The rental market in Canada is no longer running on autopilot. From 2022 to 2025, the average cost of construction financing went up by more than 40%, while the number of new rental units in big cities reached all-time highs.

Nationally, vacancy rates went above 3%, which took power away from landlords and put pressure on rental yields. In this setting, traditional real estate models seem inflexible. This is why real estate tokenization in Canada is getting more popular.

Property owners can get cash without selling their assets by allowing fractional ownership and tokenizing rental income. Investors can also get into tokenized rental properties with lower entry costs. Before looking into how rental assets are tokenized in real life, it’s important to understand this change.

Rental assets in Canada have always been stable but capital-intensive. Once money is locked into a property, it is difficult to access without refinancing or selling. Tokenization changes this dynamic, with Canada being one of the top countries to launch a real estate tokenization platform.

Tokenization is not about replacing property ownership. It is about making rental assets more flexible, programmable, and investable.

In recent years, blockchain integration in asset tokenization platforms increased for dynamic purposes. Let’s see some numbers that reflect the rental markets.

These numbers explain why tokenizing rental income is no longer experimental. It is becoming part of mainstream real estate infrastructure.

Tokenization is not limited to high-end real estate or large investment funds. In Canada, a wide range of rental assets and income streams can be tokenized, depending on the business goal and legal structure.

1. Rental Properties for Homes

This includes condos, single-family homes, and apartment units that bring in rent on a regular basis. Tokenization is a common way to allow fractional ownership and shared rental returns for these assets.

2. Rentals for Multiple Families and for a Specific Purpose

Tokenizing large rental buildings owned by developers or institutions can make them more liquid, raise money, or spread out ownership without having to sell the property.

3. Places for students to live and co-living spaces

Tokenization works well for rental models with a lot of tenants and predictable cash flows. Investors looking for stable, recurring rental income often want these assets.

4. Rental Properties for Businesses

You can tokenize office areas, retail places, and even mixed-use buildings, in case they are under long-term lease. Through this, you can structure rental payments.

5. Housing that is both social and affordable

Tokenization is becoming a new way to fund social and affordable housing projects in Canada, where traditional financing often can’t keep up with demand.

6. What Exactly Gets Tokenized?

Tokenization does not mean the physical property moves on-chain. Instead, digital tokens represent specific economic or ownership rights, such as:

This flexibility is why real estate tokenization in Canada is gaining attention from property owners, investors, and public-sector stakeholders.

