Web3 represents the next stage of the internet’s growth, marked by decentralization and more user control. Unlike its predecessors, Web1 and Web2, Web3 is based on blockchain technology, resulting in a decentralized and trustworthy ecosystem. In terms of gameplay, Web3 opens up new possibilities, altering how players interact with virtual environments.

The transition from Web1 to Web2 and the emergence of Web1, the early Internet period, had static web pages and little user interaction. Web2 included constantly changing content, social media, and user-generated material, making the internet a more collaborative platform. However, when worries about centralization and data privacy grew, Web3 development trends as a natural next step. It uses blockchain to empower consumers and ensure data ownership.

The game sector, which has traditionally been at the forefront of technical innovation, is now seeing the revolutionary potential of Web3. Decentralization and tokenization have dissolved the conventional lines between players and developers in Web3 gaming. This change in perspective includes new concepts such as play-to-earn, which allows players to gain real-world value through in-game actions. The future of Web3 gaming promises unprecedented user experiences, fueled by full ownership of in-game assets and increased community interaction.

What are Smart Contracts, and How Do They Work?

Decentralization is aided by blockchain technology, which is a cornerstone of web3 innovation. This section delves into the complex relationship between blockchain and gaming, examining the tremendous influence of smart contracts on gaming ecosystems.

-

Blockchain Technology and its Role in Gaming

Blockchain serves as the foundation of web3 gaming, transforming how users interact with virtual worlds. Unlike previous centralized systems, blockchain allows for the decentralization of in-game asset ownership and control, assuring transparency and security. In web3 gaming, every transaction, object, or achievement is securely recorded on an immutable ledger, establishing a tamper-proof history.

The use of blockchain in web3 gaming introduces the NFTs (Non-Fungible Tokens), which represents an important shift in virtual asset ownership. NFTs are individual digital tokens that reflect ownership of certain in-game objects or characters. This invention allows users to own their virtual items, creating a sense of uniqueness and authenticity.

-

Smart Contracts for Gaming Ecosystems

Smart contracts emerge as a critical component in the changing architecture of web3 gaming, altering how agreements and transactions are carried out. Smart contracts are self-executing contracts in which the terms of the agreement are encoded directly into code. In web3 gaming, these contracts automate a variety of operations, guaranteeing trustless and transparent player interactions.

Smart contracts in web3 gaming allow for the design of complex game mechanisms and economies. For example, play-to-earn models may be smoothly integrated using smart contracts, letting players earn real money for their in-game achievements. This idea has far-reaching ramifications for the future of web3 gaming, converting virtual worlds into thriving economic ecosystems.

What Problems and Possibilities Occur in the Web3 Gaming Industry?

In the world of web3 gaming, the Improved Player Experience takes center stage, providing players with a significant shift in how they engage with virtual worlds. This revolution is fuelled by seamless interoperability across games, it not only enables the seamless flow of assets and characters but also opens up intriguing Cross-Platform Gaming Opportunities.

-

Smooth Transition of Assets and Characters

In the ever-changing world of web3 gaming, the idea of seamless object and character transfer emerges as a game changer. With the use of blockchain technology and NFTs (Non-Fungible Tokens), players may now really control their in-game assets. This ownership goes beyond the confines of a single game, allowing players to easily move their hard-earned things and characters between gaming contexts.

Consider earning a unique weapon in one web3 game and seamlessly using it in a whole other gaming realm. This amount of fluidity in asset movement not only increases the player’s sense of ownership but also contributes to a more immersive and integrated game environment.

-

Cross-Platform Gaming Opportunities

Web3 gaming comes in an era in which barriers between gaming platforms are broken down, opening the door for unparalleled cross-platform gaming opportunities. Players are no longer limited to a single device or console; they may effortlessly switch between platforms while maintaining their progress, achievements, and earned assets.

This kind of cross-platform compatibility not only accommodates players’ different choices but also promotes a more inclusive and wider gaming community. The web3 gaming experience is uniform across all platforms, including PC, console, and mobile devices, creating a unified area for gamers to interact and compete.

