If you’re a founder, builder, or investor diving into crypto, one of the first decisions you’ll face is how to store your digital assets safely. Choosing between a Hot wallet crypto and a cold, offline wallet can directly impact your business’s security, user trust, and regulatory compliance.

| The global crypto wallet market reached $14.39 billion in 2024 and is projected to grow to $18.96 billion in 2025, representing a 31.7% compound annual growth rate. |

This explosive growth underscores the critical importance of choosing the right wallet. In this guide, we’ll explain crypto hot wallet and cold wallet systems, compare their pros and cons, and show you how to choose the best setup to protect your startup while keeping operations smooth.

What Is a Hot and Cold Wallet?

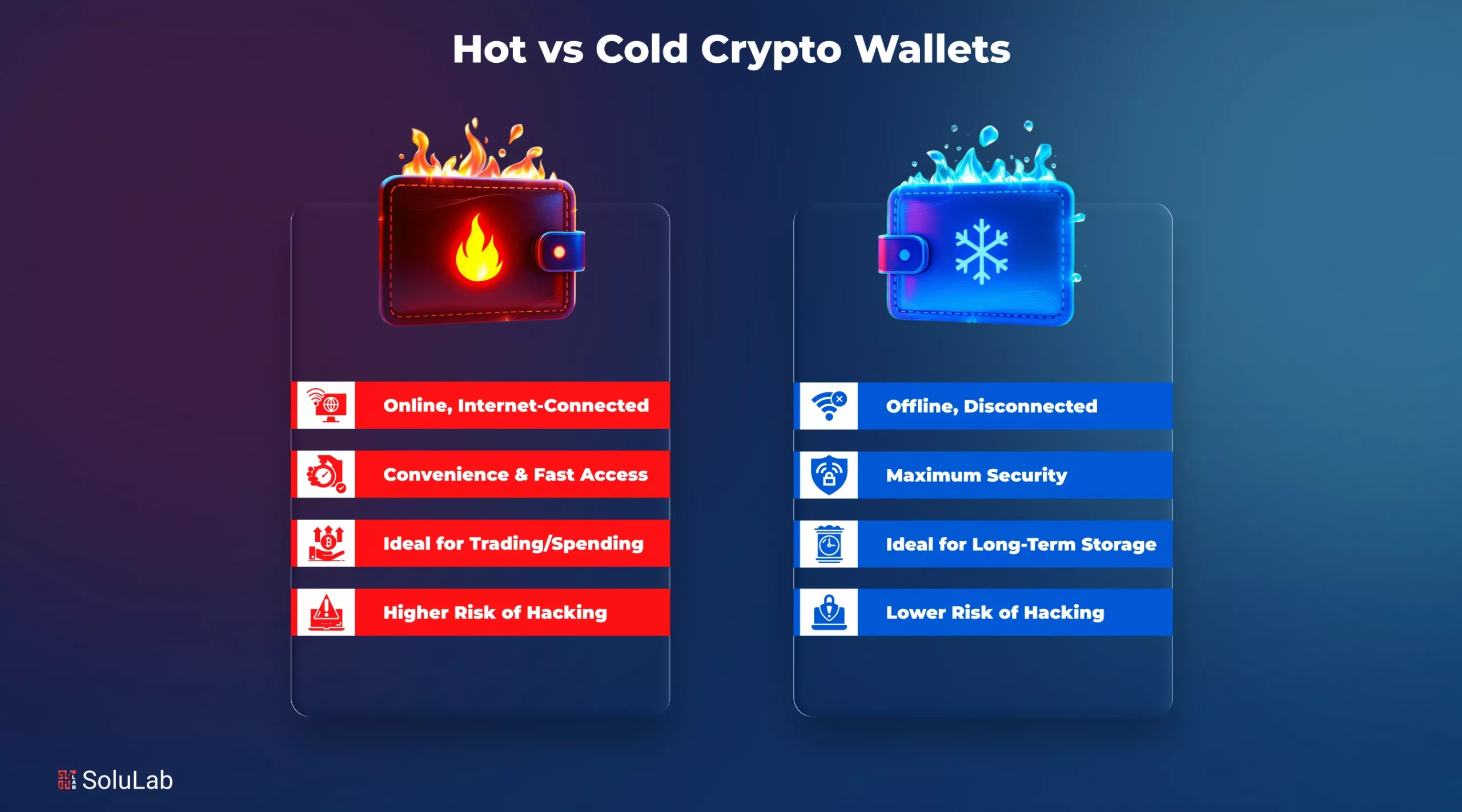

A Hot wallet is an online wallet connected to the internet. It’s designed for quick transactions, instant access, and DeFi integrations, making it perfect for founders, startups, and teams who need to manage daily liquidity efficiently. It’s like a digital checking account for your crypto assets that is always ready, always online.

On the other hand, a cold wallet (or offline wallet) keeps your private keys completely offline, stored in a hardware device or air-gapped solution. This makes it much safer against hacks and cyberattacks, ideal for long-term storage, treasury funds, or high-value crypto holdings.

A quick comparison of the two:

| Wallet Type | Accessibility | Security Level | Market Data (2024–2025) |

| Hot Wallet | Online, instant transactions | Moderate | 61.5% global market share |

| Cold Wallet | Offline, slower access | High | $511.46M market size, growing 33.7% CAGR |

By 2025, 72–78% of crypto users will rely on hot wallets, while demand for hardware and cold wallets has risen 34% year-over-year, reflecting growing awareness around security in the crypto ecosystem.

How Is A Cold Wallet Different From A Hot Wallet?

The choice between hot wallet crypto and cold storage is not just technical; it’s about balancing convenience, liquidity, and security. Here is the key differentiator you should know:

1. Security and Risk Management

Security is the biggest factor in the cold vs hot crypto wallet discussion.

In 2024, 43.8% of all crypto thefts came from online wallets losing private keys. Some of the biggest hacks were DMM Bitcoin ($305M) and WazirX ($234.9M).

