Asset tokenization started as a blockchain experiment. By 2025, it has become a measurable market with real capital, real assets, and real institutions involved.

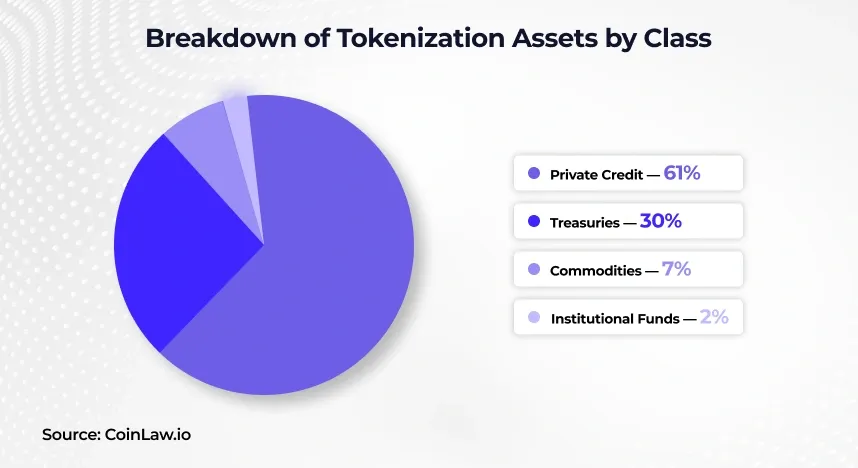

Today, the on-chain value of tokenized real-world assets (RWAs) has already crossed $50 billion. Led by tokenized U.S. treasuries, funds, gold, and real estate. Major asset managers, global banks, and sovereign-linked entities are actively running live tokenization programs. As per Coin Law, the asset tokenization market could reach $1 trillion by 2030, depending on regulatory adoption and institutional participation.

This shift raises important questions for enterprises, banks, and asset owners. What assets can realistically be tokenized? How do compliance, custody, and blockchain architecture come together? And what does it actually take to build and operate an enterprise-grade asset tokenization platform? You can get answers to all these questions in the following sections.

Asset tokenization is the process of converting ownership or economic rights of a real-world asset into digital tokens on a blockchain. Each token represents a defined share, right, or claim linked to the underlying asset.

For example, a commercial property or a gold reserve can be divided into thousands of blockchain-based tokens. Investors can buy, hold, or transfer these tokens without handling the physical asset.

The demand for tokenized assets comes from problems with the way traditional finance works. Investors want easy access, issuers want things to run smoothly, and regulators want things to be clear.

Real estate, gold, private equity, and bonds are examples of high-value assets that are hard to sell and have high entry barriers. Tokenization solves this by allowing partial ownership and faster settlement.

This is more than three times the growth that has happened in the last three years, mostly because more institutions are getting involved and regulations are getting better.

RWA tokenization is no longer theoretical. It is responding to active investor and issuer needs.

| Aspect | Asset Tokenization | RWA Tokenization |

| Definition | A broad concept of converting any asset into digital tokens on a blockchain | A focused subset of asset tokenization that deals strictly with real-world, off-chain assets |

| Asset Scope | Includes digital-native assets, utility tokens, in-game assets, and some virtual items | Limited to tangible or legally enforceable real-world assets like real estate, commodities, bonds, and funds |

| Legal Complexity | Often lighter, especially for digital or utility-based assets | High legal complexity due to ownership rights, securities laws, and jurisdictional rules |

| Regulatory Exposure | May not always fall under financial regulations | Almost always subject to securities, commodities, or property regulations |

| Custody Requirement | Custody may be optional or purely digital | Mandatory custody, escrow, or vaulting of underlying assets |

| Proof of Ownership | Ownership is defined primarily on-chain | Ownership must be enforceable both on-chain and off-chain through legal agreements |

| Compliance Design | Basic compliance or none in some cases | Embedded KYC, AML, transfer restrictions, and audit mechanisms are required |

| Enterprise Adoption | Common in startups, Web3 products, and digital platforms | Primarily adopted by banks, enterprises, asset managers, and institutional platforms |

| Risk Profile | Lower regulatory and operational risk | Higher operational, legal, and compliance risk if not designed correctly |

| Typical Use Cases | Loyalty tokens, utility tokens, digital collectibles | Real estate tokenization, gold tokenization, bond and fund tokenization |

Tokenization of assets is not only making trading easier. It is slowly changing how money moves, how ownership is set up, and how markets grow across borders. Tokenization is changing many parts of the global economy at once by turning real-world value into digital units that can be programmed.

