Initial Coin Offerings (ICOs) and Security Token Offerings (STOs) have made significant waves in the world of fundraising and investment within the blockchain and cryptocurrency industry. However, these two fundraising methods differ significantly in their nature, regulatory aspects, and potential benefits.

In this blog post, we’ll delve into the distinctions between ICOs and STOs, exploring their characteristics, advantages, and drawbacks. Understanding these differences is crucial for entrepreneurs, investors, and blockchain enthusiasts to make informed decisions in the evolving crypto landscape.

What is ICO (Initial Coin Offering)?

ICOs are fundraising events where cryptocurrency tokens are issued to investors in exchange for capital. The primary purpose of ICOs is to raise funds for new blockchain projects or decentralized applications (DApps). These tokens typically represent future access to the project’s products or services.

ICOs gained immense popularity around 2017, with projects like Ethereum, EOS, and Tezos raising substantial amounts through token sales. These events often attracted global attention and investment due to the potential for high returns.

ICOs offer several advantages, including accessibility for a wide range of investors, quick fundraising, and potential for exponential growth. However, they are also associated with significant drawbacks, such as a lack of regulatory oversight, potential scams, and volatility in token prices.

ICOs have faced increasing regulatory scrutiny in various countries, leading to legal challenges and restrictions. Governments have been concerned about fraudulent projects and the need to protect investors.

What is STO (Security Token Offering)?

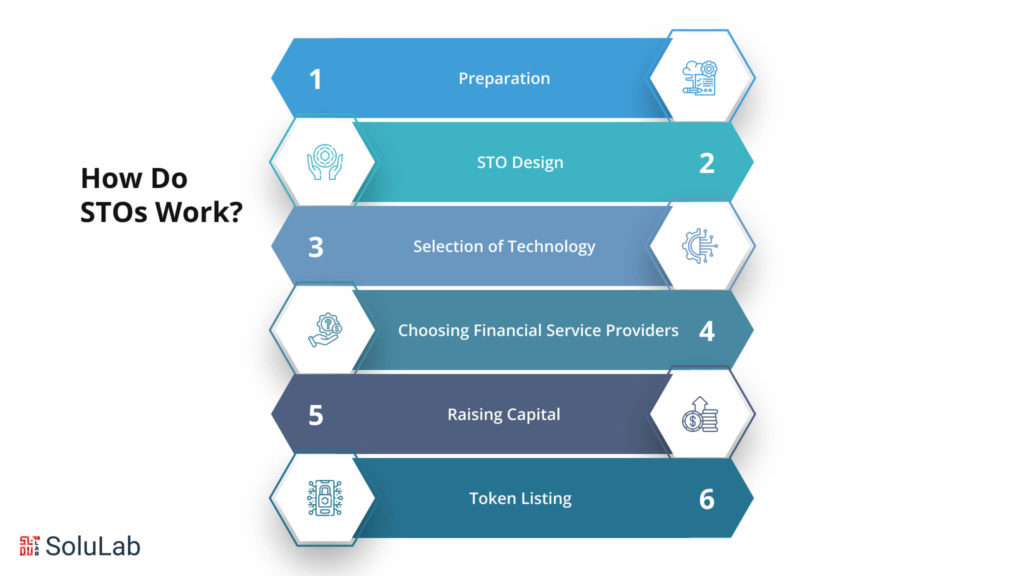

STOs, on the other hand, are a more regulated and secure method of fundraising. They involve issuing tokens that are backed by real-world assets, such as equity in a company, real estate, or commodities. STOs are designed to comply with existing securities regulations.

Several successful STOs have demonstrated the viability of this fundraising method. Projects in real estate, art, and venture capital have used STOs to tokenize assets and offer fractional ownership.

STOs offer advantages such as improved investor protection, transparency, and compliance with legal frameworks. However, they also require more regulatory compliance, which can be costly and time-consuming for issuers.

Difference between ICO and STO

STOs differ from ICOs in several crucial ways. Firstly, STOs are security offerings, subject to securities regulations, while ICOs are often utility token sales. Secondly, STOs are typically backed by tangible assets, providing investors with more security and potential for dividends or profit-sharing.

