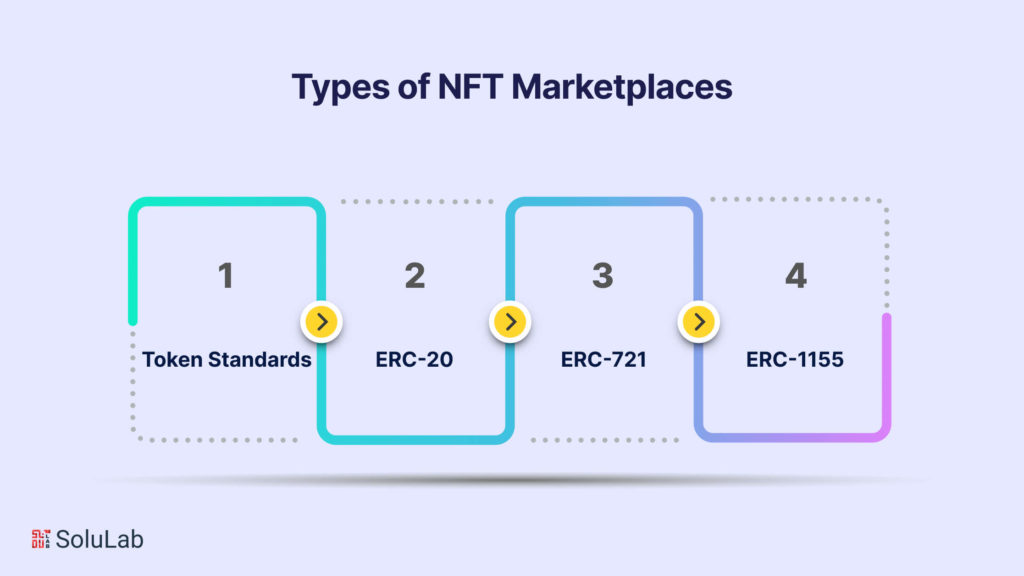

Exploring non-fungible token use cases reveals their versatility in serving various purposes for both digital and real-world entities, converting them into blockchain tokens. Before delving into deeper insights into NFT use cases, understanding the operational aspects is crucial. Developers must adhere to specific blockchain token standards to successfully launch token applications. Ethereum, for instance, provides numerous ERC standards for developers. Let’s examine the different token standards in blockchain that play a vital role in NFT functionality.

-

ERC-20

Cryptocurrency tokens on Ethereum adhere to the ERC-20 token standard. It comprises a set of rules that objects must follow to ensure interoperability and compatibility with exchanges or wallets within the Ethereum ecosystem. In October 2020, the Ethereum network had over 300,000 tokens based on the ERC-20 standard, a number continually on the rise.

-

ERC-721

Compared to the ERC-20 token standard, ERC-721 focuses on a single distinct asset without interchangeability. It represents assets, such as certifications or asset tokenization, that cannot be divisible. Tokens based on ERC-721 standard store information in personalized smart contracts, providing transparency regarding ownership, security, and immutability. Essentially, ERC-721 tokens operate as ‘non-fungible.’

-

ERC-1155

ERC-1155, a crucial token standard, forms the foundation of NFT use cases. While ERC-721 is suitable for creating new assets transferable between wallets, a collection of ERC-721 tokens may be insufficient and slow. ERC-1155, often termed the ‘multi-token standard of the next generation,’ proves beneficial in scenarios involving the trade of multiple artifacts, such as weapons and skins for a specific in-game character. Notably, ERC-1155 supports both fungible and non-fungible token applications.

History of NFTs (Non-Fungible Tokens)

The inception of Non-Fungible Tokens (NFTs) wasn’t an instantaneous phenomenon but rather evolved over the years with various early attempts laying the groundwork for what we now recognize as NFTs.

One contender for the title of the first NFT is the concept of Colored Coins, introduced in 2012. According to investor Andrew Steinworld, some argue that Colored Coins could be considered the initial manifestation of NFTs. While Colored Coins showcased a significant advancement in Bitcoin capabilities, they had limitations. Their value representation was contingent on unanimous agreement, and the scripting language of Bitcoin couldn’t accommodate this behavior within its network.

