A concept of Metaverse development that once seemed confined to the realms of science fiction has rapidly become a central focus in the world of technology and Entertainment. In this blog, we will delve into the exciting and dynamic realm of Metaverse Game Worlds, exploring the multifaceted challenges developers face as they strive to create these immersive digital universes.

What Do You Mean by Metaverse?

The term “metaverse” encompasses a vast, interconnected digital universe, often realized as a collective space where users can interact, socialize, work, and play. It’s a fusion of multiple virtual environments and experiences, brought together into a cohesive whole. This interconnected nature differentiates the metaverse from individual, isolated virtual worlds. Top metaverse platforms, such as Meta’s Horizon Workrooms, Decentraland, and Roblox, aim to provide users with a persistent, shared experience, where boundaries blur between the virtual and real worlds.

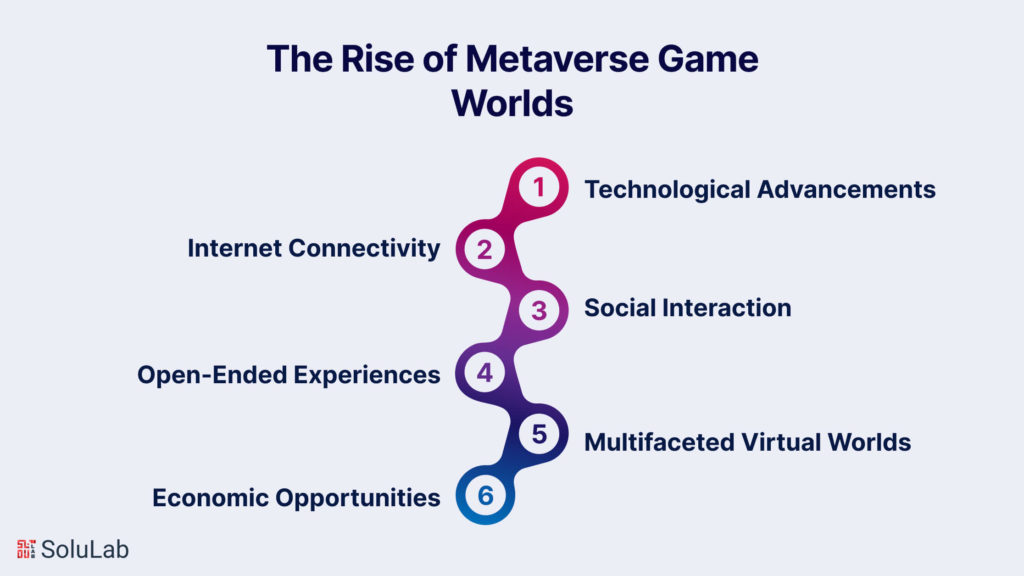

The Rise of Metaverse Game Worlds

The meteoric rise of metaverse game worlds is an undeniable testament to the ever-evolving landscape of technology and the boundless creativity of developers. This phenomenon is driven by several key factors that have converged to create a perfect storm of innovation and excitement in the world of digital entertainment.

- Technological Advancements: The rapid progression of technology, particularly in areas such as graphics rendering, network infrastructure, and processing power, has paved the way for metaverse game worlds to flourish. High-quality, immersive experiences that were once the stuff of science fiction have now become attainable, thanks to state-of-the-art hardware and software innovations.

- Internet Connectivity: With the widespread availability of high-speed internet, metaverse game worlds can seamlessly connect players from all corners of the globe. This interconnectedness fosters shared experiences, making it possible for users to collaborate, compete, or simply socialize within these virtual realms. The idea of a massive, shared digital universe has transitioned from a futuristic concept to a tangible reality.

- Social Interaction: Metaverse game worlds aren’t solely about gameplay. They place a strong emphasis on social interaction and community building. Users can meet, communicate, and forge friendships with others in ways that mimic real-world interactions. This blend of gaming and social experiences has proven immensely appealing to a broad demographic of players.