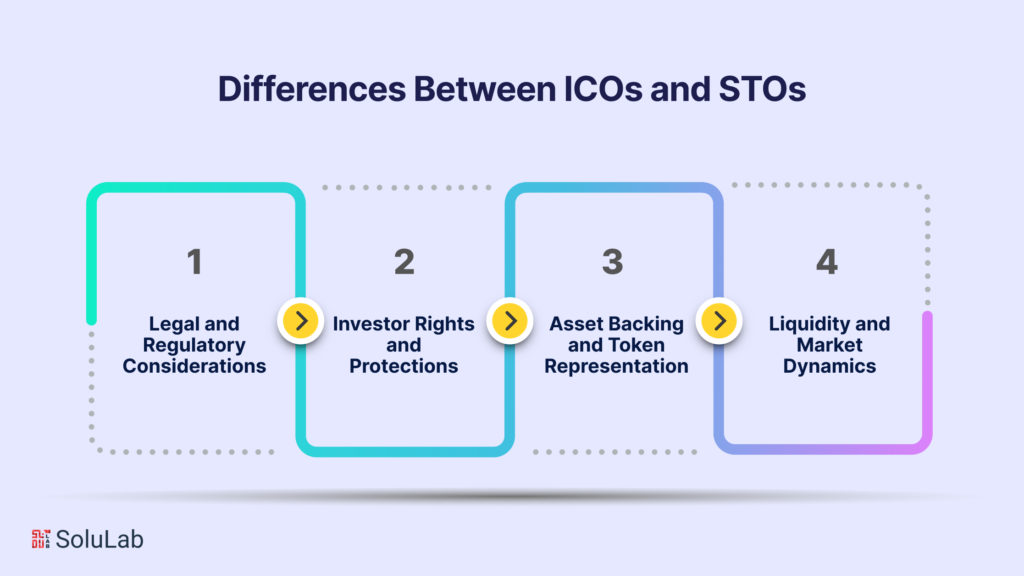

Key Differences Between ICOs and STOs

Initial Coin Offerings (ICOs) and Security Token Offerings (STOs) are both methods of raising capital in the cryptocurrency and blockchain space. However, they have distinct differences in terms of their nature, regulation, and purpose. Here are the key differences between ICOs and STOs:

Read Blog Post: 10 Best Defi Exchanges 2024

1. Legal and Regulatory Considerations

- ICOs often operate in a legal grey area, while STOs are subject to securities regulations.

- ICOs may face legal consequences for non-compliance with securities laws.

2. Investor Rights and Protections

- STO investors typically have more rights and protections, such as ownership shares and potential dividends.

- ICO investors often have limited rights and rely on the project’s success for returns.

3. Asset Backing and Token Representation

- ICO tokens may not necessarily be backed by tangible assets or represent ownership.

- STO tokens are backed by real assets, offering a clear value proposition to investors.

4. Liquidity and Market Dynamics

- ICO tokens often trade on cryptocurrency exchanges, which can lead to extreme price volatility.

- STO tokens may have a more stable price due to their asset-backed nature, but liquidity can be lower.

What to Choose: ICO or STO?

Choosing between an Initial Coin Offering (ICO) and a Security Token Offering (STO) depends on several factors, including the nature of your project, regulatory considerations, and your target audience. Here are some key factors to consider when deciding which fundraising method to choose:

1. Nature of the Project

- If your project involves a utility token that provides access to a specific product or service within your platform (e.g., a decentralized application or ecosystem), an ICO development may be suitable.

- If your project involves asset-backed tokens, such as company equity, real estate, or revenue-sharing, and you want to comply with securities regulations, an STO is more appropriate.

Read Also: 7 Most Successful ICOs of All Time

2. Regulatory Compliance

- Consider the regulatory environment in your jurisdiction and the jurisdictions of your potential investors. STOs are typically subject to securities regulations, which can be complex and vary from country to country. Ensure you have legal counsel to navigate these regulations.

- ICOs may have fewer regulatory requirements but could still face legal scrutiny in some jurisdictions.

3. Investor Base

- Determine your target investor base. If you want to attract a broad and global audience of retail investors, an ICO may be more suitable.

- If you are targeting accredited or institutional investors who are comfortable with regulatory compliance, an STO may be the better choice.

4. Investor Protection

- If you prioritize strong investor protection and transparency, an STO is more likely to provide these features due to securities regulations.

- ICOs have historically been associated with a higher risk of fraud and less legal protection for investors.

5. Asset Backing

- Consider whether your project involves tangible assets or revenue streams that can back your tokens. If so, an STO can provide a direct link between the tokens and the underlying assets.

- If your tokens are primarily utility-based and don’t represent ownership or assets, an ICO may be more appropriate.

6. Liquidity and Secondary Market

- Evaluate how you plan to provide liquidity to your investors. Security tokens are typically designed to be more liquid, potentially allowing trading on traditional securities exchanges.

- ICO tokens may face liquidity challenges and may not be listed on major exchanges.

Read Also: How To Write A Compelling ICO Whitepaper That Actually Sells?

7. Cost and Compliance

- Be aware that conducting an STO can be more expensive and time-consuming due to regulatory compliance requirements, legal fees, and the need for thorough due diligence.

- ICOs may have lower upfront costs, but they may require significant marketing efforts to attract investors.

8. Long-Term Goals

- Consider your long-term goals for the project. STOs may offer a more structured path to traditional financial markets and long-term sustainability.

- ICOs may provide more flexibility but can also be riskier and less predictable in terms of future outcomes.

Check Out Our Blog: Top 25 Smart Contract Companies To Look For in 2024

Future Trends and Developments

The crypto fundraising landscape continues to evolve, and several trends are shaping the future of ICOs and STOs:

1. Hybrid Models: Some projects are exploring hybrid models that combine elements of ICOs and STOs to strike a balance between fundraising and regulatory compliance.

2. Secondary Markets: The development of secondary trading platforms for security tokens could improve liquidity and provide investors with more options for buying and selling tokens.

3. Regulatory Clarity: As regulatory frameworks become more defined, the crypto industry may see increased participation from traditional financial institutions and mainstream investors.

