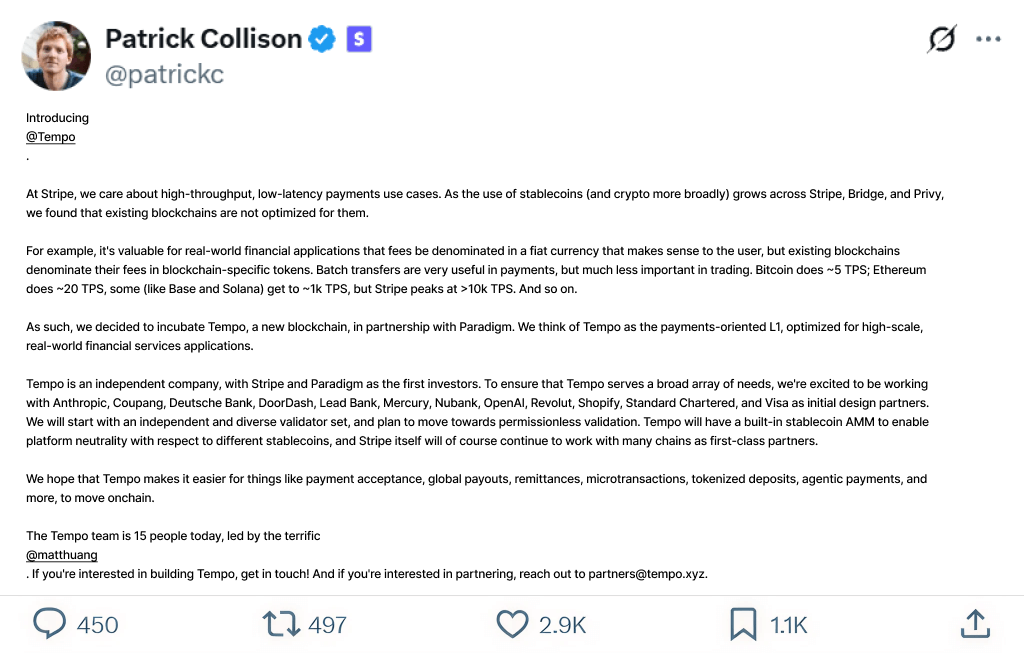

Stripe and Paradigm have officially launched Tempo, a high-speed blockchain platform designed for stablecoin payments. With the growing adoption of digital currencies, Tempo positions itself as a payment-first infrastructure to meet the rising demand for secure, scalable, and global stablecoin transactions.

While some industry experts compare Tempo to Meta’s abandoned Libra project, others believe it could as a serious challenger to established blockchains like Ethereum, Solana, and Tron.

In this blog, we’ll explore how secure and scalable Tempo really is for stablecoin transactions, exploring its features, strengths, challenges, and future. Let’s get started!

The Tempo blockchain is a payment-focused distributed ledger technology (DLT) currently operating in a private testnet phase. Its primary goal is to provide a more efficient, secure, and scalable platform for processing payments.

