In the ever-evolving landscape of blockchain technology and cryptocurrency, the rise of decentralized finance (DeFi) has ushered in a new era of financial innovation and accessibility. At the heart of this transformative movement lies Decentralized Exchange (DEX), which has revolutionized the way individuals trade and interact with digital assets. In this blog, we will delve deep into the pivotal role that decentralized crypto exchanges play within the DeFi ecosystem, shedding light on their significance, advantages, challenges, and future prospects.

Decentralized Finance(DeFi), often abbreviated as DeFi, is a revolutionary financial ecosystem built on blockchain technology that aims to replace and enhance traditional financial services and intermediaries with decentralized alternatives. In DeFi development, financial transactions, services, and products operate on open and permissionless blockchain networks, granting users greater control, transparency, and autonomy over their assets and financial activities.

DeFi platforms utilize smart contracts to automate and execute various financial functions, such as lending, borrowing, trading, and earning interest, without the need for traditional banks or financial institutions. Key characteristics of DeFi include:

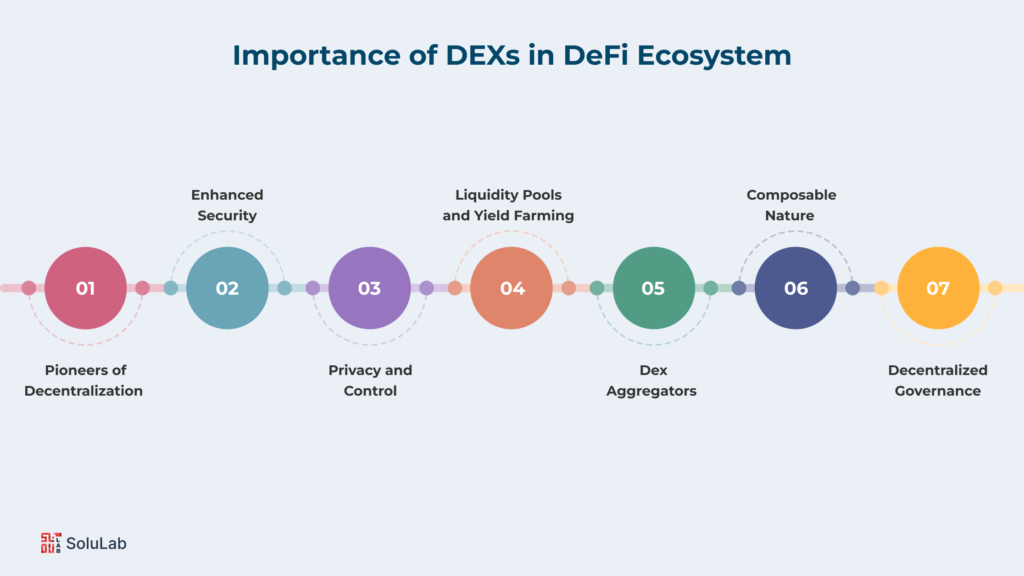

Within the expansive DeFi ecosystem, Decentralized Exchanges (DEXs) hold a central and transformative role. DEXs are blockchain-based platforms that enable users to trade cryptocurrencies directly with one another, without relying on centralized intermediaries. The significance of DEXs in DeFi ecosystem can be summarized as follows:

1. Pioneers of Decentralization: DEX platforms were among the first DeFi applications to gain widespread adoption. They set the stage for other DeFi platforms by showcasing the potential of trustless, peer-to-peer transactions.

2. Enhanced Security: DEXs prioritize security by eliminating the need for users to entrust their funds to centralized exchanges. This reduces the risk of hacks and breaches associated with centralized platforms.

3. Privacy and Control: Users of DEX platforms maintain control over their private keys and assets, ensuring greater privacy and self-sovereignty over their finances.

4. Liquidity Pools and Yield Farming: DEXs facilitate liquidity provision through liquidity pools, allowing users to earn rewards by contributing assets. This innovation has led to the growth of yield farming and liquidity mining in the DeFi space.

5. Dex Aggregators: To further streamline DeFi trading, Dex Aggregators have emerged. These platforms consolidate liquidity from various DEXs, offering users improved access to assets and enhanced trading experiences.

6. Composable Nature: DEX platforms can be integrated with other DeFi services, creating a vibrant ecosystem where users can trade, lend, borrow, and stake assets seamlessly.

