Tokenization in Australia has quietly crossed an important line.

What started as small proofs-of-concept has now become live pilots, real money transactions, and regulated market testing. This involves banks, regulators, and institutional infrastructure providers. Are you confused about what we are discussing? It’s tokenization. From May to August 2025 alone, the global real-world asset tokenization market grew from USD 8.6 billion to USD 24.31 billion. Australia is no longer watching this trend from the sidelines.

According to the Grand View Horizon, real-world asset tokenization in Australia generated a revenue of USD 55.6 million in 2024 and is expected to reach USD 221.6 million by 2030. At the same time, regulators are actively supporting controlled experimentation, and major banks are building settlement rails that work with tokenized assets. For business leaders, this raises a practical question. Is now the right time to invest in digital asset tokenization, and if yes, how do you do it safely, legally, and profitably? This guide breaks it down in a detailed way on tokenization in Australia. Let’s get in!

Tokenization in Australia is no longer a futuristic ideology; it’s happening. Three forces have pushed the market forward at the same time: institutional demand, regulatory participation, and mature infrastructure.

1. Institutional momentum is real

Australia’s largest financial institutions are actively testing tokenized settlement and asset issuance.

Banks such as ANZ, Westpac, and Commonwealth Bank are no longer asking whether tokenization works. They are asking how to scale it safely.

Projects like Project Acacia have already moved beyond lab environments into live transaction testing, including delivery-versus-payment settlement using real funds.

2. Regulators are part of the process

Unlike many markets where innovation runs ahead of regulation, Australia has taken a different path.

Both the Australian Securities and Investments Commission and the Reserve Bank of Australia are directly involved in tokenization pilots. ASIC has provided regulatory relief to allow real-money testing under controlled conditions, while the RBA is exploring how tokenized assets can integrate with the national payment infrastructure.

For businesses, this significantly reduces regulatory uncertainty.

3. The technology stack is ready

The current generation of asset tokenization platforms supports:

This maturity is what allows tokenization to move from pilots into revenue-generating systems.

Tokenization is already happening across multiple asset categories in Australia.

Some segments are clearly leading the way.

1. Real estate tokenization Australia

Australia’s real estate market is valued at over AUD 10 trillion, making it the country’s largest store of wealth. Real estate tokenization in Australia is gaining traction because it solves a long-standing problem: illiquidity.

Tokenization allows:

Most current implementations use trust or beneficial ownership structures, while the legal title remains under traditional property law frameworks. This approach balances innovation with compliance.

2. Private credit and debt instruments

Private credit is currently the largest real-world asset tokenization segment in Australia, with approximately USD 14 billion already tokenized by mid-2025.

Tokenizing private credit offers:

This segment is particularly attractive for institutional investors seeking yield with programmable risk controls.

3. Carbon credits and environmental assets

Australia is a major exporter of verified carbon offsets. Tokenizing carbon credits enables:

For enterprises operating in sustainability-driven markets, digital asset tokenization simplifies reporting and auditability.

4. Commodities and trade finance

Agricultural commodities, metals, and export-backed assets are also being tokenized. By linking physical assets with blockchain records, businesses can:

This is especially relevant for export-driven sectors.

Regulation is no longer a black box for top tokenization companies in Australia. While full licensing frameworks are still evolving, businesses can already operate within defined boundaries.

1. ASIC sandbox and regulatory relief

ASIC has granted targeted regulatory relief for tokenized asset pilots under supervised conditions. This allows companies to:

For many tokenization development companies in Australia, this sandbox phase is becoming a strategic entry point rather than a temporary experiment.

2. Clearer asset classification is coming

Frameworks proposed to Parliament aim to clarify:

This direction of travel matters. Businesses that design platforms aligned with these frameworks now will face fewer changes later.

From a business perspective, the message is simple. You do not need to wait for perfect regulation to act. You need to design with regulation in mind from day one.

