AI in portfolio management is significantly changing the financial sector by bringing about a change from conventional, human-centric techniques to a more data-driven strategy. AI goes beyond being just a catchphrase to become a vital tool at a time when timely and precise decision-making is critical to portfolio management. It tackles the problems of abrupt changes in the market that traditional methods, which are sometimes sluggish and expensive, find difficult to match. AI’s unparalleled speed in processing and analyzing financial data, both structured and unstructured, provides investors with respite from the burden of making emotionless decisions and dealing with massive volumes of data.

Moreover, dynamic, real-time market analysis is a benefit of AI-driven portfolio management solutions. They quickly respond to shifts in the market, giving investors timely information and suggestions so they may quickly modify their plans. In erratic markets, where it may dramatically reduce losses and enhance returns, this adaptability is extremely vital.

We go into further detail on AI’s enormous influence on portfolio management in this article. We’ll look at the main advantages, challenges, and use of AI in portfolio management techniques.

What is Portfolio Management?

The methodical process of developing investing strategies and figuring out how assets should be allocated is known as portfolio management. It entails choosing, keeping an eye on, and managing a range of financial products in order to maximize possible returns while lowering risk. The aim of portfolio management is to strike a balance between return and risk that corresponds with the financial objectives and risk tolerance of a person or an organization.

Important facets of managing a portfolio consist of:

1. Asset Allocation: It is the process of AI in asset management like allocating assets among various asset classes, such as cash, stocks, bonds, real estate, and commodities, according to an investor’s time horizon, financial objectives, and risk tolerance.

2. Diversification: Spreading investments throughout a variety of asset classes and asset types helps to lower overall risk. This is known as diversification. By spreading out your investments, you may counter any possible losses with gains.

3. Risk Management: Assessing and controlling the amount of risk attached to each investment in the portfolio. One possible use of AI in investment management is the use of derivatives or hedging to guard against possible losses.

4. Monitoring and Adjusting: Make sure that the investor’s goals and risk tolerance are met by the portfolio on a regular basis. If necessary, make adjustments by purchasing or selling assets to maintain the desired asset distribution.

5. Performance Measurement: It is the process of comparing the portfolio’s results to targets and benchmarks to see how well it is accomplishing the desired results.

Investment businesses use professional portfolio managers, financial consultants, and individual investors to manage their portfolios. To get the intended financial goals while controlling risk, a thorough grasp of financial markets, investment products, risk analysis, and a strategic strategy are necessary.

In What Ways Does AI Assist in the Management of Various Portfolio Risks?

AI is a big part of managing many kinds of risks in investment portfolios. It’s critical to realize that advanced risk assessment, mitigation, and decision-making solutions are provided by AI algorithms and tools in the financial industry. Let’s examine how AI helps manage the various risk categories mentioned:

1. Operational Risk

Operational risk includes possible losses resulting from insufficient or malfunctioning internal systems, procedures, or human error. A few instances are fraud, system malfunctions, or staff mistakes endangering the stability of a company.

Artificial Intelligence in asset management examines enormous volumes of data to find irregularities, possible fraud, or operational mistakes. Operational risk can be reduced by using these algorithms to spot anomalous transaction patterns or staff activity that might point to fraud.

2. Market Risk

Potential losses resulting from market swings, such as recessions, unstable political environments, shifts in interest rates, natural catastrophes, or other outside events impacting the financial markets, are referred to as market risk.

AI Portfolio uses sophisticated algorithms to forecast market movements and spot trends that human research might miss. Through the analysis of past data, news, social media, and numerous market indicators, artificial intelligence (AI) models may predict future changes in the market that may result from political unrest, natural disasters, or economic volatility.

3. Technology Risk

Technology risk is the possibility of cyberattacks, data breaches, or other technical malfunctions that might interfere with regular corporate operations.

AI plays a key role in improving cybersecurity protocols. The effect of data breaches and cyber threats can be lessened by machine learning algorithms‘ ability to recognize odd patterns in network traffic, warn of possible risks, and even respond to and stop assaults on their own.

4. Liquidity Risk

When an investment cannot be promptly sold or turned into cash at its fair market value, it carries a liquidity risk that might result in losses from restricted marketability or a significant reduction in selling price.

The evaluation of an asset’s liquidity within a portfolio is aided by AI techniques. AI can forecast possible liquidity problems by examining past data and market trends, giving investors the ability to make better-informed decisions on the liquidity of their assets.

5. Credit Risk

The possibility of suffering a financial loss in the event that a counterparty or borrower defaults, don’t pay back a loan, or doesn’t fulfill prearranged financial commitments is known as credit risk. It stands for the possibility of late or nonpayment, which would cause losses for the investor or lender.

Artificial intelligence algorithms help assess a possible investment or borrower’s creditworthiness. By examining a plethora of financial data and credit histories, these systems may offer more precise risk assessments, assisting investors in making well-informed judgments on trade-offs between risk and return.

How does AI in Portfolio Management Work?

The management of the portfolio process is streamlined by this architecture, which makes use of multiple components. Here’s a detailed explanation of how it operates:

1. Data Sources

To start information pertinent to the method of managing a portfolio is gathered from a variety of sources. This information may consist of:

- Client Profiles: Comprehensive details about a client’s background, investment objectives, risk tolerance, and demographics.

- Market Data: Current and historical information from market data providers about commodities, indices, market trends, exchange rates, and various other financial instruments.

- Regulatory Filings: Documents submitted by corporations to regulatory agencies, including quarterly earning reports, yearly reports, and other required disclosures.

- Research Reports: Comprehensive evaluations and projections from independent research groups, brokerage houses, and financial specialists.

- Asset Valuation: Information on the value of different assets, such as securities, real estate, and alternative investments that are frequently obtained from financial databases and valuation firms.

2. Data Pipelines

Data pipelines are used to route data from the above-mentioned sources. To prepare the data for additional analysis, these pipelines manage its ingestion, cleansing, and structuring.

3. Embedding Model

An embedding model processes the prepared data, transforming the textual material into vectors- numerical representations that AI algorithms can comprehend. These models can also be applied to visual content, where ai image editing helps extract and convert image-based data into useful vector formats.

4. Vector Database

To facilitate effective querying and retrieval the created vectors are kept in a vector database. Weaveit, pinecone, and PGvector are notable vector database examples.

5. Plugins and APIs

Serp, Zapier, Wolfram, and other APIs and plugins are essential for typing together various parts and providing extra features. They make it easier to do things like retrieve additional info or carry out particular operations easily.

6. Layer of Orchestration

This is essential for workflow management. This layer is exemplified by ZBrai, which handles interactions with other APIs by identifying when calls to the API are required, streamlines prompt chaining, retrieves contextual information within vector databases, and maintains a memory across several LLM calls.