- Open-Ended Experiences: Unlike traditional video games with fixed storylines and objectives, metaverse games offer open-ended experiences. Users can explore, create, and shape their own adventures, making each visit to the metaverse a unique and personalized journey. This freedom of choice is a hallmark of metaverse game worlds, giving players agency and creativity.

- Multifaceted Virtual Worlds: Metaverse games go beyond conventional gaming by creating rich, multifaceted virtual worlds. These worlds are often persistent, evolving spaces that can host a wide range of activities, from virtual concerts and business meetings to art exhibitions and educational events. The metaverse has transcended the boundaries of traditional gaming to become a dynamic, all-encompassing digital environment.

- Economic Opportunities: Metaverse game worlds offer economic opportunities to both developers and users. The virtual economies that emerge within these spaces allow for the creation, sale, and trade of virtual assets and currencies. Real-world businesses and entrepreneurs are increasingly looking to invest in or leverage the metaverse for a variety of purposes, from marketing to commerce.

In brief, the rise of metaverse game worlds represents a convergence of technology, social interaction, and open-ended experiences. These digital realms have captured the imagination of developers and players alike, providing a canvas for creativity that goes far beyond traditional gaming. As we explore the challenges faced in building metaverse game worlds, it’s essential to recognize the incredible potential and excitement that underpin this transformative phenomenon.

The Importance of Addressing Challenges

Building metaverse game worlds is not without its set of unique challenges. These challenges span technical, social, legal, and ethical dimensions, and addressing them is vital for the long-term success and sustainability of metaverse development. The sheer scale and complexity of metaverse game worlds necessitate a deep understanding of the issues at hand and a proactive approach to mitigating potential pitfalls. As top metaverse platforms continue to gain traction and investment, understanding these challenges is essential for anyone looking to make their mark in the metaverse development landscape. In the following sections, we will explore these challenges in-depth and discuss strategies for navigating the intricate journey of metaverse game world creation.

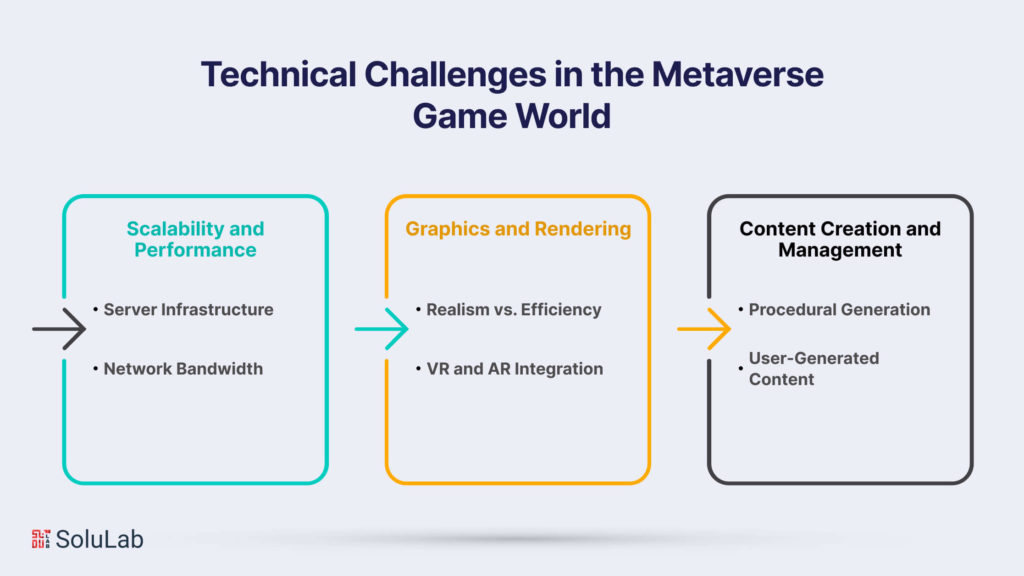

Technical Challenges in the Metaverse Game World

In the dynamic realm of metaverse game worlds, the creation and maintenance of these expansive digital environments bring forth a host of technical challenges that developers must confront. These challenges are instrumental in ensuring that metaverse game worlds deliver seamless, immersive, and enjoyable experiences to their users. Let’s delve into these technical hurdles and explore the keywords you’ve provided.