Here are the most important ways that asset tokenization is changing the economy today.

Historically, many valuable assets were locked behind high capital requirements and long holding periods. Asset tokenization removes these structural barriers.

Tokenized assets can be divided into smaller units and traded digitally, which increases participation and transaction frequency.

Economic impact:

This shift is particularly visible in real estate RWA tokenization and commodities tokenization, where liquidity was previously limited.

Tokenization allows assets to reach investors beyond geographic and institutional boundaries. Instead of relying on local markets or closed investor networks, asset owners can access global capital pools.

What changes at a macro level:

For emerging markets and asset-heavy enterprises, this creates new funding pathways that were previously unavailable.

Traditional financial systems rely on layered clearing, reconciliation, and settlement processes. These introduce delays, costs, and counterparty risk.

Blockchain asset tokenization replaces these steps with smart contracts that execute transactions automatically.

System-level benefits:

This efficiency has direct implications for tokenization in banking and tokenization in finance.

Tokenization introduces programmable ownership. Rights, restrictions, and revenue flows can be embedded directly into tokens.

This shifts ownership from static legal records to dynamic, rule-based systems.

What programmable ownership enables:

For regulators and enterprises alike, this improves transparency and reduces disputes.

Many enterprises sit on valuable but underutilized assets. Tokenization enables these assets to generate liquidity without being sold outright.

Examples include:

This changes how companies think about capital efficiency and asset monetization.

Tokenization does not replace traditional finance overnight. Instead, it introduces modular layers that can integrate with existing systems.

Economic implications:

This gradual integration is why RWA tokenization is gaining institutional acceptance.

Tokenization is enabling markets for assets that were previously difficult to price, verify, or trade.

Emerging tokenized asset categories include:

These new markets diversify investment opportunities while supporting long-term economic themes like sustainability.

As asset tokenization matures, regulation is no longer treated as an external constraint. It is being built into platform architecture and token logic.

This shift results in:

Jurisdictions that embrace this approach are positioning themselves as global tokenization hubs.

Asset tokenization is reshaping the modern economy by making assets more liquid, ownership more transparent, and capital more mobile. It does not disrupt value creation. It modernizes how value moves.

For enterprises, banks, and investment firms, tokenization is becoming a structural advantage rather than a speculative trend.

There isn’t just one way to tokenize Real-World Assets (RWA). There are differences in how assets are owned, valued, regulated, and traded. Because of this, RWA tokenization platforms are usually built around different types of assets, each with its own legal, technical, and financial issues.

Businesses can choose the best token structure, custody model, and compliance framework for their tokenized asset by knowing these categories.

These are the main types of RWA tokenization that businesses and banks are using right now.

Financial asset tokenization focuses on instruments that already exist within regulated financial markets. These assets have well-defined cash flows, valuation models, and investor expectations.

This category is often the entry point for banks, asset managers, and private equity firms.

Common financial RWAs include:

Why the Financial category works well for tokenization:

Financial RWA tokenization is primarily compliance-driven and institutional in nature.

Commodities are among the most mature and widely adopted RWA categories for tokenization. These assets are tangible, globally traded, and supported by standardized valuation methods.

Tokenization introduces liquidity and transparency without disrupting physical custody.

Tokenized commodity examples include:

Key characteristics of this category:

Commodities tokenization is especially attractive for institutional investors seeking asset-backed exposure with on-chain transparency.

