With decentralized finance (DeFi) transforming the conventional financial scene, yield farming has become a profitable venture for investors looking to optimize their profits. We’ll dive into the context of DeFi yield farming in this beginner’s guide, explaining what it is, how it operates, and any possible hazards or rewards. This tutorial will teach you the fundamental knowledge you need to successfully navigate the fascinating world of yield farming, regardless of your level of experience with DeFi.

But first, let’s understand what is Yield Farming in brief!

Yield farming is a way to earn rewards by lending or staking your crypto in DeFi platforms. It helps the platform with activities like lending, borrowing, or trading.

Yield farming lets investors earn rewards by putting their coins or tokens in a decentralized exchange (DEX) to provide liquidity. Farmers use DEXs to lend, borrow, or stake coins to earn interest and profit from price changes. Smart contracts lock the tokens used for yield farming.

Yield farming helps maximize returns in DeFi by earning rewards through lending or staking crypto. Here’s how yield farming works:

1. It starts by adding funds to liquidity pools (smart contracts with assets).

2. These pools power DeFi marketplaces for exchanging, borrowing, or lending tokens.

3. Liquidity providers earn rewards through fees generated by these platforms.

4. Simply holding ETH is not yield farming—it involves lending ETH via DeFi protocols.

5. Farmers move funds between protocols to chase higher yields.

6. Success in yield farming requires Ethereum network experience.

7. More liquidity = higher rewards, making capital size a key factor in profits.

8. Understanding Defi yield farming strategies is essential for finding the best farming opportunities.

Yield farming in the crypto space presents two primary variants: liquidity pool (LP) farms and staking farms. While both involve depositing cryptocurrency into smart contracts, their mechanisms differ significantly, offering distinct opportunities for users.

LP farms require users to deposit crypto assets into smart contracts specifically designed to create liquidity pools. These pools function similarly to decentralized trading pairs, facilitating trading between two or more cryptocurrencies.

In LP farms, trading is limited to the cryptocurrencies provided by liquidity providers. Decentralized finance (DeFi) platforms incentivize liquidity providers with LP tokens, representing their deposits in the pool. These tokens enable providers to withdraw their deposits along with accumulated interest from trading fees at any time.

The significance of LP tokens extends further as DeFi platforms offering liquidity mining programs establish staking interfaces for them. This allows liquidity providers to lock in their funds, earning automatic and continuous rewards in the form of governance tokens. By understanding the nuances of LP farms, users can optimize their participation in crypto yield farming.

Another yield-generation strategy that has investors interested is stake farming. The method entails a user funding a smart contract with cryptocurrency that has been configured to provide a staking pool. A decentralized trading pair and the staking pool are not comparable, though. Conversely, it is more akin to a decentralized vault for a certain class of asset.

In yield farming, the stake farming method concentrates on safeguarding the deposits rather than providing trading freedom. When compared to liquidity pool farms, stake farms may provide users with a more efficient experience.

Unlike operating as a liquidity provider on a decentralized exchange, stake farms only need customers to deposit a single asset in order to generate passive revenue. They then concentrate on staking the tokens issued by the liquidity providers.

Staking and yield farming are two popular strategies in the world of decentralized finance (DeFi), each offering unique opportunities and mechanisms for earning rewards. Here’s a breakdown of the key differences between the two:

Liquidity pools and stake farming are not the only options available to you when you need to learn more about yield farming in cryptocurrency. New liquidity mining programs have been implemented by several DeFi projects, and new DeFi activity variations are linked to rewards in the form of governance tokens. These additional yield production methods can provide you with a more thorough understanding of “how DeFi yield farming works.”

In order to compensate users who must deposit assets in the decentralized insurance funds, insurance mining exclusively concentrates on yield farms. Because the winning insurance claims are deducted from the decentralized insurance funds, they carry a significant risk. Investors in this kind of yield generating might benefit from yielding farming rates on the capital they risk for project protection.

One glaring illustration of such a system is the liquidity stability pool. After that, users would contribute LUSD stablecoin to the pool, which would serve as the background for the liquidity lending protocol. The native Liquity coin, LQTY, is how users get their DeFi farms benefits.

Arbitrage mining capitalizes on yield farms offering incentives tailored for arbitrage traders. By exploiting market discrepancies across the DeFi ecosystem, arbitrage traders seek to maximize returns from these incentives.

Similar to arbitrage mining, trade mining involves earning token rewards through trading activities. However, the key distinction lies in the simplicity of trades conducted solely to earn rewards.