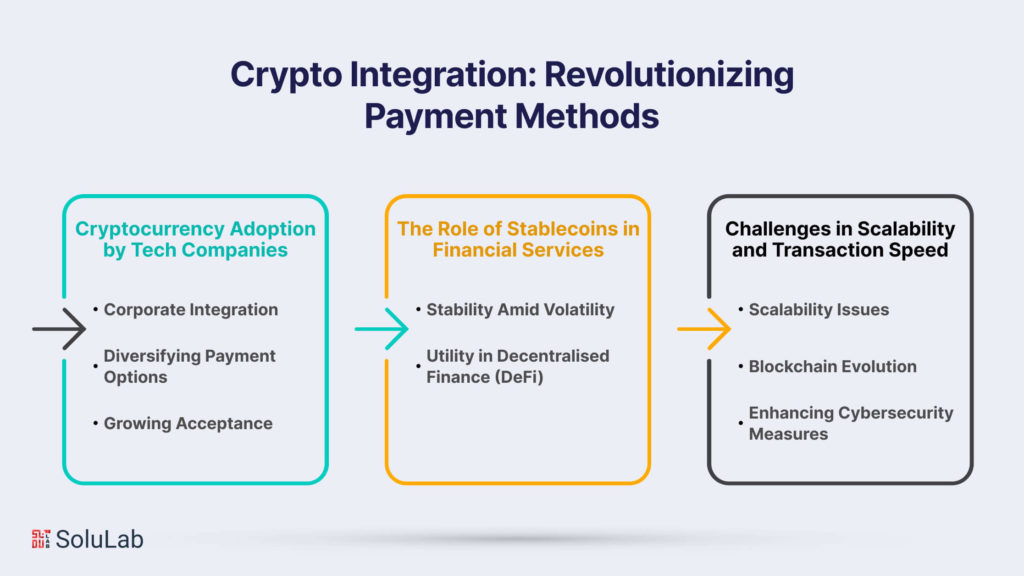

Scalability and Performance

- Server Infrastructure: The backbone of a metaverse game world lies in its server infrastructure. This component is responsible for handling the influx of users, data, and interactions. In the context of metaverse game development companies, investing in a scalable and robust server infrastructure is imperative. The Virtual Reality Metaverse is particularly relevant here, as VR experiences demand low-latency, high-performance servers to maintain immersion.

- Network Bandwidth: As metaverse game worlds continue to expand, the demand for network bandwidth grows exponentially. Efficient and real-time data exchange is critical to facilitate seamless interactions. Augmented reality (AR) and Virtual Reality (VR) experiences within the metaverse are especially reliant on a well-optimized network infrastructure. In a VR context, Augmented reality comes into play as it highlights the need for efficient data transfer in AR environments.

Graphics and Rendering

- Realism vs. Efficiency: The visual quality of a metaverse game world is often a double-edged sword. Striking a balance between delivering realistic graphics and ensuring efficient rendering is a perpetual challenge. Developers must employ strategies like Metaverse AI Integration to dynamically adjust rendering quality based on the user’s hardware capabilities, ensuring a smooth experience.

- VR and AR Integration: Metaverse game worlds aim to provide support for both Virtual Reality (VR) and Augmented Reality (AR) experiences. This integration introduces complexity to graphics and rendering, as it involves specialized techniques to maintain immersion and interact with the real world. Ensuring a consistent user experience across different devices and platforms is a key challenge, where Virtual Reality Metaverse is relevant due to the importance of optimizing VR experiences.

