Blockchain fintech companies have revolutionized the financial sector over the last 10 years by upending established banking procedures and changing the landscape. Their innovative technologies have brought them to the forefront and profoundly changed the financial services industry, along with shifting customer demands.

The term “fintech,” or financial technology, describes advanced technology that attempts to improve things by automating the usage and provision of financial services. Fintech is used to assist various businesses, customers, and entrepreneurs in managing all of their financial operations and procedures more effectively in order to enhance things all around. Blockchain is one of the main elements of fintech.

A number of firms have emerged recently to leverage blockchain technology appropriately in order to help expedite the financial revolution. Now, let’s look at a few of the most well-known fintech blockchain companies that are transforming the finance sector.

How is Fintech Blockchain Technology Transforming the Banking Sector?

The digitalization wave propels fintech success by enabling faster innovation to satisfy changing client demands. By reducing transaction fees and operating expenses, they have increased accessibility to financial services. Think about these instances:

- Services for sending money abroad that are quicker and less expensive.

- Digital banks, sometimes known as Neobanks, offer no-fee accounts, flexible credit and debit cards as well as business credit cards, expedited onboarding, and tools for budgeting.

- Payment Infrastructure as a Service, or PIaaS, is a scalable and adaptable method of managing operations and payments. Providing businesses with an easy way to take payments.

- Embedded finance is the process of integrating different platforms with banking, insurance, stock trading, wallet-as-a-service, and other services.

The requirements of the contemporary digital consumer are met by the widespread use of digital wallets and mobile banking applications, which provide a more affordable and practical method of payment. Fintech services are increasingly synonymous with personalized customer experiences and customized financial advice, strengthening client loyalty and confidence.

How Much Switching to Digital Will Cost?

Fintech blockchain is growing, but because of their complicated legacy IT systems, traditional banks are having trouble keeping up with technology. The return on investment in new digital banking services has not yet been completely realized, despite attempts to remain competitive. Banks are incorporating fintech technologies into their systems to expedite procedures and lower development costs in order to meet client demand.

Crypto fintech companies offer better experiences and products, but profitability is still a problem. In periods of limited capital, banks are crucial partners for fintech survival due to their extensive operations and varied range of products. Nevertheless, the process of establishing financial alliances takes time.

1. Fireblocks

Fireblocks is a pioneering fintech company in the crypto space, revolutionizing how financial institutions manage and transact with cryptocurrencies. With a suite of innovative solutions, Fireblocks addresses critical challenges faced by traditional finance companies venturing into the crypto realm. Offering secure wallets for crypto money transfers, Fireblocks ensures the safe and efficient movement of digital assets across borders, empowering fintech crypto companies to embrace the opportunities presented by blockchain technology without compromising on security.

Moreover, Fireblocks caters to the evolving needs of fintech crypto companies by providing robust tools for automated governance and control of crypto transactions. By leveraging blockchain’s inherent transparency and immutability, Fireblocks enables institutions to implement comprehensive compliance measures and monitor transactions in real-time, ensuring regulatory adherence and mitigating the risk of fraud or misuse. With its innovative approach to crypto finance, Fireblocks will catalyze the mainstream adoption of cryptocurrencies and drive the transformation of traditional financial systems into decentralized, blockchain-powered ecosystems.

2. ANote Music

ANote is transforming the music industry’s financial industry by tapping into blockchain technology. Serving as Europe’s primary and secondary marketplace for music royalties, ANote brings transparency, security, and accessibility to an asset class previously reserved for industry insiders. By using blockchain in fintech, ANote facilitates direct investments in songs, allowing individuals to buy rights offered by musicians, record labels, and publishers. This technology ensures trust and integrity in ownership and transfers by making transactions immutable and decentralized, removing the need for intermediaries and simplifying the investment process for everyone involved.

Furthermore, ANote introduces a fresh financial opportunity independent from traditional investments, broadening investors’ portfolios and horizons. By establishing new valuation standards for royalties throughout the EU, ANote creates a transparent marketplace where music rights’ worth is dictated by market forces and investor interest, rather than obscure industry practices. Through its blockchain-based platform, ANote democratizes access to music royalties, providing artists with new revenue streams and offering investors a chance to engage in the music industry confidently and easily.

