Initial coin offerings (ICO) are becoming an exciting fundraising tool in the constantly evolving cryptocurrency world in which investors receive virtual tokens and coins in return for money. MasterCoin was the first initial coin offering J.R. Willet started the first-ever initial coin offering (ICO) token sale in 2013. Through the initial coin offering (ICO), the token, known as MasterCoin, raised an incredible $500,000 in Bitcoin. Numerous ICOs were subsequently sparked by its success. Projects creating financial goods, including DeFi, accounted for 36% of all initial coin offerings (ICO) in 2023.

This important strategy has transformed how businesses and projects obtain capital, with several advantages for investors and entrepreneurs alike. We will examine what an initial coin offering is and the benefits it offers to businesses in the cryptocurrency space.

The cryptocurrency industry’s version of an IPO is called an ICO or an Initial Coin Offering. An ICO can be used by a business looking to generate capital to develop a new blockchain application or service using cryptocurrencies. To obtain new cryptocurrency created by the company, interested investors might participate in an initial coin offering. This token could donate some ownership in the business or project, or it might have some use concerning the goods or services the company provides.

ICOs are frequently security offerings that require registration. In some cases, though they might not be required to register. Companies that have submitted Form D after selling their securities for the first time are permitted to make offers on up to $10 million in shares within 12 months under Rule 504 Of Regulation D. If coin issuers follow this requirement, they can lawfully sell coins to purchasers as securities.

A common method of raising money for goods and services that are typically associated with cryptocurrencies is through ICOs. While IPOs and ICOs are comparable, ICO-issued currencies may also be used for software services or other products. Inventors have made money from a few initial coin offerings. Many others have done poorly or have been exposed as fraudsters, registering is required for the majority of initial coin offers. a few intial coin offerings.

Read Also: ICO vs. STO

The biggest initial coin offerings have helped millions of people and organizations to raise billions of dollars. Although the IT industry has witnessed many successful ICOs, it still provides many business opportunities. Here is the list of the top five token releases to date;

Read Also: Which are the Best ICO Listing Websites Out There?

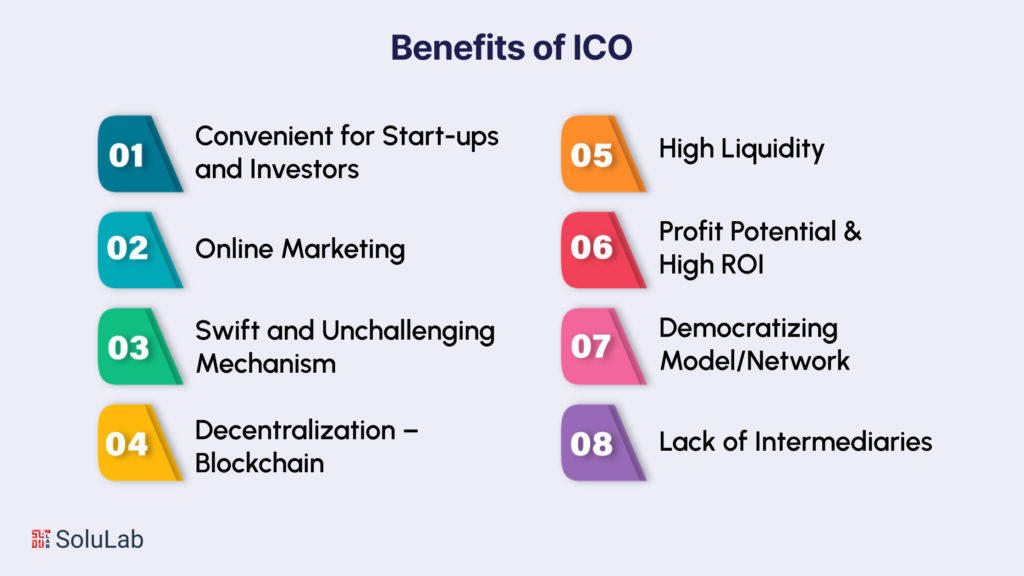

Below, we’ll discuss the usually analyzed advantages/ benefits of ICO, namely;

The biggest advantage of an Initial Coin Offering (ICO) is that it gives access to a range of people, from freelancers and startups to mature investors. There aren’t any time constraints; contributors can also invest at any time, unlike traditional funding set-ups. Anyone who wishes can become an early investor. Thus, ICOs are a favorable option for Startups because, more often than not, startup companies lack the required funds to kick-start their project but can potentially raise their value over time.