7. Execution of Queries

When a user sends an inquiry to the portfolio management software, the retrieval of data and generating process begins. This inquiry may include many topics pertinent to the target business, including operational hazards, legal compliance status, and financial health.

8. Output

Using the query and the information it has received the LLM produces an output. This output can take many forms, including factual information summaries, risk assessments, or draft report creation.

9. Management of Portfolio App

The user is thereafter shown the verified output via the portfolio management app. It serves as the central application where all information, analysis, and insights come together and display the results in an approachable manner for decision-makers.

10. Feedback Loop

Another essential component of this architecture is user input on the LLM’s output. Over time, this feedback loop improves the LLM’s output relevancy and accuracy.

11. Agent

By incorporating AI agents within this structure, complicated issues can be resolved, interactions with the outside world can be facilitated, and post-deployment experiences can improve learning. They accomplish this by using sophisticated planning and reasoning strategies, smart tool use, and the power of memory, recursion, and introspection.

12. LLM Cache

To speed up the AI system’s response time, frequently visited data can be cached using programs like Redis, GPTcache, or SQLite.

13. Logging/LLMOps

To record actions and track performance, LLM operations (LLMOps) tools including weights&biases, MLFlow which Helicone and prompt layer are used during this phase. This guarantees that LLMs are operating at their best and that feedback loops are continuously improving.

14. Validation

The output of the LLM is verified via a validation layer. Tools like LMQL, Guardrails, Rebuff, and Guidance are used to achieve this, guaranteeing the dependability and correctness of the data supplied.

15. LLM APIs Hosting

The application’s hosting and portfolio management responsibilities depend heavily on LLM APIs and hosting platforms. Developers have the option of using open-source models or LLM APIs from firms such as OpenAI and Anthropic, depending on their needs.