3. AnChain.AI

Fintech blockchain companies are utilizing AI as a driving factor, with a focus on blockchain analytics enabled by AI-driven platforms. AnChain.AI, which oversees millions of dollars in weekly transaction volumes, provides essential security to some of the biggest crypto exchanges, protocols, and DApps globally, all with the main goal of strengthening the global crypto environment. Its defensive approach is centered on the Situational Awareness Platform (SAP), an advanced technology designed to proactively protect cryptocurrency holdings.

AnChain.AI’s SAP isn’t merely reactive; it’s a proactive fortress, harnessing proprietary artificial intelligence, knowledge graphs, and threat intelligence on blockchain transactions. This advanced platform not only identifies and neutralizes potential threats but also precludes their manifestation, ensuring the security and trustworthiness of financial transactions within the blockchain ecosystem. As the fintech industry increasingly pivots towards blockchain integration, AnChain.AI’s groundbreaking approach establishes new benchmarks for security and risk management, providing indispensable support to the fintech blockchain technology.

4. Aragon

Aragon is a fintech firm that is leading the way in providing blockchain solutions for fintech that are designed to transform the way businesses are established and run. Their idea is based on the knowledge that the Internet and blockchain are radically changing the way businesses function and what motivates them to exist. Leading this change is Aragon, which creates solutions, especially for the future generation of businesses ready to take advantage of these changes in the fintech blockchain business environment.

By providing blockchain solutions for fintech, Aragon aims to simplify and democratize the creation and maintenance of companies and other organizational structures. Their innovative approach uses the power of blockchain technology to offer transparent, secure, and efficient solutions for entrepreneurs and organizations. Through Aragon’s platform, individuals can establish and manage entities in a decentralized, trustless manner, bypassing traditional intermediaries and red tape. This not only fosters greater accessibility and inclusivity in the world of finance but also paves the way for new business models and organizational frameworks that fully capitalize on the potential of blockchain and the Internet.

5. Zabo

Zabo is a leading innovator in the fintech crypto companies, providing an innovative cryptocurrency banking platform that combines traditional banking with blockchain technology. Users may now get their salary in Bitcoin thanks to Zabo, which is a big step in the right direction towards the widespread usage of digital currencies in regular financial transactions. Zabo makes it easier to make the smooth transfer from fiat to cryptocurrency in the future when cryptocurrencies will play a major role in personal finance.

Zabo’s core product is an API-based cryptocurrency application that acts as a bridge to link cryptocurrency accounts to other apps with little to no coding knowledge. By enabling developers and companies to quickly integrate cryptocurrency features into their platforms, this simplified method opens up new avenues for financial innovation. Zabo also offers a full range of services, such as physical bank accounts that accept hardware wallets, allowing users to easily purchase, sell, or transfer cryptocurrency while still having the ease and security of traditional banking. Zabo stands out as a forerunner, advancing the fusion of blockchain technology and conventional banking with its user-friendly and adaptable platform as blockchain fintech companies continue to transform the financial environment.

6. Horizon Blockchain Games Inc.

Horizon is spearheading a transformative journey toward a New Dimension where internet economies are vibrant, accessible, and inclusive for all participants. At the core of their vision lies Sequence, a groundbreaking initiative aimed at ushering in a new era of user-friendly blockchain solutions for fintech. The sequence comprises two pivotal components: firstly, the development of the first-of-its-kind smart wallet tailored for crypto, NFTs, Web3, and the metaverse. This intuitive wallet not only simplifies the complexities of blockchain technology but also opens doors to new realms of digital asset management and interaction.

