Visual search powered by AI is changing how we find information. Instead of typing keywords, users can now search using images. This technology helps people find similar products, identify objects, or get more details just by uploading a picture.

From shopping apps to medical tools, visual search is being used in many areas to save time and improve accuracy. They help machines “see” and understand images like humans do.

The image recognition market is projected to reach US$15.37 billion in 2025, growing at ~14.4% CAGR to 34.4 billion USD by 2031.

In this blog, we’ll explore how AI is used in visual search, the top use cases across industries, the key technologies behind it, and more. Whether you’re a tech lover or a business owner, this guide will help you understand it better.

What is AI in Visual Search?

Users can find products using visual product search by uploading an image rather than typing keywords. The system analyzes the image to identify patterns, colors, and shapes using artificial intelligence and machine learning in visual search, and then compares it with related items from a retailer’s catalog.

Let’s understand it with an example: you spot a celebrity wearing a fantastic dress, and you want to find something similar. Instead of struggling with words on a search engine, just upload a picture or take a screenshot. It’s that easy!

But, Why AI In Visual Search?

AI is changing how businesses understand customers. Many big retailers now have their own picture search tools, and major brands are investing in them too. This is making the shopping experience better for everyone.

Other stores are also starting to use similar tools. They want to help customers easily find products by showing them pictures of things they might like. Some brands even experiment with creative platforms that let them generate visual ideas quickly, helping streamline design and marketing workflows.

AI image search is not just for stores. It’s also used in construction and defense. The way it works is simple: when you look for a picture, the system looks at each tiny dot in the image and compares it to dots in other pictures. The best match is then shown to you. With people often short on time to search through products, visual search is a great way for stores to connect with customers. It helps customers quickly find what they want without spending a lot of time looking for it.

The Limitations of Traditional Text Search

Regular text searches often struggle because words can have different meanings or interpretations. This can result in irrelevant search results, especially when people are looking for specific information or products. This makes the search process less efficient. Additionally, traditional text searches face other problems, including:

- Expressing Visual Ideas: Describing visual concepts in words is hard for text searches. People looking for inspiration or trying to identify objects may find it challenging to convey their intent through text alone. This makes the search less effective.

- Precision Issues: Spelling mistakes, synonyms, and language differences can affect the precision of text queries. These issues make it hard for users to find exactly what they’re looking for, causing frustration during the search.

Visual Product Search As a Solution

Visual search, powered by Artificial Intelligence (AI), changes how we find things online. Instead of typing complex searches, you can just upload a picture, making the process faster. This is great for getting quick results in today’s fast-paced digital world.

AI is crucial for making visual search work well. It’s good at understanding images, giving you accurate results. This means you’re more likely to find exactly what you’re looking for, improving your experience.