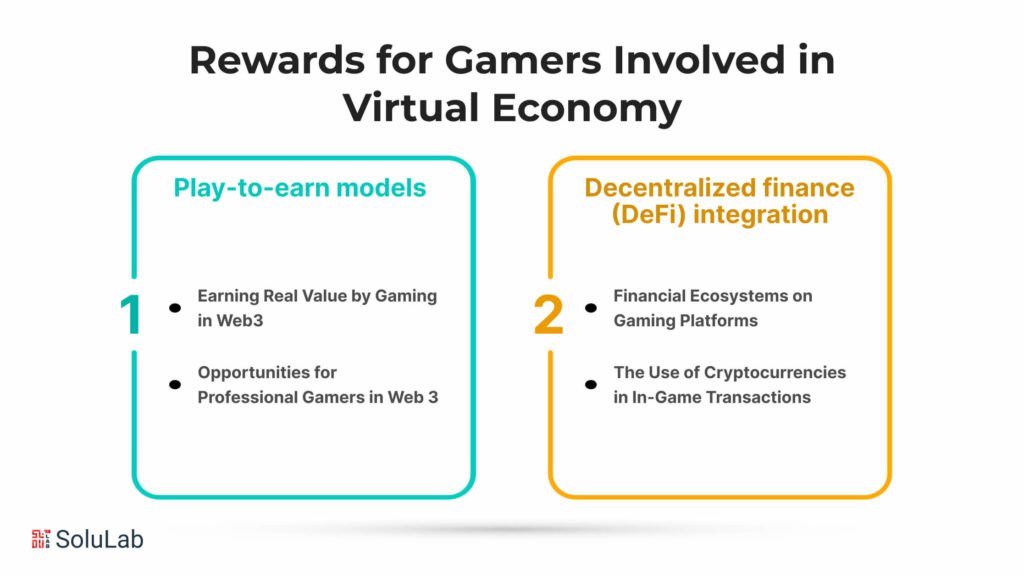

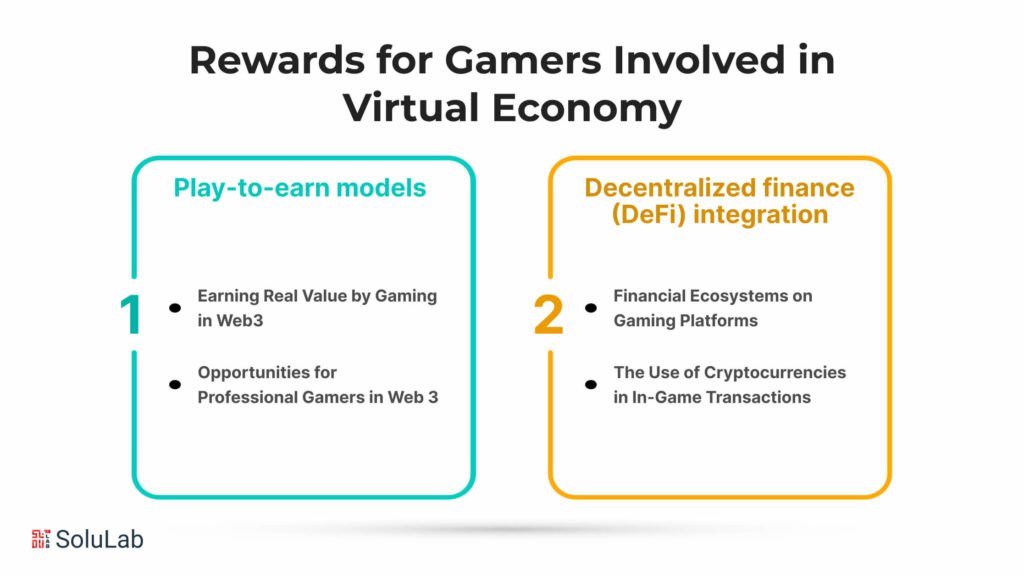

What are the Attainable Economic Rewards for Gamers Involved in the Virtual Economy?

A.Play-to-earn models

Economic prospects in Web3 gaming are expanding exponentially, revolutionizing how gamers interact with virtual environments. One of the most groundbreaking parts is the introduction of play-to-earn models, which reshape gaming by allowing users to earn real money via their virtual activities.

-

Earning Real Value by Gaming in Web3

Traditional gaming models frequently confine incentives to the virtual environment, such as in-game awards or objects. The integration of blockchain and decentralized technology allows players to earn genuine, real-world value for their in-game activity. This is made feasible by the usage of cryptocurrencies, NFTs, and other blockchain-based assets with actual market value.

The idea of play-to-earn not only gives gamers a more immersive experience but also allows them to monetize their abilities and time spent in the virtual world. By gaining digital goods that may be bought or sold, users are effectively engaging in a virtual economy that mimics real-world market dynamics.

-

Opportunities for Professional Gamers in Web 3

Web3 gaming provides several options for individuals to pursue gaming as a professional career. Web3 allows professional gamers to directly benefit from their abilities and successes, breaking free from the traditional esports paradigm in which earnings are frequently centralized and controlled by gaming companies.