Content Creation and Management

- Procedural Generation: Populating expansive metaverse environments with diverse and engaging content is no small task. Many metaverse game development companies turn to procedural generation, which utilizes algorithms to create content dynamically. This approach reduces the burden of manual content creation. The challenge here lies in maintaining a balance between variety and quality. The use of Metaverse AI Integration can aid in the optimization of procedural generation by adapting content generation to user preferences and capabilities.

- User-Generated Content: Allowing users to contribute their own creations to the metaverse is a fundamental aspect of many metaverse game worlds. However, managing user-generated content, ensuring it complies with community guidelines, and moderating it for inappropriate material is a significant challenge. The Metaverse AI Integration can be applied in this context to highlight the use of AI-powered automation for content moderation and filtering, as this technology plays a crucial role in maintaining a safe and enjoyable metaverse environment.

These technical challenges represent the intricate web of considerations that metaverse game developers navigate in their quest to provide users with immersive and compelling digital experiences. As technology evolves, so too will the strategies and solutions used to address these challenges and bring metaverse game worlds to new levels of creativity and interactivity.

User Engagement and Social Challenges

In the metaverse gaming landscape, creating and maintaining a thriving community is paramount. User engagement and social interaction are at the heart of these virtual worlds, making it essential to overcome the unique challenges they present.

Community Building

- Building a Positive Community: One of the cornerstones of successful metaverse development lies in building a positive and inclusive community. Metaverse development companies prioritize fostering an environment where users feel welcomed, respected, and valued. Encouraging positive interactions, mutual support, and collaboration are key aspects of community building. The metaverse aims to be a space where users can connect, learn, and have fun, so maintaining a friendly atmosphere is vital.

- Moderation and Safety: With vast numbers of users from diverse backgrounds, moderation and safety become critical components of a metaverse gaming community. Metaverse development companies need to establish robust moderation systems to address inappropriate behavior and content. The safety and well-being of users must be a top priority to ensure a positive experience for all participants. This challenge is closely linked to the “Metaverse gaming landscape,” as the landscape encompasses various platforms and communities, each with its unique moderation needs.

Monetization

- In-Game Purchases: Monetizing metaverse game worlds is a crucial aspect of their sustainability and growth. In-game purchases, which can include virtual goods, skins, or even access to exclusive experiences, are common ways for metaverse development companies to generate revenue. However, balancing monetization with user satisfaction is a delicate challenge. Striking the right equilibrium ensures that users feel that their investments enhance their experience rather than detract from it.

- Virtual Economies: Many metaverse game worlds feature complex virtual economies where users can trade, buy, and sell virtual assets or currencies. These economies often resemble real-world financial systems, and they introduce unique challenges related to supply, demand, inflation, and market manipulation. Managing these virtual economies and ensuring fairness and stability can be intricate tasks for metaverse development companies. As the metaverse gaming landscape continues to evolve, addressing user engagement and social challenges is paramount for creating an environment where users can connect, collaborate, and enjoy their digital experiences. The effective management of community dynamics and monetization strategies is pivotal for building metaverse communities that are not only engaging but also sustainable over the long term.

