Crypto markets often move on more than price alone. Narratives, especially those that connect blockchain activity with real-world assets, institutions, or political figures, can drive attention and liquidity very quickly.

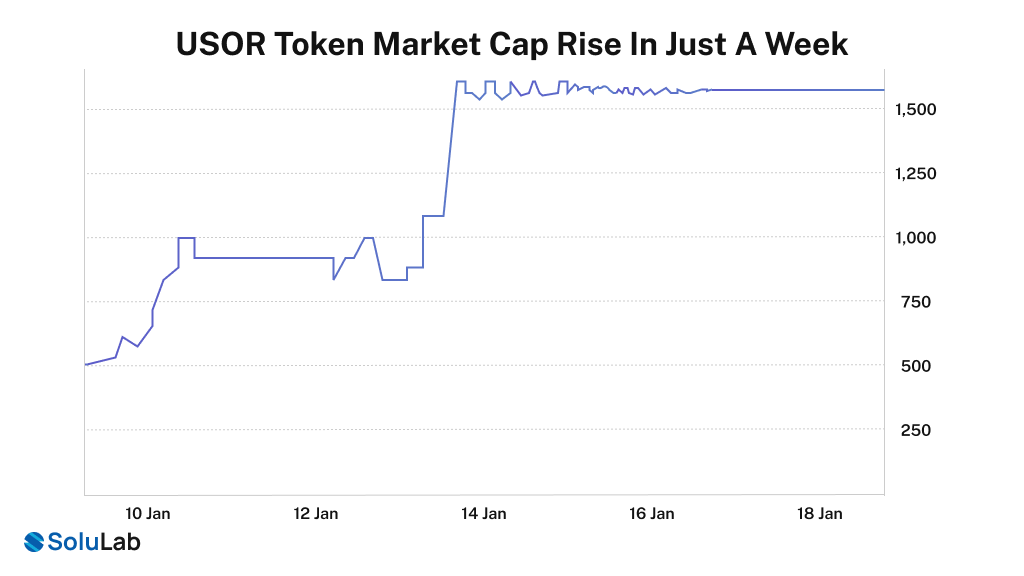

The recent rise of the U.S. Oil Reserve ($USOR) token on Solana is a clear example of this dynamic. Market interest in USOR has been fueled by claims around oil tokenization. The speculation is about institutional wallet activity and politically tagged on-chain accounts. At the same time, there is no public confirmation from U.S. government agencies or major asset managers supporting these claims.

This situation has turned USOR into more than just a tradable token. It has become a real-world stress test for how far current real-world asset (RWA) tokenization solutions can go and where they start to break down. This situation has also highlighted the role of blockchain and AI in driving innovations. Additionally, how are enterprises responding as tokenization moves toward its next phase? Let’s dig deep and strive for future toekization solutions.

Key Takeaways

- What the USOR case reveals about RWA tokenization today and where the infrastructure gaps exist.

- Using AI+Blockchain development services to address these gaps can enlighten your path towards the tokenization revolution.

Why Narrative-Driven RWA Tokens Like USOR Gain Traction?

Narrative-driven tokens tend to gain attention faster than technically complex or quietly compliant projects. USOR followed a familiar pattern seen across multiple crypto cycles.

USOR Token Market Cap Rise in Just a Week.

1. Strong real-world symbolism

Oil is not just another commodity. It is closely tied to national security, geopolitics, and economic stability. When a token uses language associated with national reserves or government custody, it can trigger assumptions of legitimacy, even without formal verification.

2. Association with institutional language

USOR benefited from broader market conversations around natural asset tokenization. Public statements from large asset managers about tokenized funds and blockchain settlement created an environment where many traders were already primed to expect institutional involvement in RWA projects, even when no direct link existed.

3. How On-chain activity creates visible momentum

- Active trading on decentralized exchanges

- Rising liquidity pools

- Concentrated wallets that attract attention

All of these are visible on-chain and easy to track. For many market participants, this visibility becomes a proxy for validation, even though it does not confirm asset backing or legal structure.

4. Social amplification through token wallet labeling

Crypto wallet labels such as “institutional” or “political” are often based on heuristics and past activity, not verified identity. Still, once these labels circulate on social platforms, they can accelerate attention and speculation.

Together, these factors explain why narrative-driven RWA tokens can scale attention faster than the underlying infrastructure can support.

How the USOR Case Exposes Gaps in Current Tokenization Infrastructure?

From a purely technical standpoint, USOR functions as expected on the blockchain technology. The token exists, trades on decentralized exchanges, and its transactions are visible on-chain. However, when evaluated as a real-world asset tokenization project, several structural gaps become clear.

1. Blockchain Verifies Transactions, Not Physical Assets

Blockchain networks are very good at proving what happens on-chain. They can reliably show when a token is created, transferred, or traded. What they cannot do is independently verify whether a real-world asset exists or is being held as claimed.

In the case of USOR, on-chain data can confirm:

- Token issuance and supply behavior across wallets

- Transfers between participants and liquidity pools

- Trading volume and market activity on Solana DEXs

At the same time, blockchain cannot confirm:

- Whether physical oil reserves exist

- Who controls or custodies those reserves

- Whether any government authorization is in place

Without trusted off-chain verification, asset-backed claims remain informational rather than provable.