An alternative claim to the first NFT goes to “Quantum” by Kevin McCoy, minted on the Namecoin Blockchain on May 2, 2014. This digital token is considered by some as the rightful pioneer of the NFT title.

However, it was the advent of “CryptoKitties,” a project by Dapper Labs on the Ethereum blockchain, that brought NFTs into the mainstream. During the crypto boom of 2017, these digital cats gained global attention, with some even fetching a staggering price of 600 ETH (equivalent to USD 172k at the time). This marked a turning point, solidifying NFTs as a viable and valuable digital asset class.

Since the CryptoKitties phenomenon, numerous NFT projects have emerged, each contributing to the expansive success and recognition of non-fungible tokens across various industries.

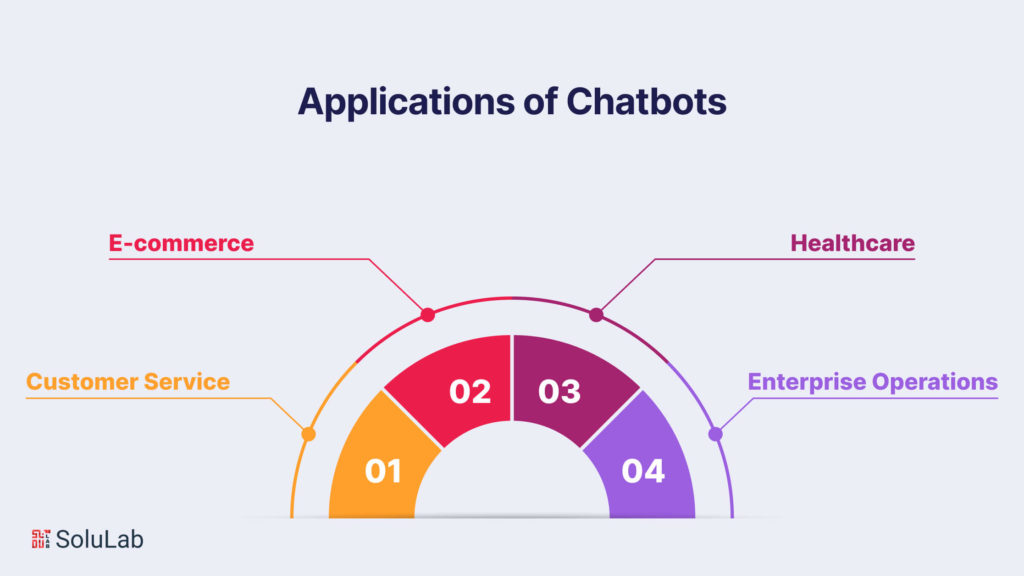

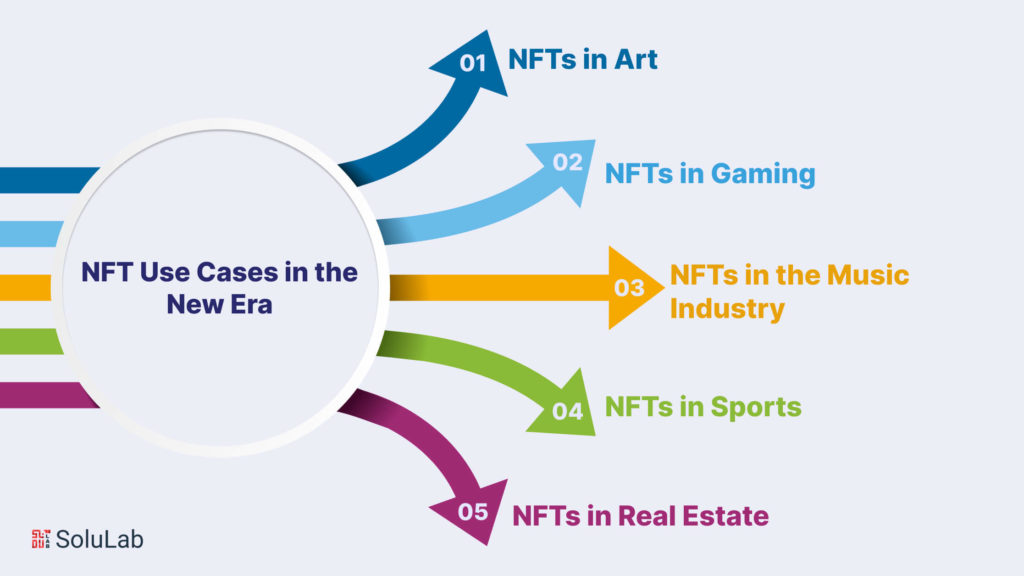

Use Cases of Non-Fungible Tokens Across Various Industries

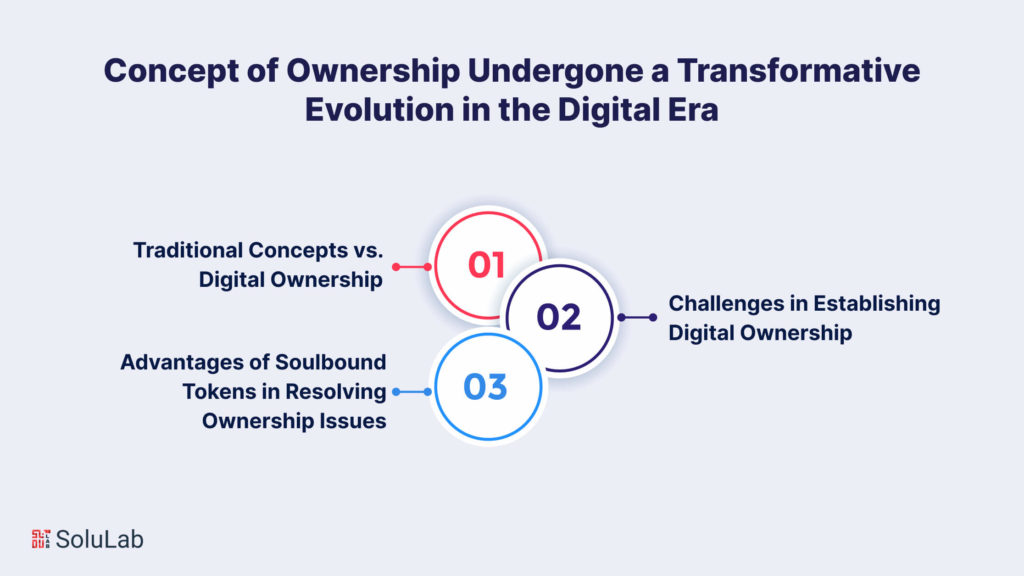

Non-Fungible Tokens (NFTs) have become a transformative force in the digital landscape, introducing a novel concept of ownership that extends across diverse industries. In this section, we will delve into the expanding realm of NFT use cases, exploring their impact on art, gaming, music, and various other sectors.

Digital Ownership: Exploring NFT Use Cases in the New Era

Non-Fungible Tokens have ushered in a new era of digital ownership, reshaping how creators monetize their work and how collectors acquire unique digital assets. This article aims to unravel the myriad use cases for NFT, showcasing the evolution of digital ownership in the contemporary digital world.

1. NFTs In Art

Within the art world, NFTs have empowered artists to craft extraordinary digital masterpieces, now tradable and saleable akin to physical art. This shift has not only generated fresh revenue streams for artists but has also provided collectors with ownership of exclusive digital creations, verified and authenticated through blockchain technology.

Undoubtedly, NFTs have already left an indelible mark on the art scene, with high-profile sales capturing global attention. A landmark moment occurred in March 2021 when an NFT crafted by digital artist Beeple fetched a record-breaking $69 million at auction. This sale served as a pivotal moment in the acceptance of NFTs within the art domain, illustrating their potential to revolutionize art transactions.