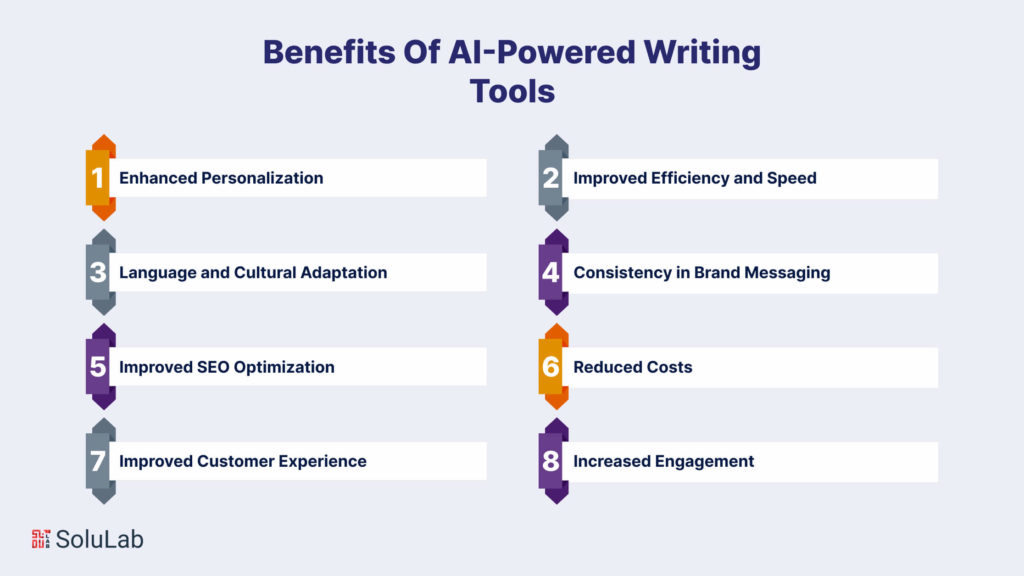

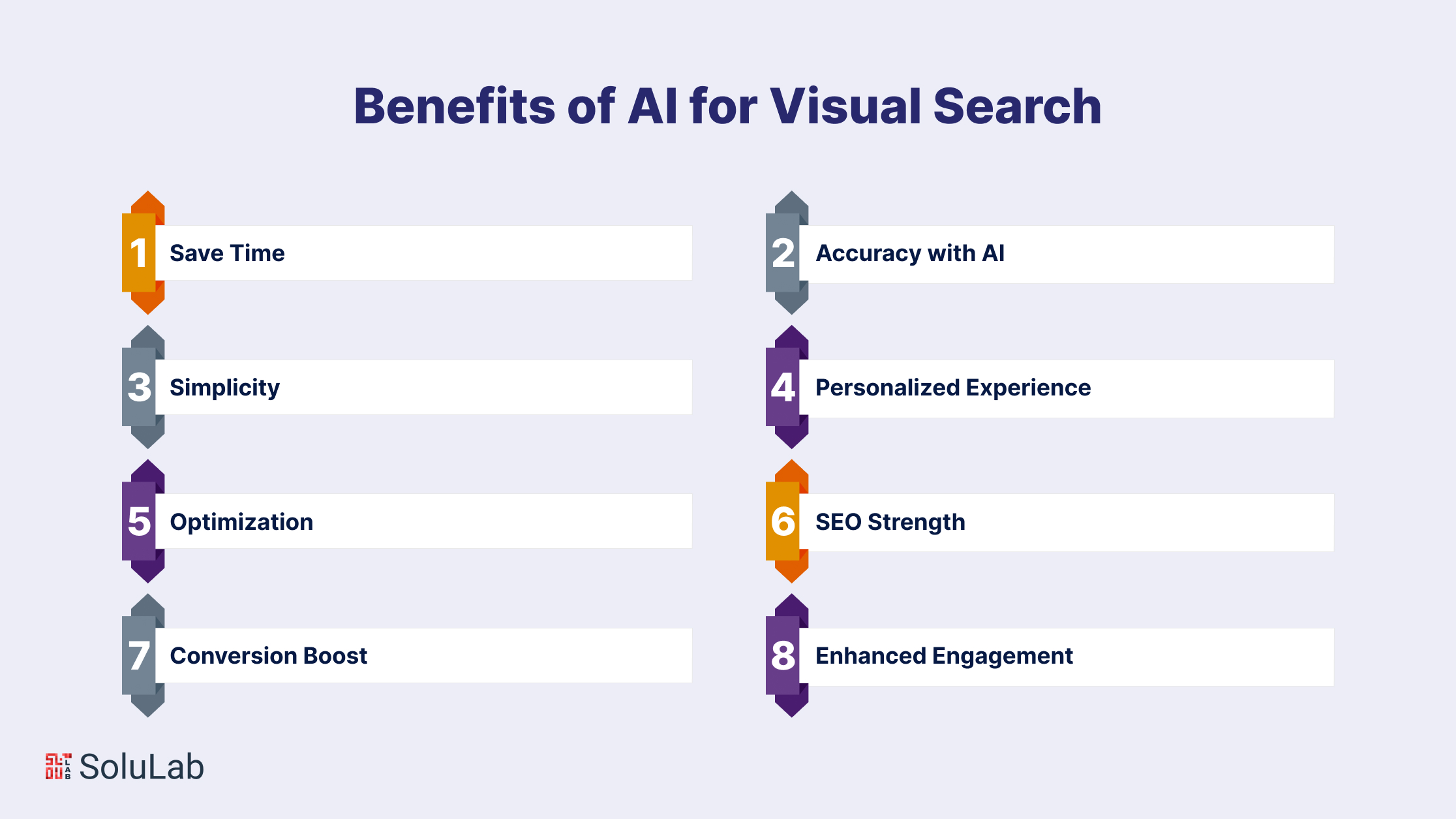

Here are some Benefits of AI for Visual Search in simpler terms:

- Save Time: Visual search emerges as a time-saving marvel in the digital landscape, eliminating the need for the laborious typing of intricate search queries. In an era where speed is of the essence, visual search streamlines the search process, allowing users to obtain rapid results by simply presenting an image. This simplicity not only accelerates the search experience but also aligns with the demands of our fast-paced, digitally-driven world.

- Accuracy with AI: The integration of Artificial Intelligence amplifies the precision of visual search by ensuring a profound understanding of images. AI algorithms meticulously analyze visual data, leading to more accurate and relevant search outcomes. This heightened accuracy significantly enhances the user experience, ensuring that the results align closely with the user’s intent, thereby maximizing the utility of visual search.

- Simplicity: Visual search transcends the limitations of language, enabling users to express themselves visually without the need for elaborate textual descriptions. This simplicity is particularly advantageous when language proves insufficient or acts as a barrier. As a result, Ai using visual search appeals to a diverse user base, fostering inclusivity and accessibility in the realm of online search.

- Personalized Experience: One of the standout benefits of visual search lies in its capacity to learn and adapt to user preferences, providing a tailored and personalized search experience. The AI behind visual search analyzes user behavior and interactions, refining search results based on individual preferences. This personal touch extends beyond the search function, with retailers leveraging visual search to recommend products that align with a user’s unique tastes. Whether through personalized emails or during interactions with the shopping cart, this customization elevates the overall user experience.

- Optimization: Visual search contributes to the optimization of the online shopping journey by simplifying the process for customers. By allowing users to visually explore products, it facilitates a seamless experience, reducing friction in the path to purchase. This optimization is instrumental in enhancing the overall shopping experience, increasing customer satisfaction, and reducing the likelihood of cart abandonment.

- SEO Strength: Integrating visual search into a website enhances its user-friendliness and search engine optimization (SEO). By catering to customers who already have a clear idea of what they want, visual search eliminates the complexities associated with traditional keyword-based searches. This streamlined approach makes the site more user-friendly and increases its visibility on search engines, contributing to improved SEO strength.

- Conversion Boost: Visual search has demonstrated its efficacy in boosting conversion rates and user engagement on eCommerce platforms. By simplifying the process of locating desired products, visual search ensures a quicker and more efficient customer journey. This expedited path to purchase not only enhances customer satisfaction but also translates into tangible increases in conversion rates and engagement metrics.

Related: AI Use Cases and Applications

- Enhanced Engagement: Visual search doesn’t just expedite the search process; it also enhances user engagement through a visually immersive experience. The interactive and dynamic exploration of products captivates users, fostering a deeper connection with the content. This heightened engagement not only retains user interest but also contributes to a more enjoyable and effective online shopping experience. As users actively participate in the visual search process, the overall interaction becomes more meaningful and memorable.

Top Brands Winning with AI-Powered Visual Search

1. Myntra: With Myntra’s visual search function, consumers may upload pictures of clothing or accessories they like, and the AI will immediately recognize comparable products from Myntra’s extensive inventory. Additionally, Myntra’s “My Stylist” tool offers personalized outfit suggestions, making it simple for customers to find matching items and put together whole looks.

2. H&M: Customers can use the H&M mobile app’s visual search feature to find related products by taking pictures of apparel they see in stores or online, or by uploading photos from their phone gallery. Without the need for written explanations, the search function quickly matches photos to H&M’s catalog in a matter of seconds due to artificial intelligence.

3. Google Lens: Launched in 2017, it is a widely used visual search platform available in various applications for Android users. It excels in advanced AI using visual search capabilities, allowing users to combine multiple apps seamlessly. In 2019, a study found Google Lens to have more accurate image recognition technology than other major visual search platforms.