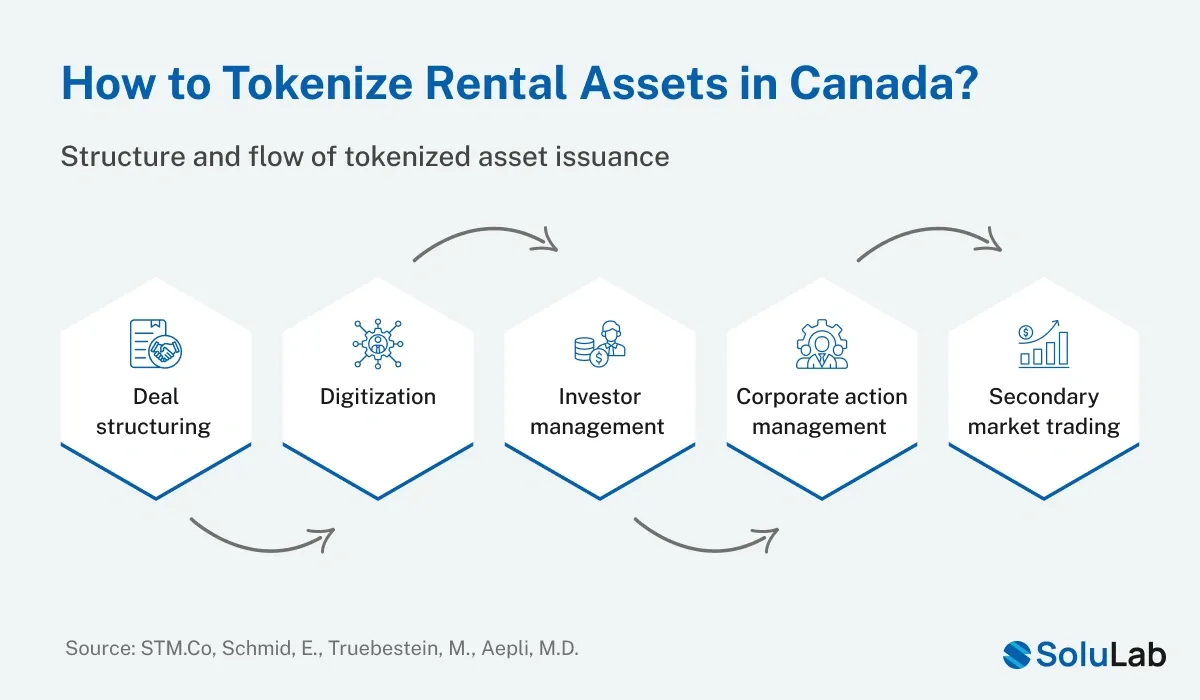

Tokenizing rental assets follows a structured and repeatable process. It brings together legal, financial, and technology components to ensure compliance and long-term usability.

The process begins with selecting the rental property to be tokenized. This step focuses on understanding the asset’s financial and legal position.

Key activities include:

This step confirms whether the asset is suitable for tokenization and investor participation.

Rental assets in Canada must be structured carefully to meet regulatory requirements.

Common structures include:

At this stage, the framework is defined for:

Strong legal clarity is essential for any real estate tokenization platform operating in Canada.

Once the legal structure is in place, the token model is designed.

This includes decisions around:

This is where rental assets are converted into tokenized rental properties that investors can clearly understand and evaluate.

This is the technical foundation of the project. A typical Tokenized Rental Platform Development process includes:

This stage is usually handled by an experienced asset tokenization development company to ensure security, scalability, and compliance.

After platform development, tokens are issued and distributed.

This step involves:

Compared to traditional real estate fundraising, this approach enables faster and more flexible access to capital.

Once live, the platform supports day-to-day rental operations.

This includes:

This operational layer is where tokenizing rental income creates long-term value for both asset owners and investors.