A Token launch is similar to the sale of API keys, and it’s difficult to restrict the sale of these keys to accredited investors alone. Hence it is bound to increase the buyer base relative to traditional equity financing for a start-up.

Read Our Blog: What is ICO and How Does it Work?

It’s easier to gather information about tokens via surfacing the net. Buyers interested in these coins can learn about the ICO through the organization’s website, online forums, messaging applications, and social media websites. The internet leverages ICOs, and a large, general audience is attracted to the venture if marketed right. Also, companies seeking to raise capital through innovative blockchain-based technologies do not need high marketing and advertising costs which helps to reduce the cost of raising capital.

All the transactions are done online. One can sell tokens internationally over the internet. Instead of relying on regulatory filings, as with other exchange forms like IPOs, stocks, bonds, etc., an ICO relies on blockchain technology to maintain a ledger of its multiple transactions. Data is constantly updated within seconds. All this makes an ICO less time-consuming, less energy-draining, and more efficient.

From substantiating and establishing contributions to distributing tokens, ICOs only require monitoring and updating the distributed digital ledgers.

A distributed ledger lets all investors know about the ICO process daily, as the status of an ICO at each time is written on the Blockchain. This decentralization concept prevents issuers’ fraudulence over investors through ICO. ICO also changes our notion of property rights. As in the case of tokens, the final arbiter of who possesses what property is not a national court system but an international blockchain.

High liquidity refers to an asset’s ability to be quickly bought or sold in the market without significantly affecting its value. ICOs are advantageous because early contributors have more liquidity in early-stage companies. Most popular tokens could exceed $100 million in 24-hour volume. Huge liquidity premium alone causes tokens to predominate (provided they are legally and technically feasible) because the time to liquidity enters inversely in the exponent of the compound annual growth rate.

ICOs are said to be unregulated and risky for investment, but surely “the profits from the hits outweigh the losses of the misses.” For instance, the price of bitcoin was around $100 in June 2013 and was trading at $4,000-5,000 in early September 2017. Now investors are searching for a token that can replace Bitcoin in terms of economic appreciation. Many are citing Ethereum as “the next bitcoin.”

ICOs are high-risk and high-reward assets. Investors seek high liquidity and the ability to recover the invested money quickly and other additional returns. A quick fix is provided to them through an ICO, making it a fairly attractive investment solution.

Initial Coin Offerings (ICOs) are changing fundraising by democratizing access to financial capital. It’s the era of globalization of financing. ICO virtualization has made it possible for anyone, anywhere in the world, to invest in a company that is established or operating in any country.

ICOs have caused the significance of going to Silicon Valley / Wall Street to raise funding to diminish. Everything is on the internet from the workings and marketing to opportunities. It paves the way for more expanded investment opportunities as more international clients/investors are lured into these projects.

Tokens mean instant custody, not requiring the role played by intermediaries. Elimination of financial intermediaries automatically minimizes the cost of funding and also the funding speed. There’s also less government control compared to traditional financing methods.

In 2019, ICO activity started to decline sharply, partly due to the legal ambiguity that ICOs operate. However, there is no foolproof way to sustain with the recent initial coin offerings even if investors do their research and track down the ICOs to invest in.

If necessary, the U.S. Securities and Exchange Commission (SEC) is permitted to intervene in an ICO, such as when the SEC has taken emergency action against Telegram and received a restraining order (temporary) after the Telegram development team allegedly engaged in illegal conduct and by the act raised $1.7 billion in an ICO during the years of 2018 and 2019. In March 2020, the Southern District of New York U.S. Court granted a preliminary injunction. An $18.5 million civil sanction and the repayment of $1.2 billion to investors were both mandated for Telegram.

Read Our Blog: ICO Vs Crowdfunding

When considering investing in an ICO, there is no assurance that the investor won’t become the victim of fraud or scam. However, you can follow these to take precautions against ICO scams.

You may have to buy more coins to invest in the project since certain ICOs use other cryptocurrencies.

The hype surrounding ICOs is tremendous. And there are many internet forums where investors meet to discuss potential opportunities. Some of the most well-known celebrities, including Steven Seagal, have urged his followers or fans to invest in a trending new initial coin offering (ICO).

The SEC previously warned that it was illegal for celebrities to advertise ICOs on media platforms without disclosing the payment they received to do so.