Secondly, Horizon introduces a developer platform integral to the Sequence ecosystem, facilitating the seamless creation of Web3 applications on Ethereum and other EVM chains. By offering developers user-friendly tools and resources, Horizon empowers them to embark on their own ventures within the blockchain space, fueling innovation and expanding the horizons of fintech blockchain companies. With Sequence, Horizon aims to democratize access to the benefits of blockchain technology, fostering a vibrant ecosystem where finance intersects with modern technology to drive positive change and empower individuals worldwide.

7. Argent

With the use of fintech blockchain technology, Argent becomes a leading force in the finance sector by providing a straightforward yet effective solution in the shape of a smart wallet made exclusively for Ethereum. Argent gives people direct access to the potential of cryptocurrencies, democratizing identity management and digital asset access. Argent gives consumers the ability to take charge of their financial destinies by offering an intuitive mobile interface that allows them to save, save, transmit, borrow, earn interest, and invest in cryptocurrency.

Argent’s fintech blockchain service is centered on a dedication to accessibility, security, and simplicity. With no need for middlemen, this non-custodial smart wallet guarantees that consumers always have complete control over their funds. In the blockchain financial space, Argent raises the bar for usability and security by fusing a sophisticated aesthetic with strong security measures. Furthermore, Argent is a worldwide financial inclusion advocate since it provides its services to anybody with an internet connection, regardless of location or nationality. Argent is a shining example of innovation in the financial sector, bringing the world of cryptocurrencies closer to the reach and convenience of everybody. This is due to the ongoing change in the fintech industry by blockchain technology.

8. Phemex

Phemex is a fintech blockchain company that is leading the way in building the most reliable cryptocurrency derivatives trading platform globally. Phemex’s ethos is centered on its dedication to a “User-oriented” approach, which puts the trust and happiness of users first. Using this perspective, Phemex painstakingly creates strong features that outperform those on current exchanges, giving traders unmatched comfort and confidence while purchasing and disposing of contracts.

Phemex uses blockchain technology to provide customers with a smooth trading experience while also guaranteeing the security and immutability of transactions. Because of the platform’s user-centric design, traders may conduct transactions in a reliable environment with confidence, knowing that their interests are protected and their assets are given top priority. Phemex is well-positioned to transform the cryptocurrency derivatives trading market and establish new benchmarks for functionality and dependability in the fintech blockchain industry thanks to its commitment to innovation and user empowerment.

9. Aurus

Aurus is at the forefront of finance using blockchain technology, revolutionizing the traditional precious metals industry through its innovative products and services. By using blockchain-based solutions, Aurus transforms the accessibility and usability of gold, silver, and platinum, making these precious metals more readily available to people worldwide. Through Aurus’s platform, individuals can seamlessly buy, store, and trade gold, silver, and platinum in a highly fractionable, portable, and accessible manner, all while enjoying the benefits of spot pricing and minimal storage and transaction fees.

As one of the leading crypto fintech companies, Aurus’s mission is to democratize access to precious metals and reshape the way they are bought, sold, and stored. By leveraging blockchain technology, Aurus eliminates barriers to entry and enables individuals to participate in the precious metals market with ease and transparency. Through its innovative approach, Aurus not only expands access to traditional assets but also unlocks new avenues for financial inclusion and empowerment, driving forward the evolution of finance in the blockchain era.

10. Bakkt

Bakkt stands as a leading startup in the fintech blockchain domain, committed to developing technology that facilitates the integration of cryptocurrencies across diverse industries. With a focus on enhancing customer loyalty and delivering exceptional experiences, Bakkt empowers companies to leverage crypto assets to create immersive and interconnected experiences for their customers. By unlocking the utility of cryptocurrencies and other digital assets, Bakkt equips its business partners with the tools to offer innovative opportunities that drive deeper engagement and satisfaction among consumers.

Through its innovative solutions, Bakkt bridges the divide between traditional finance and the blockchain ecosystem, opening up new avenues for the application of cryptocurrency in everyday transactions. By providing tailored tools and solutions, Bakkt empowers businesses to embrace blockchain technology and leverage its benefits to enhance customer loyalty and stimulate growth. As a key player among fintech blockchain companies, Bakkt is spearheading the evolution of finance by unlocking novel possibilities for businesses and consumers in the digital era.

