Regulations, taxation, investor trust, and even blockchain infrastructure vary from one country to another. Choose the wrong one, and you might face endless compliance, high taxes, or limited investor participation.

The real estate tokenization is expected to exceed $16.51 billion by 2033, growing at a CAGR of 19.50%. That’s why choosing the right country matters more than ever.

In this blog, we’ll explore the top 10 countries to launch a real estate tokenization platform, highlighting their benefits, regulations, and tips so you can make an informed decision and set your platform up for long-term success.

Choosing the right country for tokenization platform development and launch is crucial it impacts regulations, investor confidence, and long-term project success. Let’s explore the key factors to consider before making your decision:

1. Jurisdiction: Ensure the country has clear crypto and tokenization laws. A supportive regulatory framework protects investors and minimizes compliance risks.

2. Taxation: Look for countries offering favorable tax rates on digital assets. This helps in maximizing returns and maintaining operational efficiency.

3. Market Accessibility: Choose a country with global market access and financial infrastructure. It enables transactions and broader investor participation.

4. Blockchain Ecosystem: A strong local blockchain ecosystem supports innovation. Collaboration with top blockchain companies and developers enhances project scalability.

5. Political and Economic Stability: Stable governments ensure consistent policies, reducing risks of sudden legal or economic disruptions. Stability fosters investor trust and project longevity.

6. Data Protection Laws: Opt for nations with robust data privacy regulations. Secure data handling ensures compliance and builds user confidence in tokenized assets.

Read Also: 9 Key Features of Next‑Gen Tokenization Platforms for 2030

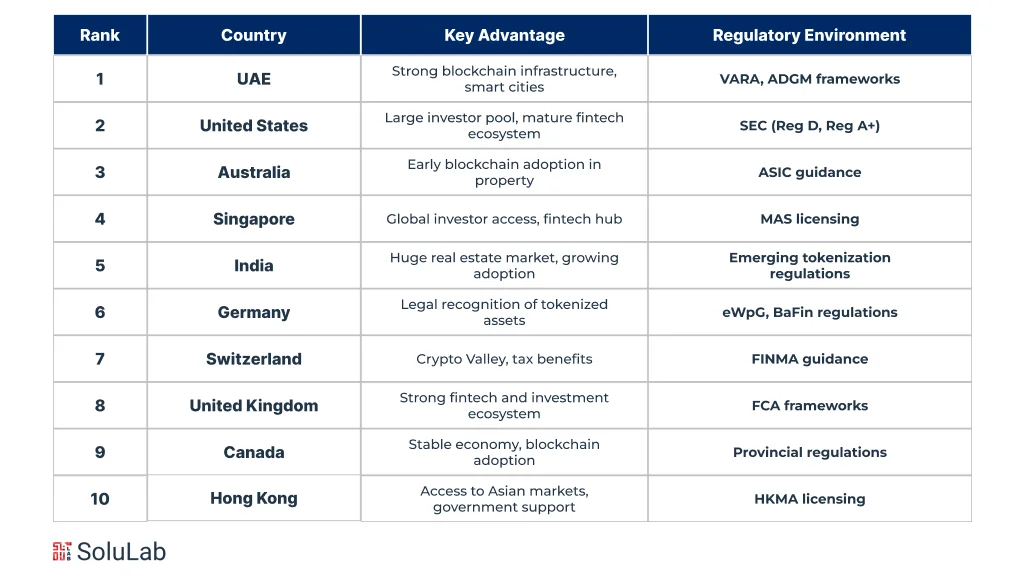

Here are the top 10 countries to consider in 2026 that provide the perfect ecosystem for launching your real estate tokenization platform:

Now, lets have a detailed analysis of every country that why its an ideal choice to invest in real estate tokenization projects before 2025 ends:

The UAE, particularly Dubai and Abu Dhabi, has become a pioneer in embracing blockchain and tokenized assets. With initiatives like the Virtual Assets Regulatory Authority (VARA) and ADGM’s DLT frameworks, the country provides a transparent regulatory environment for digital asset issuance.

Why UAE? It’s one of the few countries where you can legally tokenize properties and attract both local and international investors through compliant structures

The U.S. remains the market leader for blockchain startups and real estate investments. With the SEC refining its stance on digital securities, tokenization projects can operate under regulated frameworks such as Reg D and Reg A+.