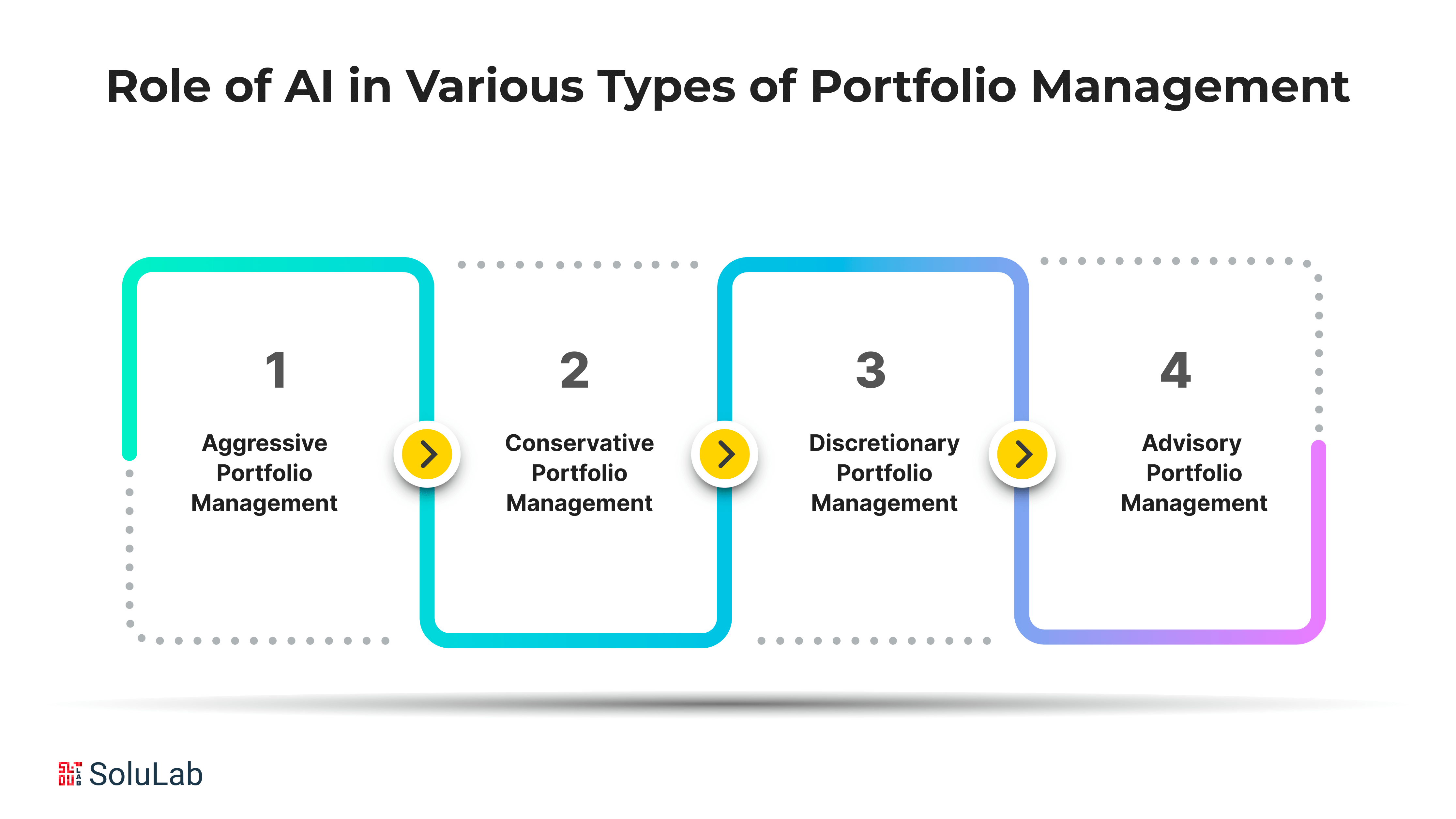

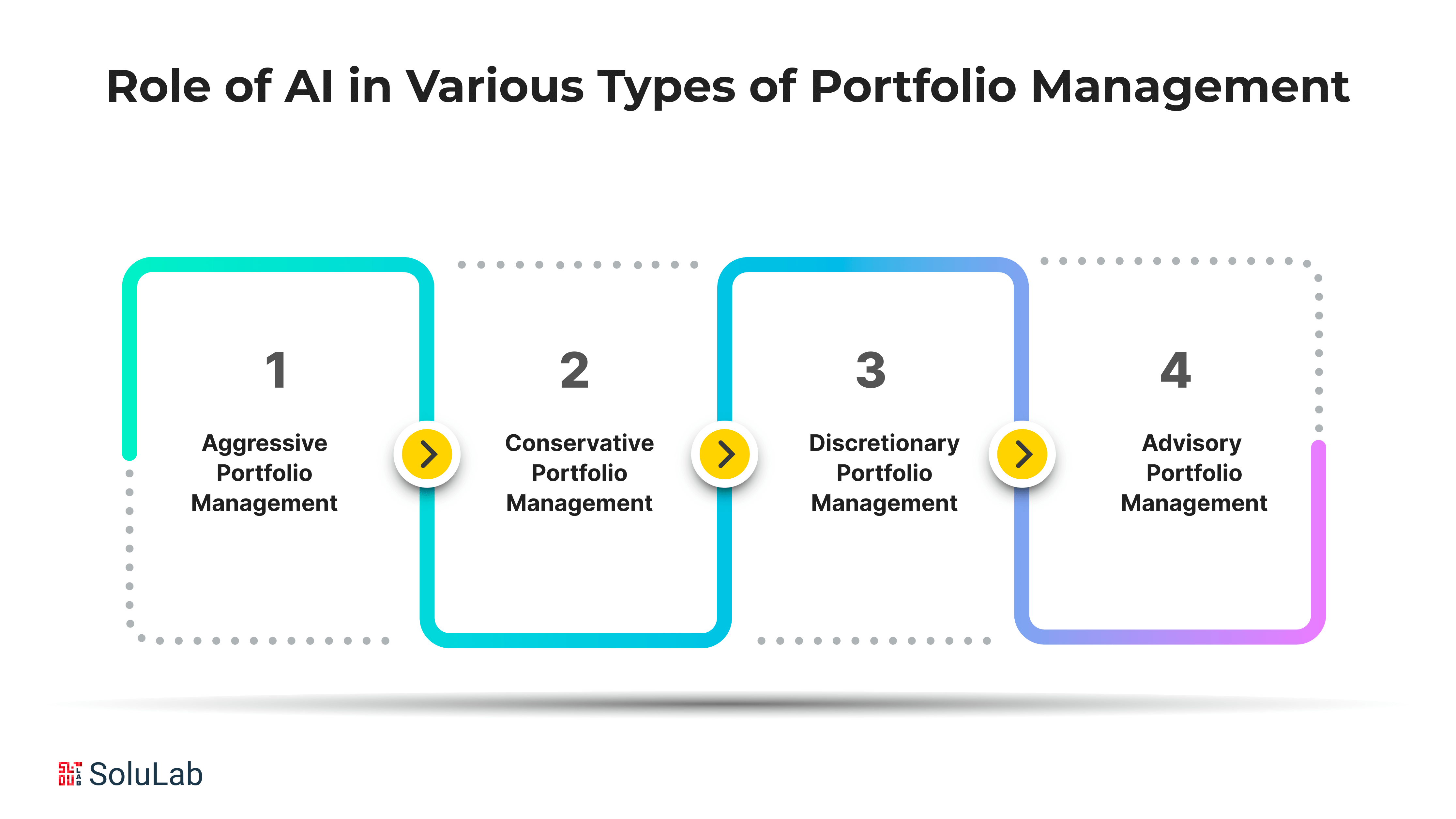

What is the Role of AI in Various Types of Portfolio Management?

AI plays an important part in many forms of portfolio management, providing specific advantages in each approach:

1. Aggressive Portfolio Management

This strategy focuses on maximizing profits. Portfolio managers engage in extensive trading to profit from discounted stocks that are acquired and then sold when their value rises. The major focus is on great growth potential and capital appreciation. AI helps with aggressive portfolio management by using powerful algorithms to rapidly examine enormous amounts of financial data. These algorithms can locate inexpensive stocks, forecast market trends, and execute transactions quickly, supporting portfolio managers in making investment decisions that optimize profits. AI’s data analysis skills assist in identifying possibilities for purchasing inexpensive stocks and selling them when their value rises.

2. Conservative Portfolio Management

This strategy is based on a set profile that corresponds to current market trends. Portfolio managers invest in assets like index funds, which provide lower but more stable returns. This strategy is designed to provide stability and a consistent, long-term profitable outlook.

AI investments help conservative portfolio management by offering insights into low-risk investing opportunities. AI algorithms can find index funds or low-risk assets that meet the aim of consistent, predictable returns. AI models can generate more stable portfolios that are more resistant to market volatility, resulting in a fixed profile that may appeal to investors looking for stability.

3. Discretionary Portfolio Management

Portfolio managers are given flexibility in making investment choices on behalf of investors. They adjust investing strategies to the investor’s objectives and risk tolerance. The manager can select appropriate investment strategies that match the investor’s objectives.

AI in investment management plays an important part in discretionary management by providing tailored investment recommendations. AI algorithms may use an investor’s financial goals, risk tolerance, and preferences to generate personalized portfolios. They can also continually modify the portfolio to changing circumstances, optimizing it to fit the investor’s requirements.

4. Advisory Portfolio Management

Portfolio managers assist with investment options, but the final decision rests with the investors. The choice is up to the investors to decide whether to accept or reject the advice given. Before making decisions, financial experts advise you to carefully analyze the merits of the professional portfolio manager’s recommendations.

AI in asset management can improve advisory portfolio management by delivering data-driven recommendations. AI systems can examine large volumes of financial data and market information in order to provide investment suggestions. These recommendations might help investors decide whether to accept or reject professional portfolio managers’ advice. AI can also assist track and analyzing the success of advised investments.