Read Also: Top 10 ICO Development Companies

Centra Tech (an ICO that closed in 2017 with $30 million in funding) has previously been endorsed by DJ Khaled and the legendary boxer Floyd Mayweather Jr. The two celebrities reached a settlement with American regulators when Centra Tech was ultimately revealed to be a fraud in court. Three of the company’s founders were found guilty of ICO fraud.

Before taking part in an ICO, investors looking to invest should become familiar with cryptocurrencies and learn everything there is to know about ICOs. ICOs are not legally regulated, so it is advised for investors to proceed with utmost caution when it involves ICOs.

The amount of funding attracted by the ICO remains the most commonly used indicator for the success of companies or entrepreneurs. Organizations are considering issuing tokens as they are assumed to be securities. Because unlike holding a stock of a company (whose products a contributor never used), ironically, tokens can be more tangible than securities. On the market end, token buyers are trying to be more cautious about buying and trading ICO tokens. On the other hand, the cryptocurrency community is putting its best efforts into regulating token sales and conducting due diligence on behalf of the public.

SoluLab stands out as a premier ICO development company, particularly valuable for startups aiming to establish their presence and raise essential capital. Using their expertise, SoluLab maximizes fundraising potential through top-tier ICO development services, tailored to fuel success in the evolving ICO technology. Their adept team specializes in pioneering solutions, guaranteeing optimal outcomes for fundraising campaigns. For those looking to redefine the cryptocurrency venture experience, SoluLab offers a fully customized white-label ICO platform with multi-blockchain support. To embark on this transformative journey, connect with SoluLab and initiate the next phase of your business expansion.

In the end, we’ll advise you if you have an inclination in the crypto universe and are interested in buying ICOs, practice proper precaution before you invest in a company just to be safe.

An Initial Coin Offering (ICO) is a fundraising method that allows businesses, especially startups, to secure capital by issuing and selling their own cryptocurrency tokens. One major benefit of ICOs is their global accessibility, enabling businesses to tap into a vast pool of potential investors without geographical constraints. This democratized funding model fosters inclusivity, as anyone can participate and support innovative projects, thereby enhancing the overall reach and visibility of the venture.

ICOs provide a unique avenue for businesses to showcase their innovative ideas and technological solutions to a wide audience. This exposure can attract tech-savvy investors who believe in the project’s potential, leading to increased funding. Additionally, ICOs often offer early adopters the chance to acquire tokens at a lower cost, fostering a community of supporters who are genuinely invested in the project’s success. This community can become vocal advocates, amplifying the project’s credibility and driving growth.

SoluLab is a leading ICO development company that specializes in creating tailored solutions for startups looking to launch their ICO campaigns. With their expertise in blockchain technology and software development, SoluLab crafts ICO platforms that are secure, user-friendly, and adaptable to multiple blockchains. By collaborating with SoluLab, businesses can ensure their ICOs are built on robust foundations, increasing investor trust and raising the likelihood of successful fundraising.

One of the appealing aspects of ICOs is the liquidity they offer to investors and token holders. Once tokens are listed on cryptocurrency exchanges, they can be traded, providing investors with the flexibility to buy or sell their tokens as desired. This liquidity fosters a dynamic secondary market, where the value of tokens can appreciate based on demand and adoption, ultimately benefiting both the project and its supporters.

A white label ICO platform, such as the one offered by SoluLab, provides businesses with a fully customized solution for launching their ICOs. This platform can be tailored to match the brand’s identity, ensuring a consistent user experience. Moreover, white label platforms often come with pre-built functionalities, reducing development time and costs. By leveraging a white label ICO platform, businesses can focus on refining their core offerings while leaving the technical intricacies to experts.

ICOs have the power to democratize fundraising, making it possible for projects in niche industries to attract capital that might be otherwise challenging to secure through traditional methods. Investors with a keen interest in a particular niche can find and support projects that align with their passions, thus fueling innovation in unique sectors. This ability to tap into a dedicated investor base enhances the viability of niche projects and contributes to diversifying the global economy.

SoluLab is a trailblazer in the realm of ICO development services, offering an unparalleled combination of expertise and innovation. Their hallmark lies in providing businesses with the opportunity to launch their own white label ICO platform, complete with multi-blockchain support. This customized approach ensures that ICO campaigns are not only secure and reliable but also tailored to the brand’s vision. With a deep understanding of blockchain technology, SoluLab is committed to transforming fundraising experiences and driving success for new cryptocurrency ventures.