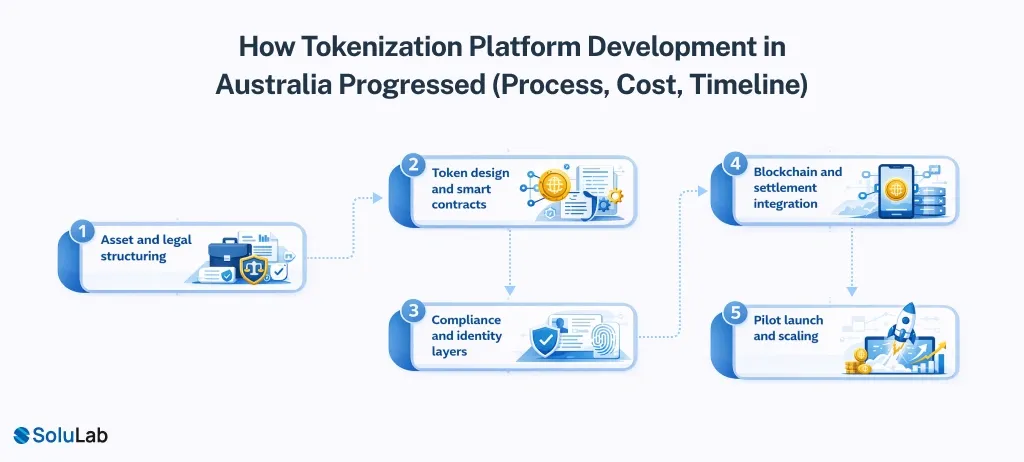

This is where interest turns into execution. A typical tokenization platform built in Australia follows a structured path:

The process starts by defining:

Legal structuring ensures the token represents enforceable rights, not just digital claims.

Next comes token economics and smart contract logic:

This is where a strong blockchain development company in Australia adds the most value.

AML, KYC, and investor accreditation are embedded directly into the platform.

For B2B platforms, compliance automation is often more important than user experience.

Platforms are typically deployed on:

Integration with payment systems and stablecoins enables near-real-time settlement.

Most platforms launch first under controlled conditions, then expand asset coverage or investor access.

Most projects reach market within one business quarter.

Costs vary widely, but broadly:

Note: Amid all these customizations and models, the basic price starts from $10k (14.5k AUD)

For most businesses, the focus is not on upfront cost, but long-term operational savings and liquidity unlock.

Asset Tokenization is not just a technology upgrade. It is a strategic positioning decision.

For example, in July 2025, Westpac, in collaboration with the Reserve Bank of Australia and the Digital Finance CRC, announced the launch of live transaction testing under Project Acacia. The goal was to test delivery-versus-payment settlement for tokenized assets using real money, not simulations. Westpac integrated tokenized asset settlement with Australia’s PayTo real-time payments system, enabling atomic settlement across blockchain networks.

The initiative aimed to reduce settlement risk, cut reconciliation costs, and prepare national infrastructure for tokenized financial markets. The pilot successfully executed live transactions, proving that tokenization can operate within Australia’s regulated financial system.

1. Early liquidity capture

Liquidity pools form early and tend to concentrate. First movers often control market standards before larger incumbents fully commit.

2. Regulatory credibility

Operating under sandbox relief today builds trust with regulators tomorrow. This matters when licensing becomes mandatory.

3. Global capital access

Tokenized assets are borderless by design. Australian businesses can tap into international capital without rebuilding infrastructure for each market.

4. Operational efficiency

Smart contracts reduce reconciliation, settlement delays, and administrative overhead. Over time, this compounds into measurable cost savings.

The market is growing fast, regulators are engaged, and institutions are investing in infrastructure that will define how value moves in the next decade. For businesses, the opportunity is no longer theoretical. It is executable.

The question is not whether tokenization will become part of Australia’s financial system. The question is who builds early, aligns with regulation, and captures the upside.

For organizations evaluating tokenization companies in Australia or planning to work with a tokenization development company, SoluLab experts are here to support you from step 1.

In case you need customization for your platforms, our experts are here to aid you. Contact us today, and discuss your ideology and gain insights from our 10+ year experts.

Yes. Chatbots can help with investor onboarding, KYC support, FAQs, and portfolio queries. They improve user experience and reduce manual support work across top tokenization platforms.

You can connect directly with SoluLab through the website, LinkedIn, or by scheduling a consultation to discuss your tokenization platform goals and requirements. Once you fill out the form, our team will reach out to you within 24 hours.

Yes. Real estate tokenization in Australia is possible using trust or beneficial ownership structures, while legal property titles remain unchanged under existing land and property regulations.

Banks and institutions such as ANZ, Westpac, and asset managers are using tokenization through regulated pilots and settlement projects.

No. While banks lead adoption, mid-sized businesses can also tokenize assets using modular platforms, sandbox frameworks, and tokenization-as-a-service models without heavy upfront investment.