11. Billion

Billon is a blockchain-based financial firm that is leading the way in developing a Distributed Ledger Technology (DLT) protocol and system that is designed for large-scale national currency payments and document storage. Through rigorous compliance with regulatory standards, Billon addresses major obstacles to the financial industry’s broad adoption of blockchain technology. Billon wants to unleash the disruptive power of blockchain technology in the regulated financial sector with its novel protocol, which is designed for high throughput and low maintenance costs.

Billon aims to transform traditional finance by utilizing blockchain technology in compliance with legal and regulatory requirements. Financial institutions can confidently adopt blockchain technology and reap its advantages while maintaining regulatory compliance with Billon’s scalable and compliant national currency payment and document storage platform. Being a driving force in the blockchain in fintech industry, Billon is utilizing blockchain technology to its fullest extent in regulated environments, therefore bringing about a new age of increased efficiency, transparency, and creativity.

12. Balancer

Using blockchain technology, Balancer emerges as a trailblazing startup in the financial space, upending the conventional approach to portfolio management with its cutting-edge automated portfolio manager and liquidity provider. Balancer completely reimagines the idea of an index fund, turning the traditional approach on its head. Rather than charging portfolio managers to rebalance investments, customers may now charge traders to do so by taking advantage of arbitrage possibilities. This ground-breaking method democratizes portfolio management and returns control to customers by doing away with the need for expensive middlemen.

Through its innovative model, Balancer unlocks new possibilities for dynamic fees and introduces liquidity bootstrapping pools (LBPs), which are particularly advantageous for launching new tokens and facilitating token swaps. By utilizing blockchain technology, Balancer provides a decentralized and efficient platform for managing portfolios and providing liquidity, offering users greater flexibility and control over their assets. As one of the leading blockchain fintech companies, Balancer is at the forefront of driving innovation in decentralized finance (DeFi), reshaping the landscape of traditional finance and opening up new opportunities for financial inclusion and empowerment.

Conclusion

In conclusion, the fintech revolution is being propelled forward by the innovative efforts of startups using the power of blockchain technology. These 12 startups showcased in our blog are at the forefront of driving transformative change in the financial industry, offering solutions that enhance efficiency, transparency, and accessibility.

From decentralized lending platforms to blockchain-powered payment networks, each startup is reshaping traditional finance and paving the way for a more inclusive and decentralized financial future. As these startups continue to push the boundaries of innovation, the fintech revolution will undoubtedly accelerate, bringing about a new era of financial services that are faster, cheaper, and more secure for everyone.

