Launch and manage digital money using a Stablecoin as a...

Read More

Operated by a central entity, ensuring regulatory compliance, fiat reserves, and user trust through licensed custodians.

Managed via smart contracts, offering transparent governance, autonomy, and resistance to centralized control or censorship.

Pegged 1:1 to currencies like USD or EUR, providing stability and easy onboarding for traditional finance users.

Supported by assets like real estate or bonds, enabling fractional ownership and liquidity in illiquid markets.

Linked to assets like gold or oil, providing inflation-resistant value without physical storage complexities.

Self-regulate supply using algorithms, maintaining price stability without reliance on physical or digital collateral.

Yes. A stablecoin launched in Dubai can be structured for cross-border payments and global circulation, as long as it follows internationally accepted compliance and risk management standards.

We develop fiat-backed, crypto-collateralized, and algorithmic stablecoins tailored to your business goals and ecosystem requirements.

Development timelines vary based on complexity, blockchain choice, and regulatory integration, but most projects are delivered within 8–16 weeks.

Yes. We ensure KYC/AML integration, legal compliance, and audit-ready smart contracts for global standards.

Absolutely. We ensure smooth integration with major exchanges, wallets, and DeFi platforms to maximize adoption and usability.

Yes. Our stablecoins are built with scalable architecture to handle increasing transactions, users, and ecosystem expansion.

Yes. We offer flexible options including fiat-collateralized, crypto-backed, and hybrid mechanisms.

The cost depends on factors like type of stablecoin (fiat-backed, algorithmic, crypto-collateralized), features, security layers, blockchain integration, and smart contract complexity. Typical projects range from $10,000 to $120,000+. Connect for a custom quote!

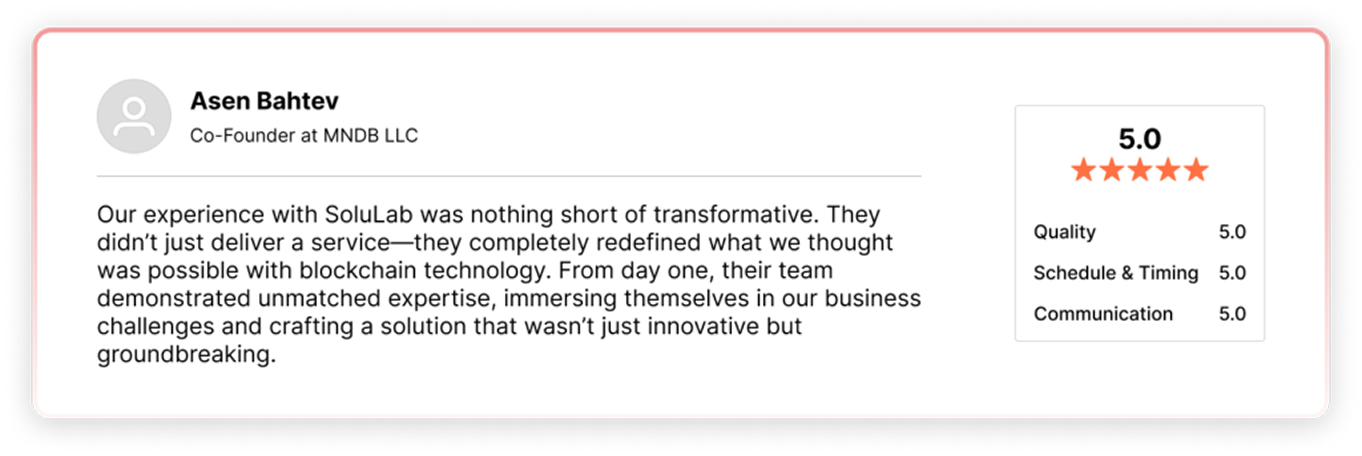

We combine technical expertise, regulatory compliance, security-first development, and scalable architecture to deliver results-driven stablecoin solutions.

Launch and manage digital money using a Stablecoin as a...

Read MoreExplore how to build your own commodity-backed stablecoin in 2026,...

Read MoreDiscover how AI agents improve stablecoin development through automation, risk...

Read More