As we step into 2026, the DeFi ecosystem has evolved from a niche blockchain experiment into a trillion-dollar industry redefining trust, transparency, and access in finance. From decentralized lending and trading to real-world asset tokenization and AI-powered analytics, DeFi is creating a borderless system where anyone can invest, borrow, or earn, all of which can be done instantly and securely.

In this comprehensive 2026 DeFi guide, we’ll explore how the ecosystem works, its key components, the latest innovations, and the challenges shaping its future. Whether you’re a blockchain enthusiast, a fintech startup, or an investor eyeing decentralized opportunities, this blog covers everything you need to know about the DeFi ecosystem in 2026.

A DeFi ecosystem is a network of decentralized financial applications and services built on blockchain technology that operate without traditional intermediaries like banks or brokers.

It uses smart contracts, self-executing programs on blockchains like Ethereum, to handle transactions, agreements, and financial activities automatically and transparently.

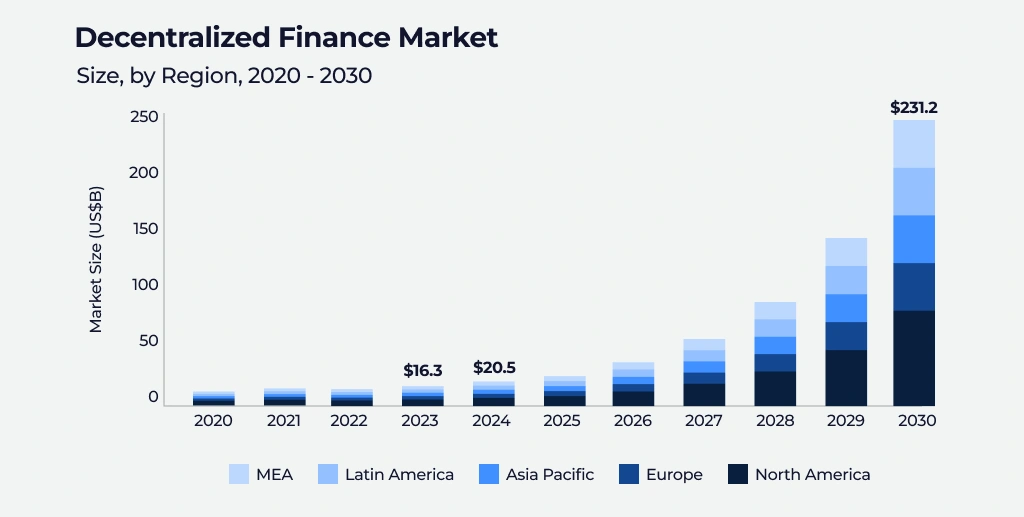

The total market size of DeFi is expected to hit USD 231.19 billion by 2030, growing at ~53.7 % CAGR from 2025-30.

Within this ecosystem, users can:

The ecosystem consists of several key components working together:

In short, the DeFi ecosystem is building a parallel financial system, one that’s decentralized, efficient, and driven by users rather than institutions.

The DeFi ecosystem uses blockchain technology to offer financial services without banks, enabling users to trade, lend, borrow, and earn interest directly through decentralized platforms and smart contracts. Key components of the DeFi ecosystem include:

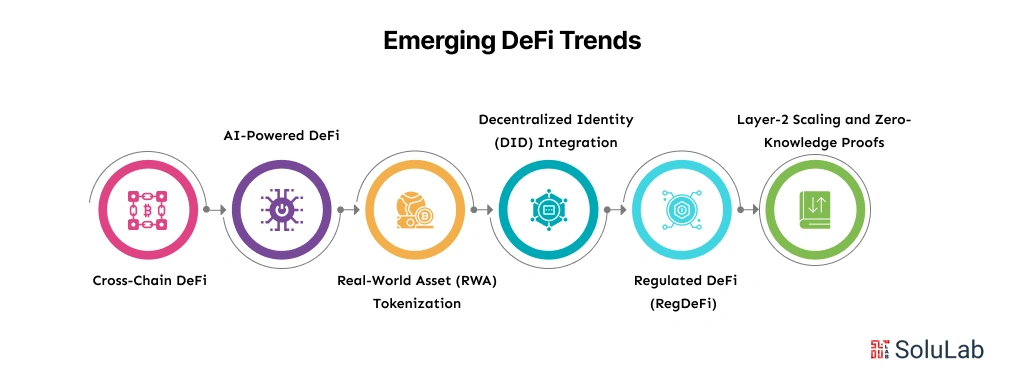

The year 2026 marks a defining phase for the DeFi ecosystem, as it continues to mature, integrate with traditional finance, and evolve beyond crypto-native use cases. Here are the key trends pushing the DeFi development companies this year:

In the past, most DeFi protocols were limited to a single blockchain, like Ethereum or BNB Chain. But in 2026, cross-chain interoperability has become a breakthrough. Platforms now enable users to move assets and liquidity seamlessly across multiple blockchains, reducing fragmentation and boosting liquidity access. This multi-chain connectivity is helping DeFi achieve true decentralization and user flexibility.