4. Snapchat Camera Search: Introduced in 2018, it enables users to search for Amazon products by recognizing barcodes. Once a barcode is detected, users receive an Amazon card with a link to the product or similar items. Snapchat’s collaboration with Amazon enhances the shopping experience.

5. Amazon StyleSnap: Launched in 2019, it is a visual search app integrated with Instagram. Users can take pictures of desired products within Amazon’s mobile app, receive relevant information, and find similar products. For sellers on Amazon, StyleSnap provides an additional avenue to reach consumers in a competitive market.

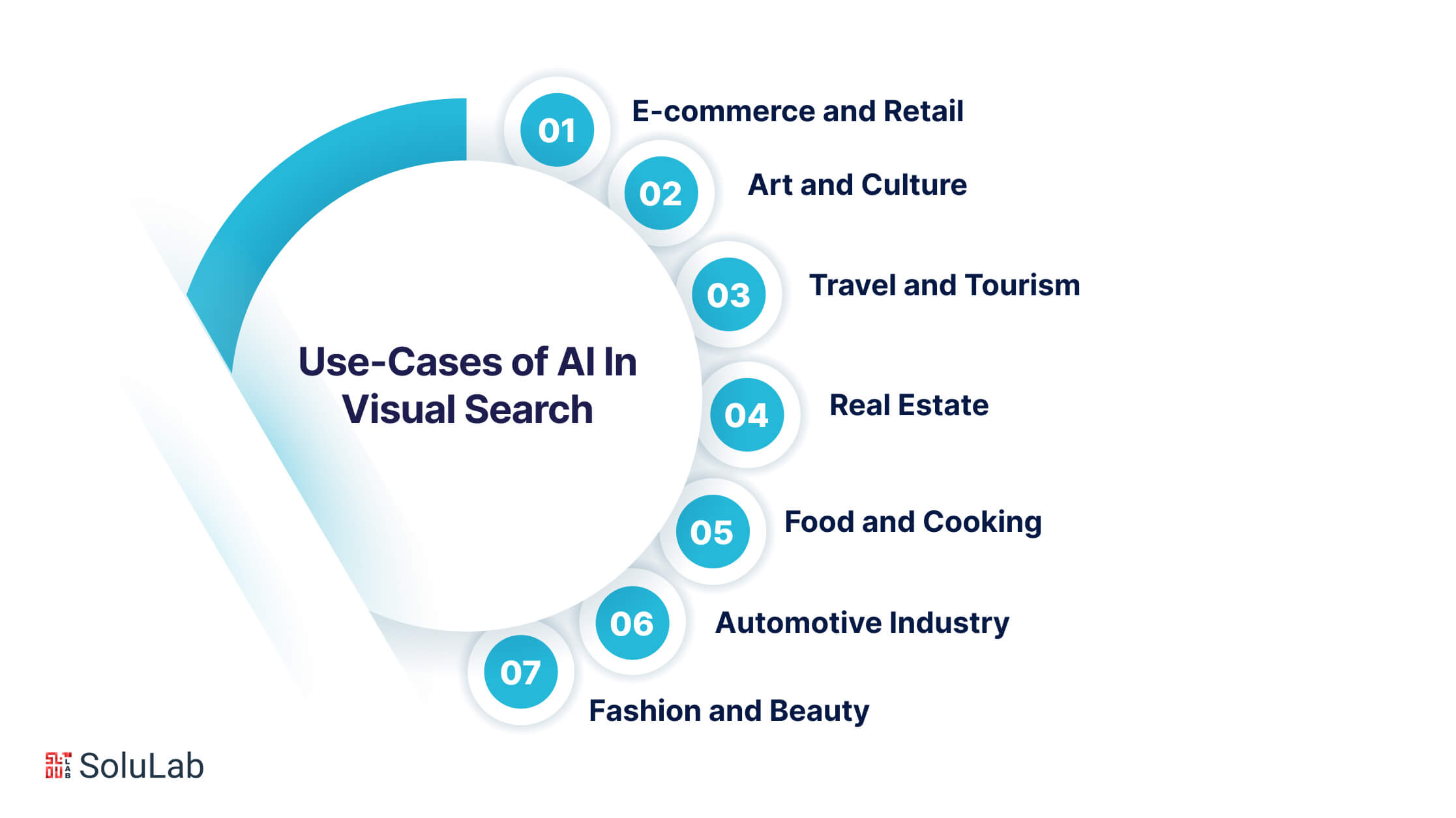

AI In Visual Search: Real-Life Use-Cases

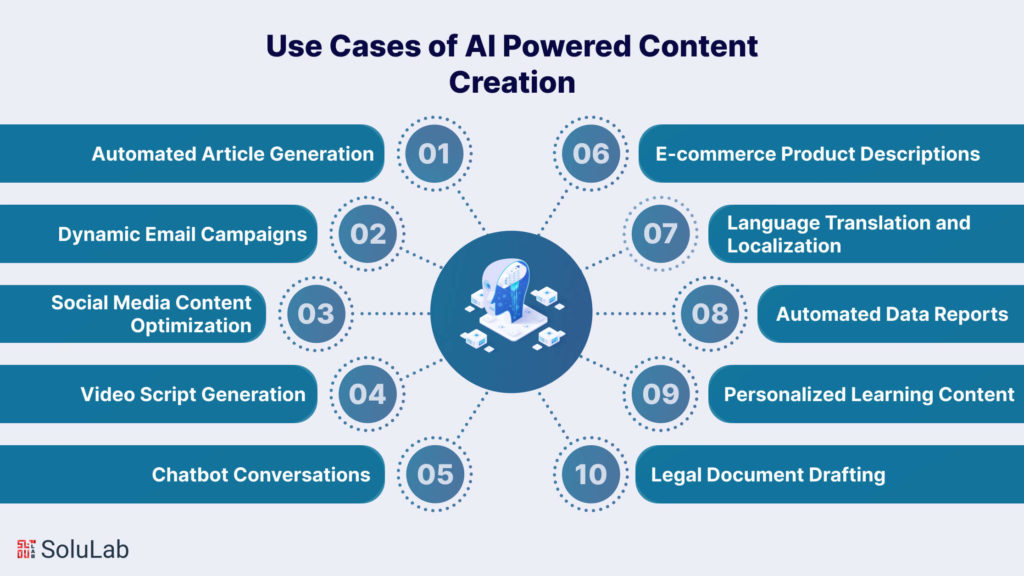

1. E-commerce and Retail

- Product Discovery: Shoppers can easily find items by taking a photo, as the system quickly identifies similar products from a vast collection. This simplifies the search, helping users discover items aligned with their preferences effortlessly.

- Outfit Matching: AI visual search allows users to upload outfit images, getting suggestions for similar clothing and accessories. This feature makes fashion exploration and coordination more accessible, simplifying the recreation of preferred looks.

- Home Decor: Users can capture images of furniture or decor they want to buy, and the system quickly identifies corresponding items online. This provides a convenient way to discover and acquire pieces that match their interior design preferences.

2. Art and Culture

- Artwork Identification: Visual search makes it easy to identify paintings or sculptures. Users can take photos, and the system promptly provides details like the artist’s name and historical context, enriching art exploration for enthusiasts.

- Museum Tours: Enhancing museum experiences, visual search allows users to capture photos of artworks or artifacts, swiftly accessing relevant information. This technology deepens understanding and appreciation for the historical and artistic significance of exhibits.

3. Travel and Tourism

- Landmark Recognition: Travelers can engage with landmarks using visual search, obtaining details and historical context by capturing photos. AI in travel and tourism industry will enriches the travel experience, and it allows a deeper connection with surroundings and insights into cultural and historical significance.

- Translation and Localization: Visual search aids language translation. Users can photograph foreign signs or documents, and the system delivers accurate translations, fostering cross-cultural understanding and communication in unfamiliar environments.

4. Real Estate

- Property Search: Visual search revolutionizes home hunting. Potential buyers can capture images of houses or neighborhoods to swiftly access property listings, streamlining the search for their dream home.