Real estate tokenization focuses on transforming property ownership into digital, tradable units. This category addresses one of the most illiquid and capital-intensive asset classes. Real estate tokenization continues to expand, with the current market valued at around $20 billion.

Tokenization enables shared ownership and faster capital movement without changing property usage.

Assets commonly tokenized include:

Why real estate is ideal for RWA tokenization:

Real estate RWA tokenization platforms must integrate legal entities, property management, and compliance controls into the asset lifecycle.

Emerging fractional investing in real estate:

Real Estate Investment Trusts (REIT) tokenization converts REIT tokens into blockchain-based digital tokens, improving liquidity and access through secondary trading and fractional ownership.

However, tokenized REITs must comply with securities regulations, making compliance-first platform design essential.

Infrastructure and energy assets are long-term, yield-generating assets traditionally accessible only to large institutions. Tokenization opens these assets to broader participation while maintaining governance.

Examples in this category include:

Tokenization benefits for this category:

This category often appeals to infrastructure funds, government-linked entities, and impact investors.

Intellectual property tokenization focuses on assets that generate ongoing income rather than physical ownership. These assets benefit from programmability and transparent revenue distribution.

Common IP-based RWAs include:

Why IP works well with tokenization:

This category blends legal enforceability with programmable revenue logic.

New asset classes are emerging as tokenization infrastructure matures. These assets were previously difficult to trade or verify at scale.

Examples include:

Why enterprises explore this category:

These RWAs require careful validation, oracle integration, and compliance design.

Each RWA category demands a different approach to:

Enterprises building or adopting an RWA tokenization platform must align the platform architecture with the asset category, not the other way around.

This alignment is what separates scalable, compliant tokenization platforms from short-lived pilots.

Fun Fact:

Stablecoins have increasingly become a foundational component of tokenized markets as real-world assets move on-chain.

By late 2025, the global stablecoin market neared a $300 billion capitalization, reflecting significant growth in adoption across payments, settlement, and digital asset transactions

Asset tokenization follows a structured process that connects a real-world asset with blockchain technology in a legally enforceable way in 2026. To understand this clearly, consider the example of gold tokenization.

In this way, blockchain asset tokenization transforms physical gold into a liquid, digital investment without moving the underlying asset.

The success of any asset tokenization initiative depends on the strength of its underlying technology stack. Unlike simple digital assets, real-world asset tokenization must bridge physical assets, legal systems, and blockchain infrastructure in a secure and scalable way.

An enterprise-ready asset tokenization platform is typically built as a layered system. Each layer has a specific responsibility, from asset representation to compliance enforcement and transaction execution. This modular approach allows businesses to scale, adapt to regulations, and integrate with existing financial systems.

At the core of this stack is blockchain technology, supported by smart contracts, custody systems, identity frameworks, and external data providers.

Blockchain architecture defines how tokenized assets are created, managed, and transferred across the platform. For asset tokenization, architecture must prioritize security, compliance, scalability, and interoperability.

Most asset tokenization platforms follow a multi-layered architecture:

This is the foundation where tokens are issued and transactions are recorded. It provides immutability, transparency, and auditability for tokenized assets.

Smart contracts define token logic, ownership rules, transfer restrictions, and automated actions such as dividend distribution or redemption. In blockchain asset tokenization, smart contracts also enforce compliance conditions.

KYC, AML, and investor eligibility checks are integrated either on-chain or through secure off-chain systems. Only approved wallets are allowed to hold or transfer certain tokenized assets.

This layer connects digital tokens to the underlying real-world asset. It includes vaults, escrow accounts, custodians, and proof-of-reserves mechanisms.

Dashboards, investor portals, admin panels, and reporting tools sit here. This is where enterprises and investors interact with the asset tokenization platform.

This architecture ensures that digital asset tokenization remains legally enforceable while benefiting from blockchain efficiency.

Choosing the right blockchain protocol is critical for any RWA tokenization platform. Different protocols offer different trade-offs in terms of decentralization, cost, speed, and regulatory compatibility.