If you want strong protection, cold wallets, especially Ledger crypto wallets, they are the safest choice. Ledger sold 3.5 million units in 2024, while Trezor shipped 2.4 million devices. The hardware wallet market is set to hit $2.06 billion by 2030, growing at 29.95% CAGR.

Hot wallets like MetaMask, Trust Wallet, and Phantom are popular because they’re easy to use and integrate with DeFi platforms, but their online connection makes them more vulnerable to phishing and keylogging attacks.

2. Market Performance and Adoption

When it comes to Best crypto hot wallets, the market leaders are clear:

- MetaMask: 30+ million active users, 99.99% transaction success rate

- Trust Wallet: Supports 70+ networks, 4.5+ million coins and tokens

- Coinbase Wallet: Enterprise-ready with high-grade security

Cold wallets are also gaining traction. Adoption surged 34% in 2025, driven by rising security awareness and institutional interest. Top cold crypto wallets like Ledger Nano X and Trezor Safe 3 are now considered industry standards for offline crypto safety.

3. Cost and Implementation

Hot wallets are cheap or free, perfect for everyday business transactions. For example, MetaMask charges 0.875% for swaps, while Trust Wallet lets you swap coins without fees.

Cold wallets need an upfront investment, typically $49–$200, but this buys long-term security for your treasury or high-value crypto holdings.

For startups, the choice depends on transaction frequency and asset size:

- If you do Daily transactions, use a crypto hot wallet

- For Long-term storage, use cold wallets

Read Our Blog: Custodial vs. Non-Custodial Wallets

Which Wallet Is Best for Your Startup in 2025?

For most startups, a hybrid approach works best, using both hot and cold wallets strategically.

1. Hot Wallet (for operations):

Use Hot wallet crypto tools like MetaMask or Trust Wallet

- Keep 10–20% of assets for daily use

- Enable multi-signature access for team transactions

2. Cold Wallet (for reserves):

- Store 80–90% of holdings in Ledger crypto wallets

- Protect high-value assets with enterprise-grade custody solutions

- Add biometric or hardware security

Choosing the right mix ensures speed, security, and compliance, especially with evolving regulations like MiCA in Europe and updated US crypto laws.