- Interior Design: Visual search helps users furnish spaces by offering tailored suggestions for furniture and decor. This technology facilitates informed decisions about enhancing living environments.

5. Food and Cooking

- Nutritional Analysis: Individuals can monitor nutritional intake by taking pictures of meals using a visual search. Image recognition estimates nutritional content, providing insights for informed decisions about eating habits and health goals.

- Grocery Shopping Assistance: Users can create visual shopping lists by taking photos of items, and the system identifies them, helping navigate the store efficiently and streamlining the shopping process.

6. Automotive Industry

- Car Recognition: Visual search streamlines car shopping. Users capture pictures of vehicles to gather comprehensive information about make, model, features, and pricing, facilitating more informed decisions.

- Parts Identification: In automotive maintenance, visual search helps identify car parts accurately. This streamlines sourcing replacement parts for mechanics and car enthusiasts, enhancing efficiency in repairs and customization projects.

7. Fashion and Beauty

- Cosmetic Recommendations: Visual search offers personalized beauty guidance. By taking selfies, users receive tailored product recommendations based on complexion, style, and preferences, enhancing the cosmetic shopping experience.

- Hairstyle Ideas: It provides a novel approach to hairstyle inspiration. By uploading photos, users get tailored suggestions considering factors like hair type and face shape, offering valuable insights for exploring new looks.

Future Of AI In Visual Search

The future of AI in visual search is going to bring even better improvements in how computers understand human language. This means that when you search for something, the results will be more accurate and tailored to what you’re looking for.

For example– Google is working on a search engine called Bard AI that lets you ask complex questions in a natural, conversational way, making searches more effective.

Looking ahead, we can expect search results to become faster and more tailored to what each person likes. AI will analyze how people search and what they prefer, delivering better and more personalized results in real-time. There’s a trend called “zero-click searches” where the answer is given right away, so users don’t need to visit a website. While this is convenient, it might reduce the number of people visiting websites, and businesses will need to think about this when planning how to reach their audience.

Conclusion

AI in visual search is changing the way we find things online. From shopping to healthcare, it helps users get faster and more accurate results just by using images. As AI continues to grow, visual search will become even more useful and widely adopted. For businesses and users alike, this is a step toward a more intuitive and efficient way of searching and interacting.

Digital Quest, a travel business, partnered with SoluLab to develop an AI-powered chatbot using Generative AI. The chatbot enhanced customer engagement by offering real-time, personalized travel recommendations and hassle-free reservations. It also integrated user feedback and multi-language support, resulting in improved user experience and high ROI.

SoluLab, a top AI development company in the USA, is well-versed in integrating visual search technology into mobile apps across various industries. No matter if you’re in beauty, fashion, or real estate, we can assist you in adding visual search features to your apps. Contact us today to discuss further.

FAQs

1. How does AI enhance visual search capabilities?

AI enhances visual search by leveraging advanced algorithms to analyze and recognize patterns, shapes, and features within images. This enables the system to understand and process visual data, providing more accurate and relevant search results.

2. Can AI-powered chatbot visual search be used for e-commerce?

Yes, AI-powered chatbot visual search is highly valuable for e-commerce. It enables users to find products by uploading images, making the shopping experience more efficient and enjoyable. This technology enhances product discovery and reduces the reliance on text-based searches.

3. How is AI impacting image recognition in visual search?

AI significantly improves image recognition in visual search by continuously learning and refining its understanding of visual content. This enables systems to recognize objects, scenes, and even specific details within images, enhancing the accuracy and efficiency of visual searches.

4. Are there privacy concerns with AI in visual search?

Yes, privacy concerns exist in AI-powered visual search. Issues may arise when personal or sensitive images are inadvertently included in searches. AI developers must implement strong privacy measures, ensuring that user data is handled responsibly and ethically.

5. Can AI in visual search be integrated with other technologies?

Yes, AI in visual search can be seamlessly integrated with other technologies. Combining it with augmented reality (AR) or natural language processing (NLP) can create more immersive and interactive experiences. Such integrations open up new possibilities for industries like retail, education, and healthcare.