After gold, silver has always been a stable commodity during volatility. However, this time, silver buying rose higher than gold. Alongside record activity in futures and ETFs, silver is now seeing a sharp rise in on-chain activity. Silver tokenization markets are not lagging behind traditional finance. In fact, they’re moving in parallel.

Over the past 30 days, on-chain transfer volume for tokenized silver exposure tied to SLV has surged by more than 1,200%. The number of holders has grown by roughly 300%, and net asset value is up close to 40%. These aren’t marginal moves. They reflect a real shift in how investors and institutions are accessing commodity exposure.

This blog explores why silver volatility is accelerating RWA tokenization, how silver tokenization works in practice, what enterprises need to launch such platforms, and where tokenized commodities are heading next.

Volatility has a way of exposing inefficiencies. In silver’s case, price swings highlighted how fragmented access still is across regions, time zones, and investor profiles.

Traditional silver exposure comes with constraints:

Tokenization of precious metals doesn’t remove market risk, but it removes friction. That distinction is important. If silver markets experience backwardation, regional premiums, and tighter supply signals, investors started looking for exposure that was:

Tokenized silver fits naturally into this gap. It allows exposure without the operational drag that often slows traditional commodity markets. For businesses, this is less about retail hype and more about infrastructure evolution. When volatility rises, markets reward platforms that move faster, settle cleaner, and offer transparency by design.

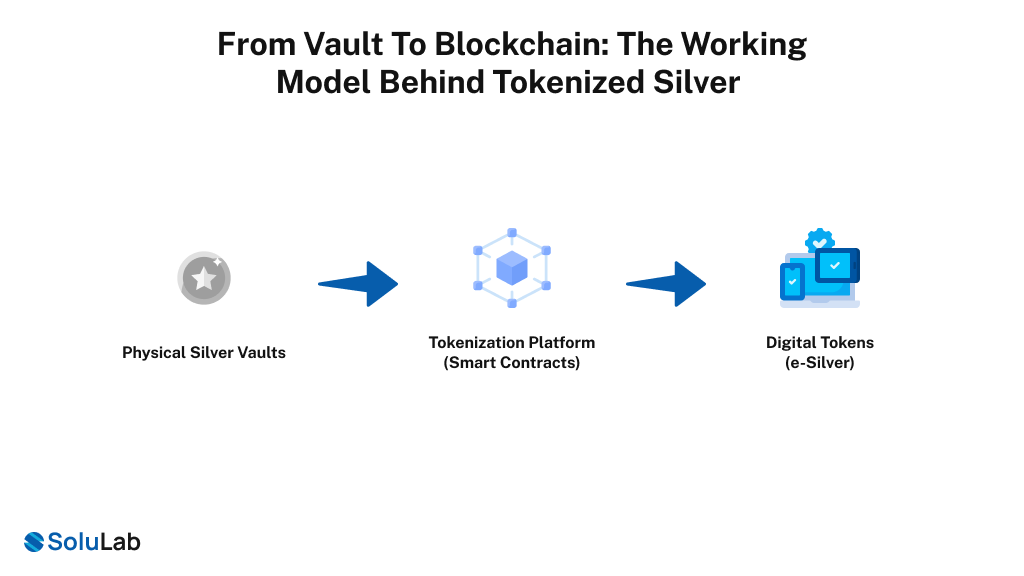

Tokenized silver isn’t about “digital silver.” It’s about creating a reliable digital representation of physical metal that already exists and is verifiably stored.

At a high level, the model is simple, but execution matters.

Physical silver is stored in insured, audited vaults. For every defined unit of silver, an equivalent number of blockchain tokens are minted. These tokens represent a direct claim on the underlying asset, subject to the platform’s legal and compliance framework.

The system typically includes:

This structure builds confidence not through promises, but through verifiable data and process transparency.

For institutional players, trust isn’t emotional. It’s operational. Enterprises care about:

Tokenization platforms that treat these as core design principles, not add-ons, are the ones seeing sustained adoption rather than short-lived volume spikes.

The response isn’t just speculation:

Liquidity doesn’t live on one chain anymore. That’s a reality most serious platforms have already accepted.

Cross-chain silver tokens allow the same underlying asset to move across different blockchain ecosystems without fragmenting trust or backing. This matters more than it sounds.

For enterprises, cross-chain capability is less about technical novelty and more about risk management and reach.

A well-designed cross-chain silver token:

This is where platform architecture becomes a differentiator. Bridging liquidity safely is not trivial, but when done right, it significantly expands market depth and utility.