Artificial Intelligence is playing a growing role in DeFi, from predictive analytics that forecast market movements to AI-driven asset allocation that maximizes yield. Startups are integrating AI agents that monitor risks, optimize liquidity pools, and automatically rebalance portfolios, making decentralized investing more intelligent and data-driven.

One of the most exciting trends of 2026 is tokenizing real-world assets such as real estate, art, bonds, or even carbon credits. By converting physical assets into blockchain-based tokens, DeFi platforms are opening new avenues for investment and liquidity. RWA tokenization bridges traditional finance with decentralized systems, allowing investors to diversify portfolios with tangible, yield-generating assets.

Security and compliance have always been major challenges for DeFi. The introduction of Decentralized Identity (DID) is changing that. DID systems allow users to verify their identity without exposing sensitive information, creating a balance between privacy and compliance. This also makes it easier for institutions to safely invest in DeFi platforms‘ development.

Governments and financial institutions are no longer ignoring but are willing to invest in DeFi. In 2026, we’re seeing the rise of RegDeFi, where decentralized protocols comply with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations. This trend is paving the way for institutional liquidity, giving DeFi the credibility needed to integrate with mainstream finance.

To handle millions of transactions efficiently, DeFi platforms are adopting Layer-2 scaling solutions and Zero-Knowledge Proofs (ZKPs). These technologies reduce congestion, lower gas fees, and improve transaction speeds while maintaining strong security. As a result, DeFi is becoming faster, cheaper, and more accessible to users worldwide.

DeFi (Decentralized Finance) is changing how people access and use financial services by removing middlemen and offering a transparent, open, and global financial system for everyone.

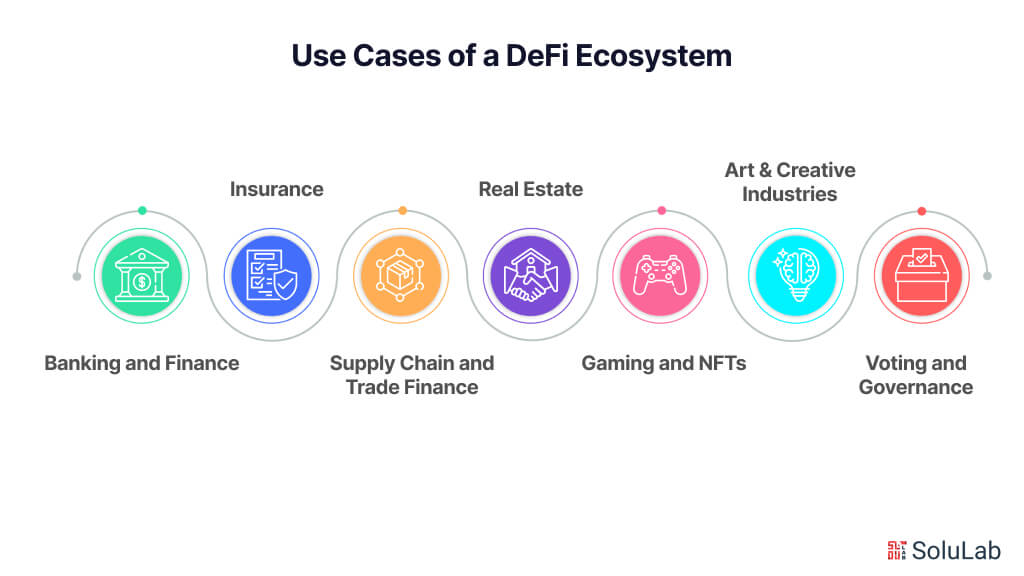

The DeFi ecosystem isn’t just about crypto trading anymore; it’s improving multiple industries by removing middlemen, increasing transparency, and giving users direct control over their money.

As DeFi continues to expand across global markets, regulatory clarity is emerging as a crucial factor for DeFi development companies. Governments and financial authorities worldwide are moving from skepticism to structured regulation by aiming to protect investors, ensure transparency, and encourage responsible innovation.

Let’s explore how different regions are approaching DeFi regulation in 2026 and what this means for the ecosystem.