7. Decentralized Governance: Many DeFi DEX platforms incorporate decentralized governance models, allowing users to participate in decision-making processes and influence the platform’s future direction.

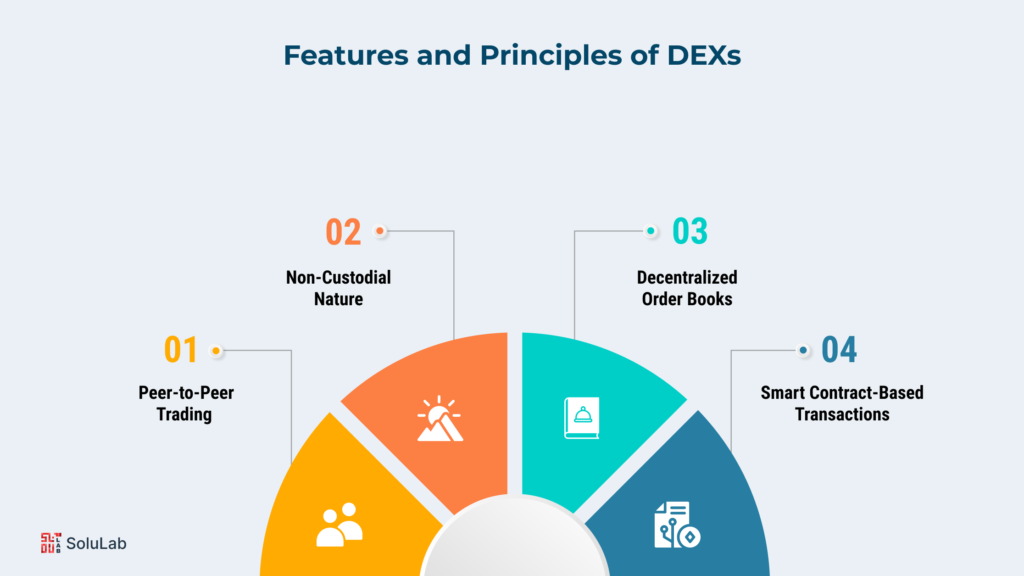

In the realm of DeFi DEX platforms, Decentralized Exchanges, or DEXs, stand as the epitome of decentralized systems for crypto dex trading. In this section, we will delve into the essence of DEXs, defining these crucial components of the DeFi ecosystem. We’ll explore their key features and principles, emphasizing their role in enabling peer-to-peer trading, their non-custodial nature, their decentralized order books, and the foundation of their operations through smart contract-based transactions.

Decentralized crypto exchanges, commonly known as DEXs, embody a set of distinctive features and principles that differentiate them from traditional centralized exchanges (CEXs). Here are the key elements that define the essence of DEXs:

Read Blog Post: List of Top 10 Defi Savings Accounts

By embodying these key features and principles, DEXs uphold the core tenets of DEX exchange crypto, fostering trust, security, and user empowerment in the ever-evolving landscape of cryptocurrency trading.

