In recent times, people have been losing faith in the traditional banking system. Often the clients get caught in the web of fraudulent practices. It is precisely the situation where the decentralized banking has gained its importance. However, if we trace the history of decentralizing, this concept is not completely new.

The system was present in the early trading relations where people used to trade without involving any middlemen. The same concept has evolved in the present times and is effectively used in decentralized banking. Improvement in technology has made transactions in the bank much easier.

The decentralized bank got prominence in July 2018 when crypto exchange Binance declared to invest in Founder’s Bank. It emerged to become the world’s first decentralized and community-owned bank. On receiving its European Union Bank License, it will permit all other market participants to become its co-founders. They will eventually adopt a blockchain governance model.

The core work of a decentralized bank is to lend cryptocurrencies by effectively employing blockchain technology. In such a bank, there is no existence of middlemen. Rather, there are smart contracts and peer-to-peer services to ensure its smooth functioning. The lenders and borrowers from any part of the world can become a member of this banking system. All you need is to have a mobile phone and a laptop or desktop with a good internet connection. With these, you are all set to become a member of a decentralized bank.

What is Decentralized Banking?

To understand the concept of decentralized banking, it is essential to have clarity on the idea of ‘Decentralizing’. It permits people to engage directly in trade relations. It employs the user’s computers instead of depending on the centrally-controlled servers of the company.

Decentralizing is a self-regulating system that functions without an organized center or authority. In terms of banking, it completely negates the interference of the third party between two clients and ensures the smooth functioning of the transaction process with the help of agreements directly via computers and the internet.

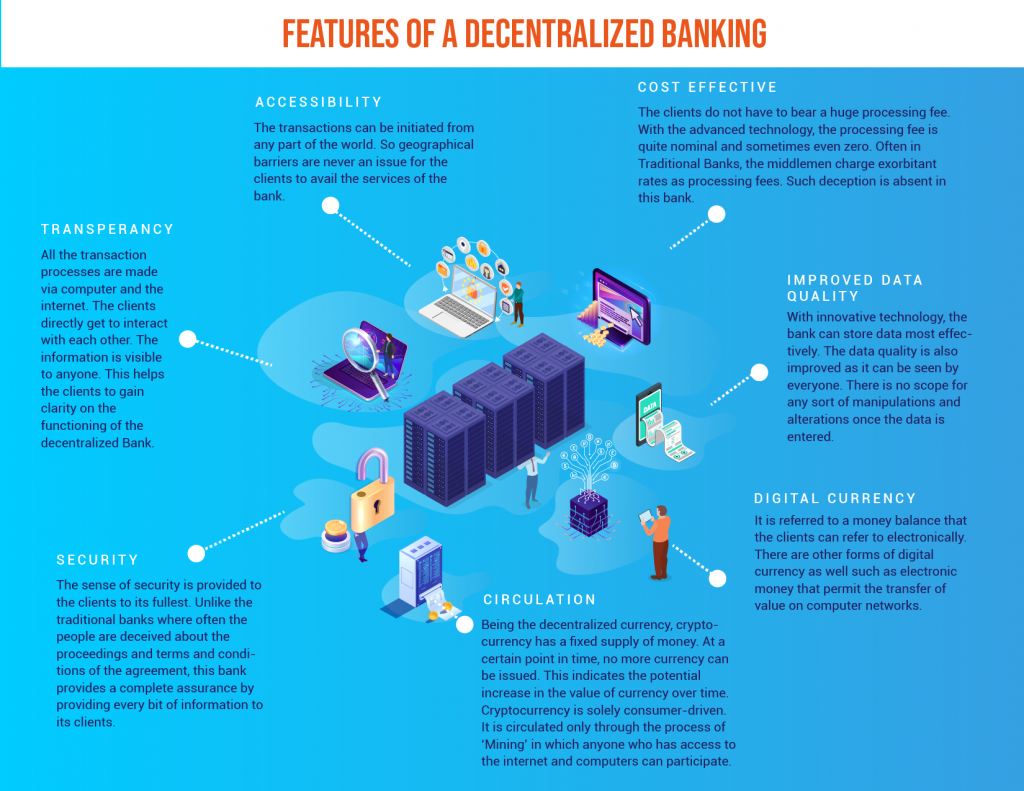

Features of a Decentralized Banking!