FAQs

1. What is blockchain technology and how does it benefit fintech startups?

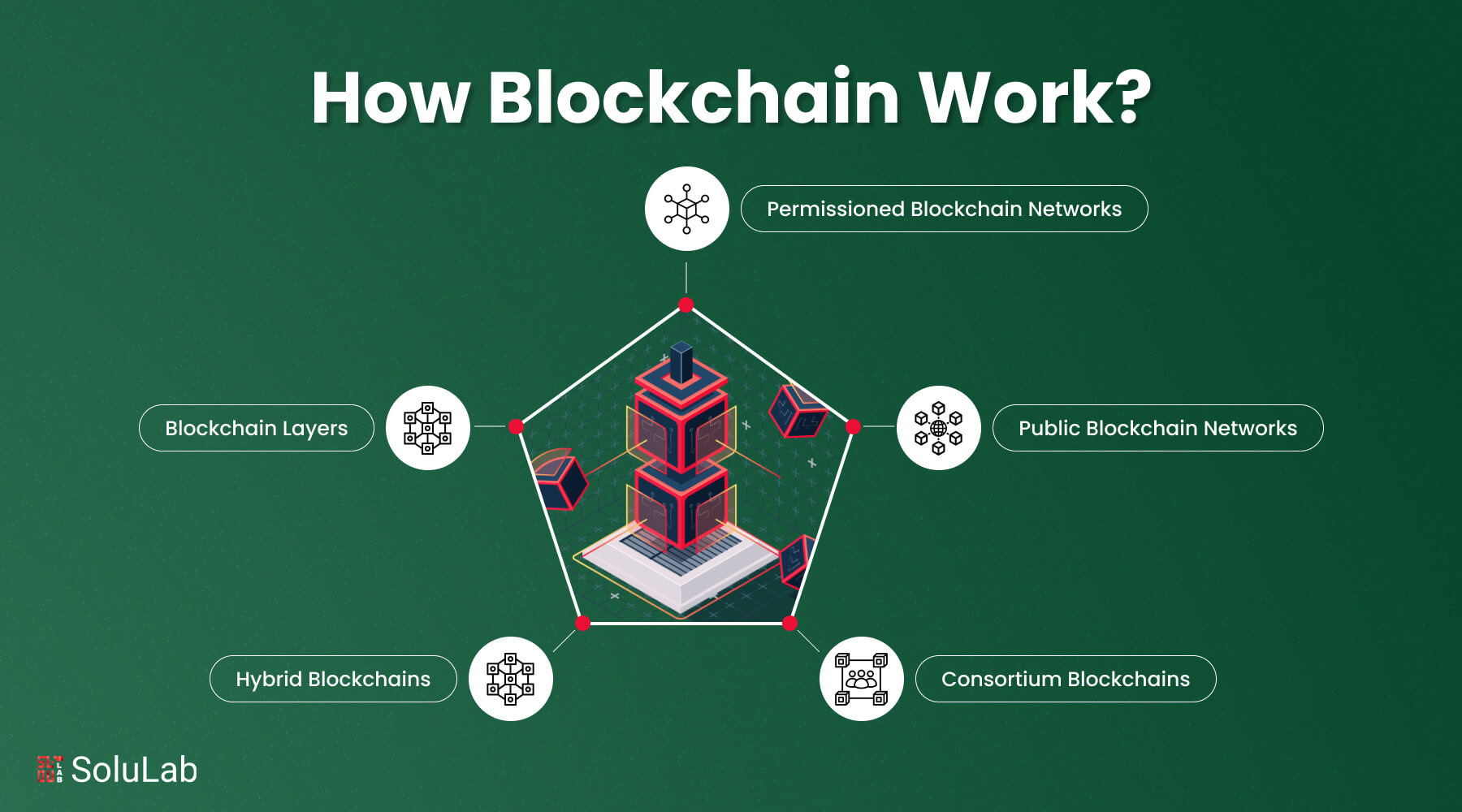

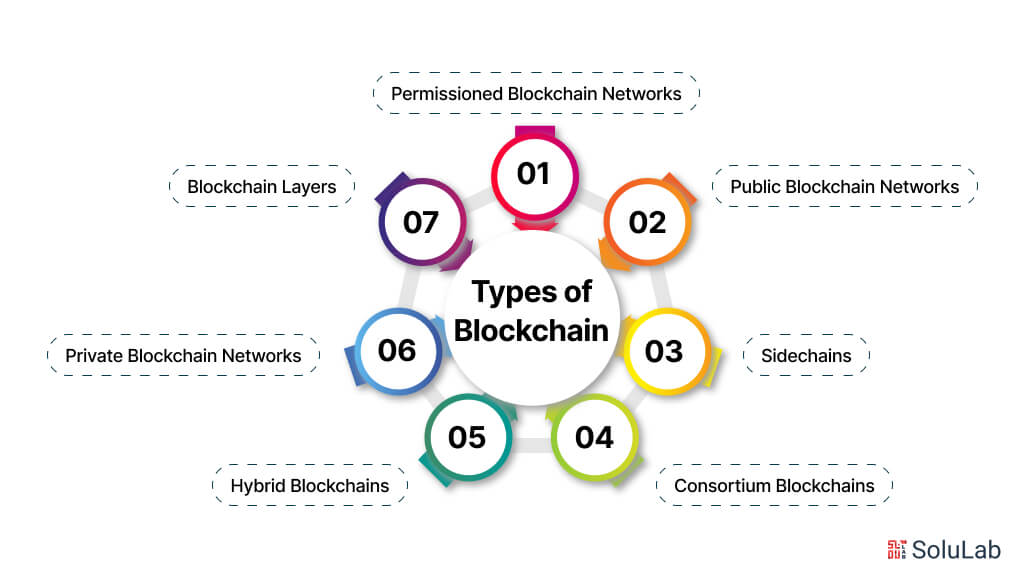

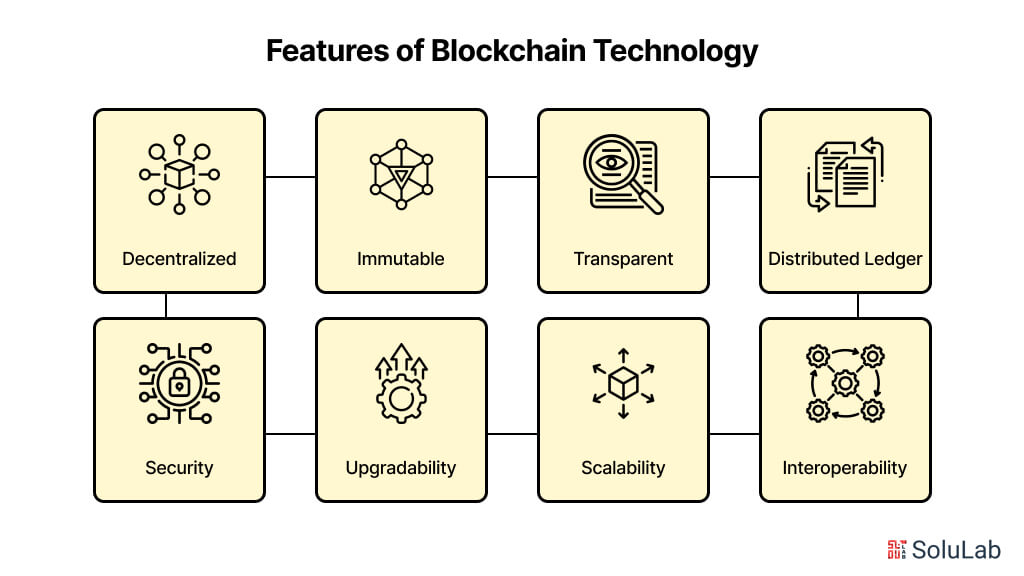

Blockchain technology is a decentralized and immutable ledger system that records transactions across a network of computers. Fintech startups leverage blockchain for its transparency, security, and efficiency. By using blockchain, startups can streamline processes, reduce costs, and enhance trust in financial transactions.

2. How do these startups use blockchain to revolutionize finance?

These startups utilize blockchain in various ways, such as facilitating cross-border payments, providing decentralized lending and borrowing platforms, creating tokenized assets, and improving transparency in financial transactions. By harnessing blockchain, they offer innovative solutions that challenge traditional financial systems and empower users with greater control over their finances.

3. Are blockchain-based fintech solutions secure?

Yes, blockchain-based fintech solutions offer enhanced security due to the decentralized nature of blockchain networks. Transactions are recorded on a distributed ledger that is immutable, making it extremely difficult for unauthorized parties to tamper with data. Additionally, cryptographic techniques ensure that transactions are secure and private.

4. How accessible are these blockchain fintech solutions to the average user?

Many of these startups prioritize user-friendliness and accessibility, offering intuitive platforms and interfaces that make it easy for individuals to participate in blockchain-based financial services. Whether it’s using a decentralized wallet for cryptocurrency transactions or accessing decentralized protocols, these solutions aim to democratize finance and empower users of all levels of expertise.

5. What regulatory challenges do blockchain fintech startups face?

Blockchain fintech startups often navigate complex regulatory landscapes as they operate in a rapidly evolving industry. Regulatory challenges can include compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations, as well as navigating licensing requirements in different jurisdictions. However, many startups work closely with regulators to ensure compliance and foster trust in their platforms.