The U.S. is gradually shifting toward a compliance-first DeFi space. The SEC and CFTC have begun introducing frameworks to distinguish between securities-based tokens and utility tokens, while the U.S. Treasury emphasizes anti-money laundering (AML) compliance.

In 2026, many American DeFi projects are adopting KYC-enabled wallets and on-chain audit systems to maintain legitimacy while retaining decentralization. The focus is on creating “regulated autonomy” for DeFi platforms that operate freely within legal boundaries.

The EU’s Markets in Crypto-Assets (MiCA) framework has set a benchmark for global DeFi regulation. By 2026, MiCA 2.0 is expected to extend coverage to decentralized protocols, requiring smart contract audits, governance disclosures, and stablecoin transparency.

The European model promotes accountability without stifling innovation, ensuring DeFi startups can grow responsibly under a unified regulatory structure.

The UAE has positioned itself as a global hub for regulated DeFi (RegDeFi). With supportive authorities like VARA (Virtual Assets Regulatory Authority) and ADGM, the UAE encourages DeFi experimentation under a sandboxed regulatory environment.

DeFi protocols here integrate identity verification, secure wallets, and institutional-grade compliance by making Dubai a preferred destination for institutional DeFi adoption.

Asia-Pacific countries exhibit a mix of approaches:

This region’s regulatory diversity fuels innovation while still ensuring accountability through regional frameworks.

Read Also: Algorithmic Stablecoins In DeFi

As we move beyond 2026, DeFi (Decentralized Finance) is expected to enter a new era of growth defined by institutional participation, intelligent automation, and real-world integration. What began as an experimental alternative to banks is now evolving into a mature, hybrid ecosystem connecting blockchain innovation with global financial systems.

DeFi is no longer a niche reserved for crypto enthusiasts; it’s becoming a legitimate pillar of global finance. Banks, hedge funds, and fintech firms are beginning to integrate DeFi protocols into their operations to enable faster settlements, transparent lending, and on-chain asset management.

By 2027, we can expect hybrid finance (CeDeFi) models where traditional institutions use DeFi infrastructure for improved transparency and efficiency, while maintaining regulatory oversight.

The convergence of Artificial Intelligence (AI) with DeFi is opening a smarter and more responsive financial ecosystem. AI algorithms can now analyze blockchain data, predict market movements, and optimize investment strategies in real time.

This merger will lead to intelligent DeFi platforms capable of self-adjusting yields, detecting risks, and personalizing user portfolios, all powered by transparent blockchain infrastructure.

The next evolution, DeFi 3.0, will blend decentralized governance models (DAOs) with real-world financial assets. It’ll be a future where users not only vote on DeFi protocols but also help manage tokenized stocks, real estate, and commodities.

This shift will blur the lines between traditional finance and DeFi, giving users both ownership and influence over financial ecosystems, something conventional banking could never offer.

The DeFi ecosystem has evolved from a bold experiment to a transformative force reshaping global finance. As we move into 2026 and beyond, DeFi is breaking barriers, connecting real-world assets, integrating AI for smarter asset management, and aligning with global regulations to create a more secure and inclusive financial world.

At SoluLab, a leading DeFi development company, we empower startups and enterprises to build secure, scalable, and regulatory-ready DeFi solutions, from DEXs and liquidity pools to yield farming platforms and DAO-based governance systems. Recently, SoluLab helped a fintech startup launch a cross-chain DeFi lending platform that uses an AI-driven chatbot and zero-knowledge proofs to ensure both privacy and transparency.

With SoluLab as your technology partner, you can lead that future confidently. Contact us now!

Investors can earn by staking, yield farming, providing liquidity, or lending crypto assets to others. Each method offers different levels of return and risk, depending on the platform and market conditions.

AI is playing a major role in risk prediction, fraud detection, and smart asset management. It helps DeFi platforms automate decision-making, optimize yields, and analyze on-chain data to create more intelligent and adaptive financial systems.

Yes. Many experts believe CeDeFi (Centralized + Decentralized Finance) will bridge both worlds, combining DeFi’s transparency and efficiency with the regulatory safeguards of traditional banking.

Startups should focus on regulatory compliance, security audits, tokenomics design, and user experience. Partnering with an experienced DeFi development company like SoluLab ensures your platform is scalable, compliant, and future-ready.

SoluLab provides end-to-end DeFi development, including DEXs, yield farming, staking platforms, DAO governance systems, and cross-chain protocols. With expertise in blockchain, AI, and security architecture, SoluLab helps businesses build DeFi products that are both innovative and regulation-ready.