An example of trade mining innovation is Integral, a hybrid decentralized exchange utilizing an AMM/order book model. Since its inception in March 2021, Integral has distributed ITGR governance tokens to traders participating in incentivized pools, potentially revolutionizing the yield-farming crypto space.

Amidst the allure of potential gains and associated risks, many ponder the future prospects of yield generation. Reflecting on the past year, Ethereum emerged as a bustling hub for yield farming in the crypto sphere, with the majority of DeFi Yield farming platforms built on its network. This underscores the lucrative opportunities perceived within the DeFi ecosystem.

Yield generation holds immense significance, facilitating substantial liquidity and offering easier access to loans for both lenders and borrowers. Those reaping substantial profits in yield farming typically wield considerable capital. Conversely, borrowers can access loans with low DeFi farms rate, or opt for higher interest rates with greater ease.

Despite its allure, yield generation remains a contentious topic in crypto circles. While some view it as a significant advancement, others caution against its risks. Flash farms, for instance, have drawn criticism from Ethereum developers due to heightened risk levels. Nonetheless, the allure of earning significant yields on assets persists, challenging traditional financial services.

DeFi investors employ high-return yield farming strategies to maximize their ROI. The techniques use DeFi protocols and financial instruments to maximize returns. Detailed descriptions of various methods follow.

1. Liquidity Mining: Depositing investments in decentralized exchanges or lending platforms for a reward is liquidity mining. After an investment, investors deposit their assets initially in liquidity pools.

Most investors receive LP tokens upon deposit. LP tokens can be staked for extra prizes or reinvested in another system. Investors join liquidity pools with high trading volumes or rewards to enhance returns. Governance tokens or awards for early or significant liquidity providers are offered by some platforms.

2. Staking: Staking is keeping assets in a blockchain network for transaction confirmation or network security. Typically, speakers receive the network’s coin. Staking contracts or pools allow users to stake their assets. Staked assets can be used to run the network’s consensus process or other functions and rewarded proportionally.

Find networks with high staking rewards or rising value. Choosing platforms with extra benefits or multi-tiered staking programs can also enhance returns.

3. Yield Aggregators: Yield aggregators automatically optimize yield farming schemes by shifting users’ funds between DeFi protocols to maximize profits. Yield Aggregators allocate funding to yield farming prospects in real-time. They also optimize reward compounding to maximize returns.

Yield aggregators give investors access to a wide selection of yield farming prospects without human changes. Most yield aggregators with advanced algorithms and high-yield pools give the best returns.

4. Leveraged Yield Farming: This method involves leveraging assets to augment capital investment in yield farming protocols, hoping for higher returns. Investors borrow to increase their yield farming pool positions. Additional capital boosts rewards but raises risk.

Investors must carefully control leverage and ensure yield exceeds borrowing costs to maximize returns. Leveraged yield farming requires high-risk tolerance and leverage management skills.

5. Joining Emerging Protocols: Many new DeFi technologies provide high returns to attract early users. These protocols may have novel reward structures or characteristics.

High reward rates or incentive programs attract initial liquidity for early participants. Early stakes and liquidity providers may benefit greatly from these techniques. Investors should investigate new protocols’ risks and returns. Early investment in promising companies can offer high rewards but also increase risk.