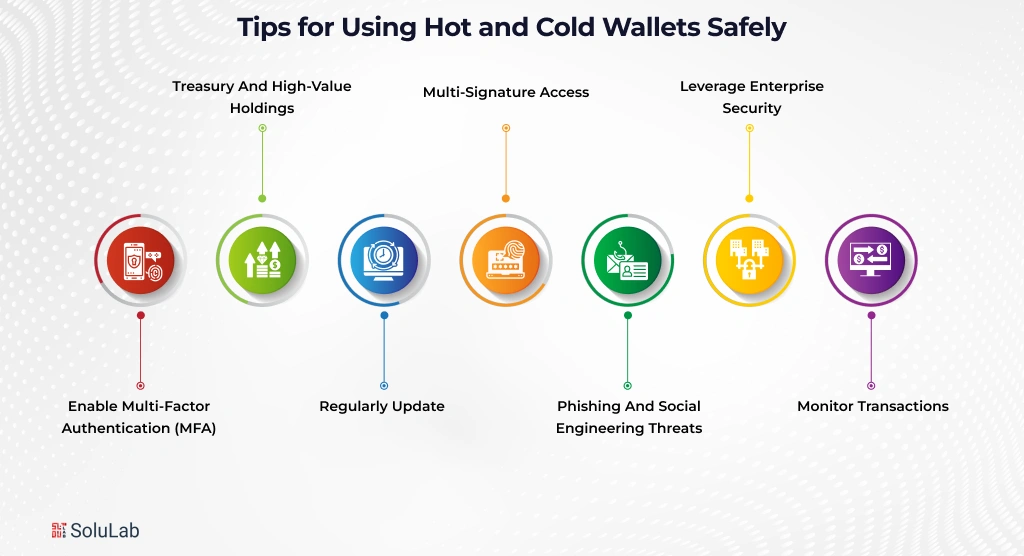

Tips for Using Hot and Cold Wallets Safely

Managing cryptocurrency for your business is not just about choosing between a Hot wallet crypto or a cold wallet, it’s about implementing strong, practical safety measures to protect your assets and your users. Here’s a detailed guide for startups and businesses:

1. Enable Multi-Factor Authentication (MFA) on All Crypto Hot Wallet Accounts

Hot wallets are connected to the internet, making them convenient but more exposed to attacks. Adding MFA ensures that even if a password is compromised, unauthorized access is prevented. For B2B setups, consider team-level MFA where every operational wallet requires approval from multiple key holders.

2. Use Cold Wallets for Treasury and High-Value Holdings

Cold wallets are offline and provide top-tier security. Allocate 80–90% of your company’s crypto holdings to cold wallets, especially for reserves, long-term investments, or treasury funds. Popular options include Ledger crypto wallets and Trezor devices, which are recognized for enterprise-level security.

3. Regularly Update Wallet Firmware and Software

Outdated wallets are easy targets. Whether using Best crypto hot wallets like MetaMask or hardware wallets, ensure automatic updates are enabled. Scheduled maintenance and patching reduce the risk of exploits and keep your infrastructure compliant with emerging regulations like MiCA and U.S. crypto guidelines.

4. Implement Multi-Signature Access and Multiple Backups

A multi-signature setup means transactions need approval from several authorized team members. This reduces the risk of internal errors or misuse. Keep secure backups of wallet keys in geographically separated, encrypted locations. This ensures continuity even if one backup is lost or damaged.

5. Educate Your Team on Phishing and Social Engineering Threats

Technology alone cannot protect your assets. In 2024, 60% of crypto thefts happened due to human error, not technical flaws. Run regular training sessions for employees on recognizing phishing emails, suspicious links, and social engineering attempts. Encourage a security-first mindset for all wallet interactions.

6. Leverage Professional Wallet Development Companies for Enterprise Security

Partnering with a crypto wallet development company ensures your business adopts best practices for security, compliance, and scalability. Professional developers can implement features like multi-chain support, enterprise-grade custody solutions, and automated monitoring, reducing risks while giving your team peace of mind.

7. Monitor Transactions and Implement Alerts

Even with secure setups, active monitoring of wallet transactions is critical. Set up real-time alerts for unusual activities, especially for hot wallets used in daily operations. Combining monitoring with multi-signature approval strengthens your security posture.