Here are few of the major features of a decentralized bank.

- Transparency – All the transaction processes are made via computer and the internet. The clients directly get to interact with each other. The information is visible to anyone. This helps the clients to gain clarity on the functioning of the decentralized Bank.

- Accessibility – The transactions can be initiated from any part of the world. So geographical barriers are never an issue for the clients to avail the services of the bank.

- Improved data quality – With innovative technology, the bank can store data most effectively. The data quality is also improved as it can be seen by everyone. There is no scope for any sort of manipulations and alterations once the data is entered.

- Security – The sense of security is provided to the clients to its fullest. Unlike the traditional banks where often the people are deceived about the proceedings and terms and conditions of the agreement, this bank provides a complete assurance by providing every bit of information to its clients.

- Cost-Effective – The clients do not have to bear a huge processing fee. With the advanced technology, the processing fee is quite nominal and sometimes even zero. Often in Traditional Banks, the middlemen charge exorbitant rates as processing fees. Such deception is absent in this bank.

- Digital Currency – It is referred to a money balance that the clients can refer to electronically. There are other forms of digital currency as well such as electronic money that permit the transfer of value on computer networks.

- Circulation – Being the decentralized currency, cryptocurrency has a fixed supply of money. At a certain point in time, no more currency can be issued. This indicates the potential increase in the value of currency over time. Cryptocurrency is solely consumer-driven. It is circulated only through the process of ‘Mining’ in which anyone who has access to the internet and computers can participate.

Difference between Decentralized Banks and Traditional Banks?

The major point of difference between decentralized banks and traditional banks is the presence of middlemen in the operating process. Traditional banks cannot operate without the involvement of intermediaries. They do not provide their clients with financial freedom. Their technology is not that well advanced to ensure the democratization of the financial systems. Whereas, in a decentralized bank, a sense of lucidity and transparency remains because of the lack of intermediaries.

Technology behind Working of Decentralized Banking.

Let us delve a bit deeper into the topic to understand the technology involved in the working of a decentralized bank.

Blockchain Technology

The concept of Blockchain technology needs to be understood in terms of the function of the database. Blockchain is a type of database that differs from the common type of database in the sense that the data is arranged chronologically in the form of blocks and accordingly, a chain is created.

Various categories of information can be stored in blockchain but it is most commonly used in ledger transactions. It is the prime technology by which the Decentralised Banks work. This technology helps in recording all the transactions by maintaining transparency.

A particular entity cannot control the blockchain data. All the users can control and see the data. The borrower does not have to rely on any middlemen to get the information and details. The blockchain is immutable.

The data once entered in the blockchain cannot be altered, reversed, or manipulated. Once the data is entered, it remains permanently and anyone can view it. Its structured storage of information and transparency are the key ingredients to the success of decentralized banking.

Smart Contracts

These are the programs stored in a blockchain that function only when a set of conditions are met. They ensure the smooth initiation and completion of an agreement. This immediacy gives the clients a better understanding of the terms and conditions of the agreement.

In a decentralized bank, smart contracts make a proper and transparent display of the various terms and conditions of the agreement. These terms are written further into lines of code. The line of code controls the entire agreement process. Though the transaction process cannot be altered once done, it can be tracked. Without middlemen, they ensure smooth working of the borrowing and lending processes, even across borders.

P2P Systems

The term ‘P2P’ stands for “Peer to Peer”. The “Peer to Peer” system forms the base of the Decentralised Bank. It ensures the direct fund transaction between two strangers without the involvement of any intermediaries. So, the possibility of interference of the middlemen stands zero. It ensures that the clients can take financial decisions independently.