For real-world asset tokenization, enterprises usually prefer protocols that support smart contracts, permissioned access, and compliance controls.

Commonly used blockchain protocols include:

Widely used for asset tokenization due to its mature ecosystem and smart contract capabilities. It supports standards like ERC-20, ERC-721, and ERC-1155, making it suitable for fungible and non-fungible tokenized assets.

Enterprise implementations often use private or consortium Ethereum networks to control access while retaining compatibility with public chains.

Used to reduce transaction costs and improve scalability while remaining compatible with Ethereum standards. These are popular for real estate tokenization platforms and fund tokenization.

A permissioned blockchain suited for enterprises that require strict access control, data privacy, and regulatory oversight. Often used in tokenization for banking and financial institutions.

Protocols like Avalanche subnets or private chains are used where performance and compliance customization are required.

In practice, many modern asset tokenization platforms adopt a hybrid or multi-chain approach, allowing assets to be issued on secure permissioned networks while enabling controlled interoperability with public blockchains.

Asset tokenization is not only a technical decision. It is an economic and regulatory one. Enterprises evaluating tokenization must understand how value is created, where costs arise, and how legal obligations shape platform design.

Assets that were previously locked for long durations can now be fractionalized and traded, allowing issuers to recycle capital faster and investors to manage risk more dynamically.

However, these economic benefits materialize only when tokenization is aligned with legal enforceability and regulatory compliance. Without this alignment, tokenized assets risk becoming unusable or restricted.

From an economic perspective, tokenization improves capital efficiency by increasing liquidity and reducing operational friction.

Tokenization can improve liquidity, but legal structuring, custody, and compliance add upfront costs.

Automation through smart contracts reduces 30% of settlement, reconciliation, and reporting costs over time.

Fractional ownership can expand demand, which may improve price discovery for certain assets.

Custody, audits, compliance monitoring, and infrastructure maintenance are recurring economic factors.

Enterprises that treat tokenization as a long-term infrastructure investment, rather than a short-term fundraising tool, tend to see sustainable returns.

Regulation is the defining constraint for real-world asset tokenization. Jurisdictions differ significantly in how they classify and govern tokenized assets, especially when tokens represent ownership, income rights, or financial instruments.

Below is a high-level, factual overview of how major regions approach asset and RWA tokenization.

The United States has a strict substance-over-form regulatory approach. This means that the economic reality of a token determines whether it is regulated as a security.

This setting strongly favors RWA tokenization platforms that are institutional-grade, compliance-heavy, and have a legal-first design.

The European Union has a layered system for regulating asset tokenization that combines traditional securities law with laws that are specific to cryptocurrencies.

The EU backs institutional tokenization, but it is still not fully united because different countries have different rules about it.

The UAE has positioned itself as one of the world’s most progressive jurisdictions for real-world asset tokenization.

This proactive stance makes the UAE a preferred hub for real estate and commodities RWA tokenization.

The UAE has made itself one of the most forward-thinking places in the world for tokenizing real-world assets.

This proactive approach makes the UAE a popular place for RWA tokenization of real estate and goods.

The UK is taking a cautious but structured approach toward asset and RWA tokenization.

The UK favors gradual infrastructure modernization over rapid retail-facing tokenization.

Australia is still in an early but increasingly active phase of exploring asset tokenization frameworks.

Australia’s tokenization ecosystem is evolving, but large-scale commercial deployment is still emerging.

Jurisdiction selection directly impacts token structure, investor access, custody design, and compliance cost.

Enterprises building RWA tokenization platforms must treat regulation as a core architectural input, not a downstream constraint.

In practice, the UAE and Singapore favor controlled innovation, while the US prioritizes investor protection through exemptions.

Token standards define how digital tokens behave on a blockchain. In asset and RWA tokenization, the choice of token standard directly affects compliance, transferability, scalability, and investor experience.