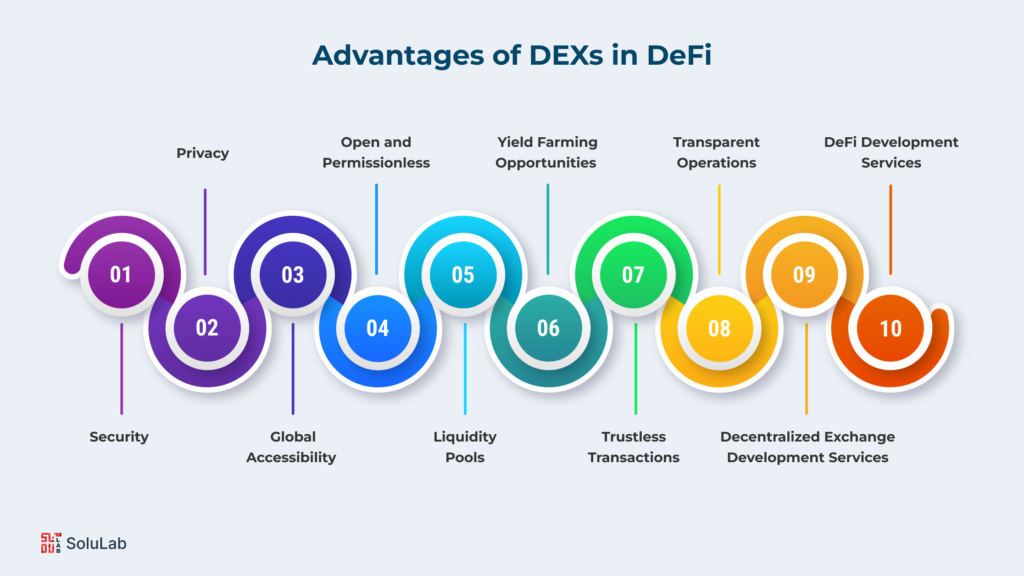

Decentralized Exchange Development holds a pivotal role within the DeFi ecosystem, offering a multitude of advantages that have contributed to their growing popularity. Here, we explore these advantages, shedding light on why DEXs are considered integral to the decentralized finance landscape.

Here we will explore the various obstacles, uncertainties, and issues faced by Decentralized Exchanges (DEXs) within the DeFi ecosystem. From liquidity challenges to regulatory concerns, it delves into the complex landscape that DEX platforms navigate to provide secure and efficient trading services.

So, here are some challenges and concerns related to the role of DEXs in DeFi:

1. Liquidity Challenges: While DEXs have made significant strides in improving liquidity, they still face challenges related to fragmentation. Liquidity is often spread across multiple DEX platforms, which can lead to lower trading volumes and higher price slippage.

Read Also: Top 10 Defi NFT Games to Look for in 2025

2. Impermanent Loss: Users who provide liquidity to DEXs may experience impermanent loss, which occurs when the value of their assets in a liquidity pool diverges from their original investment due to price fluctuations.

3. Regulatory Concerns: The evolving regulatory landscape poses challenges for DEXs. Compliance with local and global regulations, especially regarding anti-money laundering (AML) and know-your-customer (KYC) requirements, can be complex and vary by jurisdiction.

4. User Experience: Some DEX platforms are criticized for their user interfaces, which can be less intuitive compared to centralized exchanges. Additionally, the unpredictability of gas fees on blockchain networks can affect the cost and speed of transactions, impacting the user experience.

5. Smart Contract Risks: DEXs rely heavily on smart contracts, which can be vulnerable to bugs, vulnerabilities, or exploits. Ensuring the security and robustness of these contracts is a constant challenge.

6. Auditing and Security Measures: Performing thorough audits of smart contracts and implementing stringent security measures to protect user funds is a critical concern for DEXs. Any security breach can result in significant financial losses and erode trust in the DeFi ecosystem.

Read Our Blog: 7 Best Defi Trading Platforms in 2025

7. Scalability: As DeFi continues to grow, DEX platforms face scalability challenges, particularly on blockchains with limited transaction throughput. Scaling solutions like layer 2 technologies are being explored to address this issue.

8. Cross-Chain Compatibility: Achieving interoperability between different blockchain networks and ensuring smooth cross-chain asset transfers can be complex and is an ongoing challenge for DEXs.

Addressing these challenges and concerns is crucial for the continued growth and maturity of the role of DEXs in DeFi. As the ecosystem evolves, DEX platforms and the broader DeFi community are actively working to find solutions and enhance the resilience and user experience of decentralized exchanges.

