Ever wish you could invest in a high-value asset? Without needing crores in your bank account? Asset tokenization on blockchain is making that possible.

It lets you own a piece of any asset by converting it into digital tokens. Think of it like splitting a pizza into slices, each token is a slice of that asset. It’s a game-changer for investors, businesses, and even industries like real estate, finance, and art. It offers fractional ownership, more liquidity, and transparency, all powered by blockchain.

If you’re curious about how this works, why it matters, and how you can benefit from it, this guide breaks it down step-by-step. Let’s get started!

Asset tokenization is the process of converting physical or digital assets into digital tokens that exist on a blockchain. These tokens represent ownership or a share of the underlying asset, which could be anything from real estate, artwork, stocks, commodities, to even intellectual property. By utilizing blockchain technology, tokenization enables assets to be divided into smaller, tradable units, making them more accessible and liquid.

For example, a property worth ₹1 crore could be tokenized into 1 lakh tokens, each worth ₹100, allowing multiple investors to own a fraction of it. This not only democratizes investment but also ensures transparency, faster transactions, and reduced costs through smart contracts.

Asset tokenization merges traditional ownership concepts with the capabilities of blockchain technology, resulting in several transformative outcomes:

Read Also: AI Tokenization For Asset Ownership

Tokenization of asset offers a range of benefits that are transforming how we invest, trade, and manage ownership. Here are some benefits of asset tokenization:

Traditional assets, such as real estate and fine art, tend to have limited liquidity. Asset tokenization on blockchain transforms these illiquid assets into tradable digital tokens. This increased liquidity allows owners to sell their assets more easily and at any time, attracting a broader pool of potential investors.

Asset tokenization divides ownership into smaller, more manageable fractions. For instance, you can own a fraction of a prestigious real estate property or a piece of valuable artwork. This democratizes investments, enabling individuals to participate in digital assets they might not otherwise afford.

Blockchain-based digital asset tokenization eliminates geographical barriers. Investors from around the world can access and invest in tokenized assets without the need for complex international transactions, currency conversions, or intermediaries.

The blockchain’s inherent security features ensure the authenticity and integrity of tokenized assets. Ownership records are transparent, tamper-resistant, and protected by cryptographic mechanisms. This helps to mitigate the risk of fraud and disputes.

Traditional asset transfers often involve multiple intermediaries, paperwork, and significant time delays. Real-world asset tokenization simplifies this process, reducing transaction costs and eliminating intermediaries. Smart contracts can automate various aspects of asset management and distribution.

Blockchain technology provides a transparent and auditable ledger of ownership and transactions. Anyone with access to the blockchain can verify the ownership of tokenized assets, enhancing trust in the system.

Tokenized assets are traded on blockchain-based platforms that operate 24/7. This continuous market access allows investors to buy or sell assets at their convenience, eliminating the need to wait for traditional market opening hours.

Asset tokenization enables investors to diversify their portfolios easily. They can invest in a wide range of assets across different industries, like gold tokenization, art or more, spreading risk and potentially increasing returns.

Asset tokenization platforms often incorporate compliance features to ensure adherence to local and international regulations. This makes it easier for businesses and investors to operate within the legal framework.

Tokenized assets simplify the inheritance process. Ownership can be transferred seamlessly to heirs, reducing the complexities associated with traditional estate planning that otherwise is a major issue.

Now, let us look at some of the use cases and examples of the tokenized assets!

Read Also: Tokenizing TradFi: Real-World Assets & Smart Bonds

Asset tokenization is expanding rapidly across industries, transforming how ownership, investment, and trading happen. Beyond traditional sectors like real estate and stocks, new and exciting use cases are emerging:

Gold has long been a trusted store of value. Tokenizing gold allows investors to buy and sell small, verified portions of gold without needing physical storage or transportation. This makes gold investment more accessible and liquid while ensuring transparency through blockchain’s secure ledger.

Diamonds and other luxury goods are high-value assets often difficult to trade. Diamond Tokenization enables fractional ownership and origin verification, reducing fraud risk and opening investment opportunities in these exclusive markets.

Artists, musicians, and content creators can tokenize their work, such as music rights, film royalties, or digital art, allowing fans and investors to own fractions of these assets and receive ongoing revenue shares. Entertainment tokenization opens up new funding models and revenue streams for creative industries.

As climate action grows, tokenized carbon credits and sustainability assets are gaining traction. These digital tokens allow easier tracking, trading, and verification of environmental impact, supporting green finance initiatives.

Stocks, bonds, and other securities are increasingly issued as digital tokens. This streamlines issuance and trading processes, reduces settlement times, and enhances transparency. Notably, US Treasury Bills (T-Bills) are also being tokenized, offering investors a highly secure, liquid, and efficient way to buy and sell government debt instruments globally.