Professional gamers may make use of Web3’s decentralized structure to engage directly with their fans and community. Through play-to-earn models, fans may help their favorite gamers by contributing to the in-game economy, resulting in a symbiotic connection in which both players and supporters benefit. This move enables gamers to become businesses in their own right, controlling their digital assets and maintaining a more direct and open relationship with their fans.

B. Decentralized finance (DeFi) integration

The incorporation of decentralized finance (DeFi) has emerged as a major changer, transforming financial ecosystems inside gaming platforms. This revolutionary transformation is altering how gamers interact with virtual worlds while also presenting new chances for economic empowerment.

-

Financial Ecosystems on Gaming Platforms

The introduction of DeFi ideas into gaming platforms represents a shift away from traditional centralized payment arrangements. Web3 gaming allows gamers to participate in rich, decentralized financial ecosystems. Smart contracts, which use blockchain technology included in web3, enable transparent and automated transactions. This gives users greater control over their in-game assets and revenue.

In these decentralized financial ecosystems, the principle of play-to-earn takes center stage. Players are no longer passive customers, but active contributors to the gaming industry. Web3 gaming platforms use blockchain and smart contract functionality to enable the seamless production, trade, and ownership of in-game assets. This transition is consistent with the web3 concept, which emphasizes decentralization and user empowerment.

-

The Use of Cryptocurrencies in In-Game Transactions

Cryptocurrencies play an important role in influencing in-game transactions in the web3 gaming paradigm. As digital assets are tokenized via techniques such as Non-Fungible Tokens (NFTs), the transferability and ownership of in-game objects are transformed. NFTs, are a key component of the web3 gaming ecosystem, ensuring that players retain actual ownership of their virtual goods.

In web3 gaming, bitcoins are the primary means of exchange for in-game transactions. This not only allows for faster and more secure transactions but also eliminates the need for intermediaries. Cryptocurrencies let users purchase, sell, and transfer virtual assets between gaming platforms, promoting a borderless and integrated gaming economy.

What Scalability Issues Does the Web3 Game Business Face?

In the ever-evolving areas of web3 gaming, various issues and concerns have surfaced. Scalability is a significant challenge, especially when dealing with large-scale blockchain transactions in the context of web3 gaming.

-

Handling large-scale transactions on the blockchain

Scalability is an important consideration in web3 gaming, as decentralized networks use blockchain technology. As the user base grows and transaction volumes increase, the present blockchain infrastructure may encounter processing limits. Some blockchain networks, like Ethereum, may struggle to handle the sheer volume of transactions, resulting in bottlenecks and delayed processing times.

Delays or congestion caused by scalability concerns can have a negative influence on the user experience in a web3 gaming environment that relies on real-time interactions and transactions. Gamers used to smooth and quick in-game transactions may find their involvement impeded, necessitating the necessity for strong solutions.

-

Solutions and Ongoing Development

Recognizing the need for scalability in web3 settings, the gaming industry has pushed for creative solutions and continued research to overcome this difficulty. Various blockchain projects are currently working on scalability improvements, including sharding and layer 2 scaling solutions.

Sharding, for example, is the process of splitting down the blockchain into smaller, more manageable sections (shards), allowing transactions to be processed in parallel. This strategy tries to ease the load on the network and boost overall throughput.