Each standard serves a different purpose. Selecting the wrong one can limit liquidity, create compliance gaps, or increase operational complexity. Below is a practical comparison of the most commonly used token standards in blockchain asset tokenization.

| Token Standard | Token Type | Best Used For | Key Characteristics | Typical RWA Use Cases |

| ERC-20 | Fungible | Divisible, identical assets | All tokens hold equal value, highly liquid, widely supported by wallets and exchanges | Gold tokenization, fund tokenization, bond tokenization, stable-value assets |

| ERC-721 | Non-Fungible (NFT) | Unique, one-of-one assets | Each token is unique, strong provenance tracking, low divisibility | Art tokenization, unique real estate assets, collectibles |

| ERC-1155 | Hybrid (Fungible + NFT) | Mixed asset portfolios | Supports multiple token types in one contract, lower gas costs, operational flexibility | Real estate portfolios, commodity baskets, platform-level tokenization |

| ERC-1400 | Security Token | Regulated financial assets | Built-in compliance features, transfer restrictions, investor eligibility controls | Equity tokenization, regulated bond issuance, private securities |

| ERC-3643 (T-REX) | Permissioned Security Token | Institutional RWA platforms | Identity-based transfers, modular compliance, regulator-friendly architecture | Institutional RWA tokenization platforms, banking use cases |

| Custom / Permissioned Standards | Controlled Tokens | Private enterprise deployments | Restricted access, customizable logic, limited public interoperability | Banking, internal asset digitization, consortium-based platforms |

Note: For enterprises, this distinction directly determines licensing, custody design, and long-term platform scalability.

In real-world asset tokenization, standards are often combined with off-chain compliance systems, custody frameworks, and legal agreements to ensure enforceability.

An enterprise-grade Asset Tokenization Platform for precious metals, enabling fractional ownership of gold and silver fully backed by physical vault reserves. The objective was to modernize commodities investing using Blockchain Asset Tokenization while maintaining the trust, transparency, and regulatory discipline expected in traditional markets.

The platform allows investors to buy, hold, trade, and redeem tokenized gold and silver without handling physical assets. Each token represents a defined gram or ounce of metal, verified through audited proof-of-reserves and real-time price tracking. The solution was designed for global access, institutional compliance, and long-term scalability.

Read More: How Silver Tokenization Platform Development Paves the Future of RWAs?

Industry Requirement

Precious metals are widely trusted but operationally inefficient. Traditional gold and silver investing suffers from high entry barriers, limited liquidity, slow settlement, and opaque custody models.

The industry needed a real world asset tokenization solution that could:

This made RWA Tokenization the most practical path forward for modern commodities platforms.

Solution Delivered

The tokenization development partner delivered a secure and compliant RWA Tokenization Platform tailored for gold and silver.

Key capabilities included:

Tokens were minted to represent precise metal quantities, enabling low-ticket investments and broader participation.

Licensed custodians were integrated to ensure every token remained 1:1 backed by physical gold or silver, with audit visibility for users.

Tokenized metals could be traded globally, without physical movement, improving liquidity and settlement speed.

The platform supported multiple blockchain networks, external wallets, and exchange integrations, unlocking DeFi liquidity paths.

Investors could redeem tokens for physical metal or fiat currency, aligning digital ownership with real-world expectations.

Admin and investor dashboards provided insights into reserves, trading volume, redemptions, and compliance metrics.

This approach combined Digital Asset Tokenization with institutional-grade controls.

Results Achieved

The platform delivered measurable business and operational outcomes:

Getting started with asset tokenization requires a structured, compliance-first approach. Enterprises typically begin by evaluating asset suitability, regulatory exposure, and the right technology model. Whether you are a bank, asset manager, or enterprise asset owner, the goal is to build a secure Asset Tokenization Platform that aligns with legal requirements while delivering liquidity and operational efficiency.

Most organizations engage Asset Tokenization Services providers to reduce risk, shorten timelines, and ensure enterprise-grade execution.

Below is a simplified, practical rollout model used in Asset Tokenization Platform Development projects.

This phase focuses on identifying the asset type, jurisdiction, compliance needs, and business goals. The outcome is a clear roadmap for Real World Asset Tokenization and platform architecture.