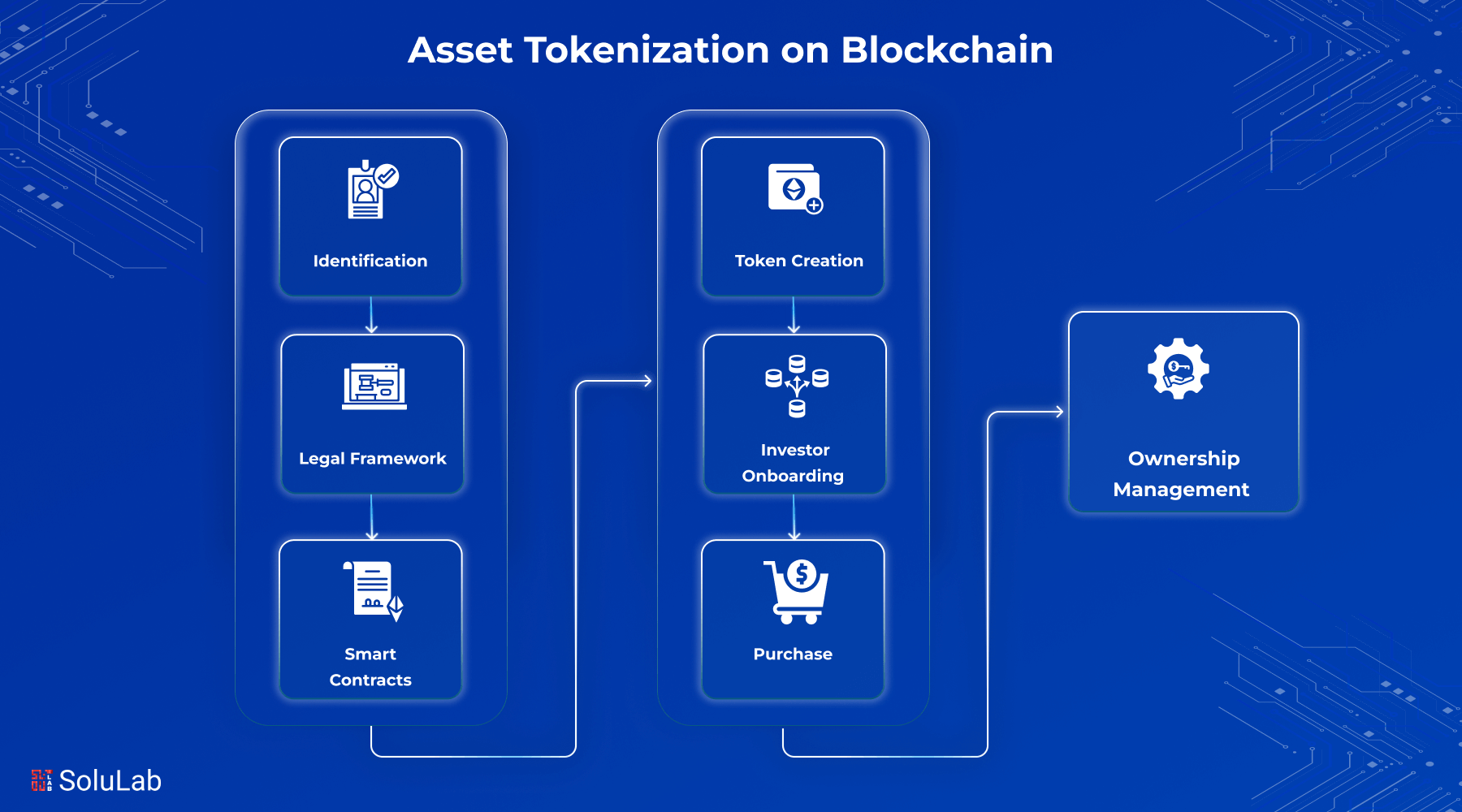

In the token economy, business interactions are reliable, quick, and irreversible. As a result, it is critical to implement the appropriate operational measures that are compliant with regulations. It is necessary to bring new participants, such as KYC utilities and blockchain analytics software vendors, forward to implement better operational measures. Here are the steps on how asset tokenization actually works:

Read Our Blog Also: Top 12 Real Estate Tokenization Companies in USA

As more industries recognize its potential to change how we own, trade, and manage assets. With the rise of digital asset tokenization, everything from real estate to fine art and even intellectual property can be turned into tradable tokens, with liquidity and global investor participation.

As blockchain technology matures, blockchain tokenization will play a critical role in making financial markets more transparent, secure, and efficient. Governments and regulatory bodies are also beginning to explore frameworks to support tokenization in blockchain. Further validating its long-term potential.

In the coming years, we can expect to see tokenized assets become mainstream, integrated into traditional financial systems, and accessible to a wider audience. From reducing entry barriers for small investors to streamlining complex asset transactions, asset tokenization is set to redefine ownership and investment.

By turning physical or digital assets into blockchain-based tokens, real world asset tokenization opens up new opportunities for fractional ownership, better liquidity, and global access. Whether you’re an investor looking to diversify or a business aiming to get value, it makes the process smoother, faster, and more transparent. As blockchain adoption grows in, understanding tokenization puts you one step ahead.

As a leading asset tokenization company, SoluLab has always been catering to the changing business needs in an efficient manner. With deep experience in blockchain development, smart contracts, and decentralized finance, our team of seasoned developers empowers businesses and investors to knock on the door of new opportunities through customized tokenization platforms.

Partner with SoluLab to unlock the full potential of blockchain-powered asset tokenization!

Token holders gain legally recognized rights to the underlying asset, which can include profits, voting, or usage rights, depending on the asset type and token structure.

In many cases, yes. Tokenization enables fractional ownership, allowing smaller investors to participate. However, some tokens may be restricted to accredited investors depending on legal frameworks.

The timeline varies depending on asset complexity, regulatory requirements, and tokenization platform development, typically ranging from a few weeks to several months with professional support.

Legal agreements and custodial arrangements usually govern the protection and maintenance of the underlying asset. Token holders rely on these protections, as the token represents ownership rights, not physical possession.

Begin by identifying the asset, ensuring regulatory compliance, partnering with a blockchain development company like SoluLab, and choosing a suitable platform for token issuance and management.