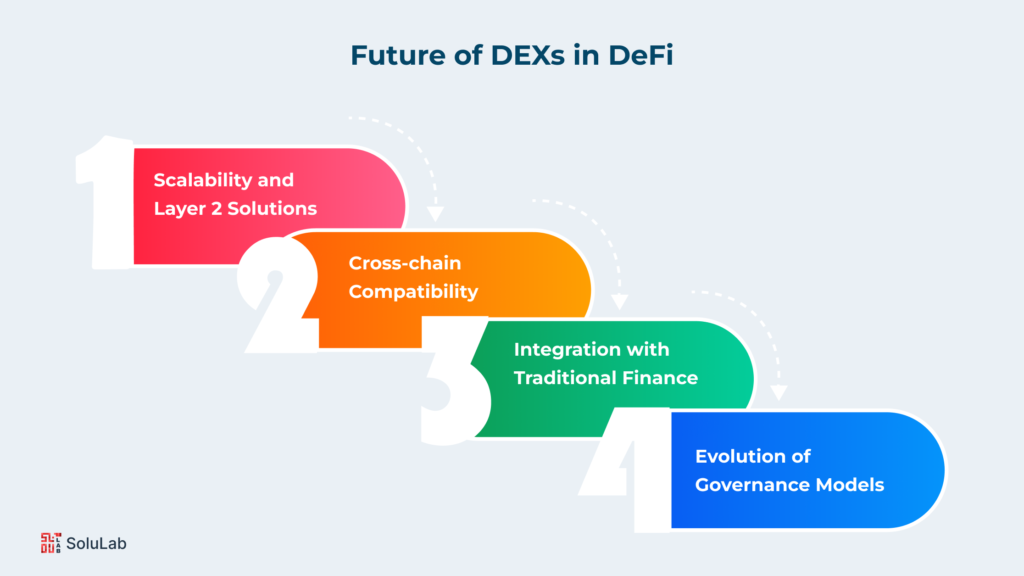

As the DeFi ecosystem continues to evolve, Decentralized Exchanges (DEXs) are poised to play an increasingly influential role. This section explores the future of DEXs, highlighting key developments and trends that will shape their trajectory within the decentralized finance landscape.

Check Blog Post: The Future of Finance: Role of Blockchain Development in DeFi Ecosystem

The future of DEXs in DeFi is marked by innovation and adaptability. As scalability improves, cross-chain capabilities expand, traditional finance integration deepens, and governance models evolve, DEX platforms are poised to become even more integral to the decentralized finance ecosystem. These advancements aim to enhance user experiences, reduce barriers to entry, and contribute to the continued growth and maturation of DeFi.

Decentralized Exchanges (DEXs) have not only transformed the DeFi landscape but are poised to redefine the entire financial industry. Their role as trustless, secure, and accessible platforms for peer-to-peer trading has been instrumental in advancing financial autonomy and inclusivity. The emergence of DEX Aggregators further demonstrates their adaptability and commitment to providing users with seamless trading experiences.

As we peer into the future, DEXs are set to continue their ascent. Scalability solutions and cross-chain compatibility will shatter existing limitations, allowing DEXs to accommodate the surging demand for decentralized trading. Integration with traditional finance represents a bridge between legacy systems and blockchain, promising to usher in a new era of financial innovation and collaboration. The ongoing evolution of governance models ensures that DEXs remain community-driven, putting the power to shape the platform’s direction squarely in the hands of its users. In summation, DEXs are not just a chapter in the story of DeFi; they are the architects of a new financial paradigm where individuals have unprecedented control over their assets and the global financial system becomes more equitable and accessible for all.

SoluLab, a recognized leader in Decentralized Exchange Development services and DeFi Development services, is well-equipped to be your strategic partner in navigating the complexities of the DEX and DeFi landscape. With a deep understanding of the ever-evolving blockchain ecosystem, SoluLab can provide tailored solutions that align with the insights and trends discussed in this blog. Whether you’re looking to build a cutting-edge DEX platform or embark on DeFi development endeavors, our experienced team can guide you from concept to execution, ensuring that your project not only meets but exceeds the demands of this dynamic industry. Trust SoluLab to be your trusted ally in transforming your DEX and DeFi aspirations into a reality. Let’s embark on this exciting journey together—contact SoluLab today to explore the limitless possibilities of decentralized finance.

DEXs operate on blockchain technology, enabling direct peer-to-peer trading without intermediaries, while CEXs are centralized platforms controlled by a single entity. DEXs prioritize decentralization and user control.

DEX Aggregators consolidate liquidity from multiple DEXs, providing users with improved access to assets, reduced slippage, and enhanced trading efficiency.

DEXs often grapple with blockchain scalability issues. To address this, they are exploring Layer 2 solutions and sidechains, which can alleviate congestion and enhance scalability.

DEXs can integrate with traditional finance systems, enabling users to convert fiat currency into digital assets and fostering collaboration between legacy financial institutions and DeFi platforms.

Users can enhance security by conducting thorough due diligence on DEX platforms, auditing smart contracts, and actively participating in the platform’s decentralized governance processes to contribute to its security and development.

SoluLab offers comprehensive Decentralized Exchange Development services and DeFi Development services. We provide end-to-end solutions, including ideation, development, deployment, and ongoing support, tailored to your specific project needs. Our experienced team understands the intricacies of the blockchain landscape, ensuring that your DEX or DeFi project aligns with industry best practices and the latest trends. Whether you’re a startup or an established business, we can guide you through the complexities of these technologies, helping you realize your vision and succeed in the dynamic world of DEX and DeFi development.