Why the U.S.? It offers access to one of the world’s largest investor pools and a mature infrastructure for digital securities.

Australia is rapidly becoming a blockchain-friendly destination with government-backed digital initiatives and a strong fintech ecosystem.

Why Australia? A strong legal system and digital-first policies make it a safe and progressive environment for real estate tokenization startups.

Singapore continues to dominate Asia’s landscape with its forward-thinking regulations under the Monetary Authority of Singapore (MAS).

Why Singapore? Businesses launching a real estate tokenization platform benefit from transparent regulation, a global investor base, and tech-savvy infrastructure.

India is gradually embracing Web3 innovation, and real estate tokenization is expected to gain strong traction by 2026.

Why India? With a rising middle class and increasing investor appetite for fractional ownership of property, India is set to be a key player in tokenized real estate markets.

Germany is one of the first EU countries to legally recognize blockchain-based securities. The Electronic Securities Act (eWpG) and BaFin regulations allow full compliance for tokenized assets.

Why Germany? It combines legal certainty, strong financial institutions, and a receptive investor community for digital assets.

Switzerland remains a top choice for blockchain-based real estate projects thanks to its progressive laws and crypto-friendly banks.

Why Switzerland? Ideal for global investors seeking a regulated, low-risk jurisdiction with a strong blockchain ecosystem.

The UK continues to evolve its digital asset regulations post-Brexit, positioning itself as a safe, innovative hub for tokenized property investments.

Why the UK? Strong legal systems, access to capital, and global credibility make it a prime location for tokenized property ventures.

Read Also: Tokenization Platform Development Checklist for Enterprises

Canada has emerged as a forward-thinking market for blockchain asset innovation, supported by clear crypto regulations and strong investor protections.

Why Canada? A stable economic and legal environment makes it one of the most reliable destinations for launching tokenized property projects.

Hong Kong is rapidly positioning itself as a regulated center for digital assets in Asia, following new crypto licensing policies in 2024.

Why Hong Kong? It offers a balance of innovation, regulation, and access to Asian capital markets, which are perfect for tokenized real estate startups.

Read Also: XRPL Blockchain for Real Estate Tokenization

Before selecting a country for your Real Estate Tokenization Platform, it’s crucial to understand the legal, financial, and technological factors that can impact your project’s success.

1. Regulatory Framework: Choose a country with clear crypto and securities regulations to ensure your tokenized real estate investment platforms operate legally and transparently.

2. Tax Policies: Analyze taxation on digital assets and foreign investments to maximize profitability and minimize unexpected liabilities for your tokenized real estate platform.

3. Investor Protection Laws: Select jurisdictions that offer strong investor safeguards to build trust and attract global participants in your tokenization venture.

4. Market Maturity: Opt for countries with advanced blockchain ecosystems and financial infrastructure to support efficient token issuance and trading.

5. Banking and Payment Systems: Ensure local banks support crypto-related transactions for fund transfers and liquidity in your platform operations.

6. Technology Infrastructure: Reliable internet connectivity and data security frameworks are vital for managing token issuance, trading, and compliance efficiently.

Whether it’s the UAE’s progressive crypto regulations, the US’s institutional adoption, or Singapore’s fintech-driven innovation, as 2025 ends, you have the opportunity to launch real estate tokenization platforms in these top countries.

SoluLab, a leading real estate tokenization development company, helps businesses and investors build secure, compliant, and scalable tokenization platforms that render the true value of digital real estate assets. From smart contract development to regulatory integration and investor dashboards, we deliver end-to-end blockchain solutions tailored to your goals.

Get in touch today to transform your real estate assets into high-value digital tokens and lead the future of property investment!

These are digital platforms that facilitate buying, selling, and managing real estate assets as blockchain-backed tokens for investors.

These platforms allow investors to invest in fractional property ownership through blockchain tokens, providing liquidity and global access.

XRP Dubai real estate tokenization involves leveraging XRP blockchain technology to create secure, fast, and scalable tokenized property assets in Dubai.

These services assist in creating blockchain solutions, legal compliance, smart contracts, and secure platforms for tokenized real estate investment.

You can tokenize real estate by creating blockchain-based digital tokens representing ownership shares, supported by legal and smart contract frameworks.