Real-World Use Cases

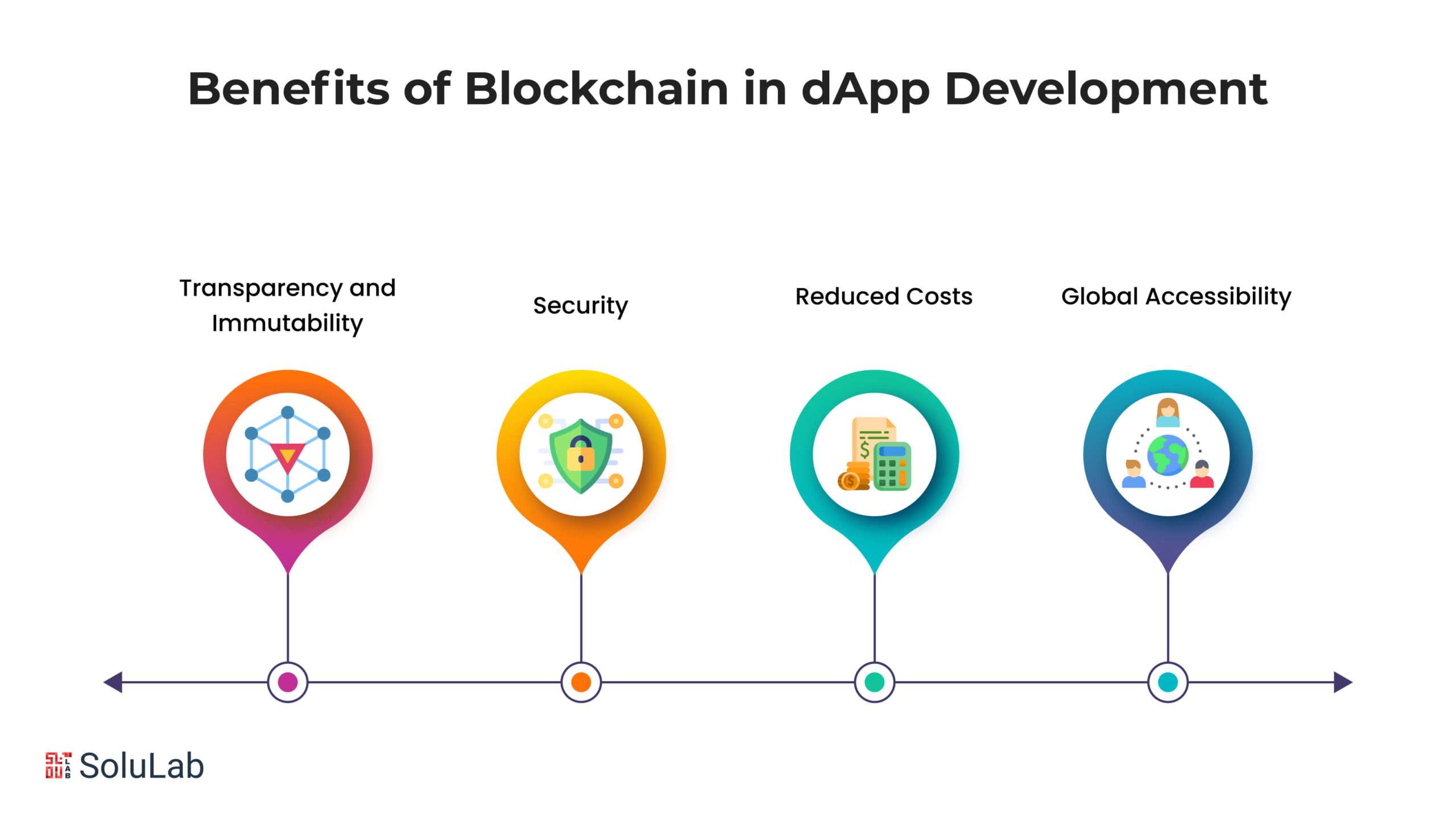

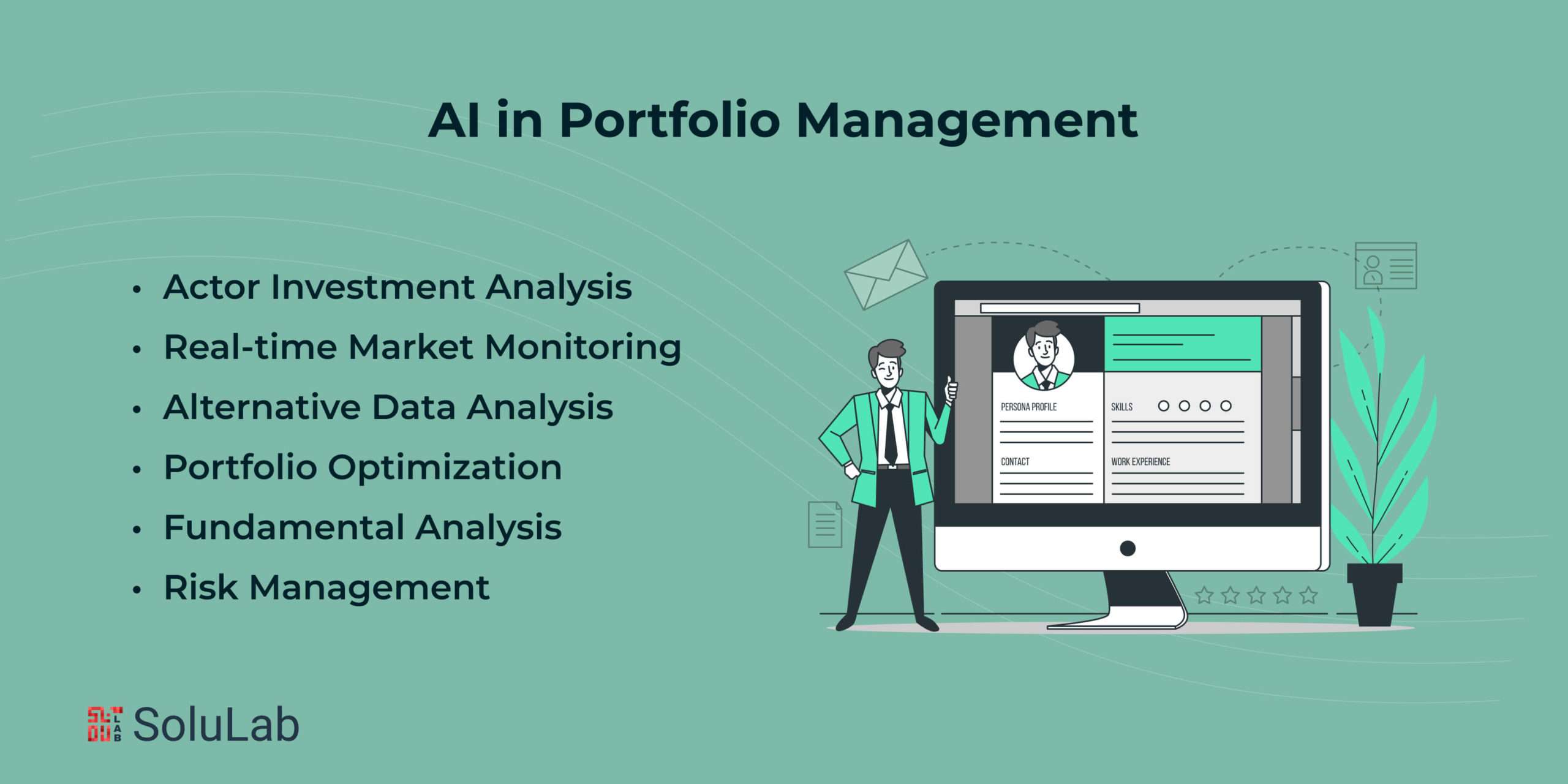

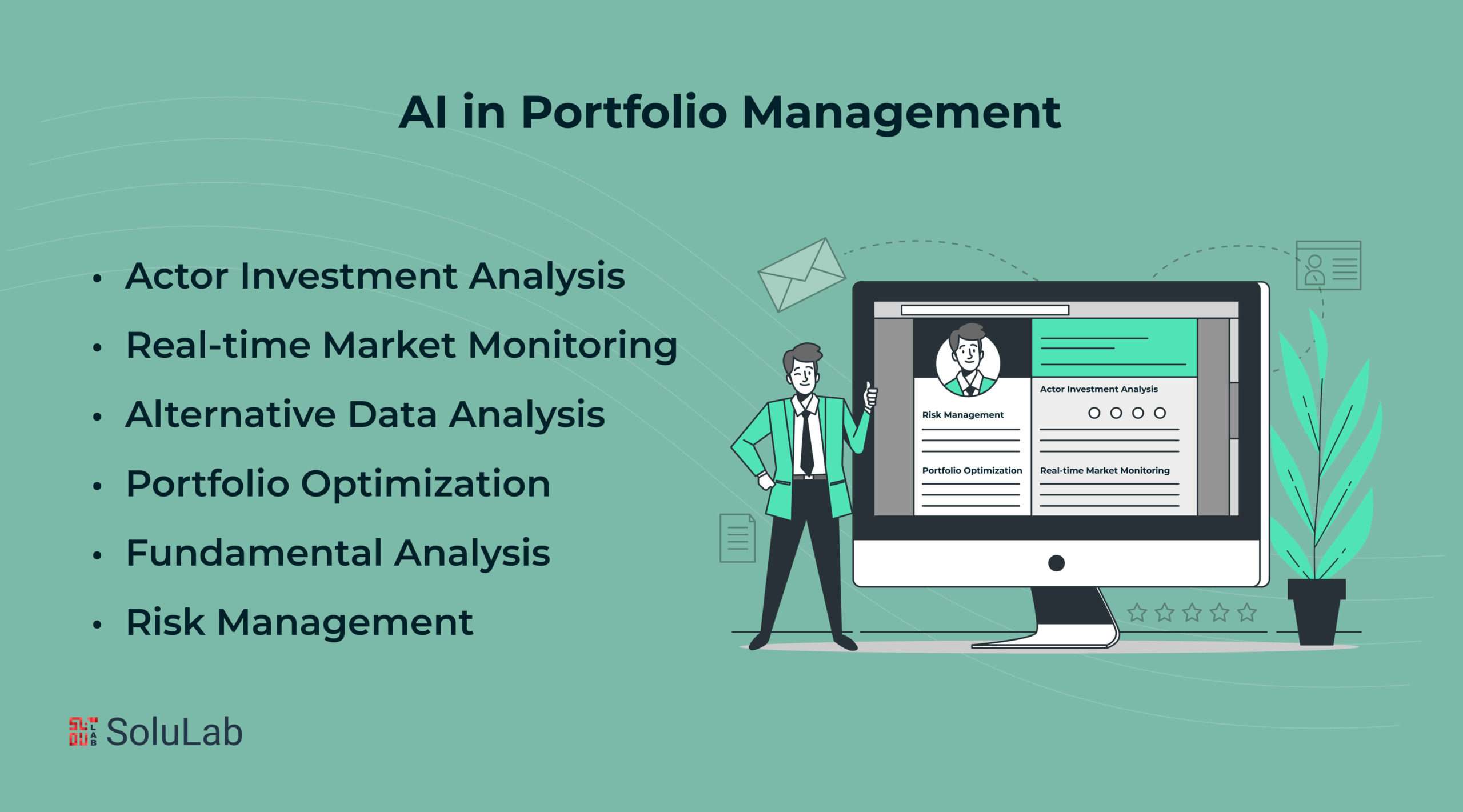

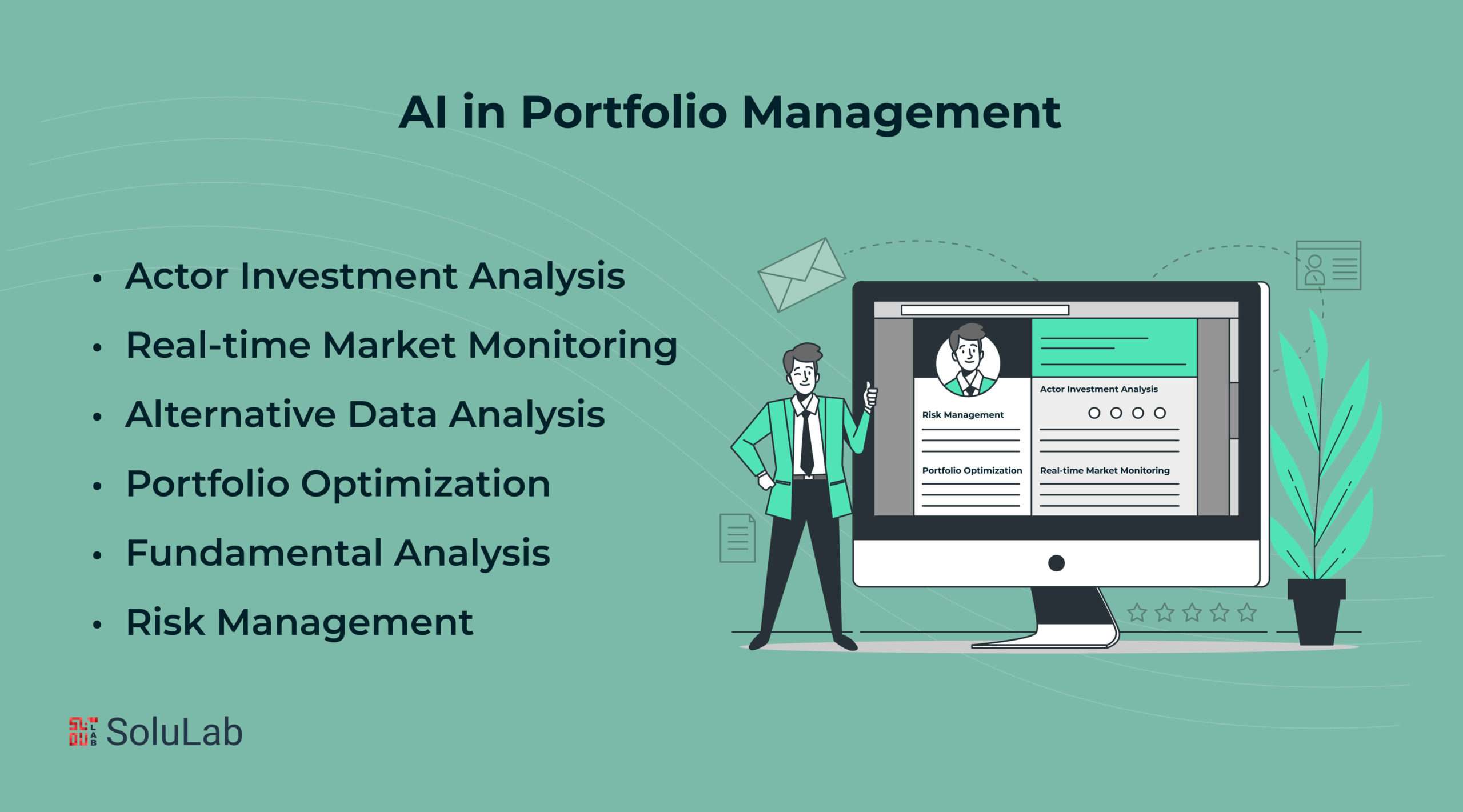

These are the major real-world use cases of AI in portfolio management:

1. Allocation of Assets

AI greatly facilitates the dynamic management of strategic asset allocation according to personal characteristics like age, risk tolerance, and shifting market conditions. AI examines enormous datasets using predictive analysis and ML to suggest and modify the best combination of asset classes for a portfolio owned by an investor.