Blockchain and the Future of ICOs and STOs

Understanding these blockchain trends and their potential impact on ICOs and STOs is essential for stakeholders in the crypto fundraising space. As the technology matures, we can anticipate exciting developments that will shape the future of token offerings and the broader blockchain industry.

Blockchain technology continues to evolve, presenting opportunities and challenges for ICOs and STOs. As the underlying technology for both fundraising methods, the future of blockchain plays a pivotal role in shaping their trajectories.

1. Interoperability: Interoperability between different blockchain networks is becoming a key focus. This will allow assets from one blockchain to be traded on another, potentially increasing liquidity for tokens from both ICOs and STOs.

Read Blog Post: Top 10 STO Development Companies in 2024

2. Smart Contract Advances: Smart contracts are at the heart of ICOs and STOs. As blockchain technology matures, we can expect more advanced and secure smart contract platforms, reducing the risk of contract vulnerabilities.

3. Scalability: Scalability issues have plagued blockchain networks, affecting transaction speeds and costs. Solving these issues will enhance the efficiency of token offerings, making them more accessible and cost-effective.

4. Regulatory Harmonization: The crypto industry seeks harmonization of regulatory frameworks globally. A cohesive approach to regulation could reduce uncertainty and promote a more favorable environment for both ICOs and STOs.

5. Token Standardization: Standardisation of token types can simplify the token creation process and enhance interoperability. Ethereum’s ERC-20 and ERC-1400 standards are examples of how standardization can facilitate token issuance.

6. Decentralized Finance (DeFi): DeFi platforms have gained traction, offering new opportunities for fundraising and investment. DeFi projects are increasingly exploring ICO and STO models within their ecosystems.

Concluding Remarks

In conclusion, comprehending the distinctions between Initial Coin Offerings (ICOs) and Security Token Offerings (STOs) is crucial within the blockchain and cryptocurrency arena. ICOs once celebrated for their rapid fundraising potential, faced regulatory uncertainties and concerns about investor safeguarding. Conversely, STOs have emerged as a more regulated and secure fundraising approach, offering investors tangible asset-backed ownership and compliance with securities laws, which has garnered institutional interest and bolstered trust in the crypto fundraising landscape.

Looking forward, expect to witness the emergence of hybrid fundraising models blending ICO and STO elements, the growth of secondary markets to enhance token liquidity, and increasing regulatory clarity. As blockchain technology matures, the crypto fundraising landscape will continually adapt, providing innovative opportunities. For entrepreneurs and investors, a deep understanding of these distinctions will serve as a compass in navigating the dynamic world of ICOs and STOs successfully. Whether you’re seeking capital or investment opportunities, staying informed and compliant will be paramount in this evolving blockchain ecosystem protocol.

SoluLab is a prominent company in the blockchain technology and software development sector, offering expertise in various industries, including decentralized finance, supply chain management, and healthcare. SoluLab has earned a reputation for delivering innovative blockchain solutions. In the context of ICOs and STOs, SoluLab provides crucial technical support and development services. They assist startups and enterprises in launching ICOs and STOs by offering secure smart contract development and wallet creation while ensuring compliance with regulatory frameworks, which is particularly vital for STOs. SoluLab serves as a valuable partner for those navigating the complex landscape of blockchain-based fundraising, offering ICO development services and STO development services, all while adhering to regulatory standards. Contact SoluLab today to explore their comprehensive blockchain solutions.

FAQs

1. What is the primary difference between an ICO and an STO?

An ICO (Initial Coin Offering) is a fundraising method where cryptocurrency tokens are issued, often as utility tokens, without direct ownership rights. In contrast, an STO (Security Token Offering) involves the issuance of tokens backed by real-world assets, such as equity or property, offering investors ownership rights and potential dividends.

2. Why are ICOs often associated with regulatory challenges?

ICOs have faced regulatory challenges due to their lack of compliance with securities laws in many jurisdictions. This lack of oversight has raised concerns about investor protection, leading to increased regulatory scrutiny.

3. What are the benefits of participating in an STO for investors?

Investors in STOs typically gain ownership rights in the underlying asset, such as shares in a company or real estate. This can provide more security and the potential for dividends or profit-sharing, making STOs appealing to those seeking traditional investment features.

4. Are ICOs still a viable fundraising method in today’s regulatory landscape?

ICOs have evolved in response to regulatory challenges. Some projects conduct compliant ICOs, while others opt for alternative fundraising methods like STOs. The viability of an ICO development company depends on the project’s nature and its ability to navigate regulatory requirements.

5. How do secondary markets impact the liquidity of security tokens from STOs?

Secondary markets, such as security token exchanges, can significantly impact the liquidity of tokens from STOs. They provide a platform for investors to buy and sell security tokens, potentially increasing liquidity and tradability compared to traditional assets.

6. What trends can we expect in the ICO and STO space shortly?

The future of ICOs and STOs will likely see increased regulatory clarity, hybrid fundraising models, and the integration of blockchain technology into traditional financial systems. Institutional involvement and a focus on compliance are also expected to shape the industry’s direction.