2. The Absence of Standardized Proof-of-Reserve Frameworks

In mature financial systems, asset backing relies on clearly defined proof-of-reserve processes. These typically involve independent audits, periodic attestations, and standardized reporting.

In USOR’s case, reserve-related claims are primarily supported by:

- Project-provided dashboards and disclosures

- Public statements without third-party validation

While transparency tools are useful, they are not substitutes for independent verification. This gap highlights a broader issue across early-stage RWA tokenization projects, where proof-of-reserve standards are still inconsistent or missing altogether.

3. Governance and Redemption Remain Unclear Over Tokenization

Another challenge exposed by USOR is the lack of clarity around governance and asset redemption. For enterprise-grade tokenization, these elements are foundational.

Key questions that remain unresolved include:

- Who legally controls the underlying asset, if it exists?

- What enforceable rights does a token holder actually have?

- Is there a defined redemption or settlement mechanism?

Without clear answers, tokens function primarily as tradable instruments rather than structured representations of real-world assets.

4. Wallet Attribution Can Create Misleading Signals

Crypto wallet development, tagging, and attribution tools are widely used for on-chain analysis. They can provide helpful context, but they are not definitive proof of ownership or endorsement.

In the USOR case, wallet labels suggesting institutional or political involvement played a role in shaping market perception.

However, these labels are often based on historical transaction patterns rather than verified identities. As a result, they can amplify narratives without confirming factual relationships.

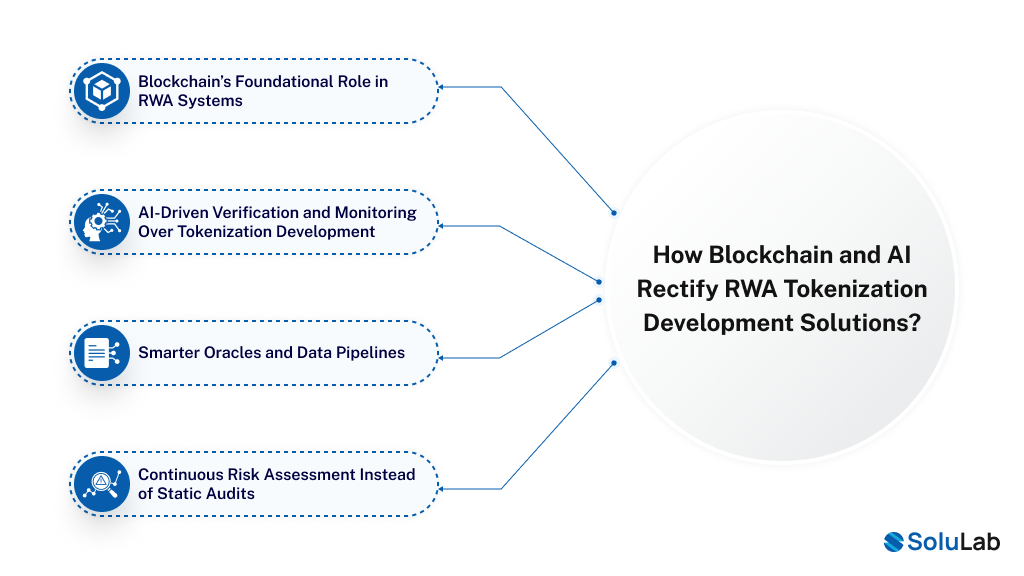

How Blockchain and AI Rectify RWA Tokenization Development Solutions?

As real-world asset tokenization evolves, it is becoming clear that blockchain alone cannot address the full complexity of asset-backed systems. The industry is now moving toward hybrid models where blockchain provides transparency and settlement, while AI handles verification, monitoring, and risk analysis.

1. Blockchain’s Foundational Role in RWA Systems

Blockchain continues to serve as the core infrastructure layer for tokenization. Its strengths remain essential to any RWA platform.

These include:

- Transparent ownership records accessible on-chain

- Immutable transaction histories for auditability

- Programmable settlement logic through smart contracts

- Global accessibility without centralized intermediaries

However, real-world assets introduce variables that require additional layers beyond smart contracts.

2. AI-Driven Verification and Monitoring Over Tokenization Development

AI is increasingly used to bridge the gap between physical assets and digital representations. Unlike blockchain, AI systems can process and analyze off-chain information in real time.

In RWA tokenization, AI is being applied to:

- Analyze audit reports and external data sources

- Monitor asset conditions and supply-chain changes

- Detect inconsistencies or anomalies in reported data

- Flag operational or compliance risks as they emerge

For commodities such as oil, this capability is especially important, as asset verification depends on inputs that blockchain cannot generate on its own.

Read Also: How AI Tokenization is Modifying Asset Ownership in 2026?

3. Smarter Oracles and Data Pipelines

Oracles act as the connection between off-chain data and on-chain logic. When combined with AI, they become significantly more reliable.