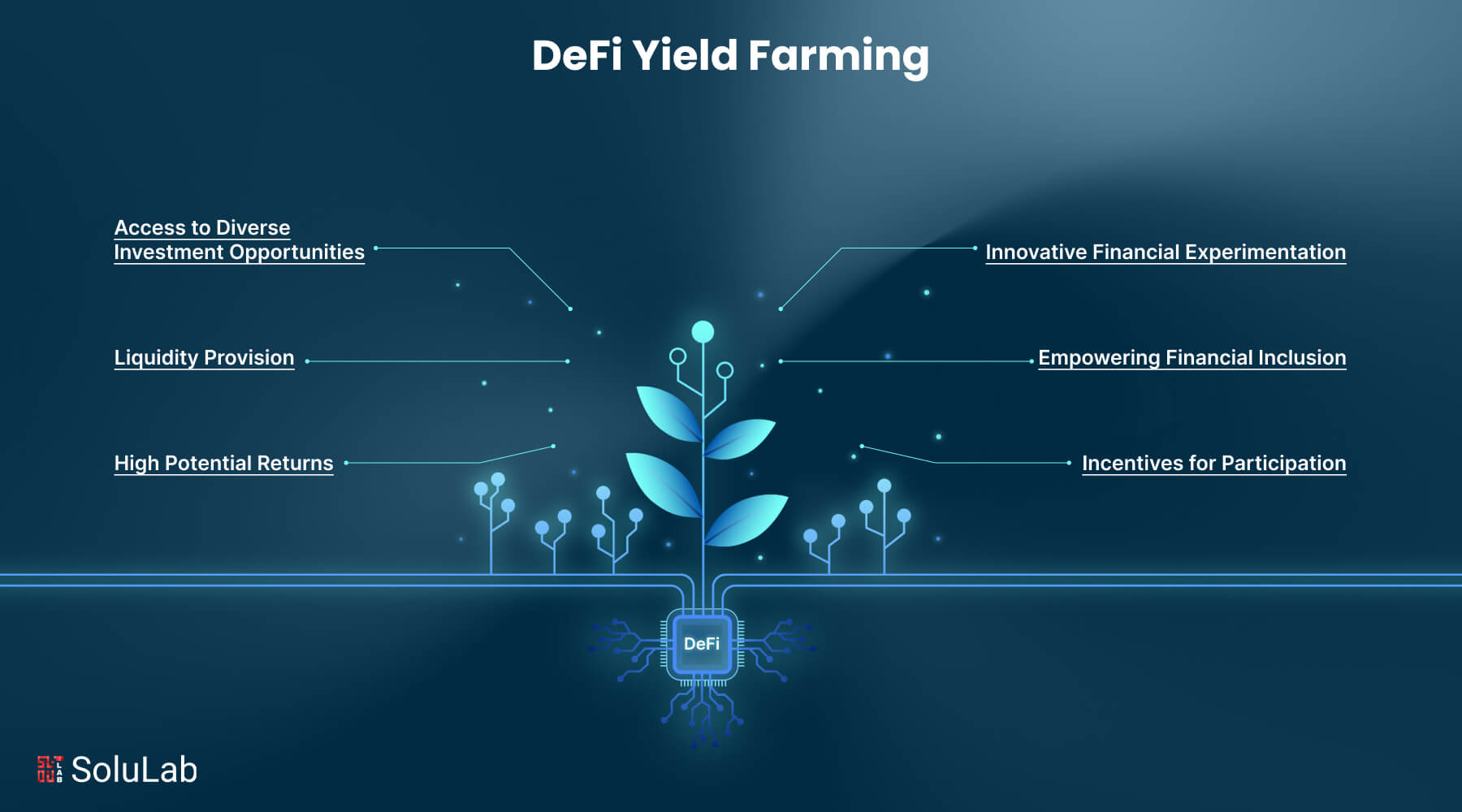

Yield farming, a cornerstone of decentralized finance (DeFi), offers a multitude of benefits for participants willing to engage in this innovative financial practice. Here are some key benefits of yield farming:

1. High Potential Returns: Yield farming presents an opportunity to earn significant returns on cryptocurrency holdings by participating in various DeFi protocols. With attractive yield rates and rewards, participants can potentially generate passive income on their assets.

2. Liquidity Provision: By providing liquidity to decentralized exchanges and liquidity pools, yield farmers contribute to the liquidity of the DeFi ecosystem. This enhances market efficiency and enables smoother trading experiences for users.

3. Access to Diverse Investment Opportunities: Yield farming allows investors to diversify their crypto portfolios by exploring different DeFi protocols and strategies. From lending and borrowing to liquidity mining and staking, participants have a wide range of options to choose from based on their risk appetite and investment goals.

4. Incentives for Participation: DeFi platforms incentivize yield farmers with rewards, often in the form of governance tokens, transaction fees, or newly minted tokens. These incentives encourage participation and help bootstrap liquidity for emerging projects and protocols.

5. Empowering Financial Inclusion: DeFi Yield farming democratizes access to financial services by providing opportunities for anyone with an internet connection and cryptocurrency holdings to participate in DeFi. This inclusive nature of DeFi yield farming promotes financial empowerment and fosters broader adoption of decentralized finance principles.

6. Innovative Financial Experimentation: Yield farming fosters experimentation and innovation within the DeFi space, driving the development of new protocols, products, and features. This continual evolution pushes the boundaries of traditional finance and opens up new avenues for decentralized financial services.