Advantages Of NFTs In Art

- True Ownership Of Digital Artworks: In the past, digital art lacked uniqueness and intrinsic value. NFTs now allow creators to fashion digital artworks that are distinct and possess genuine ownership, akin to physical art. This transformative shift has profound implications for the perception and valuation of digital art.

- Bypassing Traditional Gatekeepers: NFTs empower artists to directly sell their works to collectors, eliminating intermediaries like galleries and auction houses. This democratization of the art world holds the promise of enabling more artists to showcase and sell their creations to a broader audience.

In essence, NFTs have unlocked a myriad of possibilities in the realm of art, creating novel avenues for revenue and engagement. The ability to produce, trade, and own unique digital artworks has redefined the dynamics between artists and collectors, marking a revolutionary chapter in the art industry.

2. NFTs in Gaming

The gaming industry, which has witnessed remarkable growth with the advent of mobile phones and gaming platforms, is now experiencing a new wave of innovation with the integration of Non-Fungible Tokens (NFTs). The central question arises: “What exactly do NFTs bring to the gaming arena?” NFTs in gaming represent a groundbreaking fusion, as dedicated developers and gamers explore the potential of NFT-powered games to elevate gameplay and establish innovative revenue channels. In essence, these digital assets within the gaming realm can encompass in-game items, characters, and even entire virtual worlds, providing a fresh dimension to the gaming experience. Such assets can be bought, sold, and traded on blockchain-based marketplaces, introducing novel opportunities for gamers, developers, and investors.

Advantages of NFTs in the Gaming Industry

- New Revenue Streams for Game Developers: NFT games enable developers to go beyond traditional revenue sources such as game sales and in-game purchases. By crafting unique in-game items that players can own and trade on blockchain-based marketplaces, developers open avenues for additional revenue. This has the potential to establish a more sustainable business model, fostering innovation in game development.

- Enhanced Transparency and Security for In-Game Assets: The utilization of blockchain technology applications ensures greater transparency and security for in-game assets. Through the tracking of ownership and transfer of assets on the blockchain, players can be confident that their digital possessions are safeguarded and immune to replication or counterfeiting. This instills a sense of trust and fairness in the gaming experience, assuring players that their investments in the virtual game world are well-protected.

Use cases of NFTs in gaming represent not just a technological evolution but a paradigm shift, introducing a layer of ownership, traceability, and security that extends the gaming experience beyond mere entertainment. As the gaming industry continues to embrace NFTs, we anticipate a landscape where creativity flourishes, revenue models diversify, and players engage in more immersive and secure virtual worlds.

3. NFTs in the Music Industry

As a revolutionary trend in the music industry, Non-Fungible Tokens (NFTs) are rapidly becoming a novel avenue for artists to not only monetize their creations but also forge deeper connections with their fan base. NFTs in music encompass digital assets representing music, artwork, concert tickets, and exclusive items related to an artist’s body of work. These assets, imbued with unique value, are traded on blockchain-based marketplaces, providing fans with an opportunity to possess a tangible piece of their favorite artist’s legacy and concurrently establishing innovative revenue channels for musicians.

Advantages of NFTs in Music

- New Income Source for Artists: NFTs in the music industry unlock a fresh revenue stream for artists. By crafting distinctive NFTs that encapsulate their creative output, artists can sell these digital assets to fans and collectors. This approach extends beyond conventional revenue sources like music sales and streaming royalties, potentially offering a more sustainable income stream for artists amidst the dynamic shifts in the music industry.

- Unique Fan Engagement: NFTs in music create a personalized and exclusive channel for fans to connect with their favorite artists. Ownership of exclusive NFTs representing a specific album or concert fosters a deeper sense of connection and investment. This unique fan engagement has the potential to cultivate more committed and loyal fan bases, encouraging increased social interaction and trading activities among enthusiasts.

NFTs in the music industry extend beyond mere tokens; they become a conduit for tangible fan experiences and novel revenue models. As artists continue to explore the NFT utility use cases, the music landscape evolves into a realm where creativity meets technology, offering both artists and fans an enriched and interactive music ecosystem.