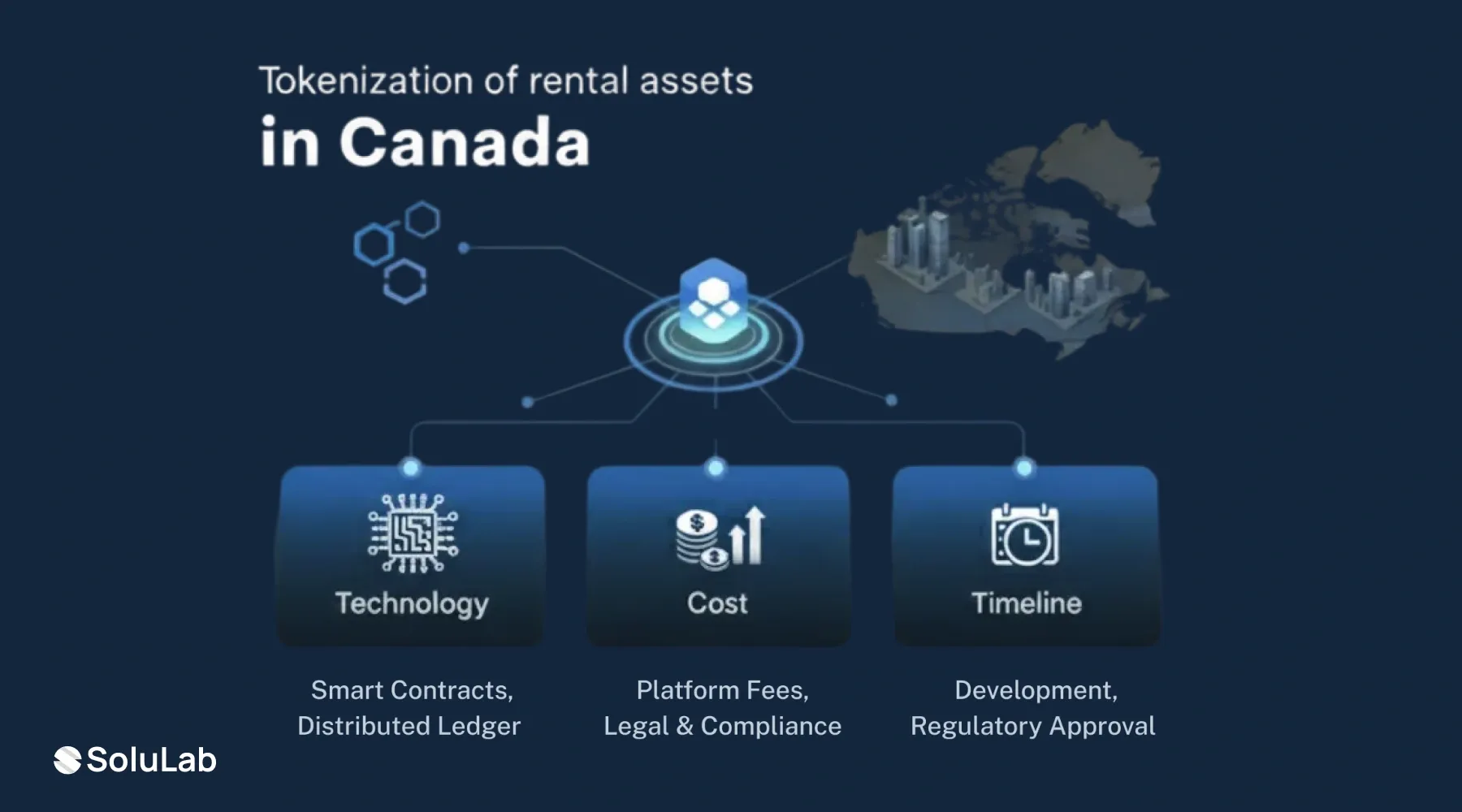

| Stage | Key Technology | Timeline | Cost Impact |

| Due Diligence | Valuation tools, data systems | 2–4 weeks | Low–Medium ($5k) |

| Legal Setup | KYC/AML tools, legal frameworks | 3–6 weeks | Medium–High |

| Token Design | Blockchain, smart contracts | 3–5 weeks | Medium($10k) |

| Platform Development | Tokenized rental platform | 6–10 weeks | High($10K) |

| Token Issuance | Issuance modules, investor portals | 2–3 weeks | Medium |

| Operations | Smart contracts, reporting tools | Ongoing | Ongoing |

In total, most projects take 3 to 5 months from planning to launch.

Through the above details, you might have gained insights into how the tokenization of rental assets in Canada is reshaping the development. Also, with the table given, where you can see the technology cost and timeline, you can clearly know what you need and what’s involved in the process.

To know more in-depth about tokenization, consult SoluLab, a top tokenization development company. SoluLab provides services across Canada, increasing your growth by 50%. With our 250+ expert developers, you can be reassured about technology usage and model development.

Solulab can help you in:

For more services, contact our experts and bring your vision to life. The earlier you realize, the more you grow in the market.

In Canada, residential rentals, multi-family buildings, student housing, commercial rental properties, and even social or affordable housing projects can be tokenized. Both ownership rights and rental income streams can be structured into compliant tokenized assets.

Tokenized rental platform development includes legal structuring, smart contract creation, investor and admin dashboards, wallet integration, KYC and AML modules, rent distribution automation, and reporting layers to support compliant and scalable rental asset operations.

Yes, the core technology remains similar, but regulatory, compliance, and ownership structures differ. When expanding to markets like Indonesia, the platform must be adapted to local laws, investor rules, and regional asset tokenization requirements.

You can contact SoluLab directly through their website to discuss rental asset tokenization, platform development, or compliance planning. Their team helps assess feasibility, cost, timeline, and the right tokenization approach for your business.

Yes, tokenizing rental income is not limited to large institutions. Small and mid-sized property owners can use fractional ownership and tokenized rental platforms to unlock capital, improve liquidity, and attract new investor participation.