AI-enhanced data pipelines help:

- Validate incoming data before it reaches smart contracts

- Reduce reliance on single data providers

- Improve confidence in asset-linked inputs

This reduces the risk of incorrect or manipulated data influencing on-chain outcomes.

4. Continuous Risk Assessment Instead of Static Audits

Traditional audits offer snapshots in time. AI-enabled systems allow for continuous monitoring.

This enables ongoing assessment of:

- Changes in asset custody or status

- Market stress signals affecting asset value

- Regulatory or compliance-related developments

What RWA Tokenization Solutions Enterprises Are Adopting in Response?

Together, blockchain and AI are shifting RWA tokenization from static representations to continuously monitored systems.

Enterprises watching cases like USOR are not abandoning tokenization. Instead, they are adjusting how they approach it, with a stronger emphasis on infrastructure, governance, and verification. Also, they are reshaping how RWA tokenization works.

1. Stronger and More Transparent Verification Frameworks

Enterprises are increasingly treating verification as a baseline requirement rather than an add-on.

This includes:

- Independent third-party audits

- Regular proof-of-reserve attestations

- Clear and accessible reporting structures

These measures help reduce uncertainty and build long-term credibility.

2. Clear Governance and Legal Mapping

Serious RWA initiatives now invest time upfront in defining governance.

This involves clarifying:

- Asset ownership and custody structure

- Token holder rights and obligations

- Jurisdictional and regulatory considerations

- Compliance responsibilities across stakeholders

Clear governance reduces ambiguity and limits regulatory exposure.

3. Integrated AI and Data Layers

AI has moved beyond experimentation in enterprise tokenization projects. It is now used operationally to support:

- Compliance monitoring and reporting

- Data reconciliation between on-chain and off-chain systems

- Risk analysis and anomaly detection

- Ongoing operational oversight

This integration supports scalability and trust across asset classes.

4. Infrastructure-First Development Approach

Rather than launching tokens first and adding controls later, enterprises are increasingly designing tokenization platforms end to end.

This approach focuses on:

- Building verification flows before token issuance

- Testing governance and redemption mechanisms early

- Aligning technical systems with regulatory expectations

Blockchain development companies such as SoluLab increasingly focus on building this underlying infrastructure, rather than deploying standalone smart contracts.

How the Future of RWA Tokenization Development Will Be After USOR-Driven Cycles?

The USOR case highlights what happens when narrative momentum outpaces system design. As the market learns from these cycles, RWA tokenization is beginning to evolve in more structured ways.

1. A Shift From Narrative to Verifiable Systems

Future RWA projects are expected to be evaluated less on branding and more on:

- Data transparency and traceability

- Auditability and third-party validation

- Robust system architecture

Narratives may attract initial attention, but infrastructure will determine durability.

2. Rising Institutional Expectations

Institutional participants continue to observe rather than rush in. Their focus remains on:

- Clear and repeatable standards

- Proven verification models

- Demonstrated resilience across market cycles

This cautious approach reflects long-term confidence, not disinterest.

3. Tokenization as Infrastructure, Not a Product

RWA tokenization is increasingly viewed as:

- A financial infrastructure layer

- A bridge between physical assets and digital markets

- A long-term operational capability

Projects that treat tokenization purely as a marketing concept are likely to struggle as expectations rise.

4. Gradual Convergence of Technology and Regulation

As regulatory frameworks mature and technology improves, tokenization platforms are expected to align more closely with traditional financial infrastructure, while retaining the benefits of transparency and efficiency that blockchain enables.

Conclusion

As you can see in the above sections, the enterprises are quickly adopting the new tokenization development solutions. If you are also looking for the latest features for your tokenization platform, SoluLab is here to guide you and provide you with reliable services.

We at SoluLab, a top tokenization platform development company, provide

- Asset Tokenization Consulting

- Custom Tokenization Platform Development

- Smart Contract Development

- RWA Tokenization Platform Development

- Blockchain Integration Services

- AI-Powered Tokenization Solutions

Additionally, our latest features and standard compliance can reshape your tokenization infrastructure. Contact us today to share your vision and bring it to reality.

FAQs

The cost of an RWA tokenization platform depends on several factors, including asset type, compliance requirements, blockchain network, AI integrations, and platform complexity. A basic pilot can start at $10k, while enterprise-grade platforms with AI verification, compliance layers, and multi-chain support typically require a higher investment.

Development timelines usually range from 4 to 16 weeks. This depends on whether the platform is a proof of concept or a full-scale production system. Factors such as custom smart contracts, AI-powered analytics, KYC/AML integration, and regulatory alignment can extend timelines, but they also improve long-term reliability and readiness.

You can directly connect with SoluLab through the official website to discuss asset tokenization consulting, custom platform development, or AI-powered tokenization solutions. It takes typically 24 to 48 hours, based on the region and timings.

Yes, carbon credits and green assets are increasingly being tokenized. Blockchain-based carbon credit tokenization helps improve transparency, traceability, and global access. When combined with AI-driven verification and reporting, green tokenization platforms can support compliance, prevent double-counting, and enable fractional ownership of sustainability-linked assets.