Launch and manage digital money using a Stablecoin as a...

Read More

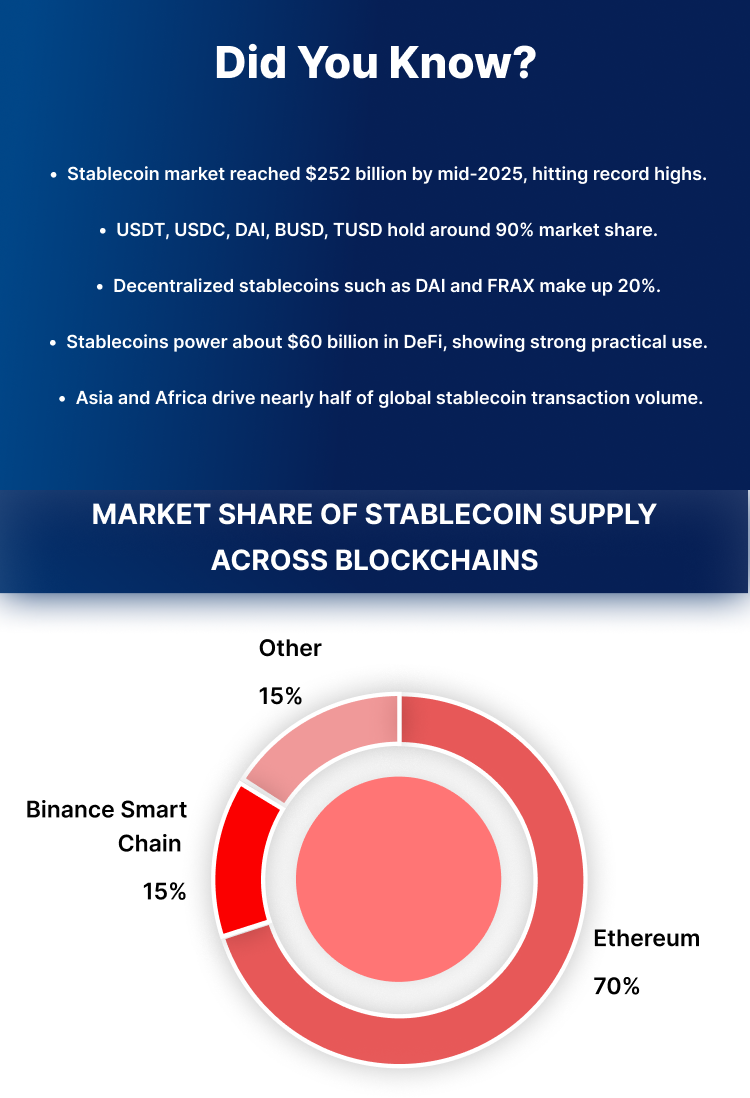

Traditional remittance relies on banks and intermediaries, causing delays and higher fees. Stablecoin remittance uses blockchain, enabling near-instant, low-cost, and transparent transfers with on-chain visibility, making it more efficient and accessible for global payments.

Yes, but it depends on jurisdiction. You must comply with financial regulations such as AML, KYC, and licensing requirements. We ensure platforms align with regional laws, keeping your operations legally compliant and risk-free.

USDC, USDT, BUSD, and DAI are widely adopted for remittances due to stability, liquidity, and global availability. As a stablecoin development company, we can help you select the best-fit stablecoin based on corridor requirements, transaction costs, and compliance needs.

Timelines depend on scope. An MVP typically takes 10–12 weeks, while a full enterprise-grade platform may require 4–6 months. We customize timelines based on required features, integrations, and compliance obligations.

Costs vary depending on platform complexity, features, and integrations. MVPs are more affordable, while enterprise-grade solutions require larger investments. We provide a detailed estimate after analyzing requirements, compliance needs, and scalability goals.

Startups should choose a blockchain and stablecoin model to build or integrate AI-powered routing and compliance tools. They should ensure multi-currency and multi-wallet support. Partner with SoluLab for full-stack development and deployment.

Yes. We integrate AML, KYC, GDPR, and PCI DSS standards to ensure global compliance. Your platform will meet international regulatory frameworks while maintaining user trust and institutional-grade security across remittance corridors.

Yes. We offer ongoing support, system upgrades, compliance updates, and feature enhancements. Our team ensures your platform stays secure, scalable, and aligned with evolving market and regulatory requirements.

You can get started by contacting our team for a consultation. We analyze your business needs, recommend suitable models, and create a roadmap for building and launching your custom stablecoin remittance platform.

Launch and manage digital money using a Stablecoin as a...

Read MoreExplore how to build your own commodity-backed stablecoin in 2026,...

Read MoreDiscover how AI agents improve stablecoin development through automation, risk...

Read More