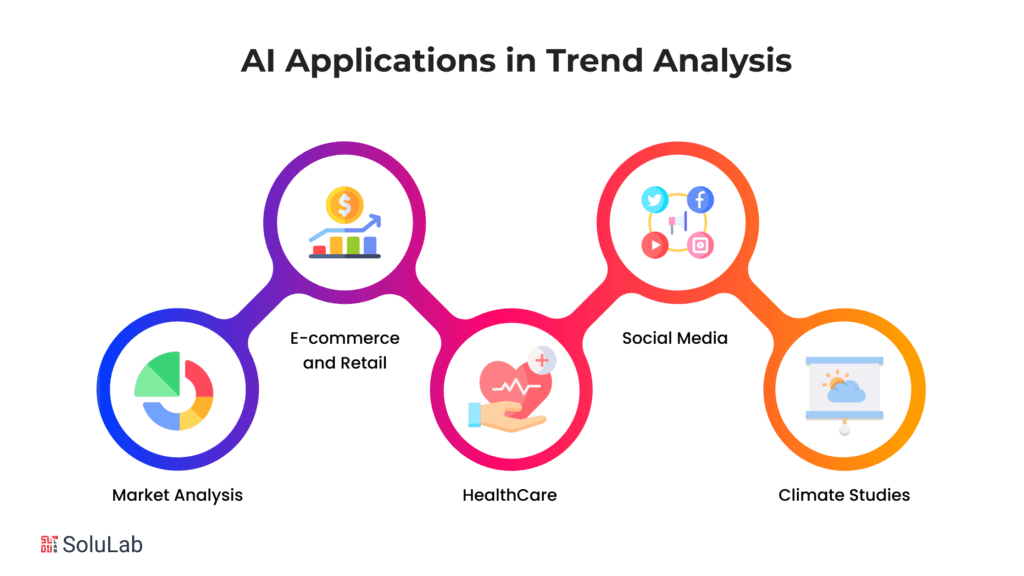

2. Monitoring Market real-time

AI’s real-time market monitoring constantly examines a variety of sources, including market data, social media, and news. AI swiftly recognizes new events and trends that may have an impact on investing choices by utilizing natural language processing and ML. This makes it possible for portfolio managers to react quickly to shifts in the market, improving their decision-making with up-to-date information.

3. Analysis of Factor Investing

Creating portfolios based on particular characteristics such as quality, size, value, and volatility is known as factor investing. By identifying and assessing these aspects through the analysis of market trends and historical data, AI improves this process. AI makes it possible to build more accurate and well-informed portfolios by identifying the variables that have historically resulted in higher returns or reduced risk.

4. Strategies for Dynamic Hedging

To create strategies for dynamic hedging that adjust to shifting market conditions, AI is essential. AI helps reduce possible losses by controlling portfolio position risks and modifying hedging strategies in real time, improving all-time performance and stability.

Artificial Intelligence Use Cases in Portfolio Management

The use of artificial intelligence in portfolio management has been increasingly applied to enhance decision-making processes, improve efficiency, and optimize investment strategies. Some use cases of AI in portfolio management include:

1. Factor Investment Analysis

Factor investing involves building portfolios based on certain criteria such as value, size, momentum, quality, or volatility. AI can assist in identifying and evaluating these elements by analyzing historical data, market patterns, and correlations. It helps to optimize investing strategies by identifying which elements have historically contributed to better returns or lower risk, allowing for more informed and accurate portfolio creation.

AI enables investors to examine each factor’s historical relevance in terms of return generation or risk management. AI may use machine learning algorithms to evaluate complex interactions between numerous components and how they function in a variety of market scenarios. This research allows investors to make better-educated judgments when selecting and weighing elements in their portfolios.

2. Real-time Market Monitoring

AI’s real-time market monitoring entails continually evaluating several sources, such as news, social media, and market data. AI can quickly discover developing trends, news, or events that may have a substantial influence on investing decisions using machine learning and natural language processing applications. This functionality helps portfolio managers to respond quickly to market developments and make sound decisions according to current data. For example, AI may detect swings in consumer mood, geopolitical developments, or breaking news that may affect certain sectors or businesses. By quickly detecting these key elements, AI helps investors gain timely insights, allowing them to alter their investing approaches or portfolio allocations as needed.

The capacity to analyze and comprehend real-time data quickly offers investors a competitive advantage when responding to market changes or unexpected developments. Investment professionals may keep up-to-date on the newest information by employing AI’s monitoring skills across several data sources, boosting their ability to make nimble and educated investment choices.

3. Alternative Data Analysis

AI’s capacity to evaluate alternate data sources, such as social media sentiment toward a certain brand, yields extra insights. AI can identify patterns or connections that conventional financial research may miss. This helps to make better-educated investing selections based on a larger set of facts.

Including these unorthodox data sources broadens investing methods by offering a more complete picture. This augmentation allows investors to respond more quickly to market changes, revealing possibilities and threats that traditional financial research may ignore. AI’s ability to analyze and comprehend alternative data augments traditional methodologies, increasing the depth and reliability of investment decision-making.

Read Blog: Use Cases Of AI Agents

4. Portfolio Optimization

AI substantially assists portfolio optimization by using advanced algorithms to successfully balance risk and return. AI algorithms can determine the best mix of risky and safe assets based on an investor’s risk tolerance by evaluating massive datasets. AI tries to produce the best portfolio by increasing the Sharpe ratio, which increases profitability relative to risk.

Using predictive analytics and historical data, AI Portfolio evaluates alternative investment situations, identifying patterns and connections that human research may miss. It gives insights into diversification methods and appropriate asset allocations while taking into account market circumstances and individual risk profiles. This helps investors and portfolio managers make more educated and data-driven decisions, resulting in greater risk-adjusted returns and an enhanced overall portfolio.

5. Fundamental Analysis

AI approaches are useful for quickly organizing textual research from economic reports, yearly reports, and other relevant publications. This relieves portfolio management specialists of the burden of significant research, allowing them to spend more time executing data-driven choices.

Furthermore, AI portfolio management can detect hidden connections and pick stocks that are likely to outperform or underperform based on these links. However, it’s crucial to remember that not all trading decisions are based simply on statistics. AI lacks human intuition, particularly in terms of emotional intelligence while trading. In some trading circumstances, human professionals have an advantage over AI due to their emotional nature.