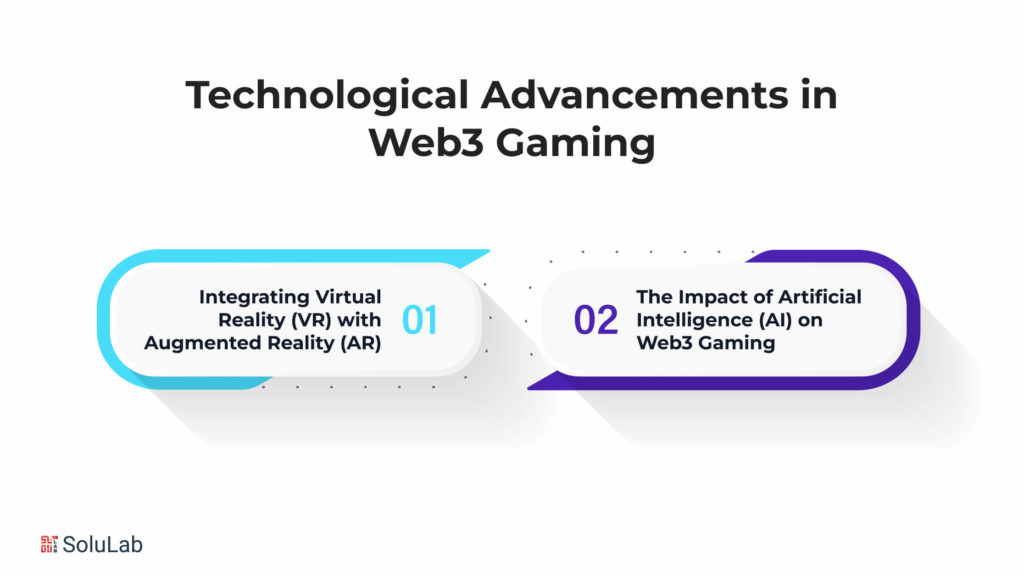

What have been the Technological Advancements in Web3 Gaming?

As we look ahead to the future of gaming in the realm of Web3, two technological advancements stand out: the integration of Virtual Reality (VR) and Augmented Reality (AR), and the critical role played by Artificial Intelligence (AI) in shaping the landscape of Web3 trends.

-

Integrating Virtual Reality (VR) with Augmented Reality (AR)

In the future of Web3 gaming, we may expect a seamless mixing of the virtual and real worlds thanks to the combination of Virtual Reality (VR) and Augmented Reality (AR). This integration goes beyond just visual upgrades; it includes immersive experiences that change the way players interact with their environs.

Consider a situation in which gamers wearing VR headsets enter a parallel realm within the Web3 gaming environment. This convergence not only improves the game experience, but also creates new avenues for discovery inside the decentralized and linked world of Web3 gaming.

-

The Impact of Artificial Intelligence (AI) on Web3 Gaming

In the changing world of Web3 gaming, Artificial Intelligence (AI) emerges as a critical factor, transforming the fundamental fabric of immersive experiences. AI algorithms will not only improve the realism of non-player characters (NPCs) but will also respond in real-time to player actions, resulting in a customized and developing gaming experience.

This adaptive intelligence goes beyond in-game components to affect game development, content creation, and even player matching. The combination of AI with Web3 technologies will be critical in developing a gaming environment that learns, adapts, and interacts seamlessly with the decentralized nature of Web3 platforms.

Conclusion

To summarize, the combination of Web3 and gaming represents a watershed point in the history of the gaming industry, driving it toward a future defined by decentralization, player empowerment, and creative business models. As we negotiate this revolutionary terrain, it becomes clear that Web3 in gaming is more than just a fad; it is a paradigm shift with far-reaching ramifications.

SoluLab, a top Web3 development firm, is at the forefront of this technological revolution, providing access to a gaming world defined by transparency, security, and unmatched user experiences. SoluLab’s creative approach to web3 gaming development fits neatly with the idea of decentralized ecosystems, enabling interoperability and unleashing new dimensions for player involvement.

As we look ahead, the need to employ Web3 engineers becomes more clear. SoluLab’s dedication to innovation and expertise in web3 development distinguishes it as a valuable strategic partner for companies attempting to negotiate the challenges of this developing gaming frontier. Businesses that leverage SoluLab’s expertise may not only adapt but also lead the way in designing the future era of gaming.

FAQs

1. What is the significance of Web3 in the gaming industry?

Web3 in gaming marks a revolutionary shift towards decentralization, introducing blockchain technology and smart contracts to enhance player experiences and create new economic opportunities.

2. How does Web3 contribute to the decentralization of gaming?

Web3’s decentralized architecture ensures that gaming ecosystems are not controlled by a single entity, providing players with more autonomy and fostering a truly player-driven environment.

3. Can you explain the role of NFTs (Non-Fungible Tokens) in Web3 gaming?

NFTs in Web3 gaming enable the tokenization of in-game assets, allowing players to truly own and trade virtual items. This not only adds real value to virtual possessions but also opens up new avenues for the gaming economy.

4. How does Web3 improve the player experience in gaming?

Web3 introduces interoperability between games, enabling seamless transitions of assets and characters across different gaming platforms. Additionally, community-driven development ensures that players actively contribute to and influence the gaming landscape.

5. Are there economic opportunities for gamers in Web3?

Absolutely! Web3 gaming introduces play-to-earn models, where players can earn tangible value through their in-game activities. This has paved the way for professional gamers to thrive in the decentralized gaming ecosystem.

6. What role do decentralized finance (DeFi) and cryptocurrencies play in Web3 gaming?

DeFi integration within Web3 gaming platforms facilitates financial ecosystems, allowing for secure and efficient in-game transactions. Cryptocurrencies play a vital role in enabling decentralized economies within the gaming space.