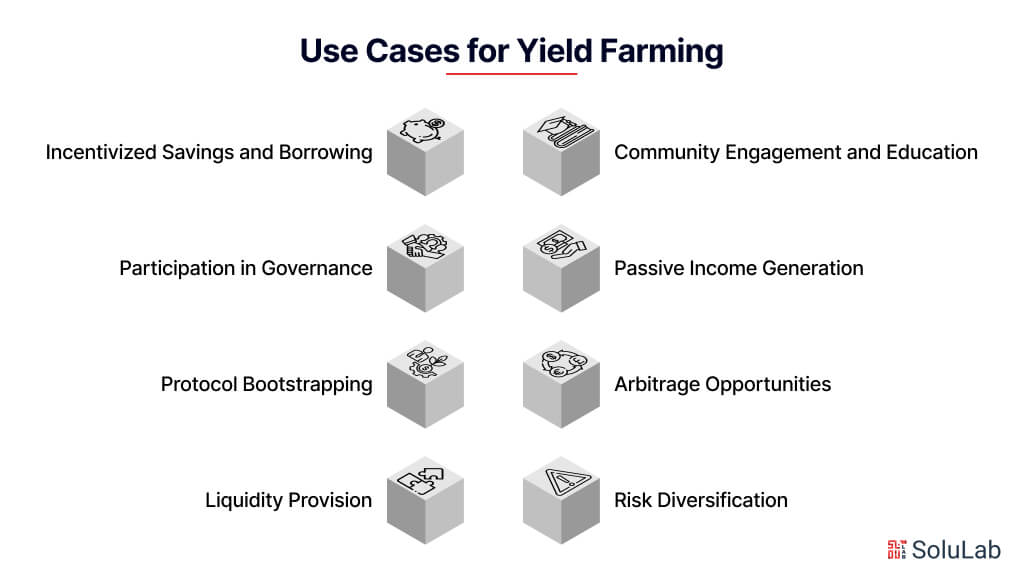

Yield farming, a prominent practice within decentralized finance (DeFi), offers a diverse array of use cases that cater to different investment strategies and objectives. Here are some notable use cases for yield farming:

In conclusion, this beginner’s guide has provided a comprehensive overview of DeFi yield farming, exploring its mechanisms, benefits, risks, and diverse use cases within the decentralized finance ecosystem. From generating passive income and providing liquidity to participating in governance and exploring arbitrage opportunities, yield farming offers a plethora of avenues for investors to engage with DeFi and maximize their returns. While the potential rewards of yield farming are enticing, it’s crucial for participants to exercise caution, conduct thorough research, and practice risk management to navigate the associated risks effectively.

Looking to embark on your journey into the world of DeFi yield farming? SoluLab stands ready to guide you through the process as a leading DeFi yield farming development company. Our team of experts specializes in crafting tailored solutions for decentralized finance, including yield farming platforms, liquidity pools, and governance mechanisms. Whether you’re an investor looking to participate in yield farming or a project seeking to launch a DeFi platform, we’re here to help you unlock the full potential of decentralized finance. Contact us today to learn more and embark on your DeFi journey with confidence.

Yield farming, also known as liquidity mining, is a practice in decentralized finance (DeFi) where users provide liquidity to protocols in exchange for rewards. These rewards can include transaction fees, governance tokens, or newly minted tokens, offering participants an opportunity to earn passive income on their cryptocurrency holdings.

To start yield farming in DeFi, you’ll need to connect your cryptocurrency wallet to a DeFi platform that offers yield farming opportunities. From there, you can deposit your assets into liquidity pools, stake them in protocols, or engage in other yield farming strategies to begin earning rewards.

While yield farming can be lucrative, it also comes with risks. These risks include impermanent loss, smart contract vulnerabilities, market volatility, liquidity risks, regulatory uncertainties, overleveraging, and unknown protocol risks. It’s essential to understand these risks and practice proper risk management when participating in yield farming.

Yield farming offers several benefits, including the potential for high returns, liquidity provision, access to diverse investment opportunities, incentives for participation, financial inclusion, and fostering innovation within the DeFi Yield farming ecosystem.

SoluLab is a leading DeFi development company specializing in crafting tailored solutions for decentralized finance, including yield farming platforms, liquidity pools, and governance mechanisms. Our team of experts can guide you through the process of launching a DeFi project, from conceptualization to deployment, ensuring a seamless and successful journey into the world of decentralized finance. Contact us today to learn more about how we can help you realize your DeFi goals.