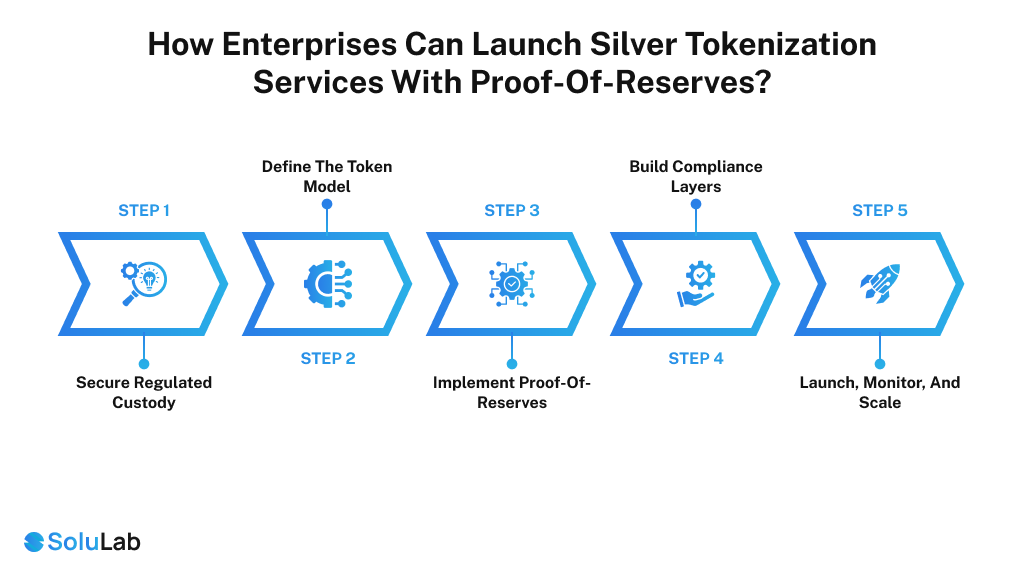

Launching a silver tokenization service is a structured execution process, not a marketing initiative. Enterprises that succeed treat it like building financial infrastructure, with clear sequencing and accountability.

Step 1: Secure regulated custody

Start by partnering with insured vault providers that already handle bullion at scale. This establishes the legal and operational foundation.

Step 2: Define the token model

Decide whether tokens represent direct ownership, a redeemable claim, or ETF-linked exposure. This choice drives regulatory treatment and user rights.

Step 3: Implement proof-of-reserves

Integrate third-party audits, on-chain supply dashboards, and controlled mint/burn logic. This step is non-negotiable for institutional trust.

Step 4: Build compliance layers

Add KYC, AML, transfer rules, and jurisdiction-specific access controls directly into smart contracts and platform workflows.

Step 5: Launch, monitor, and scale

Go live with controlled issuance, monitor redemption behavior, then expand cross-chain and liquidity integrations.

For most enterprises, silver tokenization takes 3–6 months to launch. Development and setup costs typically range from $10,000 to $100,000, depending on custody partners, compliance scope, and cross-chain support.

Done right, this approach creates a system that institutions trust and markets can scale.

Silver tokenization is already in swing across many countries across the globe. For example, the U.S.,the Middle East, China, India, Japan, and Singapore are already involved in metal tokenization and ETFs. The World Economic Forum also stated that RWA tokenization could cross $2 to $4 trillion as of 2030.

Across regions, tokenized commodities are moving beyond basic spot trading and into utility-driven, balance-sheet-relevant use cases.

In the United States, institutional desks are increasingly exploring tokenized metals for:

U.S. market structure changes, combined with higher futures margins and tighter risk controls, are quietly pushing institutions to look at tokenized rails as complementary infrastructure rather than alternatives.

In the Middle East, particularly the UAE and Saudi Arabia, tokenized metals are aligning with a broader push. They also headed toward digital asset hubs and commodity-backed financial products. The region already plays a major role in global bullion trading and storage. Tokenization allows these markets to:

Read More: How Dubai is Leading Real Estate Tokenization in 2026?

Across these markets, tokenized silver is no longer viewed as speculative. It’s increasingly seen as a way to access metals without friction in markets where physical constraints are tightening.

As you can see, precious metal investments are roaring in the market. Innovations, from digital gold and silver to ETFs. This change has not started yet, but the effects are showing now. To stay ahead in the market, a long-term vision is necessary. Bring your idea to the top asset tokenization development company, SoluLab, and the implementation yourself.

Solulab offers,

One of our recent project on a tokenization platform for gold and silver reflects our expertise and efforts in making a successful solution for precious metals.

With our 250+ experts’ support, we can make your tokenization platform world-class. Contact us today and discuss your unique idea!

Yes. Both follow similar models using physical custody, audits, and blockchain tokens. The difference lies in demand drivers: gold leans monetary, while silver blends investment and industrial use.

Green tokenization helps track carbon credits, energy use, and sustainability metrics. For manufacturing and real estate, it improves compliance reporting, transparency, and access to ESG-focused capital pools.

You can connect with SoluLab through its official website or business channels to discuss silver tokenization, compliance needs, timelines, and platform architecture suited to your enterprise goals.

Tokenization secures silver through audited custody, tamper-proof blockchain records, controlled minting, and transparent supply tracking, reducing fraud, double-counting, and manual reconciliation risks.

The best integrations include regulated custodians, proof-of-reserves systems, KYC/AML tools, cross-chain bridges, and DeFi or settlement APIs to ensure liquidity, compliance, and enterprise scalability.