4. NFTs in Sports

In the dynamic world of sports, Non-Fungible Tokens (NFTs) are redefining how fans connect with their favorite teams and athletes. These digital assets, each possessing unique characteristics, introduce a new layer of fan interaction and provide unprecedented opportunities for sports organizations and enthusiasts. NFTs bring the concept of digital collectibles and memorabilia to sports. Fans can own exclusive digital assets such as virtual trading cards, iconic sports moments, or limited-edition memorabilia, all secured and authenticated through blockchain technology. It also paves the way for virtual stadium experiences. Fans can own virtual seats, granting access to exclusive content, behind-the-scenes footage, and even virtual meet-and-greet opportunities with athletes, creating a more immersive fan experience.

Advantages of NFTs in Sports

- Authentic Fan Experiences: NFTs redefine the sports fan experience by offering an authentic and immersive connection. Through ownership of unique digital assets like virtual trading cards or exclusive behind-the-scenes content, fans not only gain a sense of authenticity but also form a virtual bond with their favorite teams and athletes. This transcends geographical boundaries, creating a global community united by a shared passion for sports. NFTs become more than just tokens; they become cherished symbols of fandom and shared experiences.

- New Revenue Streams for Teams: NFTs present a transformative opportunity for sports teams to diversify their revenue streams and ensure financial sustainability. Teams can release limited-edition NFT collectibles, creating a sense of scarcity and exclusivity. Fans, eager to own a piece of sports history, engage in the excitement of acquiring digital assets that commemorate iconic moments or showcase their favorite players. This not only generates revenue but also turns the act of collecting into a dynamic and participatory experience.

As NFTs continue to weave their way into the sports landscape, they bring a wave of innovation, transforming fan engagement and revenue models. From virtual experiences to authentic collectibles, NFTs are reshaping the sports industry, creating new avenues for fan interaction and financial sustainability for teams and athletes alike.

5. NFTs in Real Estate

Just as NFTs have reshaped the art world, they are now making waves in the NFT real world use cases in the sector of real estate, offering a revolutionary approach to property ownership and transactions. These digital assets, underpinned by blockchain technology, present unique opportunities for property developers, investors, and homeowners alike. NFTs enable the tokenization of real estate, breaking down property assets into tradable and divisible digital tokens. This allows for fractional ownership, providing investors with the opportunity to own a portion of high-value properties, and enhancing liquidity in the real estate market. Moreover, real estate developers can utilize NFTs to offer exclusive access and rewards to property owners. NFT holders may receive special privileges, such as access to communal amenities, discounts on property-related services, or even invitations to exclusive events, fostering a sense of community and value.

Advantages of NFTs in Real Estate

- Fractional Ownership and Accessibility: NFTs democratize real estate investments by introducing fractional ownership, allowing investors to seamlessly buy and trade digital tokens representing fractions of properties. This innovative approach not only broadens participation but also transforms traditionally high-barrier real estate markets into inclusive opportunities for a diverse investor demographic.

- Transparent Property Transactions: Blockchain technology, integral to NFT-based real estate transactions, goes beyond enhancing transparency. Securely storing ownership records, property details, and transaction history, not only reduces the risk of fraud but also instills confidence in all stakeholders. This heightened transparency, facilitated by blockchain, ensures a secure and reliable platform for conducting property transactions, fostering trust in the real estate market.