Legal and Ethical Considerations

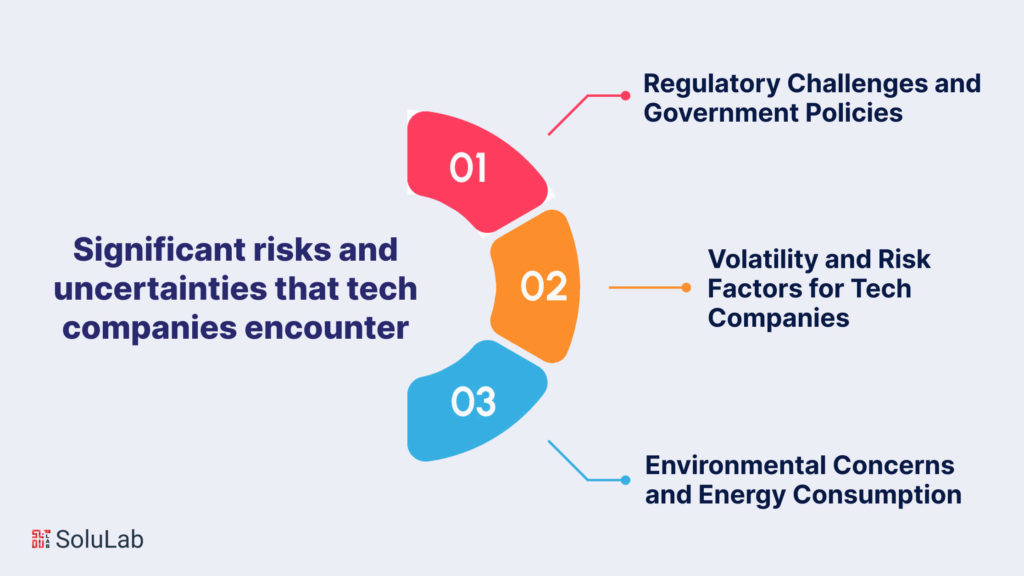

The development of metaverse game worlds introduces a myriad of legal and ethical considerations that developers and users must navigate. Ensuring compliance with intellectual property laws and safeguarding user privacy and data security are paramount in the metaverse landscape.

Intellectual Property

- Copyright and Trademark Issues: Metaverse development companies must be acutely aware of the potential copyright and trademark issues that can arise when creating virtual worlds. Incorporating real-world brands, music, or other copyrighted materials in a metaverse game world may lead to legal disputes if proper permissions and licenses are not obtained. Protecting the intellectual property rights of both creators and copyright holders is essential.

- Licensing and Fair Use: Licensing plays a critical role in metaverse development, allowing creators to obtain the necessary rights to use certain content. Understanding licensing agreements and adhering to fair use principles is crucial in metaverse game development. It’s imperative to respect intellectual property while promoting creativity and innovation within the metaverse.

Privacy and Data SecurityPrivacy and Data Security - Data Collection and User Privacy: Metaverse development companies often collect a substantial amount of user data to enhance the user experience and support various metaverse use cases and benefits. However, respecting user privacy and complying with data protection regulations are paramount. Transparent data collection practices, robust data security measures, and user consent mechanisms should be in place to safeguard user information and instill trust.

- Cybersecurity Concerns: With metaverse game worlds growing in complexity and popularity, they become attractive targets for cyber threats and malicious actors. Protecting the metaverse against data breaches, hacking attempts, and other cybersecurity concerns is a constant challenge. Metaverse development companies must invest in robust security measures and continuously adapt to emerging threats.

As the metaverse continues to expand and intertwine with various metaverse use cases and benefits, addressing these legal and ethical considerations is essential. Developers and users must collaborate to ensure that metaverse game worlds can thrive within a framework that respects intellectual property rights and upholds user privacy and data security, fostering a trustworthy and enjoyable metaverse experience.

The Role of AI and Automation

In the realm of metaverse development, the integration of AI (Artificial Intelligence) and automation plays a pivotal role in shaping the user experience, enhancing efficiency, and addressing key challenges. Here, we delve into the multifaceted ways in which AI and automation are revolutionizing the metaverse landscape, highlighting their significance in three critical areas.

-

AI-driven NPCs and Storytelling

AI-driven Non-Playable Characters (NPCs) are the backbone of immersive metaverse game worlds. These intelligent entities are instrumental in shaping the user experience, driving storylines, and fostering engaging interactions. AI-driven NPCs can adapt to user behavior, create dynamic and personalized narratives, and provide users with a sense of agency within the metaverse. The Metaverse AI Integration emphasizes the integral role of AI in creating lifelike, interactive NPCs and crafting captivating narratives that transcend traditional gaming experiences.