Peer to Peer platforms bring a wide range of services to their clients such as payment processing, information regarding buyers and sellers, and quality assurance. Unlike the traditional banks where information is suppressed, it provides a clear idea about its functioning to its customers. Some of these services do not even involve a transaction fee. They primarily aim to bring all the clients on the same platform so they can work collectively.

Click to know more about the Decentralized p2p exchange!

Working Procedure of a Decentralized Bank!

A Decentralized bank initiates the lending process just like the traditional banks. Though the function is the same in both types of banks, there are differences in their working process. In traditional banks, the middlemen play a vital role in influencing the decision of the lenders.

The fund owners do not have a say regarding the way of utilization of the funds. The intermediaries decide on the sanctioning of the loans to the clients. Moreover, there is also an issue of geographical hindrance in the case of traditional banks.

With technological innovations, a decentralized bank has made the lending process quite an easy one. Primarily, there are no geographical barriers that can cause hindrance to the lending process. The clients can lend money and initiate transactions from anywhere in the world. There is absolutely no concept of an office building. All the processes are initiated through computers and an internet connection.

Secondly, a decentralized bank provides full freedom to its clients. As there are no middlemen, no one can impose or influence the decision of the clients. They are independent to take their own financial decisions as per their level of comfort.

Thirdly, the transaction process and the terms of the agreement are completely transparent. It is to make sure that the clients do not feel insecure about investing their funds or lending money from these banks.

It never conducts any meetings on the topic of approving or disapproving the loans. The process of sanctioning is quite fast and easy, unlike the traditional banks. There is no one to track the financial history as it is automated. The transaction fees are nominal and sometimes even zero, thereby making it even more beneficial for the customers.

Benefits of Decentralized Banking!

- Generates Trust – A decentralized bank lowers the risk of systemic failure. Decentralization has led to the emergence of digital currencies that is accompanied by user- confidence. The rise in the valuation of cryptocurrencies somewhat reflects the peoples’ fading trust in central banks and the various government-planned schemes. Decentralized banking comes to counter this decreasing trust of the clients and attempt to rebuild the bond that people share with the banking sector.

- Fostering an Open Culture – Decentralisation does not come merely with an innovative technological approach. It promotes an open culture that contributes to economic development. As there are no geographical hindrances, people from all over the world can come on the same platform and work incoherence. It contributes to an open culture as people from various cultures get to meet and even exchange their ideas through the transaction process.

- Giving People Control of their Money – It allows every user to choose the currency in which they want to invest. Some currencies are collapsing around the world mostly due to mismanagement by corrupt elites. With a decentralized bank, people get knowledge about the investment and the lending processes, thereby allowing complete control.

Drawbacks of Decentralized Banks

Every coin has two sides and this banking is no exception. While there are so many benefits associated with it, there are certain cons as well that need to be discussed.

- Lack of Oversight – There are absolutely no interventions and monitoring authorities to look into the issues or errors that a client might commit by mistake. While the middlemen may be dominating in certain cases, they also provide a sort of guidance to those who are not so well-equipped with financial marketing. Such person-to-person guidance is lacking in this banking system. But this is also one of the core pillars of the success of decentralized banking since there is no interference.

- Posing Challenges – Decentralized banking can pose challenges for regulators and legal and legal enforcement. This is quite contrary to the centralized banks who provide the clients a clear path of taking action if the need arises.

Conclusion - Future of Decentralized Banking?

Society, at large, is gradually getting accustomed to the widespread use of technology. Decentralized banks are gaining a lot of popularity with each passing day. The central banks and the governments of various countries are also coming in support of it.

They are recognising the significance and importance of blockchain technology in the banking sector. People are also accepting it wholeheartedly because of its transparent nature. They are trusting it and appreciating the fact that no third party is getting involved in the transaction process.

Decentralized payment methods will also be developed along with the evolution in the domain of banking. Even a small purchase can be met with decentralized payment methods. The users will not be hesitant to invest in cryptocurrencies. Proper knowledge in digital currency will encourage them to invest which will lead to global development of decentralized banking.

SoluLab is one of the top 3 blockchain developers in the world. Reach out to us today for your project’s free consultation.