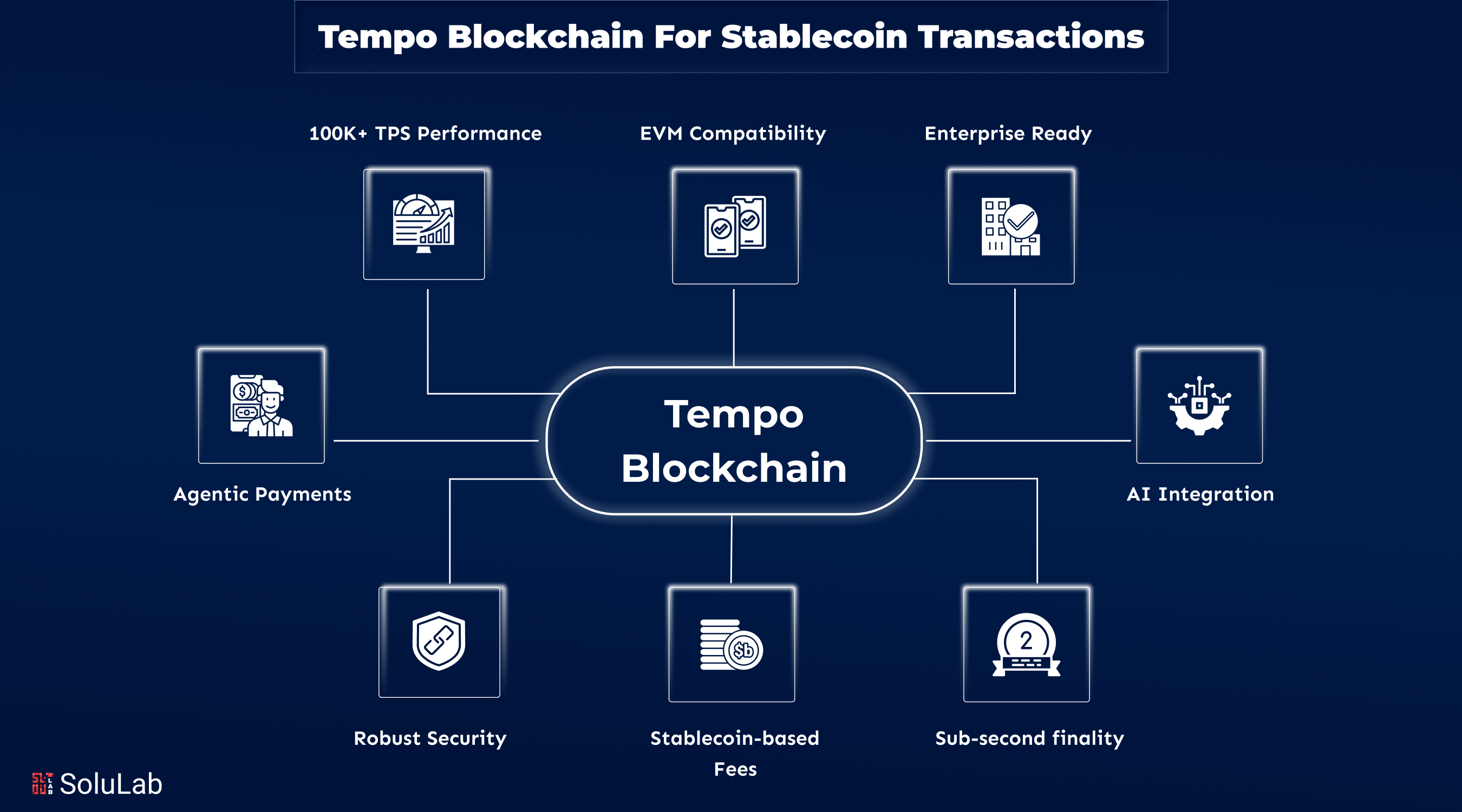

With a target of over 100,000 transactions per second with sub-second finality, it offers high-throughput stablecoin transactions, which are far faster than existing blockchain rates and are intended for real-world applications.

This acquisition shows Tempo’s commitment to building robust stablecoin capabilities, which are crucial for stable, real-world value transfers on a blockchain network.

Tempo makes stablecoin transactions safe and reliable through the combination of enhanced security measures, blockchain transparency, and compliance standards, providing businesses and users with full confidence in the digital transactions.

1. Blockchain Transparency: Tempo has employed blockchain technology, and transactions are documented on a public ledger. This will provide a great level of transparency so that data can hardly be changed or manipulated, which will enhance security and trust.

2. Smart Contract Audits: Every smart contract of Tempo is audited by third parties. This makes the code devoid of loopholes, which minimizes the occurrence of such risks as hacking, fraud, or unauthorized access to funds.

3. Encryption Protocols: Tempo protects the sensitive user data and transaction information with sophisticated encryption protocols. This avoids unauthorized interception or misuse of personal and financial data in the course of transactions in stablecoins.

4. Regulatory Compliance: Tempo is compliant with KYC and AML regulations. It prevents money laundering, fraud, and other financial crimes by authenticating user identities and tracking suspicious activity across stablecoin transactions.

5. Fraud Detection Systems: Artificial Intelligence fraud detection is constantly reviewed on Tempo to identify any fraud patterns in transactions. In case of abnormal activity detection, it raises alarms and defenses, which guarantee safe and authentic transfers of stablecoins.

Tempo Blockchain is a trusted stablecoin payment platform that brings efficiency, security, and global accessibility. It is a great option in digital finance due to its distinctive characteristics as a business and individual tool.

Read Also: UAE’s Dirham-Backed Stablecoin

Co-developed by Stripe and the cryptocurrency company Paradigm, Tempo is a payments-first Layer-1 blockchain that has the potential to alter digital payments. Tempo features an automated market maker to enable a smooth conversion process, allows fees to be paid in stablecoins (instead of native tokens), and is compatible with Ethereum’s EVM, which makes developer adoption easier.

With partners including Visa, Deutsche Bank, Shopify, OpenAI, and Revolut, it is seated in a private testnet and is designed for microtransactions, payroll, worldwide payouts, money transfer, and AI-driven agentic payments.

Allowlists/blocklists, memos for ISO-20022-style reconciliation, and opt-in privacy are further privacy and compliance elements that Tempo incorporates.

Tempo Blockchain’s focus on security and scalability indicates that it has the potential to improve stablecoin transactions. It provides safe and effective transfers while managing massive transaction volumes by combining advanced consensus methods, fast processing, and strong security measures. This results in lower risks in handling digital assets, quicker settlement times, and more trust for investors and enterprises.

NovaPay Nexus partnered with SoluLab to integrate multi-crypto support, enhance security, and build a user-friendly interface. The result? A decentralized, fee-free payment solution for businesses with full control and privacy. NovaPay Nexus now drives wider adoption of ISO-compliant cryptocurrencies across industries, redefining how secure digital payments are made.

SoluLab, a prominent blockchain development company can help you leverage Tempo Blockchain for stablecoin payments. Connect with us today!

Tempo Blockchain for stablecoin payments ensures top security through advanced consensus mechanisms, optional privacy, and compliance tools like asset freezing, offering safe, reliable, and regulated transfers.

Unlike Ethereum’s 15–30 TPS, Tempo handles 100,000+ TPS with sub-second finality, offering faster and cheaper stablecoin transfers while maintaining compatibility with Ethereum’s ecosystem.

Yes. Tempo Blockchain is fully EVM-compatible, allowing seamless integration with any crypto wallet company for secure stablecoin storage, transfers, and enterprise-grade payment solutions.

Yes. With fast transaction speeds and stablecoin gas fees, Tempo drastically reduces costs compared to traditional banking systems, improving remittance and payroll efficiency.

Its scalability, optional privacy, compliance tools, and partnerships set Tempo apart, positioning it as a payments-focused blockchain tailored for enterprise adoption.