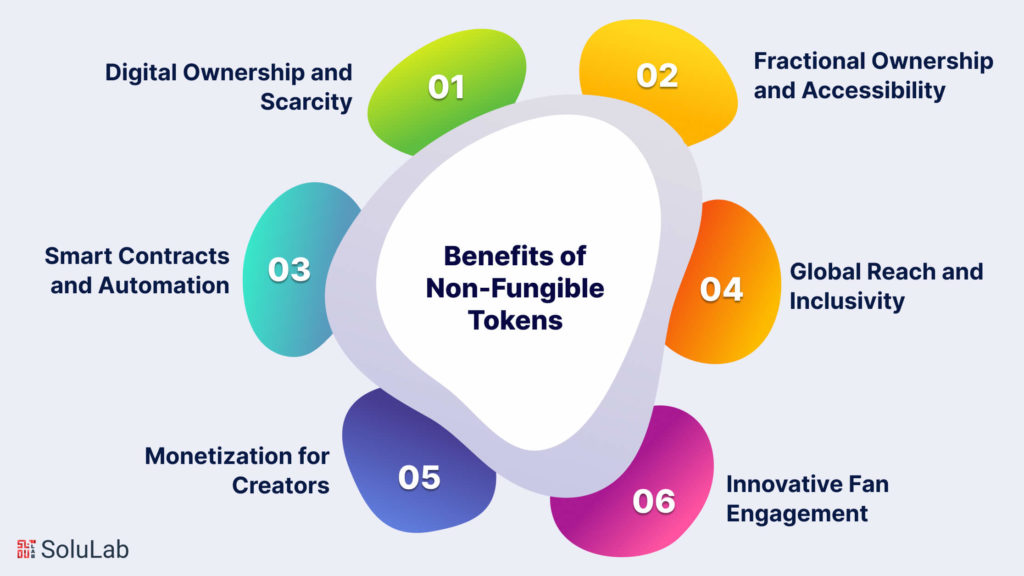

Benefits of Non-Fungible Tokens

Non-fungible tokens (NFTs) have emerged as a transformative force across various industries, bringing a myriad of benefits that extend beyond traditional forms of ownership and exchange.

1. Digital Ownership and Scarcity: NFTs provide a novel solution to digital ownership, allowing individuals to truly own and verify unique digital assets. Through blockchain technology, the scarcity and uniqueness of these assets are irrefutably established, offering creators and collectors a new paradigm for valuing and exchanging digital content.

2. Fractional Ownership and Accessibility: NFTs introduce the concept of fractional ownership, making high-value assets, such as real estate or high-profile artworks, accessible to a broader audience. Investors can purchase and trade digital tokens representing fractions of these assets, democratizing investment opportunities and fostering financial inclusivity.

3. Smart Contracts and Automation: Smart contracts embedded within NFTs automate and enforce predefined rules, facilitating transparent and trustless transactions. This not only reduces the need for intermediaries but also ensures that the terms and conditions of ownership and transactions are executed seamlessly, bringing efficiency and reliability to diverse industries.

4. Global Reach and Inclusivity: NFTs break down geographical barriers, allowing creators and investors to participate in a global marketplace. Artists can reach a worldwide audience, while investors can diversify their portfolios beyond traditional limitations. This global reach fosters inclusivity, creating opportunities for collaboration and engagement on an international scale.

5. Monetization for Creators: NFTs empower creators to monetize their digital creations directly. Artists, musicians, and other content creators can tokenize their work, allowing fans and collectors to support them by purchasing unique digital assets. This direct creator-to-collector relationship reduces dependence on intermediaries, providing creators with a more direct and sustainable revenue stream.

6. Transparency and Authenticity: Blockchain technology ensures transparency and authenticity in the provenance of NFTs. Ownership records, transaction histories, and details of digital assets are securely stored on the blockchain, mitigating the risk of fraud and counterfeiting. This transparency builds trust among participants in various industries, from art and music to real estate.

7. Innovative Fan Engagement: In the realm of entertainment and sports, NFTs redefine fan engagement. Fans can own exclusive digital collectibles, participate in tokenized loyalty programs, and access unique experiences, creating a dynamic and interactive relationship between creators and their audience.

As Non-Fungible Tokens continue to evolve and find applications in diverse sectors, their benefits reshape how we perceive ownership, value, and engagement in the digital age. Whether in the art world, real estate, or entertainment, NFTs are unlocking new possibilities and transforming traditional paradigms across the spectrum.

Why are Non-Fungible Tokens Popular These Days?