6. Risk Management

AI helps to manage portfolio risk by leveraging sophisticated analytics and data-driven insights. AI-driven risk assessment algorithms measure an investor’s risk tolerance using a variety of parameters such as age, financial objectives, income stability, and costs, resulting in a more precise risk profile. AI helps with diversification by using advanced algorithms to examine and propose various asset allocations. AI uses machine learning to recommend effective diversification techniques, which disperse assets across diverse asset classes and risk levels, lowering total portfolio risk.

Furthermore, AI-powered platforms offer individualized investing options. It provides a variety of fund alternatives and portfolio techniques, allowing investors to tailor their portfolios to their risk preferences. AI algorithms continuously monitor market developments, enabling rapid fund swaps to maximize returns while considering risk.

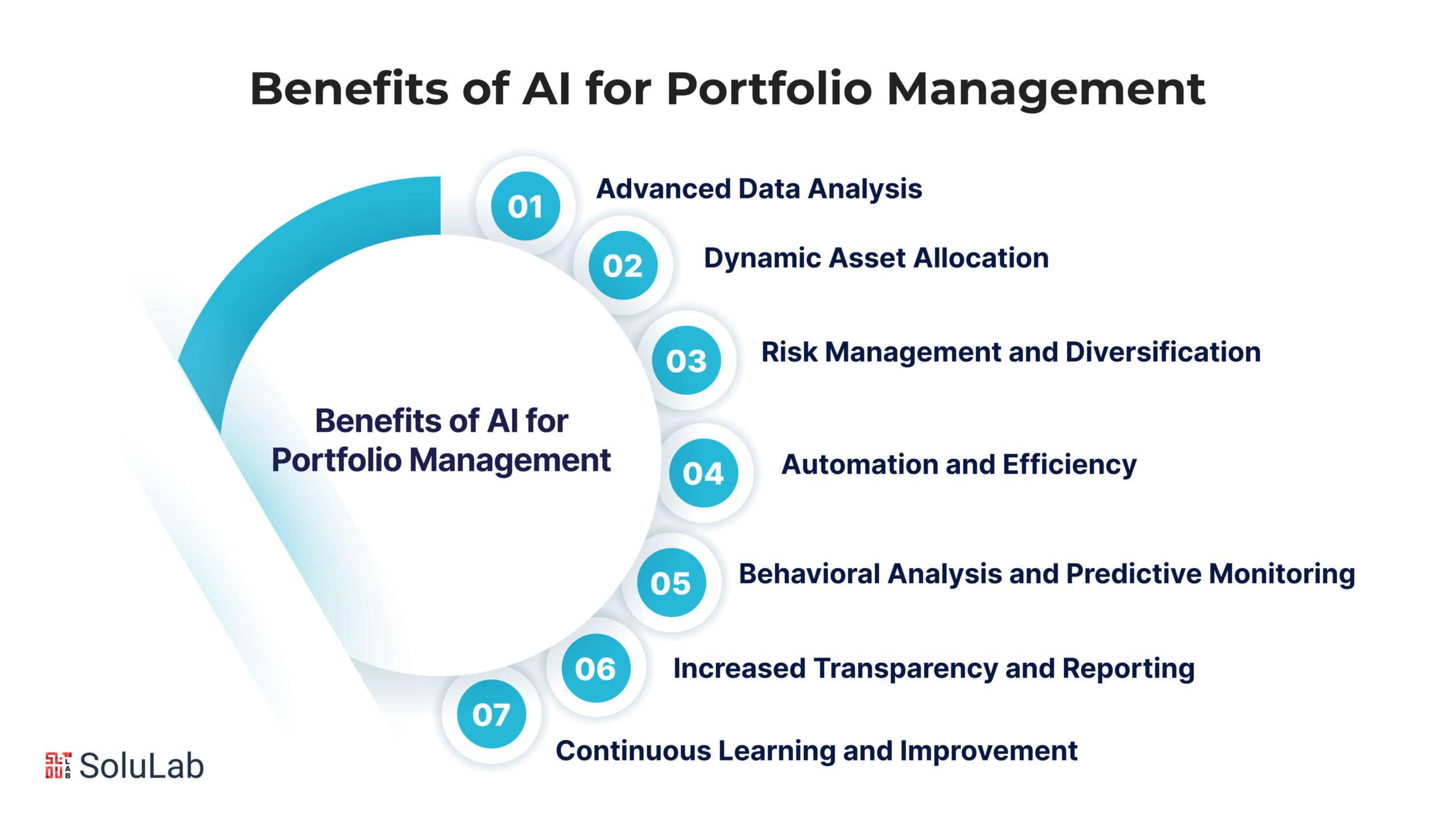

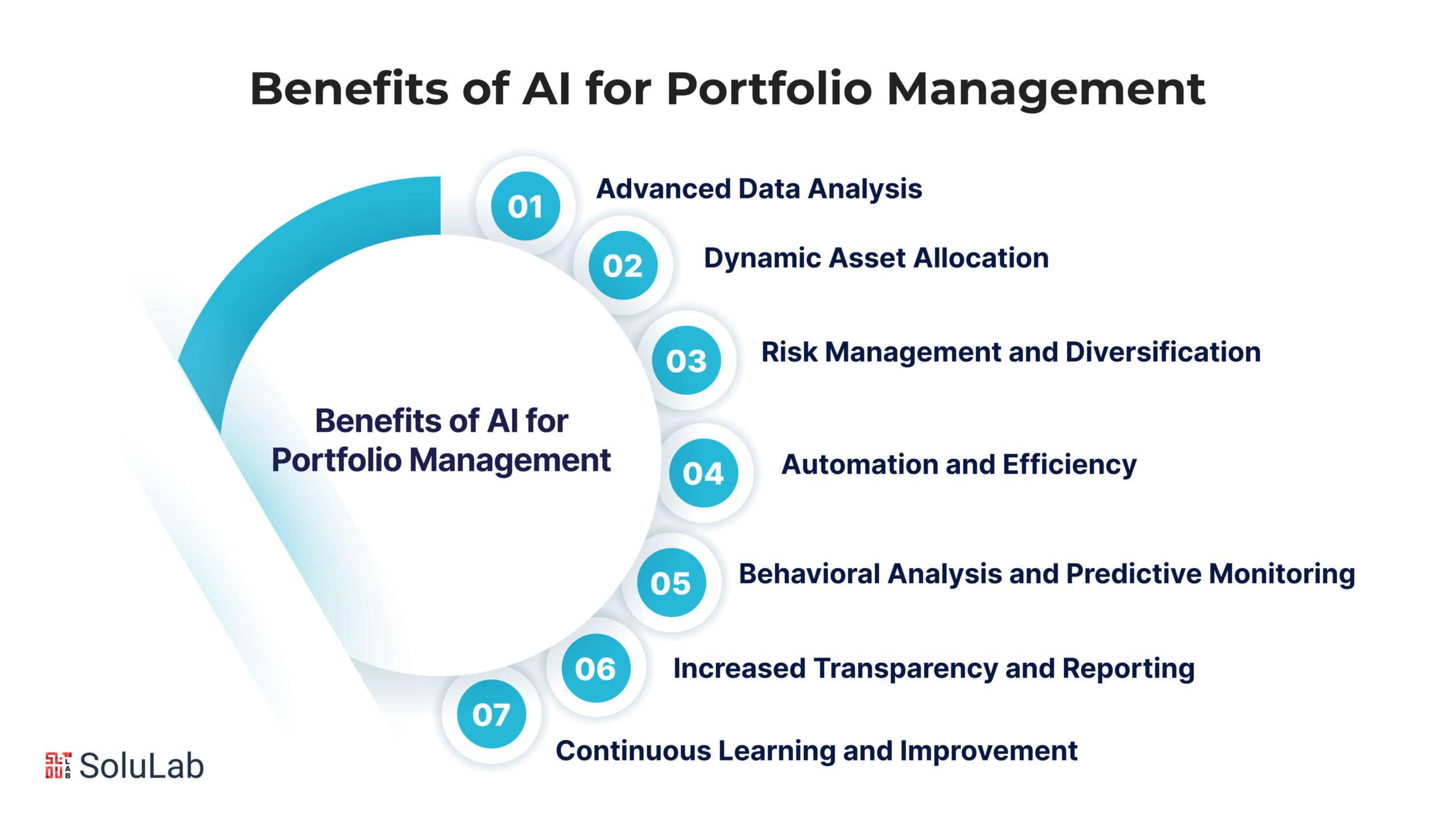

Benefits of AI for Portfolio Management

Let’s look at the advantages AI provides to portfolio management, emphasizing how it improves several elements of this financial activity.

1. Advanced Data Analysis: AI in portfolio management uses strong algorithms to examine large datasets, detecting patterns, trends, and correlations that human analysts may not see right away. AI can make better investing judgments by analyzing large amounts of financial data, economic indicators, news, and other sources.

Read Also: Generative AI for Data Analysis and Modeling

2. Dynamic Asset Allocation: AI can constantly monitor market circumstances and investor choices in order to automatically divide assets in a portfolio. This versatility allows for quick modifications in reaction to changing market circumstances, ensuring that the portfolio aligns with the investor’s goals and risk tolerance.

3. Risk Management and Diversification: AI diversifies portfolios by discovering correlations across asset classes, hence reducing total risk exposure. Its examination of asset interrelationships enables strategic allocation, which reduces the portfolio’s exposure to market volatility and increases its resilience.

4. Automation and Efficiency: Artificial intelligence (AI) simplifies typical portfolio management processes such as portfolio rebalancing, transaction execution, and investment monitoring. This automation allows managers to concentrate on higher-level plans and decision-making.

5. Behavioral Analysis and Predictive Monitoring: AI may also use behavioral analysis and predictive modeling to study investor behavior patterns and forecast probable market moves. This can help make more targeted financial decisions and manage portfolios in a more personalized way.

6. Increased Transparency and Reporting: High-quality AI-powered systems provide clear, comprehensive reports that give useful insights into portfolio outcomes, make benchmark comparisons easier, and explain the reasoning behind investment decisions. This transparency builds confidence and allows investors to better understand and follow their investments.

7. Continuous Learning and Improvement: AI systems may learn from their experiences and improve with time. They may change and evolve in response to new data inputs, market conditions, and performance feedback, always improving their investing methods.

AI’s function in portfolio management is to use technological advances in data analysis, machine learning, and automation to improve investment decisions, risk management, and portfolio performance. Its capacity to manage enormous volumes of data and run complicated analyses gives it a crucial edge in generating trained, dynamic investment decisions.

Final Words