-

Moderation and Content Filtering

Maintaining a safe and enjoyable metaverse environment hinges on effective moderation and content filtering. AI-powered systems have become instrumental in automating these processes. Metaverse development companies employ AI algorithms to scan, identify, and filter out inappropriate content, ensuring that user-generated content complies with community guidelines. This not only promotes a welcoming and secure metaverse community but also reduces the administrative burden on moderators. The keywords “Metaverse AI Integration” underscore the importance of AI in content moderation and filtering, which is essential for building a responsible and user-friendly metaverse.

-

Analytics and Player Behavior Prediction

AI-driven analytics and player behavior prediction are transformative tools in metaverse development. AI can process vast amounts of data to discern player preferences, habits, and trends. This information is instrumental in optimizing the user experience, from tailoring in-game content to predicting and preventing adverse behaviors. AI can forecast potential issues such as harassment or cheating, allowing metaverse development companies to address them proactively. The Metaverse AI Integration emphasizes the integral role of AI in analyzing player behavior, predicting trends, and enhancing the overall metaverse experience.

In metaverse development, AI and automation are catalysts for innovation, enriching the metaverse landscape by delivering personalized, secure, and dynamic experiences. As the metaverse continues to evolve, the seamless integration of AI-driven NPCs, advanced moderation and content filtering, and predictive analytics will be instrumental in creating immersive, user-centric metaverse game worlds that are both enjoyable and responsible.

Strategies for Overcoming Challenges of Building Metaverse Game World

The metaverse gaming industry presents a unique landscape filled with a multitude of intricate challenges. To effectively navigate these challenges and ensure the continued success and growth of metaverse game worlds, metaverse development companies and stakeholders must adopt strategic approaches that encompass collaboration, transparency, and innovation. Let’s delve deeper into these strategies that underscore their importance in addressing the pressing challenges within the metaverse gaming industry.

-

Cross-Industry Collaboration

Collaboration across diverse industries is a cornerstone strategy in addressing challenges within the metaverse gaming industry. Given the multifaceted nature of the metaverse, these cross-industry partnerships are crucial for finding holistic solutions. Metaverse development companies must engage with technology experts to harness innovations that can resolve technical challenges such as server infrastructure, graphics rendering, and network efficiency. Furthermore, collaboration with the entertainment industry can lead to unique content collaborations, offering immersive experiences that promote user engagement and community growth. Legal experts, on the other hand, provide essential guidance on navigating complex legal and ethical matters, particularly when it comes to intellectual property and data privacy concerns. The challenges in metaverse gaming underscore the importance of these multidisciplinary collaborations in addressing the unique and evolving issues faced by the metaverse gaming industry.

-

Transparency and User Education

Transparency is a cornerstone of trust within the metaverse gaming industry. It encompasses clear and open communication about data usage, privacy policies, and community guidelines. Metaverse development companies must provide transparency regarding how user data is collected, stored, and utilized to build user trust and confidence. These practices address concerns related to privacy and data security, promoting a safer and more trustworthy metaverse environment. Simultaneously, user education plays a pivotal role, empowering users to make informed decisions about their participation in the metaverse. An educated user base is more likely to engage responsibly, adhere to community guidelines, and understand the potential risks and benefits of metaverse gaming. The challenges in metaverse gaming emphasize the significance of these strategies in fostering a responsible and trustworthy metaverse gaming community.

-

Continuous Innovation and Adaptation

In the metaverse gaming industry, continuous innovation and adaptation are the pillars of resilience. Challenges within this dynamic landscape are ever-evolving, spanning cybersecurity, content moderation, and the rapid emergence of new technologies. Metaverse development companies must remain at the forefront of industry advancements to address challenges proactively. Innovation can involve embracing Metaverse AI Integration, which optimizes content moderation, enhances user experiences, and streamlines in-game experiences. Continuous adaptation ensures that metaverse game worlds remain agile, responsive to user needs, and capable of embracing emerging trends and technologies. The challenges in metaverse gaming emphasize the necessity of this strategy for metaverse development companies to thrive in a rapidly changing and competitive industry.