NFTs, although in existence since 2015, have recently surged in popularity due to several factors. Primarily, the widespread acceptance and enthusiasm for cryptocurrencies and blockchain technology have played a pivotal role. The convergence of technological advancements, fan enthusiasm, royalty economics, and the principle of scarcity has fueled this surge. Consumers are keen to participate in owning exclusive digital assets, viewing them not only as unique content but also as potential investments.

The ownership of an NFT grants control over the associated digital content, even though the content can still be circulated online. The visibility of an NFT online contributes to its popularity, ultimately enhancing its value. When an NFT is traded, the original creator receives a 10 percent share, with a portion going to the platform and the majority to the current owner. This model presents the prospect of continuous revenue for creators as digital assets gain traction in buying and selling transactions.

The essence of NFTs lies in authenticity. Each digital collectible possesses unique information that sets it apart, easily verifiable through blockchain technology. Counterfeiting is impractical as the origins of each item can be traced back to its original creator. Unlike cryptocurrencies, NFTs are not interchangeable because each holds its distinct value, akin to the uniqueness of physical collectibles like baseball cards.

Final Words

In conclusion, the surging popularity of Non-Fungible Tokens (NFTs) marks a transformative shift in how we perceive and engage with digital assets. Propelled by the normalization of cryptocurrencies, blockchain frameworks, and a convergence of technological, economic, and cultural factors, NFTs have become a novel frontier for ownership and investment. The fusion of fandom, the allure of royalties, and the fundamental concept of scarcity have ignited a widespread desire among consumers to possess exclusive digital content, creating a thriving market for NFTs.

As authenticity becomes paramount in the digital realm, NFTs stand as verifiable and unique digital collectibles, immune to counterfeiting due to the traceability provided by blockchain technology. Their popularity isn’t just confined to ownership but extends to their visibility online, contributing to the value they accumulate over time. Creators, platforms, and current owners participate in a symbiotic relationship, paving the way for ongoing revenue streams in the dynamic landscape of digital assets.

If you’re considering venturing into the NFT space, SoluLab stands as a valuable ally. With our expertise in blockchain development and a deep understanding of the evolving NFT marketplace, we can help turn your vision into a reality. From conceptualization to implementation, SoluLab is your trusted partner in navigating the intricacies of NFT marketplace development. Embrace the future of digital ownership and innovation with SoluLab – where possibilities in the NFT non fungible tokens realm are limitless. Contact us today to embark on your journey into the world of NFTs.

FAQs

1. What exactly is an NFT?

An NFT, or Non-Fungible Token, is a unique digital asset that represents ownership or proof of authenticity of a specific item, often digital content such as art, music, or collectibles. Unlike cryptocurrencies, NFTs are indivisible and each has distinct information stored on the blockchain, ensuring its uniqueness and authenticity.

2. Why are NFTs gaining popularity now?

The recent surge in NFT popularity is attributed to the widespread acceptance of cryptocurrencies and blockchain technology. The combination of technological advancements, fan enthusiasm, the allure of royalties, and the scarcity principle has created a perfect storm, making NFTs a sought-after investment and ownership opportunity for consumers.

3. How do NFTs generate ongoing revenue for creators?

When an NFT is sold, the original creator receives a 10 percent cut of the revenue, with a percentage going to the platform and the majority to the current owner. As the digital asset continues to be bought and sold over time, creators stand to gain ongoing revenue, creating a sustainable income stream from their popular digital creations.

4. Can NFTs be counterfeited or replicated?

No, NFTs cannot be counterfeited or replicated. The distinguishing information within each digital collectible makes it unique and easily verifiable through blockchain technology. This traceability ensures that each NFT can be traced back to its original creator, preventing fraudulent replication.

5. How can SoluLab assist in NFT marketplace development?

SoluLab, with its expertise in blockchain development solution, is well-equipped to assist in NFT marketplace development. From conceptualization to implementation, SoluLab provides comprehensive solutions, guiding clients through the intricacies of the NFT space. Contact us to embark on your journey into the world of NFTs, where innovation and digital ownership possibilities are limitless.