Integrating AI in portfolio management has altered the way investment choices are made. AI has accelerated the processing of massive and diversified information, improving decision-making by offering useful insights into market patterns and new investment possibilities. AI’s flexibility to rapidly changing market circumstances has made it a vital tool for trading firms, allowing them to handle volatility, increase risk management, and ultimately boost profitability and performance.

As we approach a new era in portfolio management, the adoption of AI is more than a fad; it is a critical strategy for anyone looking to stay ahead in the competitive world of finance. The future contains significant AI developments and innovations, presenting a unique opportunity for those implementing AI portfolio management.

SoluLab, as a leading AI development company, offers tailored solutions for portfolio management leveraging modern AI technologies. With a team of seasoned AI developers, SoluLab empowers financial institutions to harness the power of AI for risk assessment, predictive analytics, and portfolio optimization. By integrating advanced AI algorithms, including machine learning and natural language processing, SoluLab enables clients to gain actionable insights from vast amounts of data, enhance decision-making processes, and maximize investment returns. Whether it’s developing custom AI-driven trading algorithms or implementing robo-advisory services, SoluLab provides end-to-end AI solutions tailored to clients’ specific needs. Hire AI developers from SoluLab today to revolutionize your portfolio management strategies and stay ahead in today’s dynamic financial markets. Contact us now!

FAQs

1. How can AI enhance portfolio management strategies?

AI can enhance portfolio management strategies by leveraging advanced algorithms to analyze vast amounts of data, identify patterns and trends, assess risk factors, optimize asset allocation, and make informed investment decisions. With AI, portfolio managers can gain deeper insights, improve decision-making processes, and achieve better risk-adjusted returns.

2. What are some common AI techniques used in portfolio management?

Common AI techniques used in portfolio management include machine learning, natural language processing (NLP), predictive analytics, sentiment analysis, and algorithmic trading. These techniques enable portfolio managers to analyze market data, assess investor sentiment, identify trading opportunities, and optimize portfolio allocations.

3. Can AI predict market movements accurately?

While AI can analyze historical market data and identify patterns that may indicate future market movements, it’s important to note that predicting market movements with absolute accuracy is challenging. Market dynamics are influenced by various factors, including economic indicators, geopolitical events, and investor behavior, which may be unpredictable. However, AI can provide valuable insights and assist in making more informed investment decisions.

4. How can SoluLab help integrate AI into portfolio management?

SoluLab, as a leading AI Agent development company, offers tailored solutions for portfolio management. With a team of experienced AI developers, SoluLab can develop custom AI algorithms and applications to address specific needs in portfolio optimization, risk assessment, algorithmic trading, and robo-advisory services. By leveraging SoluLab’s expertise in AI development, financial institutions can enhance their portfolio management strategies and stay competitive in today’s dynamic markets.

5. Is AI suitable for all types of portfolios?

AI can be beneficial for various types of portfolios, including individual investor portfolios, institutional portfolios, hedge funds, and asset management firms. Whether managing large diversified portfolios or focusing on specific asset classes, AI techniques can be customized to suit different investment strategies and objectives. However, the implementation of AI in portfolio management should be carefully tailored to specific requirements and regulatory considerations.