By actively implementing these strategies, metaverse development companies can effectively tackle the diverse challenges present within the metaverse gaming industry. Cross-industry collaboration, transparency, and user education, coupled with a commitment to continuous innovation and adaptation, create a holistic approach that empowers the metaverse gaming community to overcome challenges, build trust, and seize new opportunities in this exciting and evolving landscape.

Final Words

In conclusion, the journey of building metaverse game worlds is marked by boundless opportunities and complex challenges. As the metaverse rapidly gains prominence in the gaming and technology spheres, it becomes clear that developers and stakeholders must approach this frontier with a strategic mindset, embracing multidisciplinary collaboration, transparency, and continuous innovation. The metaverse’s rise as a dynamic digital universe, brimming with interactive possibilities, transcends conventional gaming experiences, emphasizing the paramount importance of addressing technical, social, legal, and ethical intricacies.

Metaverse development companies and creators stand at the forefront of a digital renaissance, where AI and automation play pivotal roles in enhancing immersion, moderating content, and predicting player behavior. By embracing the evolution of technology, fostering cross-industry collaboration, and prioritizing the well-being and engagement of users, the metaverse can continue to flourish as an ever-evolving digital realm. In navigating the myriad challenges and harnessing the full potential of metaverse game worlds, we embark on an exhilarating journey, poised to define the future of interactive digital experiences, where creativity and community thrive in unison.

SoluLab, as a Metaverse game development company, plays a pivotal role in shaping the metaverse by providing innovative solutions that power immersive digital experiences. With a profound understanding of the metaverse’s complexities, SoluLab leverages its expertise in software development, artificial intelligence, and blockchain technologies to create cutting-edge applications and platforms. Their commitment to metaverse development extends to designing scalable, secure, and user-friendly environments that seamlessly integrate AI, automation, and data analytics, contributing to the seamless operation and enjoyment of metaverse game worlds. SoluLab’s contributions encompass the development of AI-driven NPCs, advanced content moderation, and predictive analytics that enhance user engagement and safety. With a holistic approach to metaverse development, SoluLab empowers businesses and creators to embark on the exciting journey of building dynamic and inclusive metaverse game worlds that redefine digital interaction and entertainment.

FAQs

1. What is the metaverse, and how does it differ from traditional gaming?

The metaverse is a vast interconnected digital universe that transcends traditional gaming. It combines elements of gaming, social interaction, and shared experiences, creating immersive, open-ended virtual worlds where users can explore, interact, and create content.

2. What role does AI play in metaverse game worlds?

AI is instrumental in metaverse development, driving AI-driven NPCs, enhancing content moderation and filtering, and predicting player behavior. It contributes to immersive storytelling, content quality control, and player engagement, making metaverse experiences more dynamic and user-centric.

3. How are metaverse development companies addressing challenges in user engagement and safety?

Metaverse development companies focus on community building, promoting positive interactions, and investing in robust moderation systems. They also employ AI-driven content filtering to ensure a safe and welcoming environment for users, fostering trust and user satisfaction.

4. What is the significance of cross-industry collaboration in metaverse development?

Cross-industry collaboration is essential to address the multifaceted challenges in metaverse gaming. It leverages expertise from technology, entertainment, and legal domains to find comprehensive solutions, ensuring the metaverse’s growth and sustainability.

5. How can users contribute to the metaverse’s growth and development?

Users can actively participate in metaverse game worlds by creating and sharing content, engaging in communities, and providing valuable feedback to developers. By adhering to community guidelines and respecting intellectual property, users contribute to the positive and vibrant metaverse ecosystem.