Timeline: 48–72 hours

Estimated Cost: $5,000 – $20,000

Token standards, custody models, compliance workflows, and blockchain selection are finalized. This phase defines how the RWA tokenization platform will operate end to end.

Timeline: 1–2 weeks

Estimated Cost: $15,000 – $20,000

Smart contracts, compliance modules, wallets, and dashboards are built. Enterprises may choose full custom development or a white label tokenization platform to accelerate launch.

Timeline: 3–4 weeks

Estimated Cost: $10,000 – $20,000

Assets are tokenized, investors onboarded, and secondary trading enabled. Ongoing support ensures regulatory alignment and platform scalability.

Timeline: 1–2 weeks

Estimated Cost: $10,000 – $20,000

This structured approach minimizes risk while enabling faster, compliant tokenization at enterprise scale.

By 2030, asset tokenization and real world asset tokenization are expected to move from early adoption to core financial infrastructure. Also, Business Research company predicted that the market is expected to grow to $5,254.63 billion as of 2029.

As blockchain matures and regulation stabilizes, RWA Tokenization Platforms will reshape how assets are issued, traded, and managed across global markets.

Tokenized gold, silver, oil, copper, and agricultural assets will increasingly trade on regulated digital exchanges. Commodities tokenization improves liquidity, enables fractional ownership, and reduces settlement cycles from days to near real-time. Analysts project tokenized commodities to represent a multi-trillion-dollar market by 2030.

Read Also: How Does Copper Tokenization Benefit Modern Businesses?

Cross-chain infrastructure will allow tokenized assets to move across blockchains, banks, and marketplaces. This interoperability will integrate blockchain asset tokenization directly into lending, collateral, and settlement systems, especially for tokenization in banking and tokenization in finance.

AI will become the intelligence layer of asset tokenization platforms. Enterprises will use AI to monitor tokenized assets in real time, optimize pricing, manage risk, and automate compliance. This fusion turns Digital Asset Tokenization into a data-driven, self-optimizing system.

Green tokenization will accelerate the adoption of tokenized carbon credits, renewable energy certificates, and ESG-linked infrastructure. Blockchain enables auditable impact tracking, while tokenization makes sustainable assets investable at scale.

Jurisdictions like the UAE, Singapore, and Switzerland will lead RWA tokenization through clear regulations and enterprise-friendly frameworks.

Asset tokenization is moving from experimentation to execution. As this guide explains, it is reshaping how assets are owned, financed, and traded by improving liquidity, transparency, and capital efficiency across industries. If you are thinking of an asset tokenization development company to partner with and build a world-class platform, then SoluLab is here to assist you.

At SoluLab, we turn your ideas into production-ready asset tokenization platforms. Our team delivers secure, compliant, and scalable real estate tokenization solutions tailored to your asset class, jurisdiction, and business goals.

With SoluLab, you can:

If you are planning to tokenize assets or build an RWA tokenization platform, connect with us to get started confidently.

Asset tokenization is ideal for real estate firms, private equity funds, commodity traders, family offices, and fintech startups looking to unlock liquidity, automate ownership, and scale globally. Enterprises with illiquid assets benefit the most from tokenization adoption.

Suitability depends on asset value, ownership structure, regulatory environment, revenue model, and market demand. A feasibility assessment helps determine technical, legal, and financial viability before implementation.

Costs typically range based on features, jurisdiction, compliance requirements, and asset type. Enterprise-grade platforms usually start from five-figure budgets, while full-stack deployments require larger investment.

ROI depends on asset class, market demand, and monetization strategy. Most platforms see commercial outcomes within 6–18 months when combined with a proper liquidity strategy.

Yes. Smart contracts automate issuance, compliance rules, ownership tracking, and transactions. They ensure trust without intermediaries.

The first step is a feasibility and compliance assessment. This determines the ideal structure, technology stack, and regulatory path. If you are not aware, then contact SoluLab. It’s simple, just visit the site and fill in your details. Our team will get in touch with you within 24 to 48 hours, based on the region.