Future Trends in Crypto Wallets

Based on our observation, here are the main trends that can come up in crypto wallets by 2026 or ahead:

1. Hybrid Wallets

The line between Hot wallet crypto and cold storage is fading fast. Businesses today need both speed and safety, and that’s exactly what hybrid wallets offer. These systems combine the convenience of a crypto hot wallet with the offline protection of a cold one.

In 2026, we’re seeing startups and enterprises adopt AI-powered hybrid wallets that automatically move funds between hot and cold crypto wallets based on risk levels and transaction size.

For founders, this means you no longer have to choose between security and usability. You can have both and still maintain compliance with growing crypto regulations.

2. Multi-Chain Wallets

Managing multiple tokens across networks can be painful. That’s where multi-chain wallets come in. These modern solutions allow users to manage Bitcoin, Ethereum, Solana, and other assets under one dashboard.

Popular platforms like Rabby and Core Wallet are already leading this shift. For businesses building new wallet infrastructure, adding multi-chain support is now a must, not a feature. It saves users time, simplifies UX, and reduces the friction of switching between blockchains.

3. AI and Biometrics

Security in wallets is no longer about private keys alone. By 2025, biometric authentication adoption has increased by 46%, and AI-driven fraud detection is becoming standard across both Best crypto hot wallets and hardware cold wallets.

AI helps identify suspicious behavior like unusual transfers or repeated access attempts, before they become a threat. Biometrics, on the other hand, offer instant and password-free authentication, improving user trust.

For startups or enterprises developing their own wallets, AI integration and biometrics powered security ensure enterprise-grade security without adding friction. Partnering with experienced crypto wallet development companies can help you implement these features faster, with a compliance-ready design and minimal operational risk.

How Can SoluLab Help You Build One?

SoluLab is a leading Crypto wallet development company trusted by startups and businesses worldwide to build secure, scalable, and compliant crypto wallets.

Whether you need a custom DeFi wallet, hardware wallet integration, or a hybrid hot and cold wallet system, SoluLab provides:

- End-to-end wallet development, from design to deployment

- Multi-chain integration for managing multiple cryptocurrencies

- Smart contract automation for secure custody and transactions

- Compliance-ready solutions with KYC/AML and audit support

As one of the top crypto wallet development companies, SoluLab helps founders and businesses create user-friendly, secure, and scalable wallets that protect assets and improve customer trust.

Conclusion

Choosing between a Hot wallet crypto and a cold wallet is more than a tech choice, it’s a strategic business decision.

- Hot wallets are ideal for daily transactions and liquidity but require strong security.

- Cold wallets are safer for storing large holdings as security becomes a priority.

- Hybrid wallets combine the best of both, giving your business speed and safety.

In 2025, as Web3 adoption grows and regulations tighten, partnering with a trusted Web3 wallet development company like SoluLab ensures your wallet infrastructure is secure, compliant, and ready to scale.

Remember: your wallet isn’t just a tool, it’s the foundation of trust for your users and business growth. Contact us to get your wallet market ready in weeks!

FAQs

1. Can I use both hot and cold wallets together?

Yes. Many investors use a hybrid approach: a hot wallet for daily transactions and trading, and a cold wallet for storing the bulk of their crypto securely.

2. What types of cryptocurrencies can be stored in hot and cold wallets?

Both wallets support major cryptocurrencies and tokens, but compatibility depends on the wallet provider. Cold wallets often support multiple coins, including Bitcoin, Ethereum, stablecoins, and tokenized assets.

3. Are there costs associated with hot and cold wallets?

Hot wallets are often free or low-cost, especially mobile or web wallets. Cold wallets, particularly hardware devices, have a one-time purchase cost, but offer superior security for long-term storage.

4. Can cold wallets be used for staking or DeFi participation?

Yes, some cold wallets support staking and DeFi interactions when connected temporarily to the internet, though hot wallets remain more convenient for frequent activity.

5. Can I move crypto between hot and cold wallets easily?

Yes, cryptocurrencies can be transferred between hot and cold wallets, allowing investors